A Guide to Tiered Loyalty Programs That Boost LTV & AOV

Jan 27, 2026

|

Published

Let's get real for a moment—most loyalty programs are a confusing mess. They make customers jump through hoops for points that feel worthless and leave merchants wondering if they're actually making any money.

This guide isn't about that. We're throwing out the old playbook and redefining the tiered loyalty program as a simple, powerful, and profit-first strategy. We'll show you exactly why savvy Shopify brands are ditching complicated point systems and deep discounts for something that just works: native Shopify store credit.

Rethinking Loyalty Beyond Points and Discounts

This shift is all about eliminating customer friction while protecting your profit margins. Think of it this way: a points system is like a complicated board game. The rulebook is long, the math is confusing, and most players give up before they even start. A store credit program, on the other hand, is like handing your best customers cash to spend exclusively with you. It's simple, direct, and incredibly effective at increasing Customer Lifetime Value (LTV).

Our goal here is to help you build a premium loyalty experience that actually drives repeat business and skyrockets your LTV, all without ever leaving your Shopify dashboard.

The Shift Toward Smarter Retention

Winning in e-commerce today isn't just about finding new customers; it's about holding onto the great ones you already have. A tiered loyalty program is one of the best tools in your arsenal to do just that, but how you build it makes all the difference. The old way was a race to the bottom with confusing point conversions and margin-crushing coupon codes.

The smarter approach is built on a clear value exchange that benefits both you and your customer. This is where native Shopify store credit truly excels. It feels tangible, almost like cash in hand, which directly encourages shoppers to increase their average order value (AOV) just to unlock that next reward tier. If you're new to the concept, it's worth taking a moment to understand what store credit is and how it works.

A well-designed tiered loyalty program using store credit transforms retention from a cost center into a profit driver. It rewards your best customers in a way that guarantees their next purchase is with you, not a competitor, directly boosting LTV.

Why Tiers and Store Credit Are a Perfect Match

When you combine a tiered structure with native Shopify store credit, you create a powerful and intuitive path for customers to follow. It introduces that addictive "gamified" feeling without the headache of abstract points. Customers can instantly see the connection between what they spend and what they get, which motivates them to climb the ladder for even better perks.

And this model isn't just a niche idea—it’s where the market is heading. The global loyalty management market was valued at a massive $5.57 billion in 2022 and is on track to explode to $24.44 billion by 2029. This incredible growth is being driven by strategies that deliver real, measurable results by focusing on LTV and AOV.

In fact, as of 2023, a staggering 77% of consumers belonged to a premium loyalty program. The demand is there. This guide will show you exactly how to capture it.

Why Store Credit Is the Smartest Reward for Shopify

When you're building a tiered loyalty program, the reward you choose is everything. For years, Shopify merchants have been stuck between two less-than-ideal options: confusing point systems that feel like homework and margin-killing discount codes that just teach customers to wait for a sale.

Thankfully, there’s a much better way. Native Shopify store credit changes the game entirely, creating a win-win that drives up both Customer Lifetime Value (LTV) and Average Order Value (AOV).

Instead of making customers do math ("Wait, how many points do I need for $5 off?"), store credit is simple. It's a cash-like balance that people instantly understand. It feels like real money in their account, ready to spend, which makes the reward feel far more valuable and removes all the friction of a typical points program.

Protect Your Profitability

Let's be honest: discount codes are a direct hit to your bottom line. The moment a customer uses a 20% off coupon, that revenue is gone. It disappears from the transaction right away, squeezing your margins before the order even ships. This can trap you in a tough cycle, constantly giving up profit today in the hope of a repeat purchase tomorrow.

Store credit turns that entire model upside down. It’s not an immediate cost; it’s an investment in a future sale. You issue credit to a loyal customer, and it only becomes a real cost to your business when they come back to spend it. This protects your cash flow and ensures your loyalty program is funding the exact behavior you want—more repeat business, which is the cornerstone of high LTV.

By rewarding customers with store credit, you transform a loyalty liability into a powerful retention asset. The "cost" of the reward is intrinsically linked to a future revenue-generating event, safeguarding your unit economics and fueling LTV.

This is what makes a tiered loyalty program a true profit driver. You can confidently offer more generous store credit rewards in your higher tiers because you know that value is coming right back to your store. Better yet, customers often spend more than their credit balance to get the item they really want, directly increasing AOV.

Elevate the Customer Experience

From the customer's point of view, store credit is just a better, cleaner experience. There are no confusing conversion rates to figure out or complex rules to remember. They see a clear dollar amount in their account—a balance they earned and can use whenever they want. That kind of transparency builds trust and makes your rewards feel genuine.

It’s simple, intuitive, and feels instantly usable.

Now, compare that to the low-grade anxiety of using a discount code. Did I copy it right? Is it expired? Will it work with the other items in my cart? Store credit gets rid of all that friction. It's an automatic, seamless reward that makes shopping easier, not more complicated. For a deeper dive, you can learn more about the strategic advantages of using Shopify store credit in our detailed guide.

Keep It Simple with Shopify’s Native Functionality

One of the biggest, yet most overlooked, perks of using store credit is how simple it is to run. Because it’s a native Shopify feature, it works perfectly within your existing setup. No clunky third-party apps, no complex integrations, and no heavy scripts that can slow your site down.

Let's break down how native Shopify store credit really stacks up against the old-school methods.

Loyalty Rewards Comparison: Points vs. Discounts vs. Store Credit

This table gives a clear, side-by-side look at how these three common reward types impact your business and your customers.

Feature | Points Systems | Discount Codes | Native Store Credit |

|---|---|---|---|

Profit Impact | High risk of liability from unredeemed points. | Immediately erodes transaction margin. | Cost is only realized on a future purchase, boosting LTV. |

Customer Clarity | Often confusing with complex conversion math. | Simple, but trains customers to expect sales. | Clear, tangible value like a gift card. |

Operational Effort | Requires third-party apps and integrations. | Can be cumbersome to manage and track. | Seamlessly integrated into Shopify. |

Ultimately, by building your tiered loyalty program on a foundation of native store credit, you're not just creating a more profitable and customer-friendly system—you're also making it significantly easier on yourself. This frees you up to focus on what really matters: increasing LTV and AOV by building relationships with your best customers.

Designing Your High-Impact Tiered Program

Alright, let's roll up our sleeves and move from theory to action. It's time to build the architecture of a tiered loyalty program that actually gets customers to change their behavior—in a good way. A killer program isn't about being complicated; it's about giving your customers a clear, compelling path that makes them want to spend more and stick around longer.

The real goal here is to design a system that feels attainable for newcomers but still aspirational for your loyal fans. By zeroing in on Customer Lifetime Value (LTV), you can build a structure that rewards your absolute best customers in a way that directly fuels more repeat business. This blueprint cuts through the noise of confusing points systems and focuses on the pure clarity and power of native Shopify store credit.

Defining Your Tier Entry Rules

The very foundation of your program is how people climb the ladder. The best way to do this? Keep it simple. Tie your tiers directly to customer value. Forget tracking a dozen different abstract actions and focus on one of two powerful metrics: lifetime spend or purchase frequency.

Lifetime Spend: This is the most straightforward and, frankly, the most effective method. It rewards customers based on their total dollar contribution over time, perfectly aligning your program with LTV. A customer who has spent more is more valuable, and their tier should shout that from the rooftops.

Purchase Frequency: This approach is fantastic for brands with lower-priced items or products that people buy over and over. It rewards the habit of coming back, which is a massive driver of LTV in the long run.

For most merchants on Shopify, lifetime spend is the winning ticket. It’s dead simple for customers to grasp ("Spend $X more to hit Gold!") and directly incentivizes them to increase their AOV to reach those juicy milestones.

Once you’ve picked your metric, it's time to set the thresholds. Think about making the first tier feel within reach for a new customer after just their second or third purchase. This gives them an immediate win and a taste of progress. From there, each new tier should feel like a significant—but still achievable—leap.

Structuring Your Store Credit Rewards

With your tiers mapped out, the next step is attaching rewards that people actually care about. This is where using native Shopify store credit as your currency is a game-changer. You’re not just giving a one-off discount; you’re handing them a balance that pulls them back for their next purchase. The key is to make the rewards scale in a way that feels noticeably better at each level.

A simple percentage-back model is your best friend here. It’s incredibly easy to communicate and naturally encourages people to spend more to earn more. This structure has a direct, positive kick on your average order value (AOV) because customers can see a clear return on every single dollar they spend.

Here’s what that might look like in the real world:

Tier Name | Lifetime Spend to Qualify | Store Credit Reward |

|---|---|---|

Silver Status | Spend $250+ | Earn 3% back in store credit on every purchase. |

Gold Status | Spend $1,000+ | Earn 7% back in store credit on every purchase. |

Platinum Status | Spend $2,500+ | Earn 10% back in store credit on every purchase. |

This model works so well because the value is crystal clear. A customer in the Gold tier knows that a $100 order instantly puts $7 back in their account for next time. That’s a tangible, immediate reward that feels great and drives repeat business.

Establishing Upgrade and Downgrade Logic

A program that moves with your customers is one that keeps them hooked. Your rules for moving between tiers need to be just as clear as your entry criteria.

Upgrades should be automatic and feel like a celebration. The moment a customer’s lifetime spend ticks over a threshold—say, from $990 to $1,050—they should instantly be welcomed into the Gold tier. This is a golden opportunity to hit them with a congratulatory email that celebrates their new status and reminds them of their awesome new earning rate.

Downgrades, on the other hand, need a much softer touch. You want your top tiers to feel exclusive, but you don't want to punish loyal customers who just had a quiet year. A common and fair strategy is to review tier status annually. If a customer hasn't bought anything in the last 12 months, you could gently move them down one level. This "activity rule" keeps the program from going stale and encourages consistent shopping without feeling punitive. It's the final piece to ensuring your tiered program is a powerful, long-term engine for LTV growth.

Boosting AOV and LTV with Strategic Communication

You can build the most brilliant tiered loyalty program in the world, but if your customers don't know about it, it might as well not exist. If they can't easily see their status or understand the value they’re getting, you're leaving money on the table. Communication is the engine that turns your loyalty program from a background feature into a powerful driver of higher average order value (AOV) and, ultimately, greater Customer Lifetime Value (LTV).

The trick is to weave your program's messaging into every single stage of the customer journey. It needs to be a visible, engaging part of the shopping experience itself. This isn’t about blasting inboxes with promotions; it’s about giving customers timely, valuable information that makes them feel good about shopping with you. And when your program is built on something as simple and tangible as Shopify store credit, that communication becomes crystal clear.

Make Your Program Impossible to Ignore

Visibility is the first and most important step. Customers should see their tier status and store credit balance without having to go digging for it. When you embed this information right into your Shopify store, you create a constant, gentle reminder of the value they've earned just by being a customer.

This kind of visibility has a direct impact on how people shop. A customer seeing they're just a few dollars away from the next tier is far more likely to add one more item to their cart. It's a simple, powerful nudge that boosts AOV on the spot.

Here are a few high-impact ways to make this happen:

Floating Wallet Widgets: Think of a small, persistent icon on your site that shows a customer's balance and tier (e.g., "Gold Status | $15.20 Credit"). It's always there, always reminding them of their perks.

On-Site Progress Bars: People love a good progress bar. Place a visual indicator on their account page or even in the cart showing how close they are to the next tier. It gamifies the experience and encourages them to close the gap.

Checkout Reminders: Display their available store credit right at checkout. Making it effortless to apply their rewards removes friction and makes them feel smart for using their balance.

Drive Repeat Purchases with Automated Messaging

The conversation shouldn't end when a customer leaves your site. Automated post-purchase emails are your secret weapon for reinforcing the program's value and nudging them toward that all-important next purchase. Every message is a chance to strengthen that relationship and increase LTV.

A great loyalty program feels less like a marketing scheme and more like a VIP club. Every email should reinforce the exclusivity and value of being a member, framing their store credit as a well-deserved perk, not just a transaction.

To really see how well this is working, you have to track the right things. Understanding and measuring metrics like Customer Lifetime Value is non-negotiable, and great communication is one of the most direct ways to move that number up.

Essential Automated Email Campaigns

At a minimum, you should have these three automated emails working for you around the clock, turning one-time buyers into high-LTV customers.

Welcome to the Program Email: The moment a customer makes their first purchase and officially joins your program, send them a dedicated welcome email. Explain the perks in simple terms, show them their starting store credit, and clearly spell out what it takes to climb to the next level.

Tier Upgrade Celebration: Hitting a new tier is a big deal, so treat it like one! Trigger an immediate, celebratory email congratulating them on reaching a new status. Be sure to highlight their new, higher store credit earning rate to get them excited about shopping again.

Store Credit Balance Reminders: This one is pure gold. Set up an automated email that goes out every 30-60 days to customers with an unused credit balance. Frame it as a friendly heads-up about the "cash" they have waiting. It's an incredibly effective and low-effort way to boost repeat purchase rates.

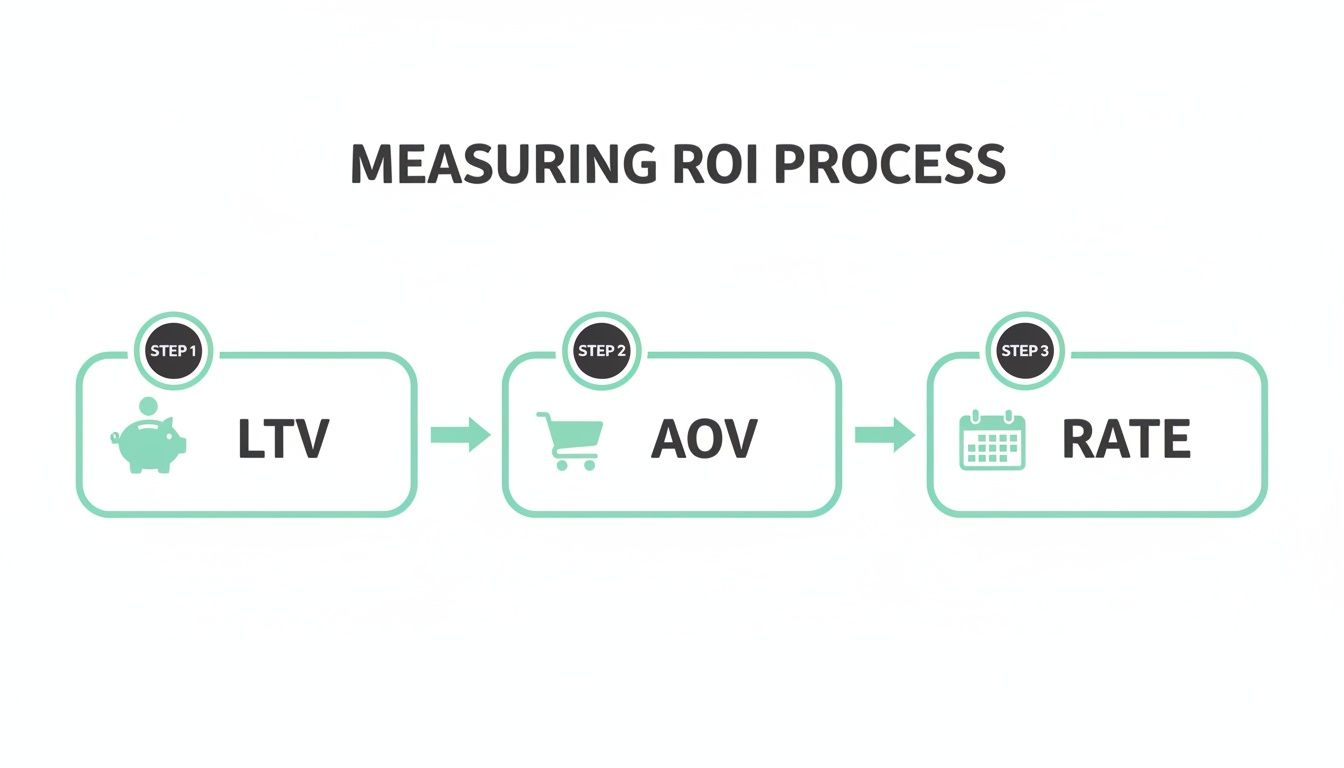

Measuring the True ROI of Your Loyalty Program

So, you've launched a tiered loyalty program. How do you prove it’s actually making you money and not just costing you? The answer isn't found in vanity metrics; it’s about digging into the data that really matters. You need to connect the dots between your program and your bottom line.

The two numbers that tell this story most clearly are Customer Lifetime Value (LTV) and Average Order Value (AOV). These aren't just spreadsheet fillers; they are the truest measures of whether your program is working. And when you build your tiers around native Shopify store credit, you'll see a direct and measurable lift in both.

The Power Metrics: LTV and AOV

Think of LTV as the total amount of money you can expect from a single customer over their entire time shopping with you. A great loyalty program is designed to do one thing: make that number go up, consistently. It turns one-and-done shoppers into loyal, long-term fans who keep coming back.

AOV, on the other hand, is simply how much a customer spends in a single checkout. A store credit system gives this a natural boost. It’s simple psychology—when a customer sees they’re just a few dollars away from unlocking the next tier and earning more credit, they’ll often toss one more item in the cart. That little nudge directly increases the value of that sale.

Secondary Metrics That Tell the Full Story

While LTV and AOV are your headliners, a few other metrics give you the full context of how your program is changing customer habits. Keep an eye on these to get a complete picture of your return on investment.

Repeat Purchase Rate: This is the big one. What percentage of your customers come back for a second, third, or fourth purchase? This is the ultimate loyalty test, and a rising rate shows your store credit rewards are a powerful magnet.

Time Between Purchases: How long does it take for a customer to come back and buy again? A successful program will shrink this window, proving your brand is staying top-of-mind and customers are more engaged.

The most effective tiered loyalty programs don't just reward spending—they change it. By focusing on LTV and AOV, you can prove that your program is actively shaping customer behavior to be more valuable over time.

To truly grasp the financial impact, you have to know how to calculate marketing ROI properly. At its core, your loyalty program is a marketing engine, and it deserves the same level of financial scrutiny.

The proof is in the numbers. Among businesses that actually measure the impact of their loyalty efforts, a staggering 80% reported positive returns. On average, they brought in 4.9 times more revenue than they spent on the program itself. This isn't just a feel-good initiative; a well-run tiered program is a powerful profit center. If you want to dive deeper, you can discover more insights about loyalty program performance. By tracking the right KPIs, you'll have all the evidence you need to justify and grow your retention strategy.

How to Migrate from Points to Store Credit

Thinking about switching from a confusing points system to native Shopify store credit? It might feel like a huge leap, but it’s an upgrade that pays off big time in customer clarity and, frankly, your bottom line.

A smooth transition all comes down to a smart strategy. You need to respect the value your customers have already earned while showing them exactly why this new system is better for them. This is your chance to ditch the confusion and replace it with real, tangible value that drives LTV.

The first move is converting all those existing points into a clear, dollar-value store credit balance. This one step eliminates the biggest headache of old-school loyalty programs: confusing math. Suddenly, a customer doesn't have 5,000 points of unknown worth; they have $25.00 in their account, ready to go. That simple shift makes their loyalty feel a whole lot more valuable.

Calculating Fair Conversions

First things first, you need to set a simple, direct cash equivalent for your current points. Let's say 200 points currently gets a customer a $1 discount. That means a customer with 2,000 points should get $10 in store credit. Easy. Just be sure to announce a clear cut-off date for earning the old points to make a clean break.

Now, here's a pro tip: consider offering a little something extra for making the switch. A small 10% migration bonus can generate a massive amount of goodwill. That same customer with 2,000 points would now get $11 in store credit instead of $10, immediately framing the change as a win for them. When you're ready to get into the nuts and bolts, you can learn more about how to issue store credit on Shopify with its built-in tools.

This whole process is designed to boost the metrics that really matter—like Customer Lifetime Value (LTV) and Average Order Value (AOV).

As you can see, a clear, value-driven tiered loyalty program directly feeds into a healthier, more profitable customer base.

Crafting Your Communication Strategy

How you talk about this change is every bit as important as the technical side of things. You should frame the move as a direct response to customer feedback. You're not just changing things; you're making them simpler, more valuable, and easier to use for them.

Your messaging needs to hit three key notes:

Simplicity: No more confusing points! We're switching to a clear, cash-like store credit balance.

Value: Your rewards are now easier to see and even easier to spend.

Benefit: Our new tiered loyalty program means even better rewards that increase in value as you shop with us.

Transitioning to store credit isn’t just a system change; it’s an opportunity to re-engage your loyal customers and show them you’re invested in improving their experience. A successful migration builds trust and sets the stage for greater lifetime value.

Don't underestimate the power of a great tiered program. They are masters at driving repeat business and creating emotional connections that a simple discount never could. Just look at Sephora—their loyalty members account for an astounding 80% of the company's total sales. That's the power of a dedicated, engaged community. If you want more proof, you can read up on findings from top-tier loyalty programs and see the impact for yourself.

Handle this transition with care, and you’ll build a loyalty engine that’s far more robust and profitable.

Let's tackle some of the common questions and concerns that pop up when merchants think about switching to a tiered loyalty program. It's totally normal to have a few "what ifs" when you're changing up your strategy, especially when it involves customer rewards and your bottom line.

Here are straight-up answers to the questions we hear most often.

Won't This Just Increase My Costs?

This is probably the biggest myth out there about using native Shopify store credit. It’s easy to think of it as just another discount, but the mechanics are completely different.

A traditional discount code is an immediate hit to your revenue on that specific sale. Store credit, on the other hand, only becomes a "cost" when a happy customer comes back to your store to make another purchase. Think about that for a second. It completely flips the script, protecting your immediate cash flow.

You're not just giving away margin; you're investing in the next sale. This simple shift turns your loyalty program from a cost center into a powerful engine for repeat business and higher Customer Lifetime Value (LTV).

Is Store Credit Really Better Than Discounts for AOV?

Without a doubt. A 10% off coupon is a one-and-done deal—it encourages a single purchase. A tiered store credit program plays the long game by motivating customers to consistently spend a little more.

Imagine a shopper seeing they're just a few dollars away from unlocking the next tier and earning rewards at a faster rate. What do they do? More often than not, they’ll add another item to their cart to hit that goal.

This creates a natural, sustainable lift in your average order value (AOV) because the incentive is always tied to future value, not just an immediate price cut.

But Don't Customers Like Hoarding Points?

Sure, some people get a kick out of collecting points, but for many, it's just confusing. Points systems force your customers to do mental gymnastics to figure out what their rewards are actually worth. That friction is a conversion killer.

Store credit is the exact opposite. It's simple, clear, and tangible. $10 in credit is... well, $10 to spend in your store. There's no guesswork.

This transparency makes the reward feel more real and more valuable, giving customers a much stronger reason to come back and shop. When it comes to loyalty, simplicity almost always wins. You’re building trust by making things easy, turning your program into a genuine asset that increases customer LTV.

Ready to see how a store credit loyalty program can actually boost your profitability? Redeemly makes it dead simple to launch a tiered program that drives up AOV and LTV, all without the headaches of points or the margin-crushing pain of constant discounts. Learn more about Redeemly and get started.

Join 7000+ brands using our apps