How to Issue Store Credit on Shopify to Boost Customer Lifetime Value

Dec 21, 2025

|

Published

Returns are just a part of doing business, but they don't have to be a total loss. Instead of resorting to discount codes or confusing points systems that can devalue your brand, you can issue store credit. It’s a straightforward strategy using Shopify's native tools that keeps revenue in your business, boosts customer lifetime value (LTV), and builds a stronger connection with your customers.

Why Store Credit Is Your Secret Weapon for Customer Loyalty

Let’s be real—nobody loves seeing a return request. Your first thought is often about lost revenue and a customer you might not see again. But what if you could flip that script? Smart Shopify merchants are doing just that by offering store credit instead of a straight cash refund. Unlike discount coupons, which can attract one-off bargain hunters, store credit is designed to retain high-value customers and encourage repeat business. This simple shift can make a huge difference to your store's bottom line and your customer relationships.

When you keep the money within your ecosystem, you’re not just stopping a sale from vanishing. You're guaranteeing a future purchase. This simple act transforms a potentially negative experience (a product that wasn't a good fit) into a positive one—a second chance to find something perfect. It’s a powerful signal that you’re committed to making them happy, not just making a sale.

Turning Returns Into Guaranteed Revenue

The numbers behind store credit are hard to argue with, especially if you're in an industry with high return rates. Apparel and fashion stores on Shopify, for example, can see returns as high as 30–40%. If you refunded all of that in cash, you'd have a serious cash flow headache.

Store credit neatly sidesteps that problem. It converts what would have been a refund liability directly into a future sale. In fact, most merchants find that 40% to 70% of issued credit gets redeemed, turning what was a potential loss into a repeat purchase and giving customer lifetime value a healthy boost.

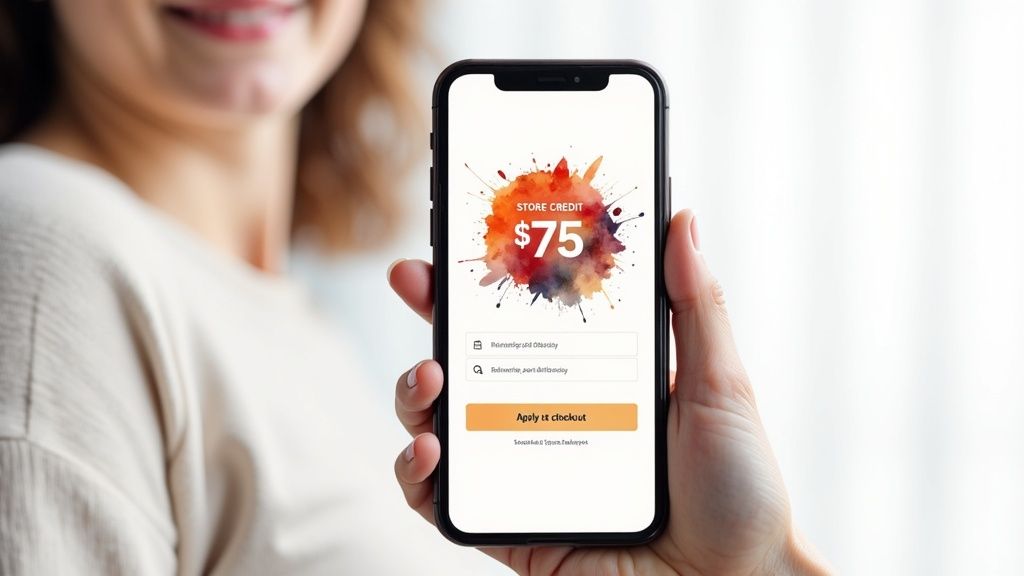

Here’s a peek at how Shopify’s native gift card feature works, which is the go-to method for issuing credit manually.

This clean interface lets you create gift cards in specific amounts, making it a breeze to issue credit that matches the exact value of a customer's return.

Boosting Average Order Value and Loyalty

But store credit does more than just plug a leak in your revenue bucket. It actually encourages customers to spend more. When a shopper comes back to your store with a credit balance, they often see it as "free money." This mindset makes them far more likely to buy items that cost more than their credit amount, paying the difference out of pocket. That’s a direct lift to your average order value (AOV) and a significant boost to their overall lifetime value.

You can dive deeper into the mechanics by checking out our guide on what store credit is and how it drives repeat business.

Store credit isn't just an alternative to a refund; it's a retention tool. It sends a clear message: "We value you, and we want to help you find something you'll love." That creates a powerful psychological nudge to come back and shop again.

Issuing Store Credit Manually with Shopify's Native Tools

Before you start hunting for a third-party app, it's smart to get comfortable with the tools Shopify already gives you. You can actually issue store credit right out of the box, and while it's a manual process, it’s perfect when you're just starting out. This approach gives you total control and lets you handle returns or smooth over a customer service issue without adding another app to your stack.

The most common and straightforward way to do this is by using Shopify's gift card feature. When you issue a digital gift card for the value of a return, you're essentially creating store credit. The best part? That money stays within your business, and you give the customer an easy, familiar way to shop with you again. This is a far more effective loyalty driver than a simple discount code, as it represents real value tied to a previous purchase.

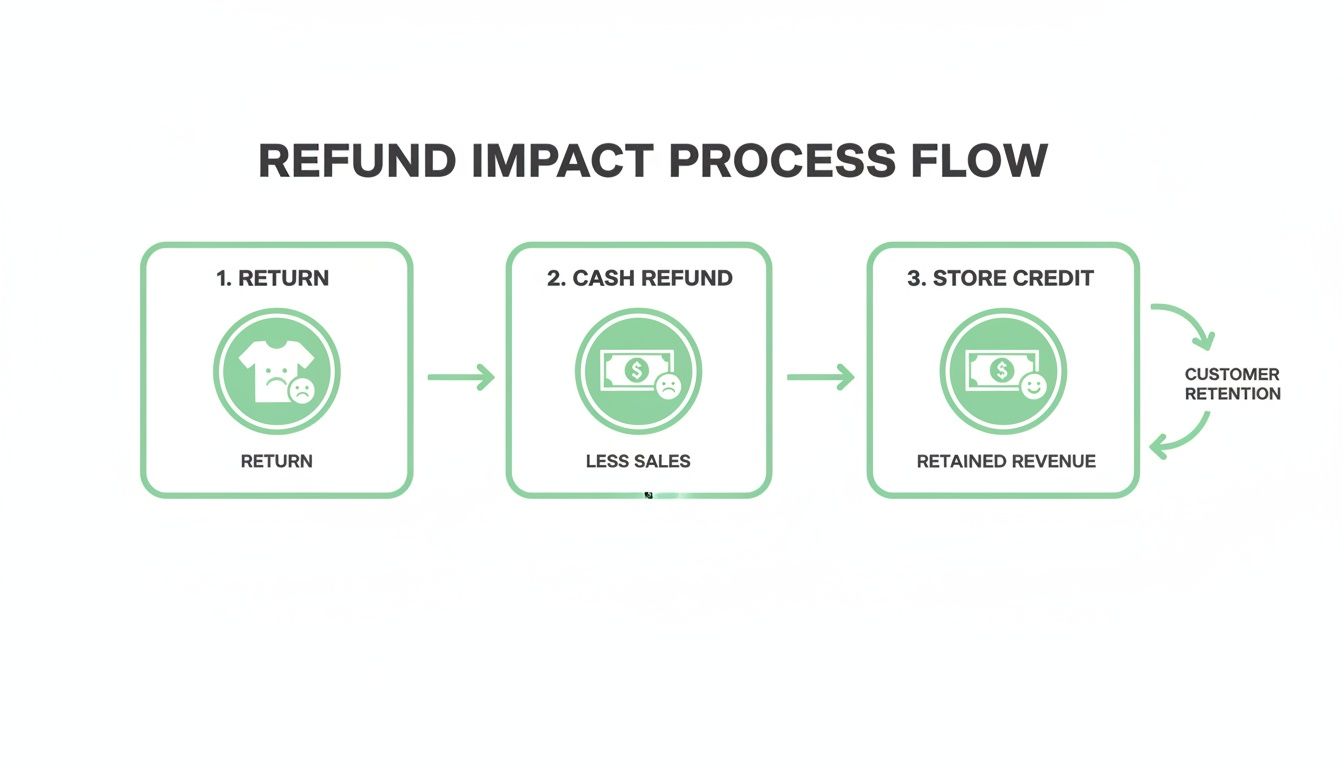

As you can see, a cash refund is a dead end—the revenue is gone. But store credit loops that customer right back into your store, encouraging them to find something else they'll love.

Using Gift Cards for Store Credit

I always tell merchants to think of gift cards as more than just a gift. They're a flexible financial tool. Let's say a customer needs to return a $75 sweater. Instead of refunding their credit card, you can instantly issue a $75 gift card code. It’s an elegant solution that requires zero complex setup.

Here's how it breaks down in your Shopify admin:

Activate Gift Cards: First, make sure you have a gift card product available in your store. If you don't already sell them, you can set one up in a couple of minutes under

Products.Issue a Custom Amount: Head over to the

Gift Cardssection. From there, you can issue a new card for any amount you need, matching the refund value down to the penny.Send it Off: Shopify handles the delivery, sending the digital gift card right to your customer's email. They get a unique code ready to use at checkout.

This simple tactic is a powerhouse for boosting customer lifetime value. A shopper holding your store credit is almost guaranteed to return. And from what I've seen, they often spend more than the card's balance, giving your average order value a nice little bump.

The Draft Order Method

Another fantastic native tool, though a bit more hands-on, is the Draft Order. This one is my go-to for more unique situations where a standard refund or gift card doesn't quite fit. Think of it less as a direct credit and more like a pre-built, personalized shopping cart.

Here’s a real-world example. A loyal customer receives an item worth $50 that has a minor cosmetic flaw. They don't want to return it, but you want to make it right. You can create a draft order, add a custom line item named "$50 Store Credit," and then apply a 100% discount to that line item.

Once you email the invoice for this draft order to the customer, they "check out" for $0. This creates a clear record in their order history. You can then fulfill that order by sending them a unique, single-use discount code for $50. It takes a few extra steps, but it provides an impeccable paper trail and shows you’re willing to create a tailored solution.

Getting a handle on these native options is a great first step. For a more detailed breakdown of how they stack up against dedicated apps, you can explore the pros and cons of sticking with a Shopify native store credit system.

Taking Your Store Credit System to the Next Level with Shopify Apps

Doing things manually works when you're just starting out, but let's be honest—it doesn't scale. As your store grows, processing returns one by one becomes a massive time-suck for your support team, not to mention a breeding ground for human error. This is where dedicated Shopify apps step in, turning that clunky manual process into a slick, automated system built on Shopify's native functionality.

Automation is really what separates an okay store credit experience from a great one. Instead of fumbling with gift cards or draft orders after a return comes in, you can set up rules that work instantly. Picture this: a customer’s return is approved, and a moment later, an email hits their inbox with their credit, ready to spend. That kind of speed and efficiency makes the customer feel taken care of and frees up your team to focus on bigger things.

This kind of integration creates a seamless loop. It encourages your customers to come right back and shop, turning a potential lost sale into a very likely repeat purchase.

Giving Customers a Centralized Wallet

One of the best things about using a dedicated app is the ability to create a customer credit wallet. Forget one-off gift card codes that get buried in an inbox. Instead, customers get a persistent credit balance tied directly to their store account. This simple shift elevates store credit from a mere refund tool to a core part of their shopping experience with you, far more valuable than a complex points system.

Now, customers can log in anytime and see their balance, which keeps your brand top of mind. That visibility is a powerful driver for both customer lifetime value and average order value. When a shopper knows they have $50 sitting in their wallet, they’re far more likely to go for that $75 item, since part of it is already paid for.

This strategy builds on what Shopify’s native system offers but makes it infinitely more user-friendly and engaging—a crucial element for building a Shopify reward program that people actually want to use.

Making Checkout an Absolute Breeze

The final piece of this puzzle is the checkout. A good app makes spending that credit completely frictionless. Your customers shouldn't have to hunt for codes or remember how much credit they have. The system should automatically see their balance and present it as a clear payment option right at checkout.

As a merchant, you'll want a few key controls. You need to be able to issue credit for the exact refund amount, set a reasonable expiration date (typically 6–12 months), and keep a close eye on your redemption rates. We've seen from industry data that a solid 50–65% of issued credit gets redeemed within 60–120 days, especially if you nudge customers with a few friendly email reminders about their balance. Just remember, from an accounting standpoint, this issued credit is a liability on your balance sheet until it's spent.

By automating the whole flow and giving customers a clear, centralized wallet, you're knocking down all the barriers that might stop them from using their credit. The easier you make it to redeem, the faster that revenue comes back into your business. This isn't just about making things convenient; it's a smart strategy to lock in future sales and grow your store profitably.

Turning Store Credit Into a Higher Average Order Value

Sure, issuing store credit is a smart way to hang onto revenue from returns. But the real magic happens when you start using it to fuel future growth. When you get strategic about how you issue store credit on Shopify, you can transform a simple refund alternative into a serious engine for boosting your average order value (AOV) and customer lifetime value.

The game isn't just about getting customers to use their credit. It’s about getting them to spend more than their credit.

Think about it from the customer's perspective. A credit balance doesn't feel like a refund; it feels like free money sitting in their account. This little psychological shift makes them way more open to buying more expensive items or tossing a few extra things into their cart. A $50 credit makes a $75 purchase feel like it only costs $25, which completely changes the buying decision.

Make Your Store Credit the Obvious Choice

The best way to get a bigger AOV out of store credit is to make it the most appealing option on the table. One of my go-to tactics for this is the "credit bonus." Instead of just offering a straight-up credit for the return value, you sweeten the deal.

Let's say a customer returns a $100 item. You give them two choices:

A standard $100 cash refund.

A much more tempting $110 in store credit.

That extra $10 completely reframes the offer. It’s no longer just a refund; it’s a reward for sticking with you. It feels like a genuine perk, which makes it an easy "yes" for the customer and keeps them in your ecosystem.

This isn't just a friendly gesture—it gets real results. We've seen that when stores add a time-sensitive bonus of 10–20% to their credit, not only do redemption rates go up, but the AOV on those orders jumps by an impressive 15–25%. It’s a classic win-win, turning a potential loss into a more profitable future sale. You can dig into how store credit reports reveal this impact on your bottom line.

Use Smart Messaging to Nudge Them Back

Once that credit is in their account, don't just let it gather dust. Your email marketing needs to do the heavy lifting, reminding customers about their balance and giving them a reason to use it now.

Forget the generic "you have credit" emails. The key is to time your reminders with moments when they’re already thinking about shopping.

New Product Drops: The second a new collection goes live, send a targeted email to everyone with a credit balance. Something like, "Your $50 credit is waiting—be the first to shop our new arrivals!" works wonders.

Back-in-Stock Alerts: Got a customer who was eyeing a sold-out item? The moment it’s back, hit them with an alert that also reminds them of their credit. That one-two punch is incredibly effective.

Upcoming Sales: Give your credit-holders a VIP perk, like early access to a big sale. It makes them feel valued and creates a natural sense of urgency to spend their balance before the good stuff is gone.

When you start treating store credit like a marketing tool instead of just an accounting entry, it becomes a central part of how you keep customers coming back and spending more.

Making Store Credit Feel Like a Win for Your Customers

Let's be honest: a great store credit system should feel almost invisible. The goal is an experience so smooth and positive that customers see their credit as a real perk, not just a consolation prize for a return that didn't work out. When you get this right, you're not just processing a refund; you're building trust and encouraging them to come back and shop again without a second thought.

It all starts with how you talk about it. Your return policy needs to be crystal clear, positioning store credit as a fantastic, hassle-free option. Ditch the corporate jargon and make the benefits obvious. And of course, your communication—especially your automated emails—needs to be on point. Following transactional email best practices is non-negotiable here.

Nail the User Experience

Beyond your policies, the actual user experience (UX) on your site is where the magic happens. Customers should never have to dig around for their store credit balance. Make it impossible to miss.

Display it prominently on their account page, right next to their order history and saved addresses. This visibility acts as a constant, gentle reminder that they have money waiting for them, nudging them to browse your new arrivals.

Then comes the checkout—the most critical part. Applying the credit has to be dead simple. The best systems I've seen automatically show the available balance and provide a simple checkbox or button to apply it to the cart. If a customer has to hunt for a code in their email and manually type it in, you've introduced friction. That friction leads to abandoned carts. It should feel as effortless as using a saved credit card.

Your store credit UX should instantly answer three questions for any customer: How much do I have? Where can I see it? How do I use it? If the answers aren't obvious within seconds, you've found a problem area that needs to be fixed.

Perfect Your Communication Flow

Your email notifications are the backbone of the entire experience. They are crucial touchpoints that can make a customer feel either valued or forgotten. A well-thought-out email flow keeps them in the loop without spamming their inbox.

I’ve seen this simple sequence work wonders for countless stores:

The Instant Confirmation: As soon as you issue the credit, an email should go out confirming the amount and briefly explaining how to use it. A clear subject line is key—something like, "Your $50 Store Credit is Ready!"

The Gentle Nudge: If the credit hasn't been used after about 30 days, send a friendly reminder. This isn't a hard sell. It's a helpful nudge, maybe even highlighting some new products they might like.

The Expiry Warning: If your credits expire (and they should, eventually), send a final heads-up 7-14 days before the deadline. This little bit of urgency is often exactly what’s needed to push someone to finally use their balance.

When you design a system that’s this transparent, easy to use, and backed by clear communication, you turn store credit from a simple operational task into a powerful tool that builds genuine customer loyalty.

Got Questions About Shopify Store Credit? We've Got Answers.

Even the most well-planned store credit system will have you scratching your head at some point. It's just part of the process. Getting ahead of these common questions means you can roll out your program smoothly, turning potential headaches into a great experience for you and your customers.

Let's dive into the stuff that trips up most Shopify merchants.

How Does This Work on the Accounting Side?

This is a big one. When you give a customer store credit, you haven't made a sale—not yet, anyway. Think of it as a liability on your balance sheet. It’s money you owe the customer in the form of future goods.

The magic happens when they redeem it. Only then do you get to count that transaction as revenue. Getting this right keeps your books clean and your accountant happy.

Can Customers Stack Store Credit with a Discount Code?

This comes up all the time. The short answer? It depends.

If you're using Shopify's native gift cards to handle store credit, then yes, a customer can usually use their gift card balance and one discount code at checkout. This is a fantastic way to nudge up that average order value, as shoppers feel like they're getting an even better deal. If you're using an app, check its specific settings, as some offer more control over how promotions can be combined.

What About Those Tricky Customer Situations?

You're going to get some curveballs. For instance, what happens if a customer takes the store credit, then changes their mind and demands cash?

This is where your return policy saves the day. It needs to be crystal clear. Spell out that once a customer accepts store credit for a return, the decision is final. Being upfront and transparent from the get-go sidesteps those awkward conversations and manages expectations from the start.

Should Store Credit Expire?

Absolutely. It’s a good idea for a couple of key reasons:

For Your Books: It keeps you from carrying an open-ended liability forever. An expiration date helps you clean up your balance sheet over time.

For Your Customers: Deadlines create a little bit of urgency. It gently encourages shoppers to come back and use their credit before they forget about it.

A 6 to 12-month expiration window usually hits the sweet spot—it’s generous enough that customers don't feel rushed, but it also lights a small fire to get them shopping again.

The most important thing to remember is that a great store credit program isn't just a refund alternative; it's a customer retention tool. It all comes down to clear policies, transparent communication, and an experience that makes your customer feel valued, not trapped. When you get that right, you’re not just saving a sale—you’re building serious customer loyalty.

Can Customers Check Their Own Balance?

They should be able to, and it should be easy. If you're using a dedicated app like Redeemly, this functionality is usually built right into the customer's account page.

If you're using the manual gift card method, the balance is in the original email they received. But let’s be honest, that’s not ideal. Nudging customers to create an account gives them a central place to see their balance, which is a much better user experience.

Ready to replace confusing discounts with a loyalty system that actually grows your profit? Redeemly uses Shopify's native store credit to boost lifetime value and average order value, all while protecting your margins.

Join 7000+ brands using our apps