A Better Shopify Reward Program That Boosts LTV and AOV

Dec 13, 2025

|

Published

Let's be real for a moment: most Shopify reward programs are stuck in the past. They’re built on a clunky, outdated model of complicated points and never-ending discounts that actually ends up costing you money. It’s a race to the bottom that trains your customers to only buy when there's a sale, cheapening your brand and failing to create any real, lasting loyalty that increases lifetime value.

The Hidden Costs of Old-School Reward Programs

So many Shopify reward programs are fundamentally broken. On the surface, the logic seems fine—offer points for purchases, let customers cash them in for discount coupons. Simple, right? But underneath, this system is quietly eating away at your profit margins and failing to boost key growth metrics like Average Order Value (AOV) and Customer Lifetime Value (LTV).

The biggest issue is what this teaches your customers: that your products aren't actually worth full price. When a shopper knows a discount is always just around the corner, they learn to wait. They hold off on buying, expecting the next coupon to land in their inbox. This behavior throws a wrench in your cash flow and makes it nearly impossible to forecast sales with any accuracy.

The Downward Spiral of Discounts

Relying on constant discounts doesn't just squeeze your margins—it attracts the wrong type of customer entirely. You start building a base of deal-hunters, not genuine brand fans. Their loyalty isn't to your products or your mission; it's to whatever percentage-off you're offering this week. This creates some serious headaches for any growing brand:

Shrinking Profit Margins: Every single discount directly cuts into your revenue. While small at first, those cuts quickly add up to a massive loss over time.

Brand Devaluation: When everything is always on sale, your brand starts to look less premium. It undermines the perceived value you’ve worked so hard to build.

Confusing Customer Experience: Let’s face it, most point systems are a pain. Customers have no idea what their points are actually worth, which just leads to frustration and kills the excitement.

This old-school approach is like trying to fill a leaky bucket. You pour all this money and effort into acquiring new customers, only to immediately give that profit back as discounts. The whole thing becomes about the transaction, not about building real value.

Once you see these hidden costs, it becomes obvious that a new strategy is needed. The goal shouldn't be to just reward a single purchase. It should be to invest in a long-term relationship that grows key metrics like lifetime value (LTV) and average order value (AOV). That’s how you build a loyalty model that’s both profitable and sustainable.

Why Store Credit Is Your Secret Weapon for Protecting Profits

Let's get real about discounts. Every time you offer a percentage off or a coupon code, you're essentially giving away revenue. That money walks out the door and never comes back, eating directly into your profit margin on that sale.

But what if there was a better way?

A modern Shopify reward program built on native store credit completely changes the game. Instead of treating rewards as a cost, you transform them into an investment in future sales. Think about it: when you give a customer store credit, that value stays locked inside your business, acting like a powerful magnet pulling them back for their next purchase.

This simple shift from a discount to store credit fundamentally alters the financial impact of your loyalty strategy. You're not just giving something away; you're pre-funding your customer's next shopping trip.

Keep It Simple, Keep Them Engaged

Ever tried to figure out what 1,000 loyalty points are actually worth? It’s confusing. Complex point systems create friction and frustration for customers. Questions like, "How many points do I have?" or "What can I even get with this?" kill the excitement and are a major reason why so many loyalty programs fail to get off the ground.

Store credit cuts right through all that noise. It’s a digital wallet for your brand, and its value is crystal clear. Seeing "$10 in store credit" is instantly understood and feels like real money waiting to be spent. That clarity makes the reward feel more tangible and valuable, which naturally leads to higher redemption rates and, ultimately, higher AOV.

A discount is a lost sale. Store credit is a future sale you've already secured. It transforms a business expense into a direct investment in customer retention and lifetime value.

By ditching the complicated math, you make it effortless for customers to engage with your program. That simplicity is the key to building a reward system people actually love and use, which in turn fuels the repeat purchases you're aiming for.

Protect Your Margins and Guarantee Repeat Business

The financial upside of using native store credit is too big to ignore. Let's look at how it works. A discount hits your bottom line the second the sale is made. Store credit, on the other hand, only becomes a cost when the customer comes back and redeems it on a future purchase. This structure is a game-changer for a few key reasons.

Let's break down the real-world financial impact with a simple scenario: offering a $10 reward on a $100 purchase.

Store Credit vs. Discounts: A Financial Snapshot

Metric | Store Credit Reward | Discount Coupon Reward |

|---|---|---|

Initial Order Value | $100 | $100 |

Reward Applied | $0 (issued as $10 credit for future use) | -$10 (applied immediately) |

Revenue from First Sale | $100 | $90 |

Guaranteed Future Spend | $10 (or more, driving a second sale) | $0 |

Impact on Margin | No immediate impact. Realized on a future, higher-AOV purchase. | Immediate 10% margin reduction. |

As you can see, the store credit approach protects your initial revenue and margin while creating a powerful incentive for a second purchase.

This model delivers powerful business advantages:

Better Cash Flow: You collect the full $100 from the initial sale. The cost of the $10 reward is deferred until the customer returns to spend it.

Sky-High Lifetime Value (LTV): You’re building a natural retention loop. Giving customers a reason to come back is the surest way to turn one-time buyers into loyal fans.

Bigger Carts (AOV): People treat store credit like "house money." They’re far more likely to spend more than their credit balance, using it to justify a larger purchase.

This isn't just about rewards; it's a smarter, more sustainable growth strategy. You get to build incredible loyalty without sacrificing the profitability you've worked so hard to achieve.

How Store Credit Drives Higher LTV and AOV

A great Shopify reward program is about more than just giving stuff away. It’s about shaping customer behavior to grow your most important metrics. This is exactly where a native store credit system outshines other options, creating a powerful cycle that directly boosts both Average Order Value (AOV) and Customer Lifetime Value (LTV).

Think about it from the customer’s perspective. When someone has a store credit balance, it doesn't feel like a flimsy coupon they might lose or forget. It feels like their money sitting in their account, waiting to be spent. This "house money" effect completely changes the psychology of their next purchase.

A shopper with $10 in their account rarely hunts for a $10 item. What are the chances? Instead, they see it as the perfect excuse to finally buy that $50 item they’ve been eyeing, because now it only costs them $40. That credit just lowered the mental barrier to a bigger purchase, naturally lifting their cart size and boosting your AOV.

Building the Retention Loop with Store Credit

Boosting a single sale is nice, but the real magic of native store credit is how it plays out over the long term. A steady drip of rewards creates an unbreakable retention loop, turning one-time buyers into your most loyal, high-spending customers. This is the bedrock of a high LTV.

The process is incredibly simple but powerful:

Customer Makes a Purchase: They buy a product and have a great experience.

They Receive a Reward: A tangible store credit balance appears in their account—a little "thank you."

The Incentive to Return is Created: That balance is a constant, gentle nudge to come back and shop again.

They Make a Second, Higher-AOV Purchase: They use their credit and almost always spend more.

The Cycle Repeats: They earn even more credit on that second purchase, strengthening their connection to your brand.

This cycle is everything. The data doesn't lie: members of a well-run Shopify reward program spend more money, more often. We consistently see loyalty members drive a 12-18% higher AOV than non-members. In strong programs, the revenue directly tied to the loyalty program—the loyalty attribution rate—can hit 15-25%.

By making rewards feel like an asset instead of just another discount, you shift the entire customer relationship. It stops being about transactions and starts becoming relational. They're no longer just hunting for a deal; they're invested in your brand.

From One-Time Buyer to Brand Loyalist

This retention engine is how you turn a customer's fleeting interest into lasting, predictable value. Every reward reinforces good behavior, making your store their go-to choice. It’s a far more sustainable (and profitable) growth model than endlessly pouring money into ads to acquire new customers who may never return.

When you focus on a seamless store credit experience, you’re not just rewarding purchases. You’re building a reliable revenue stream from the customers who matter most. To really pour fuel on the fire and amplify these benefits, consider working with Shopify SEO experts who can help drive even more high-quality traffic to your store.

How to Build a Store Credit Program That Actually Works

Alright, let's get down to brass tacks. Moving from theory to a live store credit program on Shopify is easier than you might think. This isn't about some massive, complicated technical project. The real goal is to create a dead-simple experience where your customers feel appreciated and know exactly what they’re getting.

The entire program should feel smooth and intuitive. From the moment a customer earns their first dollar in credit to the second they spend it, there should be zero friction. That means no confusing rules, no hidden balances, and a checkout process that just works.

If you want your program to succeed, you need to nail three things: automation, visibility, and communication. Get these right, and your store credit system will feel like a natural part of your store, not some clunky third-party app you bolted on.

The Nuts and Bolts of Implementation

Setting this up comes down to a few key decisions. Now, you could try to jerry-rig something using Shopify's native gift card feature to manually send credit, but that's a recipe for headaches. It completely lacks the automation that makes a loyalty program work. A dedicated app built for native store credit is almost always the smarter move.

Pick the Right Tool: Your best bet is a native Shopify app, like Redeemly, that plugs directly into Shopify’s own store credit system. This approach avoids bogging down your site with heavy external scripts and guarantees a seamless checkout experience.

Set Simple Earning Rules: Don't overcomplicate it. A clear, easy-to-understand rule like "$5 in store credit for every $100 spent" is infinitely better than a confusing points system nobody can keep track of. Customers get it instantly.

Make Balances Obvious: This is critical. Customers need to see their credit balance without having to hunt for it. A floating wallet icon on the screen or a clear section in their account page keeps their reward top of mind, constantly reminding them they have money to spend with you.

The best reward programs are the ones that demand almost zero effort from the customer. If they have to dig through their account to find their balance or can't figure out how to apply it, they just won't bother. Make it visible, and make it simple.

Crafting a Seamless Customer Experience

Once the technical side is sorted, it's all about the experience. The small details are what transform a decent program into one that genuinely boosts LTV and encourages bigger carts.

Automated Notifications: Set up simple, automated emails that trigger the moment a customer earns credit. A quick "Hey, you've just earned $10 to spend on your next order!" is a powerful nudge to bring them back.

Frictionless Redemption: Applying the credit at checkout should be a one-click affair. The last thing you want is to make them copy and paste a long, clunky code. A native integration with Shopify checkout ensures the credit is applied seamlessly, boosting AOV.

Shout It from the Rooftops: Don't launch your program in secret! Feature it on your homepage, mention it in post-purchase emails, and talk about it on social media. Frame it as a genuine perk of shopping with you. If you need some ideas on how to position it, take a look at these powerful examples of loyalty programs that absolutely nail their messaging.

By focusing on a native, automated, and customer-first approach, you can build a Shopify reward program that not only protects your margins but also creates the kind of real, lasting loyalty that fuels long-term growth.

Measuring the Success of Your New Program

So you’ve launched your Shopify reward program. Pop the champagne, right? Well, not just yet. The launch is just the starting line. The real win comes from knowing if it's actually working—and that means tracking the right numbers to see its impact on LTV and AOV.

We're not talking about vanity metrics here. Forget fuzzy engagement stats and abstract points totals. When you’re using a native store credit program, you can measure its impact in the language every business owner speaks: dollars and cents.

The goal isn't just to see more clicks or email opens. The real questions are: Are customers coming back more often? Are they spending more when they return? Answering these is how you prove your loyalty program is more than just a fun feature—it's a profit engine that drives lifetime value.

Key Performance Indicators for Store Credit

A great rewards program shows its worth on your bottom line. To get a clear picture, you'll need solid tracking in place. If you're looking for a deep dive on the technical side, this guide can show you how to utilize Google Tag Manager for comprehensive tracking.

Once you’re set up, here are the essential KPIs to watch like a hawk:

Customer Lifetime Value (LTV) Growth: This is your north star. Is the LTV of your program members climbing faster than that of non-members? If so, you're building more valuable, long-term customer relationships. We've got a great guide on how to calculate customer LTV if you need a refresher.

Repeat Purchase Rate: This is the ultimate test of stickiness. How good is your program at convincing a one-time shopper to become a two-time (or ten-time) customer? This number tells you exactly how much retention power your store credit holds.

Average Order Value (AOV) Lift: Put the average cart size of members using store credit side-by-side with non-members. You should see a noticeable bump. It's the "house money" effect—customers are more willing to add that extra item when part of the bill is already covered.

Credit Redemption Rate: This metric reveals how much your customers actually value the rewards. A high redemption rate is a fantastic sign that your store credit is both compelling and easy to use. It validates your entire program design.

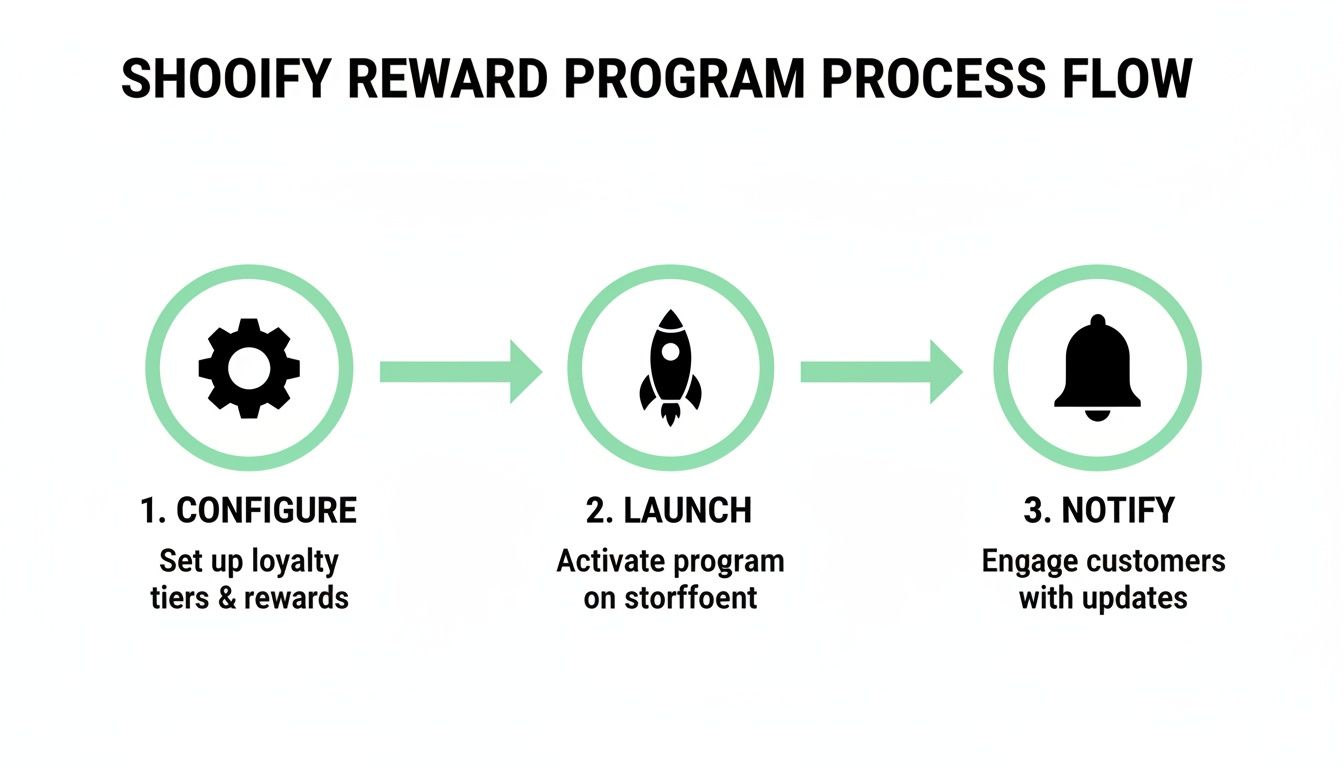

Getting this process right—from setup to launch to keeping customers in the loop—is what makes it all click.

This simple flow is the key to a smooth rollout that feels effortless for both you and your customers.

By focusing on these concrete financial outcomes, you can definitively prove the ROI of your Shopify reward program and make data-driven decisions to optimize it for even greater profitability.

And the potential here is massive. Just look at a platform like Smile.io, which has rewarded over 330 million customers across 148 countries, helping merchants process $136 billion in sales. That’s the kind of scale you can achieve with a well-oiled system, especially when you start layering in things like VIP tiers and other smart integrations to make it even more powerful.

Oops! Common Reward Program Mistakes (And How to Dodge Them)

So, you're ready to launch a Shopify reward program. That's a great move. But before you dive in, let's talk about a few common tripwires that can cause even the best-intentioned loyalty strategies to stumble right out of the gate.

The single biggest mistake? Overcomplicating things. I've seen countless brands get so wrapped up in fancy tiers and complex earning rules that they completely lose the customer. If your shoppers need a PhD in mathematics to figure out what their points are worth, you've already failed. The beauty of a native store credit program is its elegant simplicity: spend money, get money. That’s it.

Another classic blunder is building a brilliant program and then… crickets. No promotion. You can't just expect customers to find it. Treat your program launch like you would any major product drop. Shout it from the rooftops! Feature it on your homepage, blast it to your email list, and create some buzz on social media. If you don't tell them, they won't know.

Sidestepping the Sneaky Loyalty Traps

Beyond those two biggies, a few other sneaky traps are waiting to derail your program's effectiveness. Steering clear of these is crucial if you want to see a real return on your investment in the form of higher LTV and AOV.

Lame, Uninspiring Rewards: The reward has to feel worth it. Giving a customer a few pennies back after they spend a hundred dollars isn't a reward; it's almost an insult. A tangible store credit balance, like a solid $10, feels like real cash in their pocket. That's what motivates them to come back and spend more.

Forgetting to Keep in Touch: Radio silence is a killer. The moment a customer earns that credit, hit their inbox with a celebratory email. A simple, "Hey, you've got $10 waiting for you!" is an incredibly powerful nudge that gets them thinking about their next purchase.

Making Redemption a Chore: Nothing kills the good vibes of a reward faster than a difficult redemption process. Forcing customers to hunt down and copy-paste a discount code at checkout adds friction and cheapens the whole experience. Their available store credit should appear and apply automatically. Make it easy for them to give you their money.

The most effective Shopify reward program is one your customers barely have to think about. It should just work, running seamlessly in the background and making them feel appreciated without asking for anything in return.

By keeping your program dead simple, highly visible, and completely frictionless, you neatly sidestep all the problems that plague those old-school points and discount models. What you're left with is a system that actually builds real customer relationships while protecting your precious profit margins.

Answering Your Top Questions About Shopify Reward Programs

Moving away from a traditional points system can feel like a big step, but it's often the right one for your bottom line. Let's tackle some of the most common questions merchants have when considering a switch to a native store credit loyalty program.

Can't I Just Use Shopify's Built-In Features?

It’s a fair question. Shopify does have a gift card function that you can technically use to issue credit manually. But think of it like trying to run a restaurant's order system with just a notepad and pen—it works for a little while, but it breaks down fast as you grow.

A real reward program needs automation. You need a system that can automatically issue credit when a customer spends a certain amount, give them a digital "wallet" to see their balance, and send reminders so they actually use it. A dedicated app that uses Shopify's native store credit functionality handles all of that for you, making the whole experience seamless for both you and your customers.

Is Store Credit Really Easier for Customers to Understand Than Points?

Without a doubt. Imagine checking your account and seeing "$10 in store credit". You instantly know what that's worth. It feels like cash in your pocket, ready to be spent.

Now think about points. "You have 500 points." What does that even mean? Is it a dollar off? Ten dollars? Customers have to do mental gymnastics just to figure out the value, and that friction is a major turn-off. The beautiful simplicity of store credit makes it feel more valuable and encourages people to come back and spend it, boosting both LTV and AOV.

Okay, I'm Sold. How Do I Switch From My Old Points Program?

This is all about communication and making your customers feel like they're getting an upgrade. You're not taking anything away; you're making their rewards better and easier to use.

Start by announcing the change ahead of time. Frame it as a positive move: "Great news! Our rewards are getting a major upgrade to make them simpler and more valuable." Make sure you offer a fair and clear conversion rate for their existing points into a new store credit balance. To really get things rolling, you could even offer a little bonus credit on launch day to celebrate the new system. A smooth transition gets everyone excited and ready to shop.

Ready to build a more profitable loyalty program without all the complexity? Redeemly helps Shopify merchants replace confusing points and margin-killing discounts with real, cash-like store credit that boosts LTV and AOV.

Join 7000+ brands using our apps