Persuasive advertising techniques to boost Shopify profits

Jan 25, 2026

|

Published

Persuasive advertising is all about tapping into a customer’s emotions and sense of logic to guide their buying decisions. It's less about listing product specs and more about forging a connection that motivates people to act. The best campaigns skillfully weave psychological triggers with a clear, compelling message, encouraging customers to not only click "buy now" but to become loyal, repeat purchasers, boosting their overall lifetime value.

Moving Beyond Discounts to Unlock True Customer Loyalty

Let's be honest: relying on constant discounts feels like a race to the bottom. So many Shopify merchants get caught in this trap, slashing their margins and accidentally training their customers to just wait around for the next sale. The old-school belief that loyalty is built on a mountain of coupons and confusing points systems is not just outdated—it’s often counterproductive. This approach can dilute your brand's value and tends to attract bargain hunters, not true fans who drive up lifetime value.

The problem is that discounts and complex points systems build a purely transactional relationship, not an emotional one. A much more powerful strategy is found in persuasive advertising, where native Shopify store credit becomes the engine for sustainable growth, a higher customer lifetime value (LTV), and a healthier average order value (AOV).

Think of it this way: discounts are a sugar rush—a quick, cheap thrill that inevitably leads to a crash. A well-designed native store credit program, on the other hand, is a strategic investment in long-term customer health and real, lasting value.

The Psychology Behind Persuasion

To really get why native store credit is so effective, it helps to look at where the idea of persuasion even came from. Modern persuasive advertising really took off back in the 1920s when a psychologist named John B. Watson brought behaviorism into the marketing world. He championed a new approach that appealed to core human emotions—love, hate, and fear—instead of just rattling off product features.

This was a game-changer. It proved that emotional appeals were far more powerful motivators than rational arguments, a principle that still drives advertising today. You can dive deeper into the history of advertising psychology to see how these foundational ideas have evolved.

This is exactly where a smart, native Shopify store credit strategy excels. It taps directly into those positive emotions and psychological drivers that coupons and confusing points systems just can't touch.

Shifting from Transaction to Relationship

A native Shopify store credit system completely reframes the customer journey. It shifts the entire focus from a one-off transaction to an ongoing relationship. It’s not just a simple reward; it’s an investment in your customer’s next purchase. This subtle but powerful change unlocks several benefits that directly impact your most critical growth metrics: customer lifetime value and average order value.

Elevates Perceived Value: Store credit feels like real cash sitting in a customer’s account. This creates a sense of endowed value they're hesitant to waste, unlike an abstract point balance.

Boosts Average Order Value (AOV): Customers are naturally encouraged to spend more to reach the next reward tier, often adding another item to their cart to unlock a bigger credit.

Increases Customer Lifetime Value (LTV): By giving customers a compelling reason to come back, store credit becomes a powerful engine for repeat purchases and genuine long-term loyalty.

A loyalty program built on native Shopify store credit isn't just another tactic; it's a fundamental shift in how you build and maintain customer relationships. It moves the conversation from "what can I get for less?" to "what value do I have waiting for me?"

Ultimately, this guide will walk you through how to ditch those margin-killing tactics and embrace a loyalty model that actually strengthens your bottom line and boosts LTV.

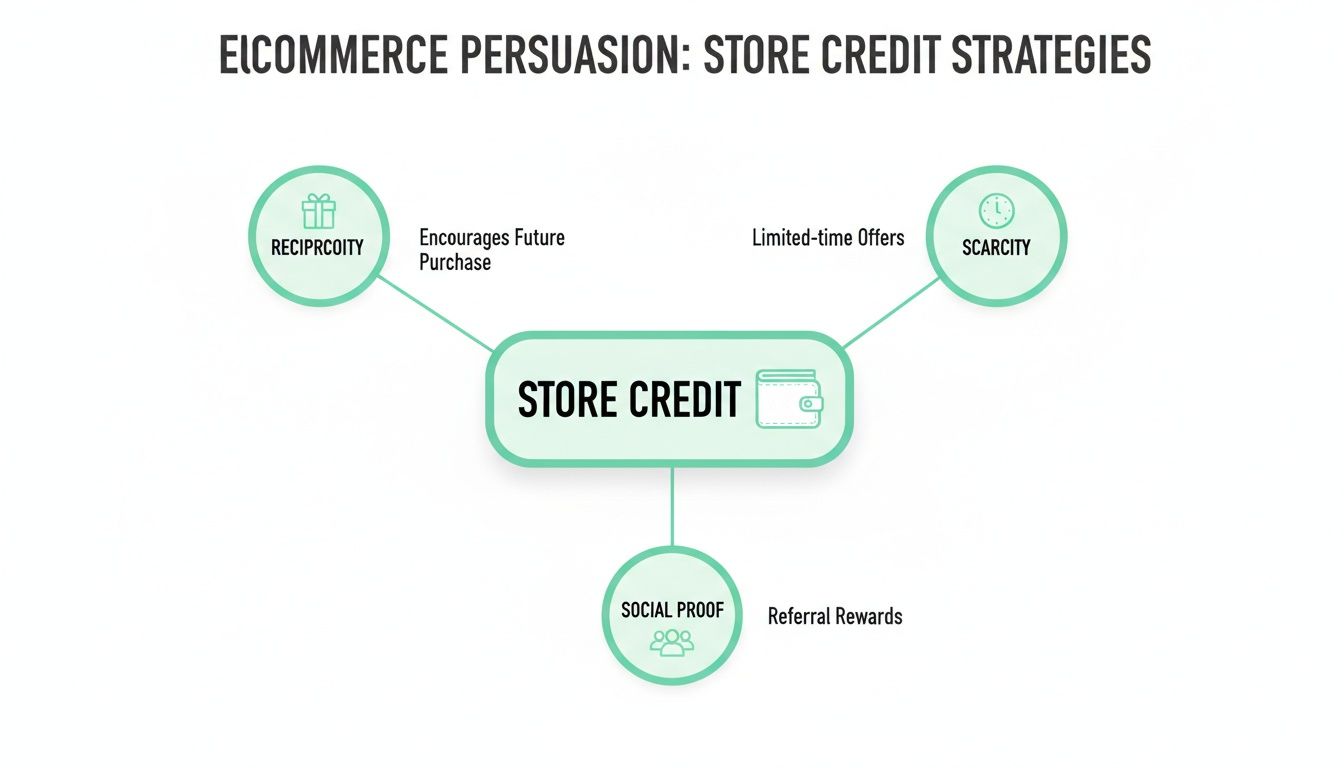

Applying Classic Persuasion Principles to Modern Ecommerce

What if you could tap into the very core of human psychology to grow your Shopify store? The best marketing doesn't just announce a product; it connects with people on a deeper level. Timeless persuasion techniques like Reciprocity, Scarcity, and Social Proof aren't just dry textbook theories—they are your secret weapons for boosting customer lifetime value and driving up your average order value.

The trick is knowing how to translate these age-old principles for a modern ecommerce world. They've powered print ads and TV commercials for decades, but they truly come alive online when woven seamlessly into the customer journey. Before you can persuade anyone, though, you have to understand them. A great starting point is learning how to create buyer personas so you can fine-tune your messaging and make a real impact.

Reciprocity: The Engine of Repeat Purchases

At its heart, Reciprocity is beautifully simple. When someone gives you something, you feel a natural urge to give something back. Think about a free sample at a store—you almost feel obligated to at least consider buying the product. In ecommerce, this powerful trigger finds its perfect match in a native Shopify store credit system.

Unlike a generic discount code that customers have come to expect, or a confusing points system they can't easily value, an unexpected store credit reward lands differently. It feels like a genuine gift. Imagine a customer buys something and a little while later gets an email saying, "$10 has been added to your account for your next order." That’s not a transaction; it's a thank you. This simple act sparks an emotional connection and a powerful psychological nudge to "return the favor" with another purchase, directly increasing customer lifetime value.

By framing rewards as earned credit instead of a simple discount or abstract points, you change the entire conversation. You’re not just closing a sale; you're starting a reciprocal relationship that increases LTV.

This isn't just about making people feel good; it directly moves the needle on your most important metrics. That feeling of wanting to reciprocate shortens the time between purchases and dramatically increases the odds of a second, third, and fourth order. That's how you build real customer lifetime value.

Scarcity and Urgency: Driving Immediate Action

Scarcity plays on a simple human truth: we want what we can't have, or what we think we might lose. People place a much higher value on things they believe are in short supply. This creates urgency, compelling them to act now. While many brands use "limited stock" or "flash sale" banners, a native store credit system lets you apply this principle in a much smarter, more sustainable way.

You can frame store credit as a valuable asset with a ticking clock. By adding an expiration date, you introduce real, legitimate urgency without cheapening your brand with constant discounts.

Just look at the difference in the messaging:

Before (Standard Discount): "Use code SAVE20 for 20% off."

After (Store Credit Scarcity): "Your $15 store credit expires in 48 hours! Don't let your earnings go to waste."

The second example is far more powerful because it taps into loss aversion. The customer isn't just missing a deal; they're on the verge of losing money that's already theirs. That’s a persuasive punch that drives immediate action, boosting repeat purchase rates and positively impacting lifetime value.

Social Proof: Building Trust and Confidence

Social Proof is the phenomenon of looking to others to guide our own behavior. It's the "everyone's doing it, so it must be good" effect. This is precisely why customer reviews, testimonials, and user-generated content are absolute gold for any ecommerce store. A native store credit program can put this principle on steroids by building a visible community of rewarded, happy customers.

When shoppers see that other people are earning and redeeming rewards—not confusing points, but real credit—it validates both the program and your brand. It's proof that being a customer is a smart choice. You can weave this social proof right into your marketing, showing potential buyers that loyalty comes with real, valuable perks. For a deeper dive into this concept, check out these powerful examples of reciprocity in marketing. It makes new visitors much more likely to want to join the club.

Classic Persuasion vs Modern Ecommerce Tactics

This table maps timeless psychological principles to concrete Shopify strategies, showing how a native store credit system effectively applies each one to boost AOV and LTV.

Persuasion Principle | Traditional Application | Modern Ecommerce Tactic (Using Native Store Credit) |

|---|---|---|

Reciprocity | Free samples, unexpected gifts | Issuing automatic, cash-like store credit after a purchase to encourage a second order and increase LTV. |

Scarcity | "Limited time only" offers | Assigning an expiration date to earned store credit, creating urgency through loss aversion to drive repeat sales. |

Social Proof | Celebrity endorsements | Showcasing how many customers have earned and redeemed credit in marketing emails and on-site. |

By weaving these persuasive advertising techniques into a native Shopify store credit program, you graduate from one-off sales gimmicks. You start building a sustainable growth engine—one that naturally encourages customers to spend more, come back faster, and build deeper, more profitable relationships with your brand.

Boosting Average Order Value with Tiered Rewards

Every e-commerce brand wants to increase their average order value (AOV). It's a fundamental metric for profitability. But let's be honest, the old "spend $100, get free shipping" trick is feeling a little tired. A far more compelling way to encourage customers to spend just a little bit more is using tiered rewards powered by native Shopify store credit.

This entire approach taps into two powerful psychological triggers: the goal gradient effect and endowed progress. The goal gradient effect is simple—the closer we get to a goal, the more motivated we are to finish. Confusing point systems fail here because the goal feels abstract. Native store credit makes the reward tangible and personal, creating a direct lever for pulling up both AOV and, subsequently, customer lifetime value.

Your store credit system can create that same feeling of urgency, making the reward tangible and personal. It’s a direct lever for pulling up both AOV and customer lifetime value.

Tapping into Goal Gradient and Endowed Progress

The second principle, endowed progress, is the idea that we're much more likely to complete a task if we feel like we've already gotten a head start. A tiered store credit system does this automatically. The moment a customer adds an item to their cart, they see they’re already on their way to earning a reward. They're invested.

This is where your on-site messaging can really shine. Forget generic banners. Instead, use dynamic prompts that speak directly to what’s in their cart right now.

Imagine a shopper has $88 worth of products. A targeted message pops up: "You're just $12 away from earning $10 in store credit!" Suddenly, the decision isn't about "spending more money"—it’s about "unlocking a reward." That simple reframe is often all the motivation someone needs to add one more item, giving your AOV an instant lift.

This map shows how a central store credit system is the hub connecting these core persuasion principles, turning a simple reward into a serious growth driver for both AOV and LTV.

The real magic here is that native store credit isn't just one tool; it’s a master key that unlocks multiple psychological triggers to influence how your customers shop, directly boosting average order value.

Building Your Tiered Reward Playbook

Setting up reward tiers that actually work isn't about throwing random numbers at the wall. It’s about being strategic. You want to create tiers that feel both achievable and aspirational, gently nudging customers to spend more to increase AOV without ever feeling pushy or hurting your margins.

A great place to start is by looking at your current AOV. Let's say your average order is $75. You can build your tiers to strategically encourage spending just above that baseline. This makes the push for growth feel completely natural to the shopper.

Here’s a simple, proven framework you can use to set up your first tiers:

Tier 1: Spend $100, Get $10 Credit. This targets your typical customer, giving them a clear goal that’s just a small stretch from their usual purchase.

Tier 2: Spend $150, Get $20 Credit. This tier appeals to your higher-value shoppers. It rewards them for their larger cart and sweetens the deal.

Tier 3: Spend $250, Get $40 Credit. Reserved for your top-tier customers, this offers a significant reward that cements their loyalty and maximizes the order.

By structuring your rewards this way, you're essentially creating a "path to value" for your customers. They can clearly see the benefit of reaching the next level, making the decision to add another item feel smart and logical, not just impulsive.

And this isn't just about a one-time AOV boost. The store credit they earn becomes a powerful reason to come back for their next purchase, creating a profitable cycle that directly increases customer lifetime value. If you're ready to get more advanced, our guide on implementing tiered loyalty programs dives even deeper.

Building a Retention Engine with Post-Purchase Persuasion

For the best Shopify brands, the first sale isn’t the end goal. It’s the starting gun. The real money, the real growth, is in what happens after that initial checkout. This is where you can use persuasive tactics to turn a one-time buyer into a lifelong fan, seriously boosting your Customer Lifetime Value (LTV).

The secret is to stop thinking in terms of coupons and confusing points systems. Instead, you need a simpler, far more powerful tool: native store credit. When you frame it as "money in their wallet," you tap into a powerful psychological trigger. It makes customers feel an almost magnetic pull to come back and spend what's rightfully theirs.

This one simple shift transforms an abstract reward into a real, tangible asset, giving shoppers a deeply personal reason to choose your brand again and again, which is the cornerstone of high LTV.

The Power of Loss Aversion

One of the most potent psychological tools in your marketing arsenal is loss aversion. The basic idea is that the pain of losing something feels about twice as strong as the pleasure of gaining something of equal value. A generic 20% off coupon or an abstract points balance doesn’t really trigger this feeling. If a customer doesn't use it, what have they actually lost? Nothing.

But $15 in store credit is a completely different game. Psychologically, customers see this as money they already possess. The idea of letting it expire feels like literally throwing cash in the trash. This small but crucial change in perception creates a gut-level urgency that discount codes and points systems just can't replicate.

By issuing native store credit, you aren't just offering a deal; you're creating an asset that customers feel protective over. This sense of ownership is what fuels your retention engine and drives up customer lifetime value.

This strategy is an absolute beast for increasing repeat purchase rates and closing the gap between orders—two metrics that are vital for healthy, sustainable LTV growth.

Crafting Compelling Post-Purchase Communication

Once a customer has that store credit sitting in their account, your job is to gently remind them of its value. Your post-purchase email and SMS flows are the perfect channels to deploy persuasive messages that get them excited to redeem their earnings and boost your LTV.

Your goal is to make them feel smart for coming back to spend the "money" they have waiting for them. Here are a few battle-tested templates that create urgency and get people to act:

The "Friendly Reminder" Email:

Subject: You've got $10 waiting for you, [Customer Name]!

Body: Thanks again for your recent order! As a thank you, we've added $10 in store credit to your account. It's ready to use on your next purchase, but don't wait too long—it expires in 30 days!

The "Urgency" SMS:

Message: Hi [Customer Name]! Quick heads-up: your $15 store credit at [Your Brand] expires in 3 days. Don't let it go to waste! Shop now: [Link]

The "New Arrivals" Nudge:

Subject: Your $20 credit is perfect for these new arrivals!

Body: We just dropped some amazing new products, and we thought of you. Use your $20 store credit to be one of the first to get them!

Each message reinforces the credit's value and gives a clear, compelling reason to come back. This consistent communication keeps your brand at the front of their mind and turns that earned credit into repeat revenue.

Positioning Store Credit as the Smarter Choice

Let's be real: your store credit program is competing against the endless barrage of discount-driven offers and confusing points systems from your competitors. This is where you can take a page from the playbook of comparative advertising, a persuasive technique that really took off in the 1970s. For Shopify merchants, that means positioning your native store credit as the obviously better choice. If you want to dive deeper, you can read more about how comparative approaches persuade consumers to see just how effective this can be.

You can subtly frame your program as the smarter, more valuable option right in your marketing copy:

Website Messaging: "Forget confusing points. Earn real cash-back credit on every purchase."

Email Copy: "Why wait for a sale? Your loyalty rewards are waiting in your account right now."

This approach helps customers immediately recognize the tangible value you're giving them, making them feel a stronger preference for your brand. By turning store credit from just a number into a spendable asset, you build a powerful, self-fueling retention engine that drives both repeat business and a higher lifetime value.

Measuring the Real Impact of Your Persuasion Strategy

A smart persuasion strategy feels good, but without clear metrics, it's just guesswork. To know if your native store credit program is actually boosting lifetime value and average order value, you have to swap your creative hat for your analyst hat.

The idea of tracking persuasion isn't new. Back in the 1950s, researchers figured out how to measure which ads genuinely changed consumer behavior, turning advertising from a purely intuitive art into a data-backed science. You can learn more about the history of persuasion measurement on copytesting.org.

For your store, this all comes down to tracking the numbers that directly connect your store credit strategy to your bottom line, especially LTV and AOV.

Key Metrics to Track Your Success

To prove your native store credit system is crushing your old discount-heavy strategy, you need to focus on the right data. It’s also crucial to understand how to measure advertising effectiveness to see the full picture of your marketing efforts.

Here are the three core metrics that reveal the true health of your customer retention and profitability:

Repeat Purchase Rate: This is the clearest sign of loyalty. If this number climbs after launching a store credit program, it's proof that customers feel a real reason to come back.

Average Time Between Purchases: A great store credit system should shrink this window. When customers have "money in their wallet," the psychological pull to use it brings them back sooner, directly impacting LTV.

Customer Lifetime Value (LTV): This is the ultimate report card for a healthy customer relationship. By driving more repeat sales and higher order values, your native store credit program should directly pump up LTV, proving its long-term value.

Tracking these core KPIs right inside Shopify's native reporting gives you a clear, undeniable picture of your ROI. The data will show you that you're not just giving away margin—you're investing in more valuable, long-term customer relationships.

A Simple Framework for A/B Testing

Once you have your baseline numbers, it’s time to start optimizing. You don’t need complicated, expensive tools to figure out what works. A simple A/B test can help you fine-tune your reward tiers and messaging for maximum impact on AOV and LTV.

It's pretty straightforward. Start by creating two distinct customer segments. For one group, offer your standard reward (e.g., "Spend $100, Get $10"). For the other, test something a bit more aggressive (e.g., "Spend $100, Get $15").

Let the test run for a set period, then dive into the numbers and compare the core metrics for each group:

Analyze the AOV: Did the juicier offer convince that segment to spend more per order?

Review Repeat Purchase Rate: Which group came back to make a second purchase more often?

Compare LTV Growth: After a few months, which segment proved to be more valuable to your business over time?

This simple approach lets the data do the talking. It cuts out the guesswork and helps you build a persuasion strategy that’s not just compelling but also demonstrably profitable, with clear wins for your average order value and lifetime value.

How to Launch a Native Shopify Store Credit Program

So, are you ready to ditch those complicated, margin-eating loyalty apps for a system that’s both smarter and more profitable? The best way to make persuasive advertising work for you is to keep things simple and seamless. A native Shopify store credit program is exactly that.

The biggest win here is the flawless integration. A native app is built specifically for Shopify's ecosystem, which means zero impact on your site speed. No clunky widgets or heavy scripts slowing down your store—a common headache with third-party loyalty platforms that can easily frustrate shoppers and hurt your average order value.

Getting Started Without a Developer

I talk to a lot of merchants, and one of their biggest fears is the technical lift. The great news? You don't need a developer. You can get a native store credit program running in just a few minutes, letting you focus on your strategy, not on wrestling with code.

The whole point is to create an experience that feels like a natural part of your store, not some feature you just bolted on. That seamless feeling is a powerful persuasion tool in itself. When customers see and redeem their credit right at checkout, the path to their next purchase becomes incredibly smooth, which is a fantastic way to boost your average order value.

A native store credit system isn't just a tool; it's a strategic asset. It makes loyalty feel effortless for the customer and profitable for you, boosting both LTV and AOV in a way complex points systems rarely achieve.

The Benefits of a Truly Native Solution

Choosing a native app does more than just save you from setup headaches. It fundamentally changes how you persuade and keep customers coming back. The checkout experience stays clean and trustworthy because it uses Shopify’s own infrastructure to apply the credit. This builds confidence and helps cut down on abandoned carts.

Ultimately, this approach ensures your loyalty program is actually driving sustainable growth—boosting lifetime value and average order value—instead of just handing out another discount. By making the switch, you can leave frustrating integrations behind and move to a streamlined solution that actively protects your profit margins.

To help you get started, our complete guide explains exactly how to issue store credit on Shopify step by step. Consider it your roadmap to a more powerful, margin-safe loyalty program.

Common Questions About Switching to Store Credit

Making the leap from a discount-first model to a native store credit loyalty program can feel like a big shift. It’s natural to have questions. We hear from Shopify merchants all the time who are tired of confusing points systems but aren't sure how a native solution works.

Let's walk through the most common ones.

Will My Customers "Get" Store Credit?

They will, and probably faster than you think. Everyone understands cash. That’s the beauty of a native Shopify store credit system—it’s intuitive. It sidesteps the confusion of abstract points systems where shoppers are left wondering, "Okay, but what are 500 points actually worth?"

When a customer sees "You have $10 in your account," the value is crystal clear. It feels less like a coupon they have to hunt for and more like money they already have waiting for them. This clarity is crucial for driving the behavior that increases customer lifetime value.

What Does This Do to My Profit Margins?

This is where a native store credit system truly shines over discounts and points. Traditional discounts are a direct hit to your revenue, right off the top, on every single sale. Store credit, on the other hand, only becomes a cost after a customer comes back to make another purchase.

Think of it this way: you're using a small slice of the profit from the first sale to guarantee a second one. This approach protects your margins on that initial transaction and directly fuels the repeat business that grows customer lifetime value.

You’re essentially turning discounts from a cost center into a self-funding retention engine that boosts LTV.

Can It Actually Lift My Average Order Value?

Absolutely. A well-designed, tiered reward structure is a game-changer for AOV. When you show a customer how close they are to a reward—"You're just $15 away from earning $10 in credit!"—you trigger a powerful psychological principle called the goal gradient effect.

Shoppers are wired to want to close that gap. They’ll often add one more item to their cart to hit the threshold. It completely reframes their thinking from "spending more money" to "earning a bigger reward," a simple nudge that consistently increases AOV without having to slash your prices across the board.

Ready to stop killing your margins and build a loyalty strategy that actually pays for itself? Redeemly makes it simple to launch a native Shopify store credit program that your customers will love. Get started with Redeemly today and start building more profitable relationships.

Join 7000+ brands using our apps