Unlocking Profit with Lower Customer Retention Costs

Jan 15, 2026

|

Published

So, what exactly are customer retention costs? Think of them as every dollar you spend to keep your existing customers happy and coming back for more. This isn't just about loyalty program rewards; it covers everything from your customer service team's salaries to the email marketing software you use to stay in touch. Getting a handle on this number is absolutely essential for building a business that lasts.

Why Your Customer Retention Costs Matter More Than Ever

In the cutthroat world of ecommerce, too many brands are stuck on a treadmill, constantly "renting" customers. They burn through cash on ads to snag a one-time buyer, only to watch them disappear forever. That old playbook is broken. It's an expensive, unsustainable game that turns customer acquisition into a money pit.

It’s time to stop chasing new shoppers and start truly "owning" your customer relationships.

This is where understanding your retention costs becomes your secret weapon. It’s not just another line item on a spreadsheet; it's a direct investment in predictable profit and long-term stability. When you focus on the customers you’ve already won, you build a resilient revenue engine that isn't at the mercy of skyrocketing ad costs.

The Broken Acquisition Model

You’ve heard it a thousand times because it's true: getting a new customer costs way more than keeping an existing one. For Shopify merchants duking it out on Facebook and Google, this isn't just a saying—it's a painful daily reality.

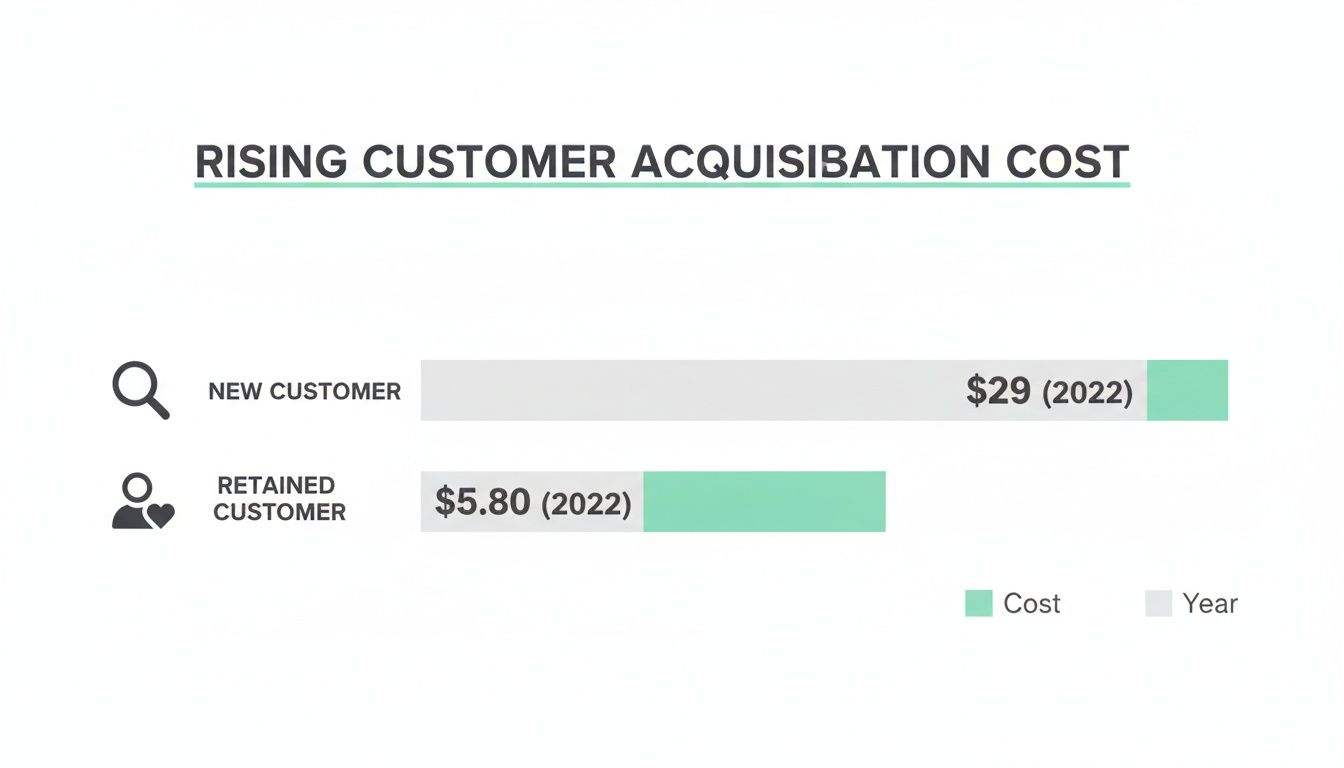

Consider this: back in 2013, the average ecommerce customer acquisition cost (CAC) was a manageable $9. Fast forward to 2022, and that number has ballooned to $29. That's a mind-boggling 222% increase.

This relentless chase for new buyers eats away at your profit margins and locks you into a stressful boom-and-bust cycle. You're basically paying a premium for a single transaction with zero guarantee of a second. This approach torpedoes the metrics that actually matter for a healthy business, like customer lifetime value (LTV) and average order value (AOV).

The Shift to a Profit-First Mentality

A much smarter strategy puts retention at the very heart of your growth plan. Instead of bleeding your budget on ads, you invest in rewarding the people who have already put their trust in you.

But hold on—not all rewards are created equal. The go-to tactics of slapping a discount code on everything or using confusing points systems often cause more problems than they solve. They just train customers to wait for sales, cheapening your brand in the process.

There's a far more profitable way: Shopify native store credit. Think of it as giving your customers real, cash-like value that they can only spend at your store.

Store credit transforms a retention expense into a guaranteed future sale. It creates a powerful psychological hook, giving customers a real reason to return and spend more, which boosts their lifetime value and your average order value.

This simple change flips the entire financial script. You stop losing margin on discounts and start investing in a system that drives repeat purchases, lifts AOV, and builds the kind of loyalty that lasts. This is the bedrock of a profit-first mindset, where keeping customers isn't just a goal—it's your primary path to building a brand that thrives.

To get the full picture, you can dive into our complete guide on the definition of customer retention.

Calculating Your True Customer Retention Costs

If you want to understand the real health of your business, you have to look past the top-line sales numbers. It’s time to get brutally honest about what you’re spending to keep your customers coming back. Calculating your customer retention cost isn’t just some fussy accounting task; it’s a strategic deep-dive that shows you if your loyalty efforts are actually working.

The basic formula seems simple on the surface:

Total Retention Spend ÷ Number of Retained Customers = Customer Retention Cost (CRC)

But the magic is in the details, especially when you start unpacking what "Total Retention Spend" really means for a modern Shopify store. Hint: It's way more than just your loyalty app subscription.

What to Actually Include in Your Calculation

To get a number you can trust, you need to add up every single tool and tactic designed to earn that second, third, and fourth sale.

Your calculation has to include:

Platform Fees: The monthly cost for your email and SMS marketing tools (think Klaviyo or Attentive).

Loyalty App Subscriptions: The fees for any third-party loyalty apps, especially those built on confusing points or tier systems.

Customer Support: A portion of your customer service team's salaries and software costs. Don't forget, great support is a powerful retention engine.

The Cost of Rewards: This is the big one—and where most brands get it wrong.

Getting this last part right is everything. Are you using discounts that carve out your profit margins, or are you using a smarter, margin-safe approach?

The Hidden Costs: Discounts vs. Store Credit

Most brands fall back on discount coupons without a second thought, but it's a costly habit. When you hand out a 20% off coupon, you immediately lose 20% of the revenue from that sale. It’s a direct hit to your bottom line, and worse, it trains customers to wait for the next sale instead of paying full price. Over time, this habit chips away at your average order value (AOV) and cheapens your brand.

Now, let's look at a Shopify native store credit system.

When you give a customer $10 in store credit, that money doesn't just vanish. It sits on your books as a liability, only becoming a real cost when that happy customer returns to spend it. This subtle shift makes a huge financial difference.

Just look at the cost gap between acquiring a new customer versus keeping an existing one. It's massive.

This isn't just a fun fact; it’s a roadmap to profitability. Investing in the customers you already have delivers a much bigger return than constantly chasing new ones.

To really drive this home, here's a direct comparison of how these two reward types impact your finances.

Store Credit Rewards vs. Discount Coupons: A Cost Comparison

Metric | Store Credit (e.g., Redeemly) | Discount Coupons |

|---|---|---|

Margin Impact | Becomes a real cost only upon redemption. Cost is your COGS, not the full face value. | Immediate revenue loss. A 20% discount means a direct 20% hit to your margin. |

AOV Impact | Encourages customers to spend more than their credit balance to "unlock" the value. | Often applied to the smallest possible purchase, training customers to spend less. |

Financial Nature | A reinvestment in a future sale. The spending is contained within your store. | A sunk cost. The "saved" money leaves your ecosystem and can be spent anywhere. |

Customer Behavior | Creates a cash-like incentive to return, building a true loyalty loop. | Encourages one-off, transactional behavior and bargain-hunting. |

As the table shows, store credit isn't just a reward—it's a fundamentally more profitable financial model for retention.

Building a More Profitable Retention Model

When you ditch margin-killing discounts and clunky points systems, you radically improve your unit economics. Store credit creates a powerful closed-loop system where your retention budget gets reinvested right back into your own business.

This doesn't just lower your direct customer retention costs; it has an incredible secondary effect: it drives up customer lifetime value (LTV). Customers holding store credit have a real, tangible reason to come back. They feel like they have money to spend, and they almost always spend more than their credit balance, boosting AOV on that next purchase.

Calculating your CRC is the first step. Once you have that number, you can clearly see how every dollar spent on discounts is gone forever, while every dollar issued as store credit is an investment in your next profitable sale. This is essential to mastering your user retention metrics and building a business that lasts.

How Store Credit Outperforms Discounts for Retention

For years, we've all been taught that discounts are the go-to lever to pull for a quick sales bump. Got inventory to move? Offer a coupon. Want to bring customers back? Send a "20% off" email. But this knee-jerk reaction has a dark side that silently eats away at your brand and your bottom line.

When you lean on discounts too heavily, you're not actually building loyalty. You're just training customers to wait for the next sale. This bargain-hunting mindset devalues your products, cheapens your brand's perception, and does absolutely nothing to improve your customer retention costs in the long run.

It’s time to get smarter about retention. There’s a fundamentally better way to build real, lasting relationships while protecting your profit margins: Shopify native store credit. This isn't just another loyalty tactic; it's a strategic shift that turns a retention expense into a powerful engine for future revenue.

The Psychology of Store Credit

The real genius of store credit is rooted in human psychology. A 20% off coupon feels promotional and temporary. But $20 in store credit? That feels like real money sitting in a digital wallet, just waiting to be spent. It creates a sense of ownership, an almost magnetic pull that brings customers back to your store.

Unlike confusing points systems that force people to do mental gymnastics to figure out their value ("What's 1,000 points even worth?"), store credit is dead simple. A customer sees $20, and they instantly understand its buying power. That clarity makes the reward far more motivating.

Store credit isn't a discount; it's a prepaid future purchase. It creates a psychological commitment, giving customers a tangible asset they feel compelled to use, which drives repeat visits and higher spending.

This simple change completely flips the script on customer behavior. Instead of passively waiting for you to offer another sale, they're actively looking for an opportunity to spend the "money" they've already got. This is the secret to driving down your retention costs while sending your lifetime value (LTV) through the roof.

Creating a Closed-Loop Financial Ecosystem

Here’s where store credit gets really powerful from a business perspective. It creates a closed-loop financial ecosystem. Think about it: when you give a discount, the money your customer saves walks right out the door. That $20 they didn't spend with you could go anywhere—including to your biggest competitor.

With store credit, every single dollar you invest in retention is guaranteed to come back to you. That $20 credit can only be redeemed for your products. This means your retention budget isn't just an expense; it’s a direct reinvestment into your own future sales. It's a beautiful, self-sustaining cycle.

This closed-loop system has a massive impact on your unit economics. Your retention spend stops being a defensive move against churn and becomes an offensive strategy for generating predictable revenue.

Driving Up Average Order Value

Store credit doesn't just bring customers back—it gets them to spend more when they do. This is where it leaves traditional discount codes in the dust when it comes to boosting average order value (AOV).

Imagine a customer has $15 in store credit. They land on your site ready to spend it. They find a $25 item they love, and their credit makes it feel like they're only paying $10 out of pocket. That perceived bargain makes it an incredibly easy decision to click "buy."

It gets even better. Smart store credit programs, like those powered by Redeemly, can be structured to reward bigger carts. A customer might see they can earn $20 in credit on a $100 order, but if they spend $150, they'll unlock $35. Suddenly, they have a powerful incentive to add just one more item to their cart to hit that next reward tier. That's a direct lift in AOV.

Trying to pull that off with a standard discount code is nearly impossible. More often than not, customers just use the coupon on the cheapest item they can find.

Why Native Shopify Solutions Win

The secret to making this all work flawlessly is to use a native Shopify solution. Clunky, third-party apps that rely on confusing points systems or slow-loading widgets just add friction to the buying process. They frustrate customers and can even kill your conversion rates.

A native system built directly on Shopify’s own infrastructure delivers a clean, fast, and intuitive experience.

No Complex Integrations: It just works, right out of the box with your theme.

No Heavy Scripts: Your site speed stays blazing fast, protecting your SEO and user experience.

Seamless Checkout: Customers can see and apply their available credit without a second thought.

This friction-free experience is absolutely crucial. By making the reward easy to earn and even easier to spend, you maximize the psychological power of store credit. It becomes a reliable, automated engine for driving repeat purchases, higher AOV, and ultimately, a much more profitable business.

Driving LTV And AOV With A Smarter Retention Strategy

Let's stop thinking about customer retention as just plugging a leaky bucket. It's not about damage control; it's about smart investing. Every dollar you don't spend on clawing back a customer is a dollar you can redirect into a strategy that actually multiplies your profits.

This is where a savvy retention plan, built on Shopify native store credit, becomes a game-changer. It directly fuels the two metrics that matter most in ecommerce: Customer Lifetime Value (LTV) and Average Order Value (AOV). When you ditch margin-killing discounts, you stop playing defense and finally start playing offense.

The Snowball Effect of The Second Purchase

The most important transaction in any customer relationship isn't the first one. It’s the second. Getting that repeat purchase is where the magic really begins. A one-time buyer is just a transaction. A two-time buyer? That's the start of a loyal relationship, and their potential LTV just exploded.

Think about it in real terms:

A new customer spends $75 on their first order.

You reward them with $10 in store credit—a tangible, cash-like reason to come back.

They return and spend another $85 to use that credit.

Just like that, their LTV jumped from $75 to $160. Compare that to a generic discount code, which usually just nudges them toward a smaller, one-off purchase and does next to nothing to build a real connection. Store credit has a powerful psychological pull that makes that second purchase feel like a no-brainer.

Automation That Pulls Customers Back

The real beauty of a modern store credit system is that it works for you 24/7. Automated tools become your silent salesforce, constantly reminding customers of the value waiting for them in your store. All without you lifting a finger.

This creates an effortless retention engine powered by a few key features:

On-Site Wallets: A visible credit balance right on your storefront is a constant, nagging reminder that they have money to spend. It’s way more effective than a forgotten coupon code buried in an email inbox.

Automated Reminders: Smart email or SMS nudges can alert customers when their credit is about to expire or just remind them of their balance after they’ve been away for a while.

Seamless Redemption: Since the credit is native to their Shopify account, checkout is frictionless. No confusing codes to copy, no frustrating hoops to jump through.

These automated touchpoints are what truly drive down retention costs. They do the heavy lifting, making sure customers don't just forget about the value you've given them.

Fueling Higher AOV With Every Reward

Beyond just bringing people back, a store credit strategy is practically designed to get them to spend more. It gives shoppers a fantastic reason to add just one more thing to their cart, directly bumping up your AOV.

This plays out in two simple but powerful ways:

Spending Beyond the Balance: When a customer has $15 in credit, they almost never look for a $15 item. They see it as a "discount" on a bigger purchase, which makes a $50 or $75 cart feel like a much better deal.

Tiered Reward Incentives: You can build a system where bigger carts earn bigger rewards. For instance, a customer earns $10 on a $100 order but gets $25 for spending $150. It’s a powerful motivator to hit that higher threshold.

Suddenly, your loyalty program isn't just a retention tool—it's a potent AOV-booster. To dig deeper into this, check out our guide on how to increase average order value for more actionable ideas.

Loyalty programs aren't just a nice-to-have; they're profit powerhouses. Classic research found that a mere 5% increase in customer retention can boost profits by a staggering 75%. Existing customers have a 60-70% chance of buying again and spend 67% more than new shoppers.

By building your retention strategy around LTV and AOV, you create a self-funding growth loop. The money you invest in store credit comes right back to your store, but it brings bigger orders with it. For businesses looking to take this to the next level, integrating an AI agent with your CRM system can help personalize these interactions and make your retention efforts even more efficient.

How Do You Stack Up? Benchmarking Your Retention Performance

After you’ve dialed in your strategy around lifetime value and average order value, the big question becomes, "So, how are we really doing?" Without any context, your retention numbers are just digits floating in space. To figure out what's working and set goals that actually move the needle, you have to see how you measure up against industry standards.

Looking at benchmarks isn’t about patting yourself on the back or feeling down about your numbers. It’s about finding the gap between "average" and "exceptional." For a ton of Shopify brands, that gap represents a massive, untapped goldmine of profit. And the fastest way to close it is with a retention strategy customers genuinely love—one built around simple, valuable rewards like native store credit.

Finding Your Place in the Ecommerce World

Let's be real: every industry plays by different rules. A customer buying a mattress has a completely different shopping cycle than someone stocking up on coffee or cosmetics. That’s why knowing your industry’s specific benchmarks is the first step to setting goals that are both realistic and ambitious when it comes to lowering your customer retention costs.

When you look at the data, you’ll see that while the average ecommerce retention rate hovers around a pretty modest 20-30% globally, the top players show what's truly possible. For instance, leading fashion brands often see repeat purchase rates as high as 65-75%, and the cosmetics industry isn't far behind, with impressive rates between 60-70%. If you’re a Shopify DTC brand, these numbers aren't just stats—they’re a wake-up call. They prove what can happen when you stop relying on generic discounts. You can dig into more of these fascinating customer retention rate findings to see for yourself.

Aiming Higher Than "Just Average"

Seeing top-tier brands hitting 60-70% repeat customer rates should light a fire under you. It proves that a huge chunk of your customer base wants to be loyal if you just give them a good enough reason. This is exactly where a native store credit program outshines confusing point systems and margin-killing coupons.

Instead of just trying to inch past the average, aim for what the best in the business are doing. Think about your goals this way:

Your Current Repeat Rate: If you’re sitting at the 25% industry average, what would a jump to 40% do for your LTV? The impact is usually bigger than you think.

Your AOV Impact: How can you structure store credit offers to not only bring people back but also get them to spend more on their second purchase?

Your Cost-Effectiveness: How much of your margin could you protect by moving your retention budget away from discount codes and into a store credit system that locks in future revenue?

A benchmark isn’t just a number to beat—it’s a vision for what your business can become. It shines a light on the direct link between a great customer rewards experience and a much healthier bottom line.

Once you know what’s possible, you can give your team a clear, ambitious target. A native store credit program isn't just another tool; it's the strategic lever you pull to take your store from being just another average player to a true industry leader, one happy, loyal customer at a time.

Alright, let's move from theory to practice. This is where you'll see your customer retention costs actually start to drop.

The most powerful way to make this happen is with a store credit system that feels like it belongs in your Shopify store—not some clunky, bolted-on distraction. You want something that just works. No custom code, no wrestling with complicated third-party apps, and definitely no heavy scripts that slow down your site and kill your conversions.

The magic of a native solution is how seamless it is. When a customer can glance at their digital wallet, see their balance, and spend it with a single click at checkout, you’ve eliminated all the friction that makes old-school loyalty programs so annoying. That simple, intuitive experience makes store credit feel like cash in their pocket, giving both their lifetime value and average order value a serious boost.

Escaping The Clutter Of Third-Party Apps

Let's be honest, many Shopify merchants have been burned by loyalty apps. They promise the world but end up delivering a mess of confusing point systems that customers just don't get, leading to abysmal engagement and wasted money. Worse, they can bog down your site with bloated code, creating a slow, frustrating experience that does more harm than good.

A native store credit program, built right on top of Shopify’s powerful APIs, dodges these problems completely. It’s cleaner, faster, and way more effective at building real loyalty. This approach gets straight to the point: making it incredibly easy for your best customers to come back and buy again.

By getting rid of the mental math of points and the hassle of coupon codes, a native store credit system turns your retention strategy from a cost center into a reliable profit driver. It’s the simplest way to reward loyalty while protecting your margins.

When you're ready to get a program like this up and running, finding the right help is crucial. The process should be simple, but knowing the platform's ins and outs is key. For brands that need a hand, making a smart choice when choosing a Shopify developer can make all the difference for a smooth launch.

Key Benefits Of A Native Approach

Using a native Shopify solution like Redeemly is a direct path to lower retention costs and higher profits. The benefits are baked right into the customer experience, creating a loop of repeat purchases that practically runs itself.

Here’s what you stand to gain:

Effortless Redemption: Customers apply their store credit right at checkout without ever leaving your site. It’s a conversion machine.

Enhanced Customer Experience: A visible credit balance in their on-site wallet is a gentle, constant nudge to come back and shop.

Increased AOV: Shoppers are naturally inclined to spend more than their credit balance, turning a retention tool into an engine for bigger carts.

Improved Site Performance: With no heavy scripts or external widgets, your site stays lightning-fast, which is great for your SEO and user experience.

This streamlined system creates a powerful financial loop where every dollar you invest in loyalty is guaranteed to come back to your store, fueling predictable and profitable growth.

Still Have Questions? Let's Clear a Few Things Up

Shifting from the discount game to a store credit strategy is a smart move, but it's natural to have a few questions. I hear these all the time from Shopify merchants looking to cut their customer retention costs and get more profitable, so let's tackle them head-on.

Won't Store Credit Be More Complicated Than Just Offering Discounts?

You'd think so, but it’s actually the complete opposite. It's way simpler for everyone involved.

Think about it from your customer's perspective. Point systems are a pain. They force you to do mental gymnastics—"Wait, how many points do I need for a dollar off?" But store credit? A $10 credit is just $10. It’s real, it’s understandable, and it feels like cash in their pocket, making it a much stronger reason to come back than 1,000 abstract points.

For you, a native Shopify solution automates the whole thing. No clunky setups, no heavy code slowing down your site—it just works.

How Exactly Does Store Credit Move the Needle on LTV and AOV?

This is where the magic happens. Store credit is purpose-built to pump up both of these crucial metrics.

First, it directly increases lifetime value (LTV) by giving customers a concrete, cash-like incentive to make that critical second or third purchase. It closes the loop and keeps them coming back.

The impact on average order value (AOV) is even more immediate. Someone with a $15 credit isn't going to hunt for a $15 item to get it for free. No, they see that $15 as a head start on a bigger purchase. That credit makes a $50 or $75 cart feel much more accessible. It’s a simple psychological nudge that turns your retention tool into a powerful AOV driver.

The real goal here is to change customer habits. Instead of them waiting around for a sale to make a small, one-time purchase, you're giving them a prepaid reason to return and spend more. That’s how you fundamentally improve your unit economics, one sale at a time.

This Sounds Great, But Can I Really Afford to Just Give Away Store Credit?

I get this question a lot, but it’s looking at the math the wrong way.

A 20% discount is a sunk cost. That margin is gone forever, the second the sale is made. Store credit, on the other hand, is an investment. It’s a liability on your books that only turns into a "cost" when a customer returns to your store to spend it—and they almost always spend more.

Every dollar of credit you issue is guaranteed to be spent right back in your business. It's a self-funding loop that protects your margins while fueling future sales.

Ready to stop handing out profits and start building real, profitable loyalty? Redeemly makes it dead simple to launch a store credit program right within Shopify that boosts both LTV and AOV. See how it works.

Join 7000+ brands using our apps