User Retention Metrics: A Complete Guide to Boosting LTV with Store Credit

Jan 14, 2026

|

Published

When we talk about user retention metrics, what are we really measuring? Simply put, we're looking at your store's ability to keep customers coming back. It’s about moving past the quick thrill of a new sale to see the real, underlying health of your business, which is ultimately reflected in your Customer Lifetime Value (LTV) and Average Order Value (AOV).

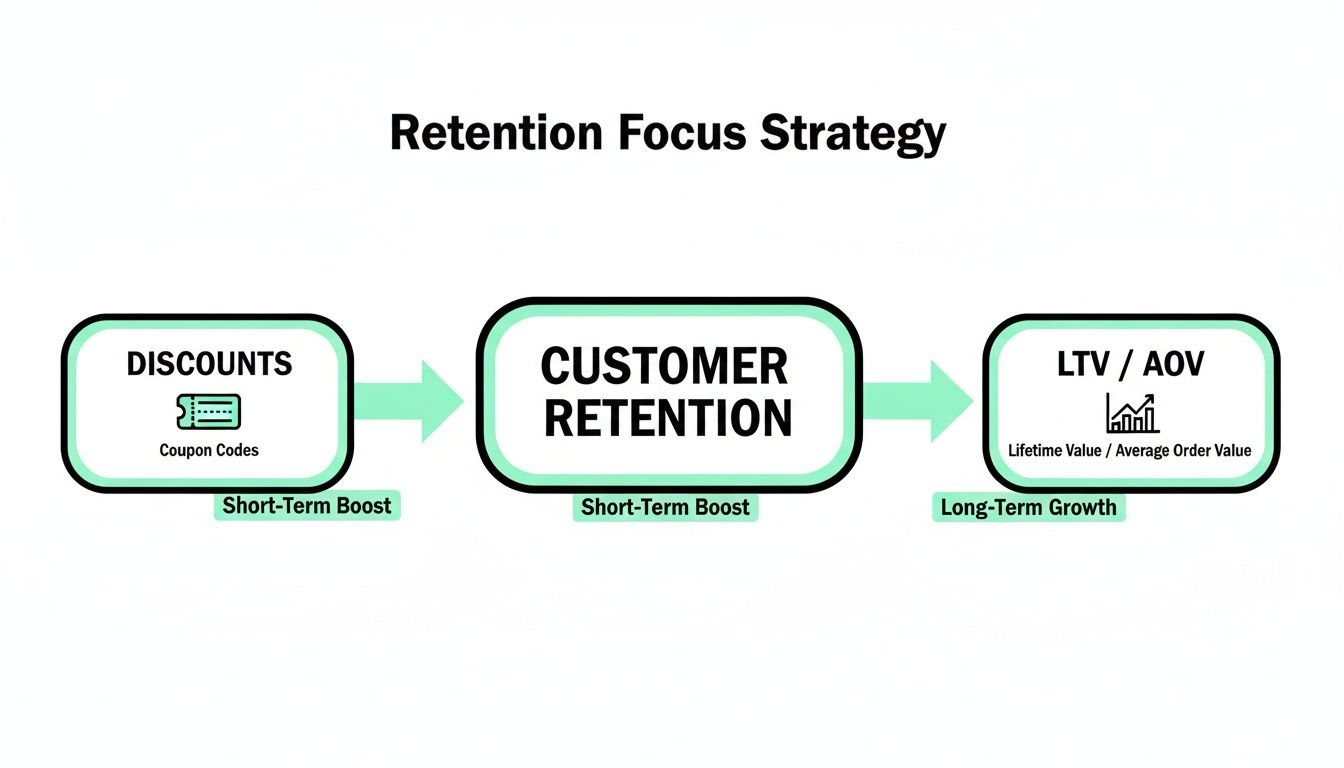

Moving Beyond Discounts for Profitable Growth

For years, Shopify merchants have been stuck on a hamster wheel of promotions. Coupon codes, flash sales, BOGO deals—they create a quick spike in sales, sure. But they mostly attract bargain hunters who are loyal to the discount, not your brand. This constant race to the bottom eats away at your profit margins and rarely builds a foundation for long-term growth.

The same goes for complicated points systems that often confuse customers or make rewards feel so far-off they aren't worth chasing. Customers don't want to do math; they want clear, tangible value.

The real secret to sustainable growth is a shift in mindset. You have to move from acquiring customers at any cost to building genuine, lasting loyalty. This means getting obsessed with user retention metrics like Customer Lifetime Value (LTV) and Average Order Value (AOV). These numbers tell a far more important story than your daily sales report. They tell you if customers are returning, how much they're spending over time, and if your business is actually built to last.

The Power of AOV and LTV

Think of AOV and LTV as the two main pillars holding up a profitable ecommerce business.

Average Order Value (AOV): This is the average dollar amount a customer spends each time they check out. Getting this number to go up is the single fastest way to increase revenue without needing a single new customer.

Customer Lifetime Value (LTV): This is the big one. It’s the total amount of money you can expect to earn from a customer over their entire relationship with you. A high LTV is the ultimate sign of a healthy, thriving brand.

The real challenge isn't just making the first sale; it's earning the second one. When you focus on LTV and AOV, you're forced to create an experience that makes people want to come back, turning one-time buyers into loyal advocates.

Instead of slashing prices with discounts, a much smarter strategy is to use a system that directly rewards the behavior you want to see. This is where native Shopify store credit comes in. It’s a powerful alternative that turns customer spending into a real, cash-like incentive for their next purchase, directly impacting LTV and AOV.

It encourages shoppers to add that one extra item to their cart to hit a reward threshold, which naturally boosts your AOV. That earned credit then acts like a magnet, pulling them back to your store to spend it, which drives up their LTV.

For a closer look at this approach, check out these proven retention marketing strategies that focus on building real relationships. Consider this guide your playbook for creating a retention engine that fuels real profit, not just temporary sales bumps.

The Core User Retention Metrics Every Store Must Track

If you want to build an ecommerce brand that lasts, you have to look beyond the daily sales numbers. Think of your store’s data as its vital signs—each metric tells you a crucial story about its underlying health. Getting a handle on the core user retention metrics is your first step toward making smart, data-driven decisions that build real, sustainable growth.

These aren't just numbers on a dashboard; they’re direct reflections of how your customers feel and act. By tracking them, you get a clear, unfiltered picture of how well you're turning one-time buyers into the kind of loyal, high-value customers who will carry your business for years to come.

Before we dive deep, here’s a quick overview of the essential metrics we’ll be exploring.

Key User Retention Metrics at a Glance

This table breaks down the most important metrics, showing you how to measure them and what they really mean for your store's health.

Metric | How to Calculate It | What It Reveals |

|---|---|---|

Retention Rate | ([Customers at End - New Customers] / Customers at Start) x 100 | The percentage of customers who stick with you over time. |

Churn Rate | (Lost Customers / Customers at Start) x 100 | The percentage of customers you're losing. The flip side of retention. |

Repeat Purchase Rate | (Customers with >1 Purchase / Total Customers) x 100 | How many of your customers are coming back for a second purchase. |

Lifetime Value (LTV) | Average Order Value x Purchase Frequency x Customer Lifespan | The total revenue you can expect from a single customer over their lifetime. |

Think of this as your diagnostic toolkit. Each metric gives you a different lens to view your customer relationships, helping you pinpoint exactly where you’re winning and where you need to improve.

Customer Retention and Churn Rates

Your Customer Retention Rate (CRR) is the foundation of loyalty. In simple terms, it tells you what percentage of your customers stuck around over a certain period. It's one of the most honest indicators of whether your products and shopping experience are actually hitting the mark.

On the other side of that coin is your Customer Churn Rate—the percentage of customers you lost during that same time. They're two parts of the same story. A high retention rate means a low churn rate. Always. Together, they paint a clear picture of whether your customer base is growing or bleeding out.

Simple Takeaway: Retention measures who stays, and churn measures who leaves. A healthy store consistently pushes its retention rate up and its churn rate down, proving it’s delivering an experience people want to return to.

This is all about shifting your focus from one-off sales to building long-term value, which is the only way to truly move these numbers.

The big idea here is that focusing on metrics like Lifetime Value and Average Order Value is the most direct path to improving your overall customer retention.

Repeat Purchase and Purchase Frequency

While retention tells you if customers are sticking around, your Repeat Purchase Rate (RPR) tells you if they’re actually buying again. This metric zeroes in on the action of making that second, third, or fourth purchase. It’s the ultimate proof that your re-engagement efforts are working.

A close cousin is Purchase Frequency, which tracks the average number of times a customer buys from you within a set period, like a year. A high purchase frequency is a great sign; it means your brand has become a go-to for your customers, not just a random one-off discovery.

Repeat Purchase Rate: The percentage of your customers who have bought from you more than once.

Purchase Frequency: The average number of orders each customer places over time.

Nailing these two metrics is how you transition from a business that’s constantly hunting for new customers to one that’s powered by a loyal, recurring revenue base.

Average Order Value (AOV)

Average Order Value (AOV) is one of your most powerful levers for boosting profitability. It’s simply the average amount a customer spends each time they check out. When your AOV is climbing, you're making more money without having to spend a single extra dollar on acquisition. It’s a huge win.

To increase AOV, brands often turn to confusing point systems or margin-killing discounts. A smarter, more profitable approach is using native Shopify store credit. When customers can earn cash-like rewards by hitting a spending goal, they are far more likely to add another item to their cart, giving your AOV a direct and immediate boost.

Customer Lifetime Value (LTV)

This is the holy grail. Customer Lifetime Value (LTV) projects the total amount of money you can expect to earn from a single customer over their entire relationship with your brand. It’s the master metric that rolls retention, purchase frequency, and AOV into one powerful number that signals your store's long-term health.

A high LTV is proof that you’ve built something special—a loyal community that chooses you over and over again. It’s the ultimate validation of your products, your service, and your entire retention strategy. For any serious Shopify merchant, mastering LTV isn't optional, and you can learn exactly how to calculate customer LTV to get started.

At the end of the day, all these user retention metrics are connected. Improve your repeat purchase rate and AOV, and you'll naturally see your LTV climb. And a higher LTV is the clearest sign of a fantastic retention rate. By tracking them all, you get a complete diagnostic of your store’s health and a clear roadmap for profitable growth.

How Store Credit Directly Boosts Your Key Metrics

Knowing your user retention metrics is one thing, but actually improving them is a whole different ballgame. The real challenge is bridging the gap between data and action. While discounts and confusing points systems have their place, they often feel like a temporary fix. A native Shopify store credit system, on the other hand, gives you a direct, powerful way to move the numbers that really matter: LTV and AOV.

This isn't just another loyalty gimmick. Think of it as a strategic tool that kicks off a virtuous cycle: customers spend, get rewarded, and come back for more. By weaving cash-like rewards right into the shopping experience, you can give your Average Order Value (AOV), Repeat Purchase Rate (RPR), and ultimately, Customer Lifetime Value (LTV) a serious lift.

Instantly Increase Average Order Value

One of the fastest ways to grow revenue is to get customers to spend just a little bit more with each purchase. This is where store credit really shines. Instead of a vague coupon, you can create a clear, tempting offer like, "Spend $100, get $10 in store credit."

This simple switch completely changes a customer's mindset. A shopper with $85 in their cart is suddenly on the hunt for a $15 item to unlock that reward. They aren't just buying more stuff; they're investing in their next purchase from you. The result? A natural, margin-friendly bump in AOV that doesn't rely on steep discounts. If you want to get granular on this, our guide explains precisely how to calculate AOV and what it means for your bottom line.

Presenting these reward tiers with a visual progress bar, like we do in Redeemly, gamifies the whole experience. It turns a simple transaction into a rewarding little win for the customer and a bigger AOV for your store.

Supercharge Your Repeat Purchase Rate

Getting that second, third, or fourth sale is the true acid test of customer loyalty. Store credit acts like a powerful magnet, pulling customers right back to your store. A coupon code can get lost in an inbox, but earned store credit feels like real money just sitting in their digital wallet, begging to be spent.

Store credit creates a psychological pull that discount codes just can't replicate. It’s not a potential saving; it’s an existing asset. This creates a powerful sense of urgency and gives customers a built-in reason to start their next shopping trip with you.

This "money in the bank" effect makes a return visit feel almost inevitable. A few automated email reminders about their available balance can re-engage customers who have gone quiet and keep your brand front and center, directly improving your Repeat Purchase Rate.

Compound Gains for a Higher Lifetime Value

At the end of the day, Customer Lifetime Value is the ultimate report card for your retention strategy. It’s where all your hard work on AOV and RPR comes together and creates exponential growth. When customers spend more per order and come back more often, their total value to your business skyrockets.

Think of it as a compounding effect:

Purchase 1: A customer spends a little extra to earn store credit (higher AOV).

Purchase 2: They come back to spend that credit, and they almost always add more to their cart (higher RPR and AOV).

Purchase 3: The cycle repeats, building a powerful shopping habit and deepening their connection to your brand.

Each turn of this flywheel strengthens the customer relationship and pads their LTV. And the best part? Store credit only becomes a cost when it's redeemed on a new sale. You're funding this loyalty loop with actual revenue, not just giving away margin for nothing. It turns your loyalty program from a marketing expense into a profitable, self-sustaining growth engine for a healthier, more predictable business.

A Practical Guide to Measuring Success on Shopify

Knowing the theory behind user retention metrics is one thing, but the real magic happens when you start applying it. This is where we get our hands dirty and move from the 'what' and 'why' to the practical 'how'—unlocking the stories your Shopify store is waiting to tell you. Trust me, you don't need a PhD in data science to make smart decisions that fuel real, sustainable growth.

The whole point is to learn how to listen to what your data is saying. Using the tools you already have, you can spot trends in customer behavior, figure out which of your retention efforts are actually moving the needle, and build a more predictable, profitable business from the ground up.

Finding Your Key Metrics in Shopify Analytics

Your Shopify dashboard is so much more than a control center for orders and inventory. It’s a goldmine of customer data, just sitting there. Many of the most important metrics we’ve talked about, especially those tied to lifetime value and average order value, are available right out of the box.

Just head over to the "Analytics" section and click into "Reports." This is where you'll get a clear, honest picture of your store's health.

Here’s where to look:

Sales over time: This report is your go-to for tracking Average Order Value (AOV). You can easily adjust the timeframe to see if your new store credit tiers are nudging customers to add that one extra item to their cart.

Returning customer rate: You’ll find this under the "Customers" tab. It’s a direct measurement of your Repeat Purchase Rate and one of the clearest indicators of customer loyalty.

Top products by units sold: While not a pure retention metric, this is incredibly useful. It shows you which products are your "hero" items—the ones that keep people coming back for more.

Making a habit of checking these reports gives you a live pulse on your business. For example, if you just launched a "Spend $100, Get $10 in Store Credit" campaign, you should expect to see a real bump in your AOV report pretty quickly. If you don't, it’s a sign to re-evaluate.

Demystifying Cohort Analysis

Standard reports are great for a high-level overview, but cohort analysis is where the real "aha!" moments happen. It’s how you can precisely measure the impact of your retention strategies over time.

Think of a cohort as simply a class of customers who all signed up at the same time—like the "Class of January" or the "Black Friday 2023 Crew."

Cohort analysis lets you follow these specific groups on their journey with your brand. It helps you answer the really important questions:

Did the bargain-hunters we acquired during our Black Friday sale ever come back to buy at full price?

Are customers who got store credit in March spending more over their lifetime than customers who got a 15% off coupon?

How long does it usually take for a brand-new customer to make that crucial second purchase?

By comparing one cohort to another, you can pinpoint exactly what creates your best, most loyal customers. It’s like running a science experiment for your own business, proving which tactics—like issuing native store credit instead of a one-time discount—truly build long-term value.

Shopify has cohort analysis reports built right in. You can use them to watch the retention rate of specific groups month after month. Let's say you see the cohort from your store credit promotion has a 20% higher retention rate after three months compared to the cohort from a discount code campaign. That's not a guess—that's hard proof of what works.

This is what empowers you to double down on profit-friendly strategies like store credit and confidently step away from those margin-killing discounts. It’s all based on your own store’s data, ready and waiting for you to use it.

Interpreting Your Numbers to Outpace the Competition

Data is just noise without context. Tracking your user retention metrics is a great first step, but the real magic happens when you understand what those numbers are telling you. This is where we’ll dig into the benchmarks you need to see where your store really stands—and how you can turn that insight into a seriously profitable retention strategy.

Let’s start with a dose of reality. In the churn-and-burn world of ecommerce, the average customer retention rate is only about 30%. That’s a tough pill to swallow, but it’s the benchmark most Shopify merchants are up against. It means only three out of every ten customers ever come back to make a second purchase, leaving a huge amount of potential revenue on the table. For more stats, check out these customer retention benchmarks.

But look at that statistic again. It’s not a problem; it's a massive opportunity. If seven out of ten shoppers are just walking away, any small, smart improvement you make can put you miles ahead of your competition.

From Benchmarks to Actionable Goals

Knowing the average is one thing, but using it to set smart, achievable goals is another. Think of your metrics as a report card for your retention efforts. Interpreting them correctly shows you exactly where to focus to get the biggest wins.

Start by holding your store's numbers up against that industry baseline:

Is your repeat purchase rate below 30%? If it is, that’s a clear signal to beef up your post-purchase experience. Are you giving customers a compelling reason to come back, or are you just letting them drift away?

Is your AOV flat? This could mean your offers aren't actually motivating people to spend more. Tossing out generic discount codes rarely moves the needle on basket size because there’s no incentive to add more to the cart.

Is your LTV lower than your customer acquisition cost (CAC)? This is a huge red flag. It means you're literally losing money on every new customer you bring in—a business model that just won't last.

These questions aren't here to discourage you. They're your roadmap to building a much stronger, more resilient business. You can find some fantastic data-driven marketing examples that show how other companies turned data into real-world success.

The Store Credit Advantage in Beating the Average

This is exactly where shifting away from tired discounts and confusing points systems gives you a serious edge. A simple, native Shopify store credit system directly tackles the weak spots that these industry benchmarks expose.

Think of it this way: the average store loses 70% of its customers. Your job is to give them a tangible, undeniable reason to be in the 30% that sticks around. A 10% off coupon is forgettable. A $15 store credit balance feels like real money sitting in their account, just waiting to be spent.

This simple change turns your retention strategy from a passive, hope-based approach into an active, incentive-driven machine. When a customer has store credit, you create a powerful psychological pull that a flimsy discount code just can't replicate. It gives them a concrete reason to open your next email, browse your site, and finish that next purchase.

By focusing on a system that boosts both your Average Order Value and Repeat Purchase Rate, you naturally start cranking up your Lifetime Value. This isn't just about hitting a number on a dashboard; it’s about building a fundamentally healthier business where every small win compounds over time, leaving the "average" store far, far behind.

Building a Sustainable Retention Engine with Store Credit

We’ve dug into the metrics and dissected the strategies. Now, let’s talk about putting it all together and building your retention engine. The good news is, you don’t have to pave the road to profitability with margin-killing discounts or overly complex points systems. There's a much simpler, more powerful way: building your entire loyalty strategy around native Shopify store credit.

This isn't about just plugging in another app. It’s a genuine shift in mindset—from renting temporary customers with one-off deals to owning the relationship and building real, lasting loyalty. The whole point is to create a self-funding cycle of repeat purchases that makes both your brand and your bank account stronger.

Why Native Store Credit Wins

Let's be honest, discount codes are a blunt instrument. They attract bargain hunters who were never going to be loyal anyway and train your best customers to wait for a sale, chipping away at your brand's value. And those complicated points systems? They often fizzle out because the rewards feel abstract and too far away, so shoppers just lose interest.

Native Shopify store credit cuts right through all that noise. It offers a clear, immediate value that customers get instantly.

Store credit feels like cash in their wallet. This psychological shift from a potential saving (a coupon) to an existing asset (store credit) creates a powerful pull, giving customers a concrete reason to return and spend again.

That simplicity is what makes it so brutally effective. No points to convert, no confusing tiers to remember. A customer buys something, earns a real dollar value, and comes back to spend it. This clarity is what drives higher engagement and, ultimately, much better retention.

A Focus on LTV and AOV

The real beauty of a store credit system is its direct, measurable impact on Lifetime Value (LTV) and Average Order Value (AOV). When you set clear reward tiers, you give shoppers a very real reason to add that one extra item to their cart. Suddenly, an $80 order becomes a $100 order because there's a $10 credit on the line.

That immediate bump in AOV is just the beginning. The credit they just earned acts like a magnet, pulling them back for their next purchase. This spend-earn-return loop is how you systematically drive up your repeat purchase rate. And when both AOV and repeat purchases are climbing, your LTV can't help but follow.

A store credit system, like Redeemly, offers a straightforward way to make this happen:

Seamless for Customers: It plugs directly into the Shopify checkout, making earning and spending credit completely frictionless.

Margin-Friendly: Credit only becomes a cost when it's redeemed on a future purchase, meaning your loyalty program is funded by actual revenue, not just hope.

Drives Action: The cash-like feel of credit gives customers the nudge they need to spend more now and guarantees they have a reason to visit again soon.

By focusing your strategy on store credit, you finally move away from costly, one-off promotions and toward a model that’s actually centered on profit. You start building a healthier, more predictable business powered by loyal customers who feel genuinely valued. It’s time to stop renting customers and start building a retention engine that truly fuels sustainable growth.

Frequently Asked Fired-Up Questions

Is Store Credit Really Better Than Slashing Prices with Discounts?

You bet it is. Think of it this way: discounts are like a sugar rush. They attract bargain hunters who are loyal to the deal, not to your brand. They grab their cheap item and disappear, never to be seen again.

Store credit, on the other hand, is about building a real relationship. It feels like money in the bank—their money. That creates a powerful psychological hook that pulls them back to your store. They have a vested interest in returning, which is the whole game.

Plus, discounts just cut into your price. Store credit encourages customers to spend more to hit a reward tier, which can instantly bump up your Average Order Value (AOV). It’s a strategy focused on growth, not just giving things away.

How Fast Will I Actually See Results?

You'll see a change in your AOV almost immediately. The moment you set up a simple tier like, "Spend $100, get $10 back," you give shoppers a clear, instant incentive to add that one extra item to their cart. It's that simple.

The bigger wins, like a healthier repeat purchase rate and a climbing LTV, will start to show up over the next few weeks and months. Loyalty is a long game, but the initial impact is surprisingly fast.

Okay, But Won't This Just Eat Into My Profits?

That's the most common myth, but here's the reality: store credit is a far smarter, margin-safe play.

A blanket discount is money you lose right out of the gate. But with store credit, you only "spend" it when a customer comes back to make another purchase. You're funding your loyalty program with actual, recurring revenue, not just slicing the profit from a single sale.

This turns retention into a self-funding engine for growth. To keep your knowledge sharp, it's always a good idea to explore diverse perspectives on retention strategies.

Ready to stop renting customers with discounts and start owning your relationships? With Redeemly, you can launch a store credit program that feels native to your Shopify store, boosting AOV and LTV without killing your margins.

See how Redeemly can transform your retention strategy today

Join 7000+ brands using our apps