How to Calculate AOV and Boost It with Shopify Native Store Credit

Dec 26, 2025

|

Published

Calculating your Average Order Value (AOV) is refreshingly simple. Just take your Total Revenue and divide it by the Number of Orders you received over a certain period. That’s it.

This one little formula gives you the average dollar amount a customer spends every time they check out, making it a crucial health check for your store and a roadmap for finding new growth.

Why AOV Is a Critical Metric for Growth

Don't mistake AOV for just another number on your dashboard. It’s a direct window into your customers' buying habits and a key driver of lifetime value. While your conversion rate tells you if people are buying, AOV reveals how much they’re buying in a single go.

Focusing on boosting your AOV is one of the most profitable things you can do. You’re not chasing down new, cold traffic; you're simply encouraging customers who are already about to buy from you to spend a little bit more, increasing their immediate value and their long-term loyalty.

A climbing AOV is a fantastic sign. It shows that customers trust your brand and see enough value to add that extra item to their cart. This is exactly where tactics like offering native Shopify store credit shine. Instead of eroding your margins with confusing points systems or endless discount codes, store credit motivates shoppers to hit higher spending goals, pushing your AOV and lifetime value up naturally.

What to Include in Your AOV Calculation

To get a true read on customer spending, you need to keep your calculation clean. The whole point is to measure the value of the products customers are choosing to buy.

Your formula should stick to the basics:

Total Revenue: The total amount of money brought in from actual product sales.

Number of Orders: The simple count of every individual transaction completed.

Let's say your store pulled in $50,000 in revenue from 1,000 orders last month. The math is easy: $50,000 ÷ 1,000 = $50 AOV.

What to Exclude for an Accurate AOV

Knowing what to leave out is just as important. If you include extra fees, you’ll artificially inflate your AOV and get a false sense of how well you're actually doing.

Always make sure to exclude these from your total revenue figure:

Shipping Costs: This is a business operating cost, not revenue from your products.

Taxes: This money just passes through you to the government.

Refunds and Returns: Be sure to subtract any returned or refunded amounts to get a real picture of your final sales.

Think of AOV as the sister metric to Customer Lifetime Value (LTV). A higher AOV almost always contributes to a higher LTV. When a customer spends more on their very first purchase, they're signaling a stronger connection to your brand, which makes them a perfect candidate for becoming a loyal, long-term shopper.

By getting this calculation right, you set a reliable benchmark for your business. This number is the bedrock of smarter marketing, especially for retention strategies like native Shopify store credit programs that not only increase immediate order value but also build lasting customer relationships and boost lifetime value.

To see how these two metrics work together, you can learn more about how to calculate customer LTV in our detailed guide.

How to Find Your AOV Directly in Shopify

All the theory in the world doesn’t mean much until you get your hands on your actual numbers. The good news? You don't need to be a spreadsheet wizard to find your Average Order Value. Shopify puts this number right at your fingertips, giving you the baseline you need to start making smarter decisions.

This isn’t just about knowing a metric; it's about shifting from guesswork to a data-backed strategy. Your AOV is the starting line for any initiative aimed at boosting customer lifetime value, especially if you’re thinking about a native store credit program. Once you know what your customers typically spend, you can build intelligent, achievable spending thresholds that nudge them to add just one more item to their cart.

Getting to Your Shopify Analytics Reports

Ready to find it? Log in to your Shopify admin, head over to Analytics on the left-hand menu, and then click into Reports. Think of this section as mission control for your store's performance.

Inside the Reports area, you'll see a bunch of different categories. We're interested in Sales. Shopify has a handful of pre-built reports here, and the one you’re looking for is usually called something like "Sales over time."

Open that report, and you'll see it right there: a card or column clearly labeled “Average order value.” It's that simple.

Your AOV is more than just a number—it’s a story about customer behavior. A sudden jump might point to a new product bundle taking off. A slow dip could mean your latest ad campaign is attracting more window shoppers. This is why you have to track it consistently if you're serious about growing profitably and increasing lifetime value.

How to Slice and Dice Your AOV Data

A single AOV number is a snapshot. The real magic happens when you start comparing different time periods to spot trends. Use the date filter at the top of the report—it's your most powerful tool for seeing the bigger picture.

Here are a few ways I recommend looking at your AOV to find actionable patterns:

Last 30 Days: How does your AOV from the last month stack up against the month before? This is great for spotting the immediate impact of a new campaign or promotion.

Quarterly: Comparing Q2 to Q1, for example, helps you zoom out and see broader seasonal shifts in buying behavior.

Year-Over-Year: This is the gold standard for measuring growth. Comparing this July to last July tells you if your business is truly growing, since it accounts for seasonality.

By making a habit of checking your AOV in Shopify, you create a solid benchmark. This is the exact number you'll use to measure whether your new strategies are working. For instance, if you launch a "Spend $100, Get $10 in Store Credit" campaign with Redeemly, you can go right back to this report, compare the new AOV to your historical average, and see the uplift in black and white.

Why Native Store Credit Is a Smarter Play Than Discounts

When you need to juice sales, what's your first move? If you're like most Shopify merchants, you probably reach for a discount code. A big "15% OFF" banner seems like the fastest way to get conversions, right?

But that's a dangerous habit. Slashing prices teaches customers to wait for sales, cheapens your brand, and slowly bleeds your profit margins dry. Every single discount is a direct, immediate hit to your revenue. You end up attracting one-off bargain hunters, not loyal fans, and your customer lifetime value (LTV) tanks.

This is where making the switch to a native Shopify store credit system can completely change the game, moving away from confusing points systems and margin-killing coupons.

The Power of "Free Money"

Let’s be honest, a coupon feels temporary. Native Shopify store credit, on the other hand, feels like cash just sitting in a customer’s digital wallet, waiting to be spent. It’s a subtle but powerful psychological shift. You’re not saving them money; you’re giving them money to spend.

Once a customer has a credit balance, their behavior changes. They're far more likely to:

Spend more than the credit amount. I’ve seen it time and again. A customer with a $10 credit rarely just buys a $10 item. They see it as a nice discount on that $50 or $75 product they were already eyeing, boosting your AOV.

Come back sooner. That balance is a gentle nudge, a constant reminder that they have money to spend at your store. It drives repeat purchases and directly increases lifetime value.

Value your brand more. Rewards feel earned, not just given away. It creates a stronger, more reciprocal relationship than a generic discount code ever could.

It's a much cleaner and more compelling incentive than complicated points systems or endless promo codes.

Protect Your Margins, Boost Your LTV

Think about the raw numbers. A 10% discount on a $100 order is a straight-up $10 loss of revenue from that sale. Gone.

Native Shopify store credit doesn't work that way. It’s not an immediate cost—it's a liability that guarantees a future purchase.

A discount is an expense that hits your margins right now. Native Shopify store credit is an investment in a future, higher-margin sale that builds real customer loyalty and boosts lifetime value.

This small accounting difference makes a massive impact. You’re essentially funding their next shopping trip, giving them a very compelling reason to return. And when they do come back to spend their credit, they almost always add more to their cart, leading to a brand new, full-margin sale.

You’re creating a flywheel that increases both AOV and LTV. Instead of chipping away at your profits, you're building a loyal base of customers who are genuinely motivated to spend more with you, more often.

If you’re serious about protecting your bottom line, our guide on how to improve profit margins offers more strategies that pair perfectly with a store credit program. Knowing your AOV is the starting line; using that number to build a smarter, margin-safe rewards system is how you win the long game.

Using Store Credit to Systematically Increase AOV

Theory is great, but a practical playbook is what actually drives results. Putting a native Shopify store credit program in place isn't about guesswork. It’s a systematic way to predictably increase your AOV by giving your customers strategic, gentle nudges at just the right time.

The idea is simple but incredibly effective. You set up spending thresholds that feel both valuable and achievable, motivating shoppers to add just one more item to their cart. This little nudge is often all it takes to transform an ordinary purchase into a larger, more profitable one for your business and increase that customer's lifetime value.

Setting Your Strategic Spending Thresholds

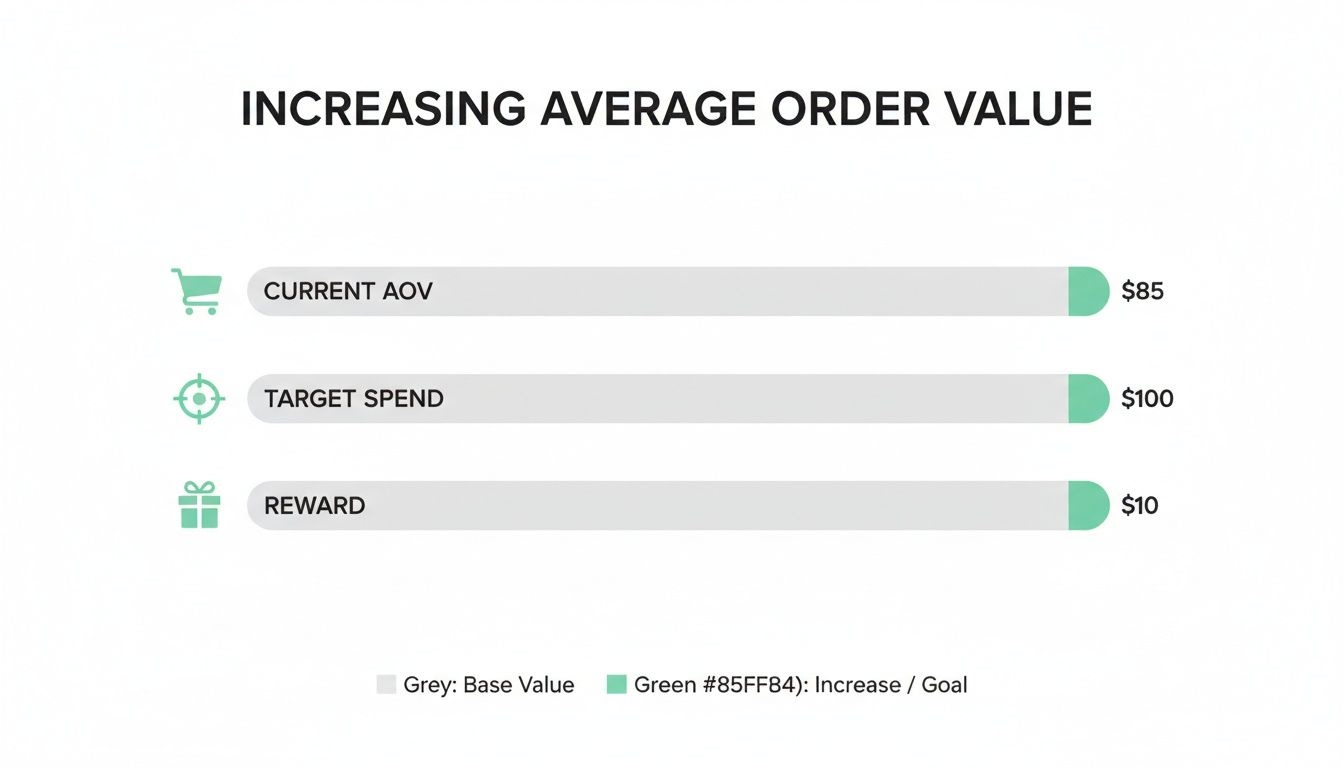

Your current AOV is your starting line. The whole game is to set a reward tier that’s just slightly out of reach but feels totally attainable. A good rule of thumb I've seen work time and again is to set your first spending threshold 15-20% higher than your current AOV.

Let's say your Shopify analytics show your AOV is $85. A perfect starting point for a threshold would be $100. That gap is small enough that a customer might toss in a lower-priced item—like a lip balm from a wellness brand or a pair of socks from a fashion store—just to unlock their reward.

The Offer: "Spend $100, Get $10 in Store Credit"

The Psychology: This isn't just another discount. The customer is actively choosing to spend more to earn a future reward, which feels like a smart financial move on their part.

The Result: You'll see your AOV climb from $85 toward that $100 mark, driven by real customer behavior, not margin-killing promotions.

This simple shift changes the dynamic from cost-cutting to value-building, which is absolutely crucial for long-term brand health and lifetime value. You can dig deeper into how native Shopify store credit works as a powerful alternative to traditional loyalty programs.

The table below breaks down how you could structure these tiers for a store with an $85 AOV. The goal is to create a "ladder" that encourages customers at different spending levels to reach for that next rung.

Sample Store Credit Reward Tiers to Increase AOV

Spend Threshold | Store Credit Reward | Customer Motivation | Potential AOV Lift |

|---|---|---|---|

$100 | $10 | Easy upsell—just $15 more to get a reward. Perfect for grabbing a small add-on item. | +17% |

$150 | $20 | Encourages a second main item or a bundle. The 13% reward rate is very attractive. | +76% |

$200 | $30 | Targets high-value shoppers. A 15% reward feels substantial and justifies a bigger purchase. | +135% |

Notice how each tier is designed to feel like a smart, achievable goal. You're not just throwing discounts out there; you're building a system that rewards higher spending.

Real-World Examples in Action

Let’s see how this plays out for a couple of different brands.

Imagine a high-end fashion brand with an AOV of $250. They could set a threshold at $300 and offer $25 in credit. The customer who was already buying a dress is now seriously tempted to add a matching accessory to hit that goal. The native store credit they earn becomes a powerful reason for them to come back, directly boosting their lifetime value.

Or take a wellness brand with a $70 AOV. They could set a threshold at $85 to earn $10 in credit. This might be the final push a customer needs to add that wellness tea they were curious about to their cart of supplements.

The key is making the next step feel small and logical. You aren't asking customers to double their cart size; you're simply making it worthwhile for them to add one more relevant product.

Designing an Irresistible Incentive

Of course, the value of the store credit has to be compelling enough to actually drive action. A reward that’s too small will just get ignored, but one that’s too generous will eat into your profitability. I've found that offering around 10% of the spend threshold as a store credit reward is a proven sweet spot.

This structure keeps the reward meaningful for the customer while protecting your margins. While store credit is a fantastic tool for this, it works best when it's part of a bigger picture. You can find other data-driven methods for boosting your store's performance in broader guides to Conversion Rate Optimization strategies. When you pair a smart store credit program with other optimizations, you create a truly robust system for sustainable growth.

Measuring the ROI of Your Store Credit Program

So you’ve launched a native Shopify store credit program. That’s a fantastic move, but the real work starts now: proving it actually works. You need to draw a straight line from this new strategy to a real lift in your most important metrics. This isn't about feelings or guesswork; it's about solid analysis that shows a tangible increase in both average order value and customer lifetime value.

The quickest way to get a pulse check is a simple before-and-after analysis. Just take a look at your AOV for the 30 or 60 days before you launched your store credit program and compare it to the same period after. This gives you a fast, high-level snapshot of the initial impact and shows you how customer spending habits changed once rewards became part of the picture.

Isolate the Impact with Customer Cohorts

A broad look is a good starting point, but to really prove the ROI, you have to get granular. The best way to do this is by splitting your customers into two clear groups:

Cohort A (The Engaged): These are the customers who have actually earned or redeemed store credit.

Cohort B (The Non-Engaged): This group includes everyone who hasn't interacted with the program at all.

When you compare the AOV between these two cohorts, you can directly attribute any lift to your store credit strategy. If Cohort A is consistently out-spending Cohort B and has a higher lifetime value, you’ve got undeniable proof that your program is motivating customers to spend more per order and remain loyal.

This visual really brings the concept to life, showing how a well-structured reward can bridge the gap between a customer's typical cart and a much more profitable one.

As you can see, the idea is simple but powerful. A customer who was about to check out with an $85 cart is gently nudged to spend just $15 more to unlock a valuable $10 reward for their next purchase.

Benchmarking Against the Broader Market

Knowing your own numbers is crucial, but putting them in context is what separates the pros. How does your AOV stack up against the rest of the e-commerce world? For Shopify merchants using a tool like Redeemly, this context is everything.

Global e-commerce data from late 2024 showed the average AOV hitting $144.57. Even more telling, branded DTC sites often see an AOV that's 2-3x higher than what you'd find on major marketplaces. Why? Because native store credit encourages customers to add more to their cart to hit a reward tier—something a simple discount code or confusing points system rarely does. It’s a natural AOV booster that helps turn one-time shoppers into repeat, high-value customers.

Proving the financial success of your program isn’t just about seeing AOV go up. It’s about demonstrating a clear return on investment that justifies your marketing spend and helps you build a stronger case for focusing on lifetime value.

Ultimately, evaluating your store credit program means understanding the core principles of how to measure marketing ROI effectively. This isn't just about store credit; it's a framework that helps you connect your loyalty initiatives directly to your bottom line. By combining smart cohort analysis with clear ROI tracking, you get the insights you need to double down on what's working and fine-tune your rewards for even better results.

Common Questions About AOV and Store Credit

Whenever you're thinking about a new strategy, questions are going to pop up. When it comes to native Shopify store credit, getting clear answers is the best way to move forward with confidence and really nail your execution.

Let's dive into some of the most common things Shopify merchants ask when they're looking to swap out discounts for a more profitable rewards model focused on lifetime value.

Can Store Credit Really Increase LTV?

Without a doubt. In fact, native Shopify store credit is one of the most effective ways to drive up customer lifetime value. Why? Because it creates a powerful, built-in reason for shoppers to come back.

Think about it. A one-off discount is just that—a single transaction. But earned credit feels like a "down payment" on their next purchase.

This simple shift changes the entire customer journey into a rewarding cycle:

Shoppers spend a little more to hit that credit threshold, which nudges up your AOV.

They come back to use the credit they earned, boosting your repeat purchase rate.

More often than not, they spend more than their credit balance, giving you another profitable sale.

This is the loop that turns first-time buyers into loyal customers who stick around and spend more over time, maximizing their lifetime value.

How Do I Choose the Right Spending Threshold?

The sweet spot for your first reward tier is usually 15-20% above your current AOV. You want the incentive to feel within reach, not like a huge leap.

For example, if your store’s AOV is sitting around $80, a "Spend $100, Get $10" offer is the perfect place to start. That small gap is just enough to encourage someone to add one more item to their cart—a natural upsell that feels like a smart move for them, not a pushy sales tactic from you.

Keep an eye on your Shopify analytics to see how people respond. Don’t be afraid to test and tweak those tiers based on what the data tells you.

Will Store Credit Hurt My Margins Like Discounts?

No, and this is probably the most important distinction to understand. A discount is a direct hit to your revenue, right here, right now. Native Shopify store credit is totally different; it's booked as a liability that only gets "cashed in" on a future purchase.

A discount is an expense. Native Shopify store credit is an investment in a future, often larger, sale. It's a tool for building lifetime value while protecting your hard-earned margins.

By incentivizing the next purchase instead of devaluing the current one, you build a much healthier and more sustainable way to grow your business.

Ready to stop the discount death spiral and start growing profitably? With Redeemly, you can launch a native Shopify store credit program that boosts AOV and LTV without messy points or margin-killing coupons. Get started with Redeemly today.

Join 7000+ brands using our apps