How to Increase Average Order Value with Strategic Store Credit

Jan 11, 2026

|

Published

Increasing your average order value is all about one simple, powerful idea: encouraging customers who are already buying from you to happily spend a little more.

It’s a fundamental shift in thinking. Instead of sinking more money into the endless chase for new traffic, you can unlock immediate, profitable growth by focusing on the value of each transaction. You're moving from a pure acquisition mindset to one that prioritizes both average order value and customer lifetime value.

The AOV Growth Trap: Why Chasing Traffic Erodes Profit

For years, the classic ecommerce playbook was pretty straightforward: chase more traffic, get more sales. That was the undisputed path to growth. But with customer acquisition costs skyrocketing, that old strategy has become a race to the bottom, squeezing your profit margins with every single click.

The real growth lever today isn’t just finding new customers; it’s about increasing the value of the ones you already have. This is where focusing on Average Order Value (AOV) becomes your most powerful tool for building a resilient, long-term brand with high lifetime value customers.

Shifting Focus From Traffic to Transaction Value

Every dollar you spend on ads is a gamble. You're paying for potential, hoping a tiny fraction of that expensive traffic actually converts.

But a dollar gained from a higher AOV? That’s pure profit enhancement. You’ve already done the hard work of getting the customer to your store. Now you’re just making that hard-won conversion more valuable.

This guide flips the old playbook on its head by focusing on a smarter incentive: native store credit. Instead of slashing your margins with discount coupons or confusing customers with complex point systems, you can use native Shopify store credit to give every single transaction a boost, increasing both AOV and future lifetime value.

To see just how much impact this has, let's look at the math. A small lift in AOV can dramatically outperform a big jump in traffic when it comes to your bottom line.

| AOV Growth: The Fastest Path to Profitability |

| :--- | :--- | :--- | :--- |

| Metric | Scenario A (Before AOV Lift) | Scenario B (After 15% AOV Lift) | Revenue Impact |

| Monthly Orders | 1,000 | 1,000 | No new customers needed |

| Average Order Value (AOV) | $80.00 | $92.00 | + $12 per order | | Total Revenue | $80,000 | $92,000 | + $12,000 monthly | | Annual Revenue | $960,000 | $1,104,000 | + $144,000 annually |

The numbers don't lie. A 15% bump in AOV added $144,000 in annual revenue without spending a single extra dollar on ads. That’s the kind of efficient growth that builds lasting businesses.

The data backs this up on a global scale. AOV is one of the fastest ways to grow revenue without increasing traffic. The global average ecommerce AOV hovered around $144–$145 in November, up 8.7% year over year. A store that lifts its AOV from $80 to $100 on 10,000 monthly orders adds $200,000 in revenue—without a single extra visitor. You can dig into more of these AOV statistics to see the full picture.

The Power of Margin-Safe Incentives

The core idea here is to reward customers for spending more, not punish your profits for making a sale. Native Shopify store credit does this perfectly.

It feels like cash in a customer’s wallet, encouraging them to toss another item in their cart to unlock that reward. This simple shift has two profound effects:

It boosts AOV today: Customers are genuinely motivated to hit spending thresholds to earn that credit.

It increases Lifetime Value (LTV) tomorrow: That credit is a built-in reason for them to come back for a second purchase.

By focusing on AOV, you're not just making more money on a single order. You are building a healthier business model where each customer becomes more valuable over time, turning one-time buyers into loyal advocates with high lifetime value.

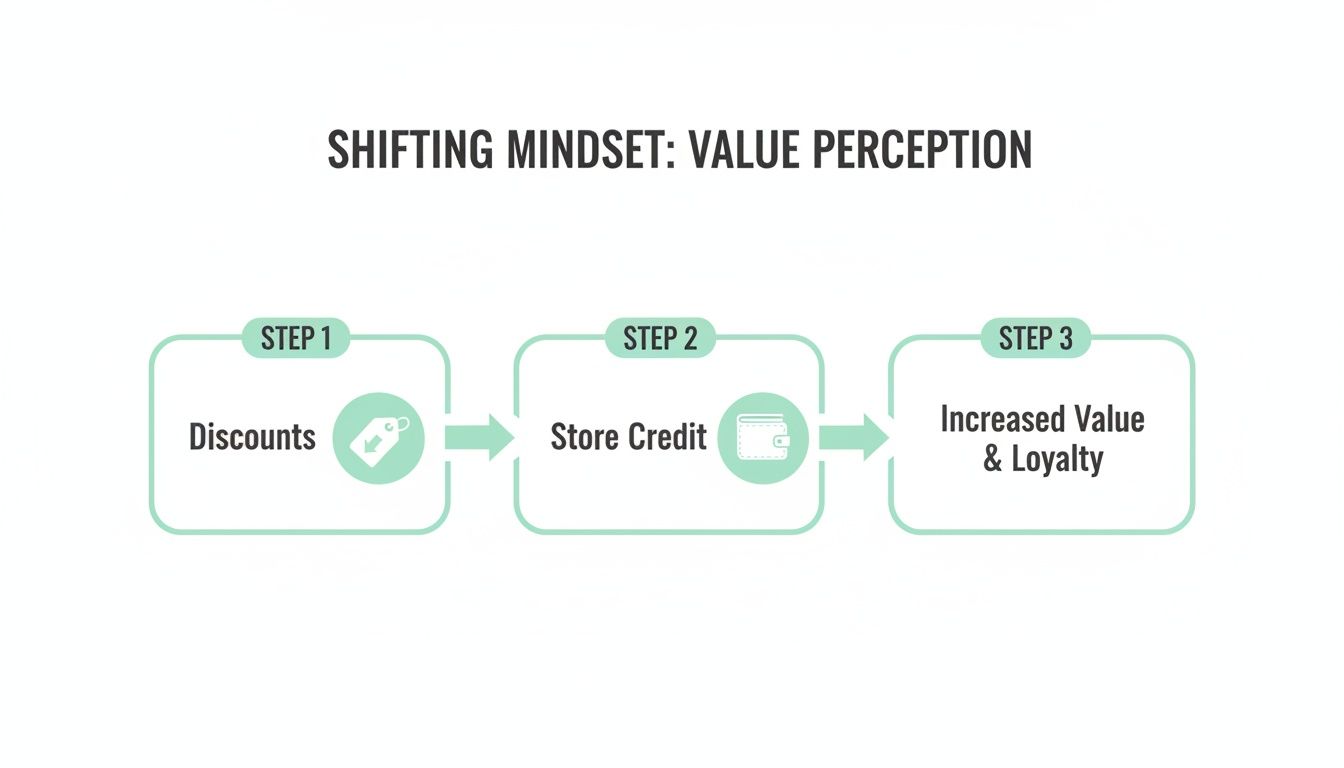

Moving from Discounts to a Store Credit Mindset

Are discount codes and confusing point systems quietly killing your brand? It’s a trap many merchants fall into. That quick "15% OFF" coupon feels like an easy win, but it often comes at a steep cost to your brand equity and profit margins.

When you constantly run sales, you’re training customers to devalue your products. Instead of building a loyal following with high lifetime value, you end up with a transactional relationship where the lowest price wins. That race to the bottom isn't just unsustainable; it actively unravels the perceived value you’ve worked so hard to create. It’s time to think differently.

The True Cost of a Discount-First Strategy

The moment a customer uses a coupon code, their focus shifts from your product’s value to its price. This mindset triggers a few damaging effects:

Margin Erosion: Every discount is a direct hit to your bottom line. A 20% discount on a $100 order could wipe out half your actual profit on that sale.

Customer Training: Frequent sales teach a simple lesson: never pay full price. This creates a cycle where customers hold off on buying, knowing a discount is always around the corner.

Brand Devaluation: Premium brands avoid constant sales for a reason. Discounts can make your products feel less exclusive, chipping away at your brand image.

This approach prioritizes the immediate transaction over the long-term customer relationship and lifetime value. The good news? There’s a much smarter, more profitable way to incentivize purchases.

Reframing Rewards: Store Credit as Customer Cash

Now, let's flip the script. Instead of taking money away with a discount, what if you gave customers money to spend on their next purchase? That’s the simple, powerful idea behind using native Shopify store credit.

Unlike a coupon or an abstract point system, store credit feels like real cash sitting in a customer’s digital wallet. It's a tangible asset they've earned, creating a strong psychological pull to come back and spend it. This one change transforms the entire dynamic from bargain hunting to value earning.

Store credit is a proactive investment in your customer's next purchase. It shifts their focus from "How much can I save today?" to "What can I buy with the rewards I've earned?"—a fundamental change that drives both AOV and lifetime value.

One of the most reliable ways to bump up AOV without torching your margins is to reward bigger carts instead of discounting them. Even Shopify's own guidance on AOV points to tactics like order minimums and loyalty programs as key levers to get customers to “add just a bit more” to their cart. Margin-friendly store credit programs fit perfectly here, nudging shoppers to spend more today while pulling them back for that critical second order. It's a core piece of the puzzle you can learn more about in Shopify’s AOV strategies to see how it fits into a broader growth plan.

A Real-World Scenario: Store Credit in Action

Let’s play this out. Imagine a customer has $78 worth of products in their cart. They see a banner: "Spend $100, Get $15 in Store Credit."

Suddenly, the customer isn't thinking about a discount. They're focused on the $15 they can earn. Their mindset shifts to, "What else can I get?" They start browsing for a $22+ item—maybe a small accessory or a complementary product—something they might have completely ignored otherwise.

They hit the threshold, complete the purchase with a higher AOV, and now they have $15 waiting for them.

A week later, an automated email reminds them of their credit balance. That $15 is a powerful motivator, bringing them right back to your store to find something new. With a single interaction, you’ve hit two critical goals: you increased the initial AOV and practically guaranteed a future repeat purchase, boosting their lifetime value. This is the power of understanding what store credit is and how it can fundamentally change customer behavior for the better.

Your Playbook for Boosting AOV with Store Credit

Alright, let's move from theory to action. Building a store credit strategy that actually grows your average order value isn't about guesswork—it's about having a clear, repeatable playbook. We're going to break down the exact steps to launch a program that gets customers spending more today while increasing their lifetime value for tomorrow.

This whole process boils down to three things: digging into your own data to set smart reward tiers, shouting about those tiers across your site, and then automating the entire experience so it runs on its own.

This is all about shifting away from discounts that erode margins and confusing points systems that customers ignore. Store credit builds a real, valuable relationship.

As you can see, discounts are a one-way street—a race to the bottom on price. Store credit creates a cycle where value flows back to both the customer and your business, increasing both AOV and lifetime value.

Setting Your Smart Reward Tiers

This first part is the most important, so don't skip it. You need to figure out what your spending thresholds should be. If you set them too high, customers will just ignore them because they feel impossible to reach. Set them too low, and you're just giving away margin without actually nudging anyone to spend more.

The secret is buried in your store's own data. Don't just look at your average order value. You need to find your modal order value—that's the order total that shows up most often.

Let's say your AOV is $75, but your modal order value is only $45. That tells you a few huge orders are dragging the average up. The reality is, most of your customers are spending around $45.

Your goal is to create a reward tier that is just slightly above that modal order value. This makes the reward feel achievable and encourages your biggest customer segment to add just one more thing to their cart to get it.

So, if your most common order size is $45, an offer like "Spend $60, Get $10 in Store Credit" is the perfect starting point. It's a gentle nudge, not a giant leap, which makes it an easy "yes" for the customer.

Communicating Value Across the Customer Journey

Once you've got your tiers dialed in, you have to make them impossible to miss. Customers can't hit a target they can't see. Your job is to sprinkle these reward opportunities at key moments when people are most likely to buy.

Here's where to put them:

Announcement Bar: A simple banner at the very top of your site keeps the offer front and center. Something like "Spend $60 and earn $10 back!" works perfectly.

Product Pages: A small note right next to the 'Add to Cart' button can be a powerful reminder just as they're considering a product.

Cart Drawer/Page: This is your knockout punch. Use a dynamic progress bar that shows people exactly how close they are. Imagine this message: "You're only $15.50 away from earning $10 in store credit!"

That little progress bar creates a powerful psychological itch. It gamifies the checkout, turning it into a mini-challenge the customer wants to win. Suddenly, the incentive isn't just a passive offer; it's an active goal they're trying to hit.

Automating the Entire Experience

Let's be real: manually issuing store credit is a non-starter. For this strategy to work at scale, the whole thing—from issuing the credit to reminding customers to use it—has to be completely automated. This is where a good native Shopify app is worth its weight in gold.

A well-integrated app should handle everything without you lifting a finger:

Automatic Issuance: When an order hits your threshold, the app should instantly add the store credit to that customer's account. No delays, no manual work.

On-Site Reminders: Customers need to see their balance. A floating wallet widget or a clear display on their account page keeps their "free money" visible and ready to spend.

Post-Purchase Email Flows: Automated emails should go out after a set time, reminding customers they have credit waiting. A simple subject line like, "You've got $10 waiting for you!" is one of the best ways to drive a repeat purchase.

This closed-loop system is what really turbocharges lifetime value. The credit they earned from that first, larger purchase becomes the reason they make their next one. It creates a self-perpetuating cycle of loyalty. Getting this system set up right is foundational, and you can get all the technical details in this guide on how to give store credit on Shopify. By automating these touchpoints, you build a retention engine that works for you 24/7.

How to Layer Strategies for a Massive AOV Lift

A well-designed store credit program is already a powerful engine for increasing AOV. But when you start layering it with other proven tactics, you get a compounding effect that turns good results into incredible ones. It’s all about creating a checkout experience where every offer reinforces the next, making it an easy and exciting decision for the customer to add more to their cart.

This isn’t about being pushy. It's about strategically presenting value in a way that feels genuinely helpful. Let's dig into how you can pair your store credit offers with irresistible product bundles, smart upsells, and perfectly timed free shipping thresholds to build a conversion powerhouse.

Create Irresistible Product Bundles

Product bundling is one of my favorite, most effective ways to lift AOV. You’re simply grouping related items into a single, convenient package—often with a slight discount—which instantly increases the perceived value and makes the purchase decision a no-brainer for the customer.

The key is to create bundles that solve a complete problem or offer a full experience. You have to think beyond just grouping your best-sellers.

Starter Kits: Package everything a new customer needs to get going. For a skincare brand, this is your classic cleanser, moisturizer, and serum combo.

Themed Collections: Group items that fit a specific vibe or use case, like a "Weekend Getaway Kit" for an apparel brand or a "Movie Night Bundle" for a snack company.

Routine Builders: For consumables, bundle items that form a daily or weekly routine. This encourages a higher initial buy-in and perfectly sets the stage for future subscription or replenishment orders.

When you combine this with store credit, the offer becomes almost too good to pass up. A customer might see a $90 bundle and realize it gets them past your $75 threshold to earn $10 in store credit. Suddenly, the bundle isn't just a good deal; it's a smart one.

Align Shipping Thresholds with Credit Tiers

Let's be honest: free shipping is one of the most powerful psychological motivators in ecommerce. A staggering 70% of cart abandonment is linked to friction at checkout, and you can bet unexpected shipping costs are a major culprit. You can flip this potential negative into a massive positive by aligning your free shipping minimums with your store credit reward tiers.

This creates a powerful "double dip" incentive that is extremely hard for shoppers to ignore.

Imagine a customer with $85 in their cart. They see a little nudge: "You're only $15 away from free shipping and earning $15 in store credit!" All of a sudden, adding that extra $15 item doesn't feel like spending more—it feels like a savvy financial move. They get another product they want, save on shipping, and get "cash back" for their next order.

This alignment is critical. If your free shipping threshold is $75 and your first store credit tier is $100, you’re creating two separate goals for the customer to track. By setting them both at $100, you create one clear, high-value target to aim for, dramatically increasing the odds they’ll stretch their budget to hit it. For a broader perspective on maximizing customer spending, exploring these 11 proven tactics to increase average order value can offer some fantastic additional insights.

Offer Smart Upsells and Cross-Sells

Upselling (offering a better version) and cross-selling (offering a complementary product) are classic AOV boosters for a reason. The trick is to make these recommendations feel truly helpful, not just like a generic sales pitch. Your store credit program gives you the perfect context to do just that.

Instead of a tired, old "You might also like..." section, frame your recommendations around your reward tiers.

Here’s how it plays out: A customer adds a $65 pair of leggings to their cart. A pop-up or in-cart message could say:

"Great choice! Add the matching $40 sports bra to complete the set and you'll unlock our $100 reward tier, earning you $15 in store credit for your next purchase."

This does three things beautifully:

It presents a relevant, logical cross-sell (the matching top).

It clearly states the benefit of hitting the next tier (the $15 credit).

It reframes the additional spending as an investment in a future reward.

By weaving your store credit program into the very fabric of your bundling, shipping, and upselling strategies, you create a cohesive system where each element supports the others. The result is a seamless customer journey that naturally guides shoppers toward a higher AOV, boosting your revenue today while building the loyalty that drives your LTV tomorrow.

Measuring What Matters for Profitable Growth

A great strategy is only as good as the data that proves it works. Launching a store credit program to bump up your average order value is a fantastic move, but if you aren't measuring it correctly, you’re just guessing. This is where we shift from hopeful tactics to data-driven decisions that fuel real, profitable growth.

It’s easy to get lost in a sea of vanity metrics. Instead, we need to zero in on the essential numbers that reveal the true health of your business and connect the dots between your new store credit offers, your average order value, and your customer lifetime value.

Pinpointing Your Key Performance Indicators

Your Shopify dashboard is overflowing with data, but for this kind of strategy, you only need to obsess over a few critical metrics. These are the KPIs that will tell you if your store credit program is not just lifting AOV, but also creating more valuable, long-term customers.

These four pillars will give you the complete picture:

Average Order Value (AOV): This is the most direct measure of success. Is it going up? Track this week-over-week and month-over-month to see the immediate impact of your reward tiers.

Repeat Purchase Rate: Store credit is designed to bring customers back for another purchase. If your repeat purchase rate is climbing, you know the incentive is doing its job as a retention tool.

Customer Lifetime Value (LTV): This is the ultimate report card. A successful program will show a steady increase in the total value each customer brings to your business over their entire relationship with you.

Profit Margin: The big question—are your AOV gains actually translating to profit? You have to keep a close eye on your margins to ensure your reward structure is sustainable and not just giving away the farm.

Tracking LTV can feel a bit complicated at first, but it's crucial for understanding the long-term impact of your efforts. For a deeper dive, check out our guide on how to calculate customer LTV to get a clear picture of this vital metric.

Running a Simple and Effective A/B Test

The single best way to see the real-world impact of your store credit offers is to test them against a control group. A straightforward A/B test right inside Shopify can give you definitive proof of what’s working. You don't need fancy, expensive tools; a simple, well-designed experiment is all it takes.

Your goal is to isolate the variable. By comparing a group that sees the offer to one that doesn't, you can confidently attribute any lift in AOV directly to your store credit strategy. No more guesswork.

Here’s a simple test you can run right now:

Variant A (The Offer): Show a targeted segment of your traffic a clear offer, like "Spend $100, Get $10 in Store Credit."

Variant B (The Control): Show the rest of your traffic the site as it is today, with no store credit offer visible.

Let the test run for a set period—I'd recommend at least two weeks to a month—to gather enough data for a meaningful result. Once it’s done, compare the AOV, conversion rate, and even the types of products purchased between the two groups. The difference is the real value your new incentive is creating.

Interpreting the Results and Fine-Tuning Your Offers

Once the data is in, it's time to dig in. Countless case studies and experiments have shown that even small tweaks to your incentives can move AOV by double-digit percentages. A Shopify Plus case study, for instance, found that a well-designed promotion and offer layout increased average order value by 32% after A/B testing—a powerful testament to data-backed decisions. This is your chance to replicate that success with simple store-credit offers.

But don’t just look at the main AOV number. Ask deeper questions. Are customers consistently hitting your reward tiers? Or are they falling just short? If you see a lot of customers landing in the $90-$99 range for a $100 tier, it could mean the incentive is compelling but your product catalog makes it slightly too difficult to bridge that last gap.

This is where you start fine-tuning. Maybe your $10 reward for a $100 spend isn't quite motivating enough. Perhaps testing a $15 reward would create a stronger pull. This continuous loop of testing, measuring, and refining is exactly how you build a truly optimized system that turns small wins into massive, sustainable growth in both AOV and lifetime value.

The Big Questions About Store Credit

Pivoting from a discount-heavy model to a store credit program is a big move. I get it. You're probably wondering how it really works, if your customers will go for it, and what it all means for your P&L. Let’s tackle the most common questions I hear from Shopify merchants when they're thinking about making this switch.

My goal here is to give you straight-up, practical answers so you can roll out a store credit system with confidence. This isn't just about a new tactic; it's about building a more profitable business that focuses on lifetime value, not just chasing the next sale.

Is This Just a Discount in Disguise?

This is always the first question, and the answer is a hard no. They might both affect your margins, but that's where the similarity ends. A discount is a one-and-done deal. It instantly devalues a sale and, worse, starts training your customers to wait for the next price drop.

Store credit, on the other hand, is an investment in the next purchase. It’s a powerful retention lever that gives customers a concrete reason to come back, directly boosting their lifetime value. Plus, since a good chunk of customers never actually redeem their credit (this is called breakage), the real cost to your business is almost always lower than the face value you issue. It's a much smarter, margin-friendly incentive.

How Will This Mess With My Cash Flow?

It won't—in fact, it can actually help. A discount immediately shrinks the amount of cash coming in from a sale. Store credit is totally different; you book it as a liability on your balance sheet. The cash from that initial, higher-AOV purchase? It’s already in your bank account.

The cost doesn't hit your books until a customer actually spends that credit on a future order. This model front-loads your revenue by encouraging those bigger initial baskets. You get more cash upfront, and the "cost" of the reward is pushed down the road.

Here's the key mindset shift: A discount is an immediate expense. Store credit is a pre-funded marketing cost for a future sale. Understanding that difference is fundamental to building a healthier financial foundation for your store.

Will My Customers Get This Instead of a Points System?

They’ll not only get it—they’ll love it. Let's be honest, points systems are often a headache. "Earn 10 points for every dollar, and 1,000 points gets you a $5 reward!" Shoppers have to pull out a calculator just to figure out what they're earning. That's friction.

Store credit is crystal clear. $10 in store credit is $10 to spend. It’s simple, tangible, and feels way more valuable. When customers see a real dollar amount in their account, it feels like cash waiting for them, not some abstract points they have to convert. That direct value is precisely why native store credit is so good at nudging that average order value up and increasing lifetime value.

By ditching the complicated math, you get straight to the point: giving customers a compelling reason to spend more with you now and come back later.

Ready to stop the discount death spiral and start building profitable customer relationships? With Redeemly, you can launch a native Shopify store credit program in minutes. Protect your margins, boost your AOV, and give customers a reason to keep coming back.

Join 7000+ brands using our apps