The Ultimate Guide to a Store Credit Shopify App for Higher LTV

Dec 25, 2025

|

Published

At its core, a store credit Shopify app offers a smarter way to reward customers, moving beyond the tired cycle of discounts and confusing point systems. It’s a cash-like system that directly boosts customer lifetime value and average order value. Instead of just slashing prices and giving away your margin with coupons, you're issuing real, tangible credit that brings customers back to your store.

Why Discounts and Points Are Killing Your LTV

We've all been there. You run a 20% off sale, get that quick hit of sales, and then reality sets in as you look at your shrunken profit margins. This all-too-common tactic feels like you're making moves, but in reality, you're just training your customers to see less value in your products and simply wait for the next price drop.

It's a reactive strategy that fosters a purely transactional relationship, not a loyal one. Customers quickly learn to expect a deal with every single purchase, which slowly chips away at your brand's value and makes it nearly impossible to sell at full price. The conversation shifts from the quality of your products to the size of the discount—and that’s a race to the bottom you just can't win.

Shifting from Coupons to Assets

Now, let's picture a different scenario. Instead of a disposable coupon, imagine your customers earning Shopify native store credit with every purchase. It’s essentially ‘cash back’ for your store. This credit doesn’t feel like a temporary deal; it feels like a real asset, a balance they own and are itching to spend. This simple psychological flip can have a massive impact on two of your most important growth metrics:

Average Order Value (AOV): When a customer sees that spending just a little bit more will earn them a bigger credit reward, what do they do? More often than not, they’ll add that extra item to their cart. You've successfully reframed the purchase from "saving money now" to "earning a benefit for later."

Customer Lifetime Value (LTV): A growing store credit balance is one of the most powerful magnets you can have to pull a customer back. It gives them a concrete reason to return for a second, third, or fourth purchase—often at full price—which skyrockets their long-term value to your business.

By issuing store credit, you're doing something much more powerful than offering a discount. You're essentially pre-funding a customer's next purchase. This proactively builds lifetime value and ensures your marketing efforts lead to repeat business, not just a series of one-off sales.

A Smarter Path to Growth

Figuring out how to improve profit margins is non-negotiable for long-term growth, and breaking free from the deep-discounting trap is a huge part of that. With a store credit Shopify app, the cost of the reward is only realized when a happy customer comes back to spend again.

This completely transforms your retention strategy from a business expense into a self-funding growth engine. You can dive deeper into this topic in our guide on how to improve profit margins for your Shopify store. It's time to stop giving away revenue and start building loyalty that actually pays for itself.

How a Native Store Credit App Actually Works

Let's be honest, most loyalty programs are a headache. They're often confusing, packed with rules, and create more frustration than actual loyalty. A store credit Shopify app is the antidote to all that complexity. Think of it less like a convoluted points system and more like a simple, cash-back reward program that lives right inside your store. It’s a beautifully straightforward way to get customers spending more, and more often.

The whole thing is designed to be frictionless for everyone. You start by setting a simple rule—something like, "5% back in store credit on every purchase." That's it. When a customer buys something, the app does the math and automatically deposits the credit into their account. No fuzzy "points" to translate, no hoops to jump through. Just a clear dollar value they can see and use on their next visit.

The Customer Journey: From Earning to Spending

From your customer's point of view, the experience feels completely natural and genuinely rewarding. They can check their growing balance right in their account area or see it in a small on-site widget. That little reminder of their credit acts as a constant, subtle nudge to come back and shop again.

When they’re ready to buy, redeeming their credit is ridiculously easy:

Shopping: They browse and add items to their cart like always. That visible credit balance might be just the push they need to add one more thing to their order, boosting average order value.

Checkout: Once they get to checkout, their store credit is right there, presented as a payment option—just like a gift card.

Redemption: With one click, they apply the balance to their total. Done.

The entire process happens within the Shopify checkout they already know and trust. There are no clunky third-party pages or confusing coupon codes to copy and paste. It just works.

The real magic of a native app is how seamlessly it integrates. It hooks directly into Shopify's core features, so you don't have to worry about clunky external scripts bogging down your site speed and killing your conversion rates. The experience is fast, clean, and feels like it was always meant to be there.

Driving a Higher Average Order Value

This simple setup has a powerful psychological effect on spending. When a customer sees they’re only $10 away from hitting the next reward tier, the urge to add another item to their cart is almost irresistible. The reward feels real and within reach, turning a simple checkout into a mini-game where they win by spending a little more.

This is how you get customers to consistently build bigger carts, pushing your average order value higher. You're not just slashing prices with a discount; you're giving them a compelling reason to spend more to earn more, which directly increases their lifetime value. To dig deeper into this, check out our guide on the benefits of Shopify native store credit and see how it can fuel your growth.

Driving Real Growth with Strategic Store Credit Campaigns

Think of a store credit system less as a tool and more as a growth engine waiting for you to turn the key. Once you have a store credit Shopify app integrated, you can stop theorizing and start launching targeted campaigns that produce real, measurable jumps in customer lifetime value and average order value.

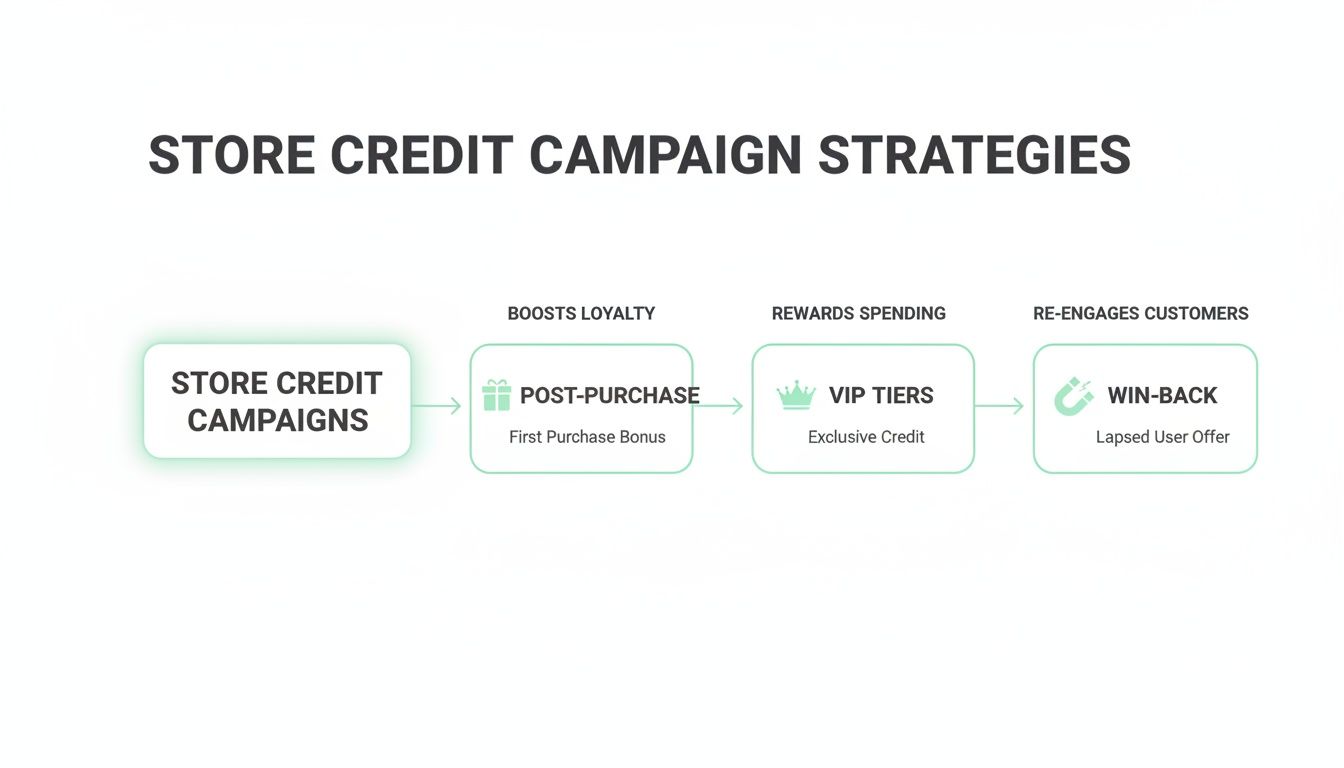

One of the most effective plays you can run is the post-purchase credit offer. That brief moment right after a customer clicks "buy" is a golden opportunity to lock in their loyalty. Instead of just a standard "thank you," imagine instantly dropping a small amount of store credit into their account. It immediately creates a reason for them to come back, shifting the relationship from purely transactional to something more reciprocal.

Campaigns That Boost Lifetime Value

To really move the needle on LTV, you have to think beyond one-off sales. Store credit is the perfect fuel for creating compelling, multi-step campaigns that keep customers hooked and spending over the long haul.

VIP Tiers: Roll out the red carpet for your best customers. You could create exclusive tiers where shoppers who spend over a certain amount unlock a higher credit-back percentage. This makes them feel genuinely valued and gives them a powerful incentive to consolidate all their spending with your brand.

Win-Back Offers: Got a list of customers who've gone quiet? Hit them with a surprise store credit deposit. A simple, personal email saying, "We miss you! Here's $10 to come back and see what's new," cuts through the noise far better than another generic discount code.

Here's the secret: store credit has superior economics. A discount erodes your margin on the current sale. Store credit, on the other hand, only becomes a cost when a customer returns to make another—often full-price—purchase. This flips your retention marketing from an expense into a self-funding growth loop for LTV.

The Math Behind Margin-Safe Growth

Let's break it down with a quick example. Say you offer 5% back in store credit on every order. A customer spends $100 and immediately gets $5 in credit. That $5 just sits in their account, acting as a constant, gentle reminder of your brand. When they inevitably return to use it, they almost always spend much more than the credit amount to get the products they really want, boosting AOV.

This isn't just theory; it materially improves repeat purchase rates. In fact, Shopify reports that merchants using unified commerce features like native store credit see an average sales uplift of around 8.9% annually, all while keeping their operational costs down.

Turning Inactive Shoppers into Loyal Fans

Your store credit campaigns are also your secret weapon for re-engagement. To get the most out of them, you should integrate these offers with proven tactics to reduce customer churn. By spotting customers who are at risk of leaving and proactively sending them a store credit offer, you can stop churn dead in its tracks.

This strategic use of credit helps you build a much more resilient customer base. You're no longer just hoping customers come back; you're actively giving them a compelling, cash-like reason to choose you again and again.

Store Credit vs. Discounts and Points: A Clear Comparison

When it comes to building customer loyalty, the tools you choose make all the difference. For years, Shopify merchants have leaned on two main tactics: percentage discounts and points-based systems. They're familiar, sure, but both have serious downsides that can quietly eat away at your profitability and frustrate your customers.

Let's put these old-school methods head-to-head with a modern, Shopify native store credit program. This direct comparison will show you exactly why a store credit Shopify app is a much smarter strategy for boosting both lifetime value and average order value.

Why Discounts Simply Give Away Revenue

The biggest appeal of a discount is its simplicity. But that's also its greatest weakness—it directly slashes your revenue on the spot. When you offer 20% off, you're not just giving a customer a deal; you're permanently sacrificing 20% of that sale's margin. This can train shoppers to devalue your products and just wait for the next sale, creating a race to the bottom that’s tough to escape.

Discounts create a transactional mindset. Store credit builds a financial relationship. A customer with a credit balance has a tangible, concrete reason to come back and spend, turning a one-time buyer into a loyal, high-LTV customer.

The Problem with Confusing Points Systems

Points systems were designed to solve the margin problem, but they ended up creating a new one: confusion. What is a "point" really worth? This forces customers to do mental gymnastics, trying to figure out how many points they need for a reward and what that reward's actual dollar value is. This friction often leads to people just giving up and ignoring the program entirely.

A store credit program, on the other hand, is completely intuitive. $10 in credit is exactly that—$10. This clarity makes the reward feel more valuable and accessible, encouraging shoppers to use it right away and driving repeat purchases without any of the mental heavy lifting.

The following visual shows just how versatile store credit can be when you start thinking strategically.

As you can see, store credit isn’t just one tactic. It’s a flexible tool you can use to hit specific goals, whether that’s securing that critical second purchase, rewarding your top-tier VIPs, or winning back customers who have gone quiet.

The Head-to-Head Comparison

To really understand the strategic differences, let's break down how these three tactics stack up against the metrics that actually matter for your business.

Metric | Store Credit Program | Percentage Discounts | Points Systems |

|---|---|---|---|

Profit Margins | Preserves initial sale margin; cost is only realized on a second purchase. | Immediately erodes the margin of the current sale. | Protects initial margin but can have high liability if points are hoarded. |

Customer Experience | Simple and transparent. $10 is $10. Feels like cash. | Easy to understand but trains customers to wait for sales. | Often confusing. Customers must calculate point values, creating friction. |

Lifetime Value (LTV) | A growing balance is a powerful magnet, pulling customers back to spend. | Encourages one-off purchases, not long-term repeat business. | Can increase LTV, but only if the program is clear and engaging enough to use. |

Brand Perception | Feels like a premium reward or a cash gift, enhancing brand value. | Can devalue the brand over time, making it feel cheap or desperate. | Can feel disconnected or gamified, sometimes cheapening the experience. |

At the end of the day, the choice is clear. Discounts offer a short-term sales bump at a long-term cost. Points systems add a layer of complexity that often backfires. Store credit, however, provides a clear, valuable, and margin-friendly way to build real relationships.

By choosing a store credit Shopify app, you're not just picking a different type of reward. You're adopting a more profitable, customer-centric strategy that fuels genuine loyalty and sustainable growth for your brand.

Picking and Launching Your Store Credit Shopify App

Ready to make the jump to a smarter loyalty program? It's honestly a lot easier than you might think. The whole game is about choosing a store credit Shopify app that feels like a natural part of your store, not some clunky add-on.

Let's walk through how to pick the right tool and get your program off the ground so you can start seeing a real impact on customer lifetime value and AOV right away.

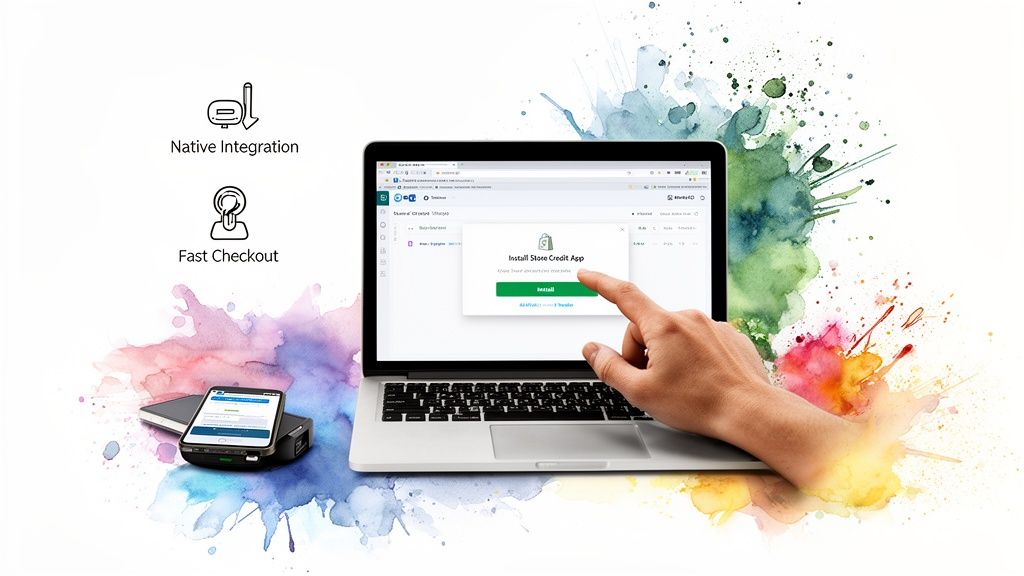

Your number one priority has to be finding a native Shopify app. Why? Because native apps are built from the ground up to play nicely with Shopify's own systems. They're lightweight, super reliable, and don't rely on heavy, external code that can bog down your site speed and kill your conversion rates.

The Non-Negotiable Features of a Great App

When you're comparing apps, cut through the noise and focus on what actually makes a difference for your customers and your sanity. Anything else is just a distraction.

Here’s your must-have checklist:

Flawless Shopify Checkout Integration: This is crucial. Customers need to be able to apply their credit right inside the normal Shopify checkout. If your app sends them to a weird third-party page or makes them copy and paste codes, you’ve already lost.

POS Ready: Got a brick-and-mortar store? Your app absolutely must let customers earn and burn credit both online and in-person. A disjointed experience is a non-starter.

Lightweight and Fast: Get confirmation that the app is native and won't add bloat. A fast site keeps shoppers happy and moving toward that "complete purchase" button.

The best loyalty programs are the ones customers don't even have to think about. A native app makes earning and redeeming credit feel like a built-in feature of your store. That builds trust and brings people back, no friction required.

Your Simple Launch Plan

Getting this up and running is a piece of cake. Once you've picked the right store credit Shopify app, you can get live in just a few steps.

Install and Set Your Rules: First, connect the app to your store. Then, set up your main reward rule—something simple like 5% back in store credit on every purchase is a great starting point.

Move Your People Over (If you need to): If you're ditching an old points system, a solid app will have a tool or support to help you import everyone's balances. Frame this to your customers as an exciting upgrade to a simpler, more valuable reward.

Shout It from the Rooftops: Time to launch! Let your customers know there's a new, better way to earn rewards. A quick email blast and some banners on your site are all you need to get the ball rolling.

That’s it. You’re ready to replace confusing points and profit-eating discounts with something better. And the potential is huge. Consider that the average Shopify order is around $100. If you can lift that by just 6% with a simple credit incentive, a store with 10,000 monthly orders could see an extra $720,000 in annual revenue. Don't just take my word for it—dive into more Shopify statistics and see what's possible.

Measuring the ROI of Your Store Credit Program

A great strategy needs great data to back it up. Launching a store credit Shopify app is a fantastic move, but proving its financial impact is what really matters. It’s what turns a nice-to-have feature into a non-negotiable part of your growth strategy. To do that, you have to look past the simple sales figures and zoom in on the metrics that truly reveal long-term customer value.

The real return on your investment isn't just about a single transaction. It’s about seeing a fundamental shift in how your customers shop. Are they coming back more often? Are they spending more when they do? When you can answer these questions with hard data, you'll have undeniable proof that your investment is paying off.

Key Metrics to Track

To get a clear picture of your program's performance, you need to build a dashboard of key performance indicators (KPIs). These aren't just vanity numbers; they reflect the true health of your customer relationships.

Repeat Purchase Rate: This is the most direct measure of loyalty you have. If your repeat purchase rate is climbing, it’s a clear sign that store credit is giving customers a compelling reason to come back for more.

Average Order Value (AOV): You’ll want to compare the AOV of customers who use store credit against those who don't. When you see a higher AOV from the credit-using group, you know the incentive is successfully nudging them to add more to their cart.

Time Between Purchases: A well-run program should actually shorten the time it takes for a customer to place their next order. That feeling of "money in the bank" creates a gentle urgency, and a shorter buying cycle is proof that it’s working.

The ultimate goal is to connect all of these smaller wins to the one metric that reigns supreme: Customer Lifetime Value (LTV). A strong store credit system is a direct-injection fuel for LTV, boosting both repeat sales and order sizes to create a more valuable customer base over time.

Tying It All to Customer Lifetime Value

Think of Customer Lifetime Value as the North Star for your entire retention strategy. It pulls together repeat purchases and AOV to give you a complete picture of a customer's total worth to your business.

When you see LTV climbing for customers who are active in your store credit program, you've found your proof. That single number tells the whole story of how you're turning one-time buyers into loyal, lifelong fans.

For anyone ready to get their hands dirty with this crucial calculation, our guide on how to calculate customer LTV breaks it all down step-by-step. By keeping a close eye on these KPIs, you can fine-tune your campaigns, adjust your reward amounts, and constantly improve your program. This data-driven approach is what transforms your store credit Shopify app from a simple tool into a reliable engine for profitable growth.

Frequently Asked Questions

You've got the big picture, but a few questions might still be lingering before you dive in. Let's tackle some of the most common things merchants ask when they're thinking about launching a store credit program on Shopify.

How Is Store Credit Different from a Gift Card in Shopify?

It’s a great question, because on the surface, they can look similar. Think of it this way: a gift card is a product. Someone buys it, usually to give to someone else, and it acts just like cash in your store.

Store credit, on the other hand, is a relationship-building tool. It’s not something customers buy; it’s something you give them as a reward, a refund, or a customer service gesture. It’s designed specifically to increase lifetime value by bringing that customer back to your store, encouraging loyalty and repeat purchases in a way a gift card doesn't.

Will a Store Credit App Slow Down My Website?

This is a critical concern, and for good reason. The short answer is: a truly native app won't. A native solution is built to integrate directly with Shopify's own infrastructure. It hooks into the platform's existing systems instead of bolting on heavy, external code that has to be loaded every time someone visits your site.

Many third-party loyalty apps are notorious for bogging down storefronts, which can crush your conversion rates. A lightweight, native store credit Shopify app is designed to feel like it’s part of Shopify itself, keeping your site fast and your customer experience smooth.

The best loyalty solutions feel like they were always part of your store. A native app provides that seamless experience, building trust and encouraging repeat business without any friction. It just works.

Is It Hard to Switch from My Current Points Program?

It might seem daunting, but migrating from a clunky points system can be surprisingly straightforward with a good game plan. The most important piece of the puzzle is communication. You need to frame the switch as an upgrade for your customers.

Instead of confusing points, they're getting a simple, transparent "cash-back" system they can actually understand and use. Top-tier apps even offer tools and support to help you import customer balances from your old program. With the right partner, you can ensure your most loyal customers feel taken care of and immediately see the value in their new, simpler rewards.

Ready to replace profit-killing discounts with a loyalty system that actually grows your business? With Redeemly, you can launch a native store credit program that boosts lifetime value and average order value without slowing down your site. See how it works at https://redeemly.ai.

Join 7000+ brands using our apps