The Shopify Loyalty Program That Actually Boosts LTV and AOV

Dec 11, 2025

|

Published

When you think "Shopify loyalty program," you're probably picturing a system that rewards customers for coming back. But the real question, the one that separates struggling stores from thriving ones, is how you reward them.

Forget the confusing point systems and margin-crushing discounts of the past. The smartest brands are now using native Shopify store credit—turning a simple reward into a powerful engine for boosting customer lifetime value and average order value.

Why Traditional Loyalty Programs Are Hurting Your Store

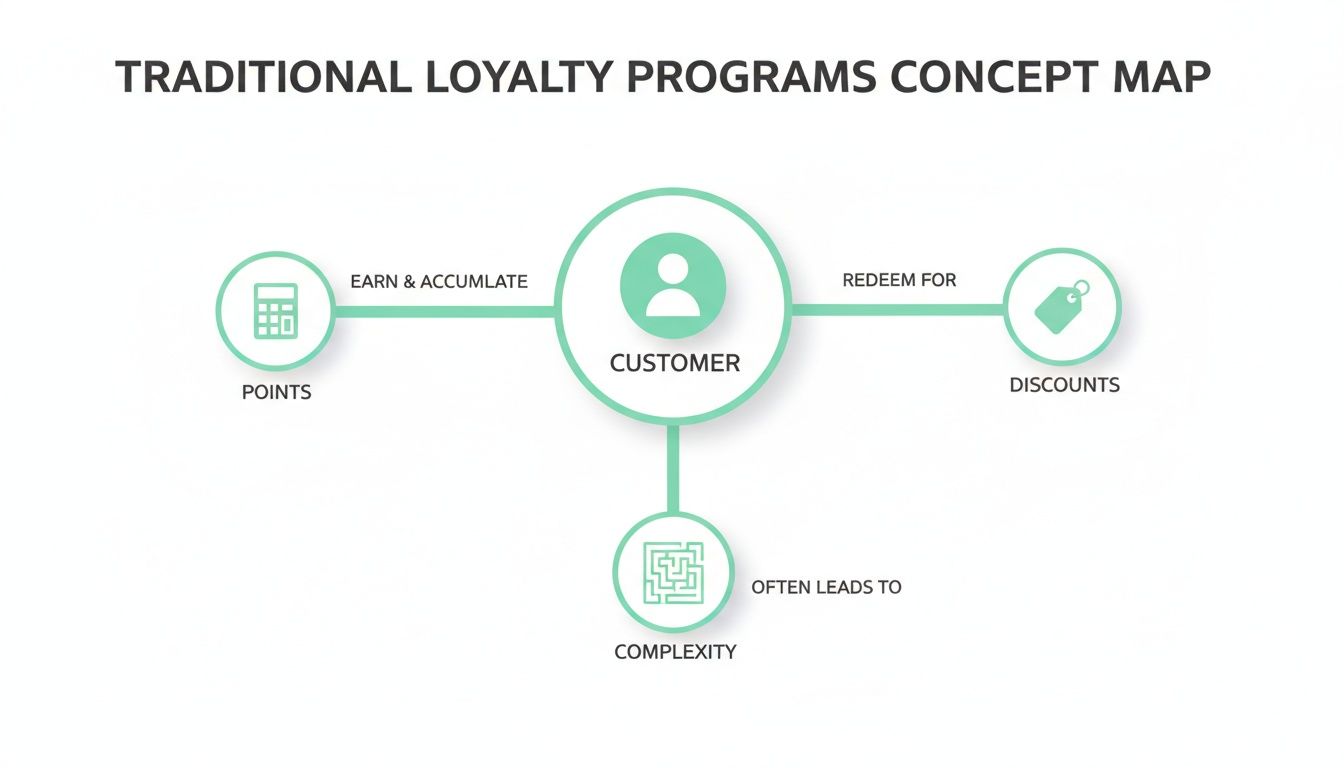

Let's be real for a second: most Shopify loyalty programs are fundamentally broken. For years, we've been sold on the idea that complex point systems and fancy VIP tiers are the secret to customer loyalty. The reality? These old-school models often do more harm than good, creating a clunky experience for shoppers while quietly eating away at your profits.

The traditional approach basically trains your best customers to become discount-hunters, not brand fans. It fosters a relationship built on transactions, not genuine affinity. This race to the bottom is completely unsustainable and ignores the two metrics that actually matter for long-term growth: customer lifetime value (LTV) and average order value (AOV).

The Problem with Points and Complicated Tiers

Think about the last time you tried to cash in airline miles. Was it a breeze? Or was it a maze of blackout dates, confusing conversion charts, and seats that never seemed to exist? That’s the exact feeling most points-based loyalty programs give your customers. They’re forced to become amateur mathematicians, trying to figure out what their "2,357 points" can actually get them.

This confusion just leads to customers checking out mentally. When a reward is too hard to understand or a pain to redeem, people just stop caring. Your loyalty program becomes a business expense that collects digital dust instead of driving repeat sales. In fact, studies show that over half of all loyalty memberships are totally inactive, proving there’s a huge disconnect between signing up and seeing real value. To see this in action, just look at these common examples of loyalty programs and you'll notice the complexities right away.

The core issue with traditional loyalty is psychological friction. When customers can't immediately grasp the value of their rewards, the motivation to earn them disappears. Simplicity isn't just a feature; it's the foundation of engagement.

The Discount Death Spiral

The other trap so many stores fall into is relying on a constant stream of discount coupons. Sure, a 15% off coupon might lock in a sale today, but it sets a dangerous expectation for every purchase after that. Customers quickly learn to just wait for the next promo code, killing any chance you had of them paying full price again.

This "discount death spiral" creates a cascade of problems:

It devalues your products: Constant sales send a clear message: your stuff isn't actually worth the original price.

It destroys your profit margins: Every single discount is a direct cut from your bottom line, leaving less money to reinvest in your business.

It attracts the wrong customers: You end up building a list of bargain-hunters, not true brand advocates who love what you do.

At the end of the day, these outdated strategies fail because they focus on the transaction, not the relationship. They offer short-term wins that actively sabotage the long-term health of your brand. It’s time for a better way—a simpler, more profitable approach built for sustainable growth.

How Store Credit Changes the Loyalty Game

Let's be honest: traditional points and discount programs are starting to feel a little dated, and customers are getting tired of them. Instead of making your shoppers do mental gymnastics to figure out what their "points" are worth, what if you could just give them something that feels like cash?

That's the simple, powerful idea behind using native Shopify store credit for your loyalty program. You're not giving them confusing points; you're giving them a dedicated digital wallet for your brand. Every dollar they earn is a real dollar they can spend, which creates a magnetic pull that abstract points just can't compete with. It’s less of a game and more of a genuine reward.

This is where so many old-school loyalty programs go wrong—they add friction.

As you can see, the path to actually getting a reward is often a mess of complicated rules and conditions. A store credit system cuts right through that noise with a clear, direct benefit your customers will instantly understand and appreciate.

The Big Three: Store Credit vs. Points vs. Discounts

To really understand the impact of store credit, it helps to see how it stacks up against the other common models. Each one affects your business differently, from profit margins to the customer experience.

Let's break it down.

Metric | Store Credit Model | Points System Model | Discount Coupon Model |

|---|---|---|---|

Profit Margin | High Protection. Revenue stays in the business, driving future full-price sales. | Moderate Risk. Can be devalued, but redemption often mimics a discount. | Direct Hit. Discounts directly reduce the revenue and margin from a sale. |

Customer Behavior | Boosts AOV/LTV. Encourages "topping up" a purchase, leading to higher spending. | Delays Gratification. Customers hoard points, which can lead to disengagement. | Encourages Waiting. Trains customers to wait for sales, devaluing your product. |

Simplicity | Very High. Customers see a clear dollar value, just like a gift card. | Low. Requires customers to do math ("How many points is a dollar?"). | High. Easy to understand but creates a transactional, not loyal, relationship. |

Breakage | Low. High perceived value means customers are motivated to spend it. | High. Unused points (liability) often expire or are forgotten, frustrating users. | N/A. A coupon is either used or it's not; no lingering value or liability. |

Ultimately, while discounts are easy, they erode your brand's value. Points create complexity and a sense of detachment. Store credit, on the other hand, strikes the perfect balance—it’s simple for the customer and incredibly smart for your bottom line.

Protecting Your Profits with a Closed-Loop System

Here’s the biggest financial win with a store credit program: it's a closed-loop system.

When you give out a 20% off coupon, that money is just gone. Vanished from your revenue. But when you issue store credit, that cash is guaranteed to flow right back into your business. A discount is a one-way street out of your bank account; store credit is a roundabout that keeps value circulating within your brand.

Think of it less as a cost and more as a pre-investment in their next purchase. That subtle shift is how you build a Shopify loyalty program that fuels sustainable growth, not just a series of one-off, discounted transactions.

Boosting Average Order Value and Lifetime Value

A store credit balance in a customer's account does something magical: it makes them spend more. It’s a powerful psychological nudge often called the "top-up effect."

A customer with a $10 credit balance rarely hunts for a $10 item to get it for "free." Instead, they see that $10 as a nice head start on a bigger purchase. They're far more likely to build a cart of $50 or $75, using their credit to justify the larger spend. This naturally lifts your average order value (AOV) without you having to slash prices.

Store credit doesn’t just reward past behavior; it shapes future spending. By creating an active balance in a customer's account, you create a compelling reason for them to return and complete their next purchase with you, not a competitor.

This cycle is the engine that drives lifetime value (LTV). Every time a customer earns and spends their credit, their connection to your brand gets a little bit stronger. You're giving them a real, monetary reason to stick with you.

In a world where over 90% of companies have some kind of loyalty program, standing out is tough. But research shows that 79% of shoppers stick with brands they truly trust. You can discover more insights about loyalty program statistics on Joy.so to see just how deep that connection runs. By swapping confusing points for clear, cash-like credit, you're building that trust and creating a loyalty experience that actually pays for itself.

Setting Up Your Native Shopify Store Credit Program

Moving to a native store credit loyalty program is one of the smartest things you can do for your Shopify store. Forget about confusing points that feel more like a math problem than a reward. Store credit is simple. It's like giving your customers cash to spend with you, an incentive they'll understand and appreciate instantly.

This is your playbook for creating a program that not only keeps shoppers coming back but also directly boosts AOV and LTV while protecting your precious profit margins.

Step 1: Define Your Core Earning Rules

First things first: you need a core earning rule. The key here is to keep it dead simple.

A straightforward rule like "earn $1 in store credit for every $20 spent" is perfect. It's easy to remember and immediately shows customers how valuable their loyalty is. This kind of cashback model anchors your program in real, tangible value, and you'll quickly see it nudge up your average order value as people add just one more thing to their cart to hit that next reward.

With your main rule in place, you can start layering in other incentives to encourage the specific actions that help grow your brand.

Welcome Bonus: Toss them $5 in store credit just for creating an account. It's a low-friction way to get them invested from day one.

Birthday Rewards: Everyone loves a birthday gift. Automatically sending some store credit on their special day is a personal touch that builds a genuine connection.

Product Reviews: Need more user-generated content? Offer a little store credit for a review. You could even add a bonus if they include a photo or video.

Step 2: Choose the Right Native Tools for Automation

Let's be real: you can't manage all this manually. You absolutely need the right Shopify app to automate everything, from issuing the credit to reminding customers to come back and spend it.

When you're looking at apps, I can't stress this enough: prioritize solutions that are native to Shopify, like Redeemly. Native apps are built right on Shopify's foundation, which means they’re lightweight, fast, and won't drag down your site speed.

A native solution also creates a buttery-smooth experience for your customers. Their store credit balance will just appear in their account and at checkout—no clunky third-party widgets, no weird redirects. This frictionless process is the secret to getting people to actually use their rewards. When you're setting things up, look into powerful Shopify integrations to connect your store credit system with other crucial tools, like your email marketing platform.

Step 3: Communicate Your Program’s Value

Launching your program is just the beginning. The real work is making sure your customers know about it and are genuinely excited to join. Your goal is to make the value so obvious they can't possibly miss it.

Start by creating a dedicated landing page for your loyalty program. Use clear visuals and plain English to explain how it works: how to earn, how to spend, and why it's so much better than other programs they've seen. This page will be your home base for everything related to the program.

The most successful store credit programs are woven into the entire customer journey. It shouldn't feel like an afterthought but a core part of the shopping experience.

You need to sprinkle reminders and benefits across all your key touchpoints:

On-Site Banners and Pop-Ups: Announce the program loud and clear to every single person who visits your site.

Product Pages: Add a small note showing how much credit a customer could earn by buying that specific item.

Post-Purchase Emails: Right after they get their order confirmation, send another email celebrating the store credit they just earned. This reinforces the value immediately and gets them thinking about their next purchase.

Customer Account Page: Make their store credit balance big and bold whenever they log in. It’s a constant, powerful reminder to come back and shop.

By keeping the rules simple, picking a great native app, and shouting the benefits from the rooftops, you’ll create a loyalty program that feels less like a marketing gimmick and more like a genuine "thank you." This is how you drive repeat business and build the kind of lasting customer relationships that lead to real, sustainable growth.

Connecting Store Credit to Real Business Growth

So, you've set up a store credit system. That's a great start, but the real magic happens when you connect the dots between that credit and your bottom line. This isn't just about handing out rewards; it's a strategic move to shape customer behavior and pump up the two metrics that truly matter for long-term success: Average Order Value (AOV) and Customer Lifetime Value (LTV).

Think about it. A store credit balance is different from abstract points or a discount code that expires next Tuesday. It feels like real money just sitting in a customer's account, giving them a concrete reason to come back and shop. This simple mental shift turns your Shopify loyalty program from a line item on your expense sheet into an engine for generating revenue.

Driving Higher AOV with the Top-Up Effect

One of the first places you'll see store credit work its magic is in your Average Order Value. It all comes down to a neat bit of psychology I call the "top-up effect."

Let’s say a customer has $15 in store credit. Their first instinct usually isn't to hunt for a $15 item to get for "free." Instead, they see that credit as a massive head start on a bigger purchase they actually want. Suddenly, that $50 item in their cart feels more like $35, which makes hitting the "buy" button a whole lot easier.

This little nudge has a direct and predictable impact on your sales:

Encourages Larger Carts: People are naturally motivated to build a bigger cart to feel like they're "making the most" of their credit.

Reduces Purchase Hesitation: The credit effectively lowers the sticker shock, helping customers overcome that last-minute hesitation at checkout.

Moves More Inventory: Shoppers become more willing to toss in those extra items they were on the fence about, which helps you clear out more products.

By giving customers a tangible starting balance, store credit subtly reframes the entire shopping experience. The question shifts from "How much am I spending?" to "How much more do I need to spend?" That's how you boost AOV without just slashing your prices.

Boosting LTV Through a Recurring Purchase Cycle

AOV is the quick win, but the real, long-term power of a store credit program is its ability to skyrocket your Customer Lifetime Value. An active credit balance is like a constant, gentle reminder that they have value waiting for them at your store. This creates a sticky, self-sustaining loop of repeat purchases.

Here's how it plays out: a customer buys something and earns credit. That credit balance becomes the main reason they come back for their next purchase. When they return to spend it, they earn even more credit, kicking off the cycle all over again.

This creates a powerful retention loop that can turn casual, one-time shoppers into your most valuable, loyal customers. While other loyalty programs often see engagement fizzle out, store credit keeps that connection alive. If you want to see how this works in the wild, check out this case study on a rewards platform like Rewardify.

The Data Proving Loyalty's Impact

This isn't just theory—the numbers back it up. A deep dive into Shopify brands revealed something incredible: customers who actually redeem loyalty rewards have a repeat purchase rate of 50%. Compare that to the tiny 10.7% rate for customers who don't redeem.

This engagement translates directly to your bank account. Loyalty program members generate 115% more revenue per customer than non-members. It’s clear proof that a well-run Shopify loyalty program is one of the most reliable ways to build predictable growth.

Ultimately, this all comes back to having a smart client engagement strategy. When you move beyond one-off transactions and create a system that continually adds value, you build a loyal customer base that will fuel your brand for years. Store credit isn't just a reward—it's a strategic investment in a more profitable future.

Measuring the Success of Your New Loyalty Program

Launching your new store credit system is a fantastic first step, but how do you know if it's actually working? Real confidence comes from seeing the direct impact on your bottom line. It's time to look past surface-level numbers and focus on the Key Performance Indicators (KPIs) that prove the real ROI of your new Shopify loyalty program.

Tracking the right data doesn't just validate your strategy—it gives you the roadmap to make smarter, data-driven decisions. This isn't about guesswork. It’s about drawing a straight line from your loyalty efforts to tangible revenue growth.

Focusing on Lifetime Value and Repeat Purchases

At its core, a store credit program is designed to create more valuable customers who stick around for the long haul. That’s why your most important metrics are Customer Lifetime Value (LTV) and purchase frequency. These two tell you if you're truly building loyalty or just giving away freebies.

To get a crystal-clear picture, you need to look at two distinct groups: your loyalty program members and your regular shoppers.

LTV of Members vs. Non-Members: This is your North Star. A successful program will always show that members have a much higher LTV than your average customer. As time goes on, you should see this gap get even wider as members come back again and again.

Repeat Purchase Rate: Are your customers coming back for more? Track the percentage of members who make a second, third, or even fourth purchase and compare that to non-members. A rising repeat purchase rate is undeniable proof that your store credit gives them a compelling reason to return.

Time Between Purchases: A killer loyalty program actually shortens the buying cycle. Measure the average number of days between purchases for both groups. If that window is shrinking for your loyal members, you know your program is doing its job.

Key Metrics for Program Health

Beyond LTV, a few other KPIs give you a real-time pulse check on your program's performance. These metrics help you understand how customers are engaging and the direct financial impact of the credit you’re issuing.

One of the most powerful indicators is your loyalty attribution rate—the slice of your total revenue directly driven by members using their rewards. Well-oiled programs often see this number land between 15% and 25%. Backing this up, data consistently shows that loyalty members spend 12% to 18% more per order than other customers, a direct result of rewards boosting AOV. You can dig into more detailed Shopify loyalty analytics on mageloyalty.com to see how this plays out.

Tracking your store credit redemption rate is absolutely crucial. A low number might mean your earning rules are too slow or customers simply don't realize they have credit. A healthy redemption rate proves the rewards are valuable enough for customers to act on.

Other essential health metrics include:

Store Credit Redemption Rate: What percentage of the credit you've issued is actually being spent? A healthy rate, often between 15-40%, shows that the program is engaging and the value is obvious to your customers.

Average Order Value (AOV) Lift: Compare the AOV of orders where store credit was used versus orders without it. This is how you prove the "top-up effect" is real and actively driving bigger carts.

Program Enrollment Rate: What percentage of your customers are actually signing up? This tells you how well you’re selling the program’s value across your website, emails, and other marketing channels.

By keeping a close eye on these KPIs, you can move from hoping your loyalty program works to knowing it does. Every data point tells a story, helping you fine-tune your strategy and build a powerful engine for predictable, sustainable growth.

Got Questions About Store Credit? Let's Talk Strategy.

Making a switch to a new loyalty model always brings up some "what ifs" and "how tos." Moving to a store credit system, even though it's simpler on the surface, is a real shift in how you think about customer retention. So, let’s tackle the most common questions and concerns we hear from merchants.

Isn't This Just More Expensive Than a Points Program?

It’s easy to think that, but in reality, it's often far more profitable. Giving away what looks like cash can feel risky, but remember, you're the one setting the rules and deciding how customers earn that credit.

Here's the real difference: a $10 store credit balance feels tangible and ready to spend. 1,000 abstract points? Not so much. That feeling of real value is what actually gets customers back to your store, ready to make another purchase.

Think of it this way: a well-structured credit program ensures the cost of that credit is a tiny fraction of the new sales it drives. Unlike a blanket discount that just eats into your margin on a sale that was probably happening anyway, store credit inspires a completely new shopping trip. It protects your profits on full-priced items and gives your LTV a serious boost.

How Do I Move My Customers Over From an Old Points System?

Moving your existing members is all about communication, transparency, and a little bit of generosity. This isn't about taking something away; it's about giving them a major upgrade.

Here's a straightforward game plan:

Announce the Upgrade: Give everyone a heads-up well before you flip the switch. Build some excitement!

Be Generous with the Conversion: Convert their old points into store credit at a rate that feels like a bonus. Turning 1,000 points into a $10 credit, for example, makes the new system's value crystal clear from day one.

Sell the Simplicity: Frame this as the upgrade it is. Talk about how easy it is now—no more confusing math, just a simple dollar balance they can see and use.

When you handle the transition with care, you build a ton of trust and get people genuinely excited to start using their new, more valuable loyalty balance.

Can I Use Store Credit for Things Besides Loyalty Rewards?

Yes! And honestly, this is where a native store credit system really shines. It stops being just a marketing tool and becomes a powerful asset for your entire operation, letting you turn potential headaches into wins.

Store credit is more than a reward; it’s a revenue retention tool. By keeping funds within your store's ecosystem for returns or service issues, you convert a potential loss into a guaranteed future sale.

Think about all the ways you can use it:

Customer Service Fixes: Instead of a cash refund for a shipping hiccup, offer store credit plus a little extra for their trouble. Most customers are happy to take it.

Smarter Returns: When a customer returns an item, offering store credit keeps that money in your business and all but guarantees they'll be back to find something else.

Referral Payouts: Give a direct store credit bonus to customers who bring their friends to your brand.

This kind of flexibility transforms your loyalty program into a core part of your business that protects your bottom line and strengthens customer relationships at every turn.

Ready to ditch the confusing points and margin-killing discounts for a loyalty program that actually builds your business? With Redeemly, you can launch a native Shopify store credit program that boosts LTV and protects your profits.

Join 7000+ brands using our apps