Shopify Cash Back: The Secret to Higher Lifetime Value

Dec 19, 2025

|

Published

Tired of one-off sales that just eat into your profits? There's a smarter way to build a sustainable business: Shopify cash back, framed as native store credit. This simple strategy rewards your customers in a way that makes them feel valued and guarantees they'll return to spend more, directly boosting your lifetime value and average order value.

Why Store Credit Beats a Simple Discount

For decades, discounts have been the go-to tactic for boosting sales. The problem? They come at a heavy cost. You attract one-and-done bargain hunters, train your best customers to wait for a sale, and slowly bleed your profit margins dry. Every coupon is a single transaction with zero promise of a return visit.

A Shopify cash back program, built on native store credit, completely flips the script. Instead of just giving away money on one order, you're reinvesting that value directly into the customer. This isn't a short-sighted discount; it's a powerful hook for future loyalty that transforms your profitability.

This small shift has a massive impact on the metrics that actually matter for long-term growth: customer lifetime value (LTV) and average order value (AOV).

A Flywheel for Higher LTV and AOV

This approach creates a powerful, self-sustaining cycle of retention and spending. When a customer gets store credit, they have a real, tangible reason to come back. It's not just a vague hope; it's money waiting for them in their account.

This simple mechanic is a powerhouse for driving two of the most important metrics for any healthy ecommerce brand:

Customer Lifetime Value (LTV): By giving them a reason to make that second, third, and fourth purchase, store credit stretches the customer relationship way beyond a single sale. Over time, the total revenue you earn from each customer multiplies.

Average Order Value (AOV): Customers will often toss an extra item in their cart just to hit a cash back threshold. It’s a natural, easy way to increase their immediate spend and boost your revenue per order.

A discount pays for the current purchase. Store credit funds the next one. This is the key to breaking free from the race to the bottom and building a more profitable, predictable business.

This isn't just about customer loyalty; it's about protecting your bottom line. Data shows that brands using store credit see 47% less revenue leakage from refunds. Why? Because the money stays inside your business, ready to be spent again.

To see just how different these two approaches are, let's break it down.

Store Credit Cash Back vs Traditional Discounts

Business Metric | Store Credit Cash Back | Traditional Discounts |

|---|---|---|

Customer Behavior | Encourages repeat purchases and boosts LTV. | Attracts one-time bargain hunters. |

Margin Impact | Protects margins by keeping value in your ecosystem. | Directly erodes profit on every transaction. |

Brand Perception | Builds a premium feel; rewards loyalty. | Can devalue the brand and train customers to wait. |

Customer Retention | Creates a strong incentive for the next visit. | No built-in reason for customers to return. |

Refunds | Recaptures revenue by issuing credit instead of cash. | Revenue is lost permanently with cash refunds. |

The difference is clear. While discounts offer a quick, temporary sales bump, a store credit cash back system builds a foundation for lasting success. It’s about cultivating genuine, long-term relationships instead of just chasing the next transaction.

If you want to dig deeper into the fundamentals, you can explore our detailed guide on what store credit is and its core benefits.

Why Simple Store Credit Beats Complicated Points Systems

Let's be honest, most loyalty points programs are a chore. They feel like a convoluted game with a confusing rulebook and rewards that are almost impossible to decipher. For your customers, it’s like being handed a foreign currency—they have to do mental math just to figure out what their points are even worth.

This friction is a conversion killer. Customers are left wondering, "How many points do I need for this?" or "What's the actual dollar value of my 5,000 points?" That hesitation often leads to abysmal engagement and even lower redemption rates, meaning the value you're trying to give them gets left on the table.

But Shopify cash back, offered as native store credit, is refreshingly straightforward. It’s not a game; it’s money in their account. A $10 credit is instantly understood as $10 they can spend. No conversions, no confusing tiers, no mental gymnastics.

The Psychology of Simplicity

That clarity isn't just a convenience—it's a powerful psychological trigger. When a customer sees a real dollar amount tied to their account, the reward feels tangible and immediate. It’s not some abstract number they might use someday; it’s money they can spend right now. This perceived value is a massive motivator.

It's no surprise then that store credit cashback programs on Shopify have been shown to deliver 3.1x higher redemption rates compared to those old-school points systems. That kind of difference is completely reshaping customer retention, especially in an ecosystem as dominant as Shopify's. You can dig deeper into how cashback programs compare and see what the data says across the industry.

Think about it. One loyalty program gives you 500 points. Another gives you $5 in store credit. Which one feels more valuable? Which one makes you want to shop again? The clear, simple cash value wins almost every time.

This psychological edge is everything. While complex points programs often collect dust, a straightforward Shopify cash back balance acts as a constant, gentle nudge, reminding customers to come back and spend the money they've already earned.

Fostering Genuine Loyalty Over One-Off Transactions

The real difference, though, is in the type of customer you're building a relationship with. Discount codes and complicated points systems tend to attract deal-hunters—shoppers who are loyal to the discount, not your brand. They buy, use their coupon, and you won't see them again until the next big sale.

Store credit cultivates something else entirely. It rewards customers by reinvesting value directly into their next purchase with you. This creates a powerful cycle where their loyalty is continuously rewarded and reinforced, building a community of repeat buyers who actually love what you do. You stop chasing one-off sales and start building long-term, profitable customer relationships.

How Cash Back Directly Boosts Your Key Growth Metrics

A well-designed Shopify cash back program does a lot more than just put a smile on your customers' faces. It directly and measurably improves the core metrics that actually fuel sustainable growth. Forget chasing fleeting sales with margin-killing discounts. Store credit creates a powerful engine for profitability by zeroing in on the two pillars of ecommerce success: Customer Lifetime Value (LTV) and Average Order Value (AOV).

This approach flips a simple reward into a strategic asset. It keeps revenue locked inside your brand’s ecosystem, paving the way for a more predictable and profitable sales cycle.

Skyrocket Your Customer Lifetime Value

If there's one standout benefit to a store credit system, it's the massive impact on Customer Lifetime Value (LTV). Think about it: a customer with a $15 credit balance has a powerful, tangible reason to come back. This isn't some flimsy coupon they'll lose or forget about; it’s their money sitting in their account, just waiting to be spent. That creates a psychological pull that a simple discount code just can't match.

This built-in incentive is the secret to turning one-time buyers into repeat purchasers. By encouraging that all-important second purchase, you dramatically increase the odds of a third and fourth. You're systematically extending the customer relationship and multiplying the total revenue you earn from every single person you acquire.

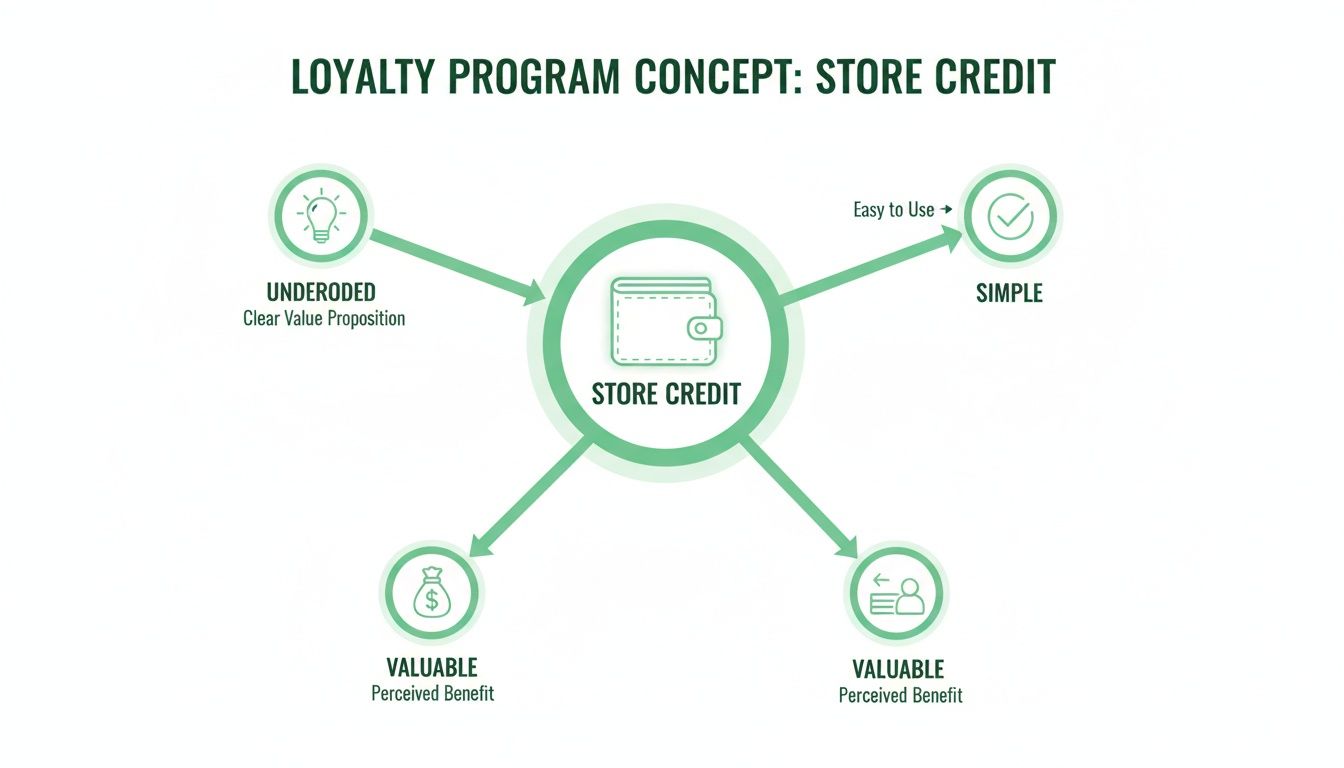

The infographic below really gets to the heart of why a store credit program is so effective at building this kind of long-term loyalty.

As you can see, the real power of store credit is its simplicity and clarity. The value is immediately obvious, which motivates customers to keep coming back for more.

Increase Average Order Value Instantly

While LTV is the long game, store credit also delivers an immediate win by boosting your Average Order Value (AOV). When a shopper sees they can earn cash back by hitting a certain spend—for example, "Get $10 back on orders over $100"—they're naturally motivated to add just one more thing to their cart.

It’s a small nudge that encourages customers to spend a little more right now to unlock a future reward. This drives up your immediate revenue without you having to slash prices across the board. For D2C brands, knowing how to improve sales forecasting is crucial for measuring the real impact these cash back offers have on revenue and customer demand.

The real magic here is how this system protects your profit margins. A 10% cash back offer only becomes a real cost when the customer returns to redeem it on a future, full-price purchase. They are effectively funding their own retention.

This effect is incredibly powerful during peak shopping seasons. Consider that Shopify merchants generated a record-breaking $11.5 billion during a recent Black Friday and Cyber Monday weekend—a 24% increase from the previous year. This explosive growth was fueled by loyalty incentives like cash back, which turned deal-hungry shoppers into long-term customers by giving them a compelling reason to return after the sales frenzy had died down.

How to Set Up a Shopify Cash Back Program

So, you’re sold on the idea of store credit. Now, how do you actually get a program up and running on Shopify?

Good news: it's not nearly as complicated as you might think. You don't need to hire a developer for a custom-coded nightmare. Shopify gives you the basic building blocks, and a whole ecosystem of apps is ready to help you automate, scale, and protect your margins right out of the gate.

There are really two ways to go about this: the manual route using Shopify’s own features, or the automated path with a dedicated app. Which one is right for you depends on where your business is today and where you want it to be tomorrow.

Starting with Shopify’s Native Tools

The simplest, most direct way to offer Shopify cash back is by using the platform’s built-in gift card feature. Just think of it as your own manual store credit machine.

When a customer qualifies for a reward or you want to process a return without a cash refund, you can just hop into your dashboard, create a digital gift card for the exact amount, and email it over. It’s that straightforward.

This approach gives you total control and is a fantastic way to dip your toes in the water without committing to another monthly app fee. The catch? It’s completely manual. As your store grows, creating individual gift cards for every single customer becomes a huge time-sink and simply isn't sustainable.

Automating with Dedicated Shopify Apps

If you want a scalable, hands-off program that actually drives growth, you need to turn to dedicated Shopify apps. These tools are designed to automate the entire cash back lifecycle, turning a manual chore into a powerful, self-running marketing engine.

The Shopify App Store is full of options built specifically for store credit and loyalty programs.

When you're browsing, the key is to find an app that builds on top of Shopify's native system. This ensures it's lightweight and won't bog down your store. (We dive much deeper into this in our complete guide to Shopify store credit.)

The magic word here is automation. A great app should automatically reward shoppers, track their balance in a "digital wallet," and make it dead simple for them to use that credit at checkout. This removes all the friction and keeps them coming back for more.

Here are the non-negotiable features you should look for:

Automated Credit Issuance: You should be able to set simple rules, like "Get 5% back on all purchases," and trust the app to do the heavy lifting.

Seamless Refund-to-Credit: Give customers a one-click option to take store credit instead of a cash refund. This is a game-changer for keeping revenue inside your business.

Customer Wallet Display: Customers need to see their credit balance right on your storefront. If they don't know they have it, they'll never spend it.

If setting this all up and managing it feels like one more thing on your plate, it might be worth getting some help. A Virtual Personal Assistant for Shopify Seller can be a great resource for handling the day-to-day operations of your new program.

Best Practices for a High-Impact Cash Back Program

Getting your Shopify cash back program up and running is one thing. Turning it into a real growth engine that drives up lifetime value is another beast entirely. Success hinges on a smart strategy. It’s not just about tossing credit at customers; it's about weaving the program so seamlessly into their shopping experience that it feels like an effortless perk.

You have to sidestep the common mistakes. We’ve all seen them: programs with confusing rules or a store credit balance that’s impossible to find. Your program needs to feel like a genuine reward, not a cheap gimmick with a bunch of strings attached. Get this right, and you'll build the kind of trust that turns first-time buyers into loyal fans.

Set a Sustainable and Appealing Rate

So, the big question: "How much should I actually give back?" I've seen brands go too low and have no impact, and others go too high and torch their margins. The sweet spot is almost always between 5-10%.

That range is high enough to catch a customer's eye and actually nudge them to add one more item to their cart, but it’s sustainable for your bottom line.

And remember, this isn't a straight discount. You're not losing 5% on that first sale. That credit only becomes a cost when the customer comes back to spend it, often on a full-priced second purchase. It's a clever, self-funding loop for generating repeat business.

Communicate the Value Everywhere

Your store credit program might as well be invisible if shoppers don't know about it. Visibility is everything. You need to shout about this perk at every critical moment in the customer's journey if you want it to lift your average order value.

On Product Pages: Try a message like, "Buy this and get $7.50 back in store credit." It immediately reframes the purchase as an investment in a future discount.

During Checkout: As they're about to pay, remind them of the credit they're earning. It validates their decision and makes them feel smart for shopping with you.

In Post-Purchase Emails: Don't wait. Send an email right away confirming the credit they just earned and showing their new balance. This creates a powerful itch to come back and spend it.

By consistently hammering home the benefits, you're training customers to associate your brand with rewards. It’s a direct line to better customer retention. If you're hungry for more ideas on this front, our guide on retention marketing strategies is packed with them.

Incentivize Your Best Customers

A single cash back rate works perfectly well, but if you want to really fire up your most loyal customers, tiered rewards are the way to go. Tiers gamify the shopping experience, giving your biggest spenders a clear goal to aim for. It’s a powerful motivator for them to spend just a little bit more to unlock the next level of rewards.

A simple tier structure could look like this:

Bronze Tier: Earn 5% cash back on all orders.

Silver Tier (Spend $500/year): Earn 7% cash back.

Gold Tier (Spend $1000/year): Earn 10% cash back.

This kind of structure doesn't just push up your AOV; it makes your VIPs feel seen and appreciated, locking in their loyalty for the long haul.

Migrating from Points to a Shopify Cash Back System

So, you’re running a points-based loyalty program and are thinking about switching to Shopify cash back. I get it, that can feel like a huge, daunting project. But trust me, it's usually a much smoother process than merchants expect.

The real trick is in how you frame it for your customers. This isn't a disruptive change; it's a genuine upgrade. You're taking them from a system of abstract, sometimes confusing points and giving them something tangible: real dollar-value credit they can spend in your store. It’s a shift from "mental math" to "money in my account," and that simple change can do wonders for customer lifetime value and AOV.

Nailing Your Communication Strategy

First things first: you have to get out in front of this change with clear, positive communication. You’re not taking away their points. You’re making their rewards program better.

Position the move as a direct result of listening to customer feedback. You wanted to make rewards simpler, more valuable, and easier to use.

Key Messaging Takeaway: "You spoke, we listened. We’re upgrading our loyalty program to make your rewards simpler and more valuable. Say goodbye to confusing points and hello to real cash back in your account!"

This kind of proactive, customer-centric messaging builds excitement and trust, heading off any potential frustration at the pass.

Figuring Out a Fair Conversion Rate

To keep your loyal customers happy, you absolutely must offer a fair and transparent conversion from their old points to their new store credit. This isn't the time to pinch pennies.

Look at your current redemption structure. For example, if 1,000 points can be redeemed for a $10 discount, your conversion rate is straightforward: 100 points = $1.00 in store credit. Don't overcomplicate it.

Once you have your rate, announce it clearly and give customers a generous heads-up—say, 30 to 60 days—to use their points if they wish before you automatically convert them.

A simple migration plan looks something like this:

Announce the Upgrade: Give everyone at least a month's notice. Use email campaigns, on-site banners, and social media to spread the word.

Explain the "Why": Don't just tell them what's happening; tell them why it's better for them. It’s simpler to understand, feels like actual cash, and is way easier to track.

Confirm the Switch: Send a "last chance" reminder a few days before the migration. Afterwards, send a final confirmation email showing their shiny new store credit balance.

Got Questions About Shopify Cash Back? We’ve Got Answers.

We've walked through the strategy, the setup, and the best ways to run your program. But you probably still have a few questions rolling around. Let's tackle the common ones we hear from merchants right before they jump in.

How Do I Actually Know if My Store Credit Program is Working?

This is a great question, because measuring the success of store credit isn't like tracking a simple discount code. You're not just looking for a quick sales bump; you're playing the long game and building real loyalty.

Instead of focusing on one-off promotions, you need to watch the metrics that show customers are sticking around and spending more over time.

Repeat Purchase Rate: The big one. Are more first-time buyers coming back for a second purchase after you launched the program? A clear "yes" here is your strongest signal of success.

Customer Lifetime Value (LTV): Is the average total spend from customers going up? When you see LTV climbing, it means the credit is doing its job and creating more valuable relationships.

Average Order Value (AOV): Keep an eye on whether customers are tossing one more item in their cart to hit a cash back tier or just to spend the credit they’ve already earned.

Can I Give Out Store Credit for Things Besides a Purchase?

Absolutely! And you definitely should. This is where store credit really outshines old-school points systems. Think of it as a flexible currency for your brand that you can use to encourage almost any behavior you want.

Here are a few smart ways to use it beyond just rewarding a sale:

Product Reviews: A little store credit is a fantastic (and margin-friendly) way to thank customers for leaving a review and building that all-important social proof.

Referrals: Turn your best customers into your best marketers by rewarding them with credit when they send a new shopper your way.

Smoothing Over Bumps: Had a shipping delay or a support issue? Issuing a bit of store credit as an apology is a powerful gesture that can turn a frustrated customer into a loyal fan.

Store credit isn’t just a lever for sales. It’s a tool for building relationships. It keeps your margins healthy while giving customers a concrete reason to come back.

What's the Right Amount of Cash Back to Offer?

There’s no single magic number, but we’ve seen thousands of brands find their sweet spot right in the 5-10% range.

Why does this work so well? It’s generous enough to feel like a real reward—something that actually changes how a customer shops—but it's not so high that you're giving away the farm. It hits that perfect balance of motivating the customer without wrecking your profit margins.

Ready to swap out those confusing points and profit-draining discounts for a simple, powerful store credit program? Redeemly makes it dead simple to boost LTV and AOV with rewards that feel just like cash. Get started with Redeemly and start turning more one-time shoppers into lifelong customers.

Join 7000+ brands using our apps