How to Reduce Customer Churn and Boost LTV with Shopify Store Credit

Jan 13, 2026

|

Published

If you're serious about reducing customer churn, it’s time to rethink your strategy. For most Shopify merchants, this means moving away from the endless cycle of margin-killing discounts and confusing point systems. It’s time to embrace a retention model built on native store credit—a powerful tool for boosting customer lifetime value (LTV) and average order value (AOV) by turning one-time buyers into your most loyal, profitable customers.

The Alarming Cost of Customer Churn on Shopify

Let's be blunt: customer churn is a silent killer for Shopify stores. Every time a customer walks away and never comes back, you're not just losing a future sale. You're losing the entire investment—all the ad spend, content creation, and marketing effort—it took to get them in the door.

This creates a classic "leaky bucket" problem. You're stuck in a loop, constantly pouring more money into acquisition just to tread water. It feels like you can never get ahead, and sustainable growth remains frustratingly out of reach.

Unfortunately, many brands make this problem worse with the very tactics they use to attract shoppers. An over-reliance on discount codes trains your audience to wait for a sale, which slowly erodes your profit margins and cheapens your brand. Instead of fostering real loyalty, you end up attracting bargain hunters who will abandon you the second a competitor offers a better deal.

Why Your Average Order Value Is Suffering

When customers are conditioned to wait for a 20% off coupon, they rarely, if ever, pay full price. This habit directly tanks your average order value (AOV), a metric that's absolutely vital for profitability. Every discount you offer is a direct hit to your bottom line.

Beyond the immediate financial sting, this discount-first culture establishes a purely transactional relationship. It misses the chance to build a real, emotional connection with your customers, which is the bedrock of long-term loyalty and high lifetime value.

The Lifetime Value Crisis in Ecommerce

The true, devastating impact of churn becomes crystal clear when you examine customer lifetime value (LTV). The numbers are staggering. Customer churn affects a massive 63% of businesses around the globe.

For DTC brands in competitive niches like fashion, the churn rates are even more brutal, often soaring to 70-80%. Think about that—for every 100 customers you acquire, up to 80 of them may never make a second purchase. This catastrophic loss of repeat business makes your customer acquisition costs completely unsustainable and craters your LTV.

Churn forces you onto an acquisition treadmill. You're constantly pouring money into finding new customers just to replace the ones who are leaving, instead of investing in the profitable, loyal customers you already have.

While churn is often seen as a marketing problem, its roots can run deeper. Hidden costs can stem from a clunky or confusing user experience. Investing in a high-converting ecommerce website design is a crucial, often overlooked, piece of the retention puzzle.

Ultimately, you have to pivot from an "acquisition-at-all-costs" mindset to a retention-first strategy. By making LTV your north-star metric, you can build a far more profitable and predictable business.

Discount Coupons vs. Shopify Store Credit

So, how do you make this shift? It starts by changing the way you reward customers. Traditional discounts and modern, native Shopify store credit programs might seem similar on the surface, but their impact on your finances and customer psychology couldn't be more different.

Metric | Discount Coupons | Shopify Store Credit (like Redeemly) |

|---|---|---|

Financial Impact | Erodes profit margins immediately. Encourages one-time, low-value purchases. | Preserves margins. Credit is spent on future, often full-price, orders, locking in revenue. |

Customer Behavior | Attracts deal-seekers with low brand loyalty. Trains customers to wait for sales. | Creates a "wallet" effect, making customers feel invested and eager to return. |

AOV & LTV | Suppresses AOV and contributes to a lower overall LTV due to churn. | Boosts both AOV and LTV by encouraging repeat purchases and larger cart sizes. |

Brand Perception | Can devalue your products and position your brand as a discount option. | Positions your brand as premium and values customer loyalty, fostering a community. |

Breakage | N/A (code is either used or it isn't). | Unspent credit (breakage) returns directly to your bottom line as pure profit. |

Looking at it side-by-side, the choice becomes clear. While discounts offer a quick sugar rush of sales, they do long-term damage to your LTV. Native Shopify store credit, on the other hand, builds a sustainable foundation for growth by locking in future revenue and strengthening customer relationships.

Why Points and Discounts Fail to Build Real Loyalty

If we want to get serious about how to reduce customer churn, we first have to talk about the tools that might be causing it in the first place. For years, Shopify brands have relied on two old standbys: discount codes and loyalty points. They can goose a sales report for a quarter, sure, but they often do more harm than good when it comes to building a real, sustainable business with high lifetime value.

Think about discount codes. When "20% Off" becomes your default marketing message, you're training your customers to wait for a sale. You're creating a customer base of deal-hunters who have zero brand affinity. They buy from you today, and from your competitor tomorrow—whoever has the better coupon.

This habit is a killer for your key growth metrics. It deflates your average order value (AOV) and absolutely poisons your customer lifetime value (LTV). You're not building a relationship; you're just making a transaction.

The Problem with Points Systems

So, feeling the sting of shrinking margins, many merchants pivot to a points-based loyalty program. It seems logical, right? Reward people for coming back. But in practice, it’s often a mess.

The biggest issue? Points are confusing. They add a layer of mental work for the customer. What’s a point actually worth? Is 1,000 points enough for a free product or just a dollar off? That friction, that moment of hesitation, is enough to make most people check out. They don't feel rewarded; they feel like they’ve been given homework.

This confusion leads to shockingly low redemption rates. When the reward isn't clear and immediate, customers just don't care. Those points sit there, unused, failing to drive the one thing they were meant for: the next purchase.

Points programs often create the illusion of a loyalty strategy without delivering the results. The complexity alienates the average customer, failing to build the emotional connection that truly drives repeat business and grows LTV.

The Psychology of Native Shopify Store Credit

This is where things get interesting. The simple, powerful psychology behind native Shopify store credit completely changes the dynamic. Unlike abstract points, store credit feels like real money. Getting $10 in store credit is like finding cash. It’s tangible, it’s intuitive, and its value is immediately understood.

This "wallet effect" creates a powerful reason for a customer to come back. They now have skin in the game. That credit isn't just a random number in their account; it's their money waiting to be spent at your store. It shifts the entire relationship from a one-off transaction to a mutual investment.

For a deeper dive into structuring these rewards, you can learn more about loyalty program tiers and how they can be used to further enhance this effect.

By swapping out confusing points and margin-crushing discounts for clear, cash-like store credit, you win on multiple fronts:

You protect your margins: The cost of that reward is only realized when a customer makes another purchase, effectively locking in that future revenue.

You increase LTV: Customers have a concrete, compelling reason to return, driving the repeat business that is the lifeblood of a high LTV.

You elevate your brand: You’re no longer the cheapest option. You’re the brand that invests back into its best customers.

At the end of the day, to reduce customer churn, you have to give people a reason to stay that feels valuable and effortless. Native Shopify store credit isn't just another gimmick; it's a direct investment in a longer, more profitable relationship with your customers.

The Store Credit Flywheel: Your Margin-Safe Retention Engine

Forget the temporary high of a discount code or the confusing math of a points system. The most powerful way to slash customer churn is hiding in plain sight, right inside your Shopify store: native store credit. This isn't just about handing out rewards; it's about building a self-perpetuating "flywheel" that juices your profits on the first sale and all but guarantees the next one.

The idea is brilliantly simple because it taps into basic psychology. Store credit feels like cash. When a customer earns $10, they don't see abstract points or a percentage off—they see a crisp $10 bill they can spend in your store. That mental shift, from a confusing game to real money, is what actually changes their behavior.

This "wallet effect" is where the flywheel starts to spin. It drives an immediate lift in average order value (AOV) and creates a powerful magnetic pull for repeat business, which is the very foundation of a high lifetime value (LTV).

How the Flywheel Spins to Boost AOV

The flywheel gets its first push before a customer even clicks "buy." By setting up tiered store credit rewards, you give shoppers a crystal-clear incentive to spend more right now.

Picture this: a customer has $85 worth of products in their cart. A small banner on the page nudges them: "Spend $100 and get $10 in store credit!" All of a sudden, that extra $15 doesn't feel like an expense; it feels like a smart investment. They toss another item in the cart to hit the threshold, and just like that, you’ve increased the AOV on that very order.

This works so well because it aligns what you want with what your customer wants:

You get a higher AOV without having to devalue your products with a discount.

They get a tangible reward that feels like free money waiting for their next visit.

You've planted the seed for their second purchase before the first one is even complete, boosting their future LTV.

Locking In Future Revenue and Nurturing LTV

Once that first order is shipped, the second phase of the flywheel kicks in. That earned store credit now acts like a powerful retention magnet. The $10 sitting in their account is a constant, nagging reminder to come back to your store, not a competitor's. It’s an itch that needs to be scratched—an unfinished transaction just waiting to happen.

This directly tackles the root cause of churn. Instead of just hoping a customer remembers you, you give them a clear financial reason to return. It’s a guaranteed touchpoint that keeps your brand top of mind.

The financial model behind store credit is its true genius. Unlike a discount, which is an immediate hit to your margin, the cost of store credit is only realized when it’s redeemed on a future purchase. You're essentially paying for loyalty with a slice of a second sale you might have otherwise never gotten.

The numbers don't lie. Global ecommerce stats paint a grim picture, with median churn rates in wholesale hitting a punishing 56% and consumer packaged goods reaching 40%. But retention completely flips the script. Top performers in media and professional services boast 84% retention rates. Increasing retention by just 5% can boost profits by 25-95%, because loyal customers spend up to 67% more and bring their friends. You can dive deeper into these average churn rates to see just how much this approach pays off.

Automating the Flywheel with Redeemly

Trying to manage all this by hand would be a nightmare. That’s where a native Shopify solution like Redeemly becomes your secret weapon. Redeemly automates this entire flywheel natively within your Shopify store—no heavy scripts, no clunky integrations to slow your site down.

Here’s how it keeps the flywheel spinning effortlessly:

On-Site Wallets: Customers can easily check their credit balance through floating widgets or on their account page, constantly reminding them of their "cash to spend."

Automated Reminders: Smart, triggered emails can alert customers about their balance, nudging them to come back and use their credit before it expires.

Frictionless Redemption: Since it’s built on Shopify's native gift card system, customers can apply their credit at checkout with a single click. No confusing codes, no friction.

By putting this store credit flywheel to work, you stop bleeding margin and start building momentum. You get a bigger AOV today, secure a purchase for tomorrow, and create a far more profitable and predictable business—all by turning a simple reward into your most effective engine for growth.

Getting Hands-On: Bringing Your Store Credit Strategy to Life with Redeemly

Alright, let's move from theory to action. Shifting away from a discount-first mindset to a margin-friendly, native Shopify store credit system isn't some complex overhaul. It's a practical change you can make right now, and with a native Shopify app like Redeemly, you don’t need to be a developer to get it done.

This is your playbook for launching a store credit program that gets to work immediately, pushing up both your average order value (AOV) and lifetime value (LTV). We’ll get into the nuts and bolts of setting up your reward tiers, making sure customers actually see the program, and automating the emails that keep them coming back.

Crafting Your Margin-Safe Reward Tiers

The real magic behind a great store credit program is in the reward structure. You want to create offers that feel like a fantastic deal for your customers but are incredibly profitable for you. This isn't about giving away free money; it's about rewarding the exact behaviors that make your business grow.

A great place to start is by setting a spending goal that’s just a bit higher than your current AOV. If you know your average customer spends $85, your first reward tier could be something simple like, "Spend $100, get $10 in store credit."

This gives shoppers a clear, achievable target. It’s the perfect little nudge they need to add that one extra item to their cart, which directly lifts your AOV.

Here are a few popular structures I’ve seen work wonders for brands:

The Simple Threshold: A straightforward, powerful offer. Think "Spend $75 and get $5 back." It’s clean, easy for customers to grasp, and a breeze to manage.

Tiered Rewards: This is where you can really encourage bigger carts. For example, "Spend $100, get $10" and "Spend $150, get $20." You're basically gamifying the shopping experience and rewarding your highest-value customers for spending more.

Percentage-Based Credit: Offering something like "10% back on all orders over $50" is a fantastic model because it scales perfectly. The more they spend, the more they get back.

Here’s the key takeaway: The beauty of native Shopify store credit is that you only feel the cost when the customer actually redeems it. You aren't slashing your margin on that first, larger order. Instead, you're investing a tiny piece of a future sale—a sale you might have otherwise lost completely.

If you’re just getting started, we put together a deep dive on the specifics of how to give store credit on Shopify that digs into these nuances even further.

Make Your Program Impossible to Miss with On-Site Widgets

What good is a loyalty program if nobody knows it exists? To make your store credit offer truly compelling, it needs to be front-and-center throughout the entire shopping journey. This is where on-site widgets and floating wallets are a game-changer.

Redeemly makes this incredibly easy. It adds lightweight, theme-friendly elements to your site that keep a customer's credit balance top-of-mind without ever bogging down your store's performance.

Take a look at how Redeemly can be set up to display these elements right on your storefront.

This visual reminder is a constant, subtle prompt. It shows customers their "cash to spend," motivating them to stick around, browse a little longer, and find the perfect item for their next purchase.

You can place these reminders in a few key spots:

A Floating Wallet Icon: A small, unobtrusive icon that sits in the corner of the screen. Logged-in customers can see their balance with a single click.

Product & Cart Page Banners: These are dynamic banners that pop up with messages like, "You have $10 in credit to spend!" or "You're only $17 away from earning $10 back!" These are incredibly effective at bumping up AOV right at the moment of decision.

Account Page Integration: A clear, dedicated section inside the customer’s account page showing their current balance and earning history.

When you make the credit balance a visible, interactive part of the shopping experience, it stops being an abstract concept and becomes a tangible asset your customers are excited to use.

Put Your Onboarding and Win-Back Emails on Autopilot

The final piece of the puzzle is automating the communication that keeps this whole system humming. Timely, relevant emails are critical for welcoming new members into your program and, just as importantly, re-engaging customers who are at risk of churning. You don't need some massive, multi-channel campaign—just a couple of smart, automated email flows.

The Welcome & Onboarding Flow: The moment a customer earns their first credit, an email should land in their inbox that does three things:

Congratulates them on their purchase and their new credit balance.

Explains clearly how to use it (e.g., "Your $10 credit can be used on your very next order, no minimums!").

Builds excitement for their next visit, maybe by teasing new arrivals or showing off a few best-sellers.

The Win-Back & Reminder Flow: This is your most powerful weapon to reduce customer churn. For shoppers who have credit sitting in their account but haven't come back, an automated reminder is pure gold. A simple sequence can work wonders:

30-Day Reminder: A friendly nudge. "Hey, just a reminder that you have $10 in store credit waiting for you!"

60-Day "At-Risk" Email: This one can have a little more urgency. A subject line like "Don't let your $10 credit expire!" often creates just enough scarcity to prompt action.

These simple flows, which you can easily set up in Redeemly or your existing email tool, are what close the loop. They ensure the credit you issue actually turns into the repeat purchases that build a loyal, high-LTV customer base.

Gauging the Real-World Impact of Your Retention Program

Look, a strategy is just a nice idea until you can see the results in your bank account. Launching a store credit program is a fantastic move, but to truly squash customer churn and build a predictable growth engine, you have to measure its impact with cold, hard data. We're not talking about fuzzy feelings of "customer happiness" here—we're talking about tracking the numbers that prove your retention efforts are directly boosting revenue.

By zeroing in on a few essential key performance indicators (KPIs), you can draw a straight line from your Redeemly program to your bottom line. This is how you turn retention from a nice-to-have into a core, profitable part of your growth strategy. Let’s get into the metrics that actually move the needle.

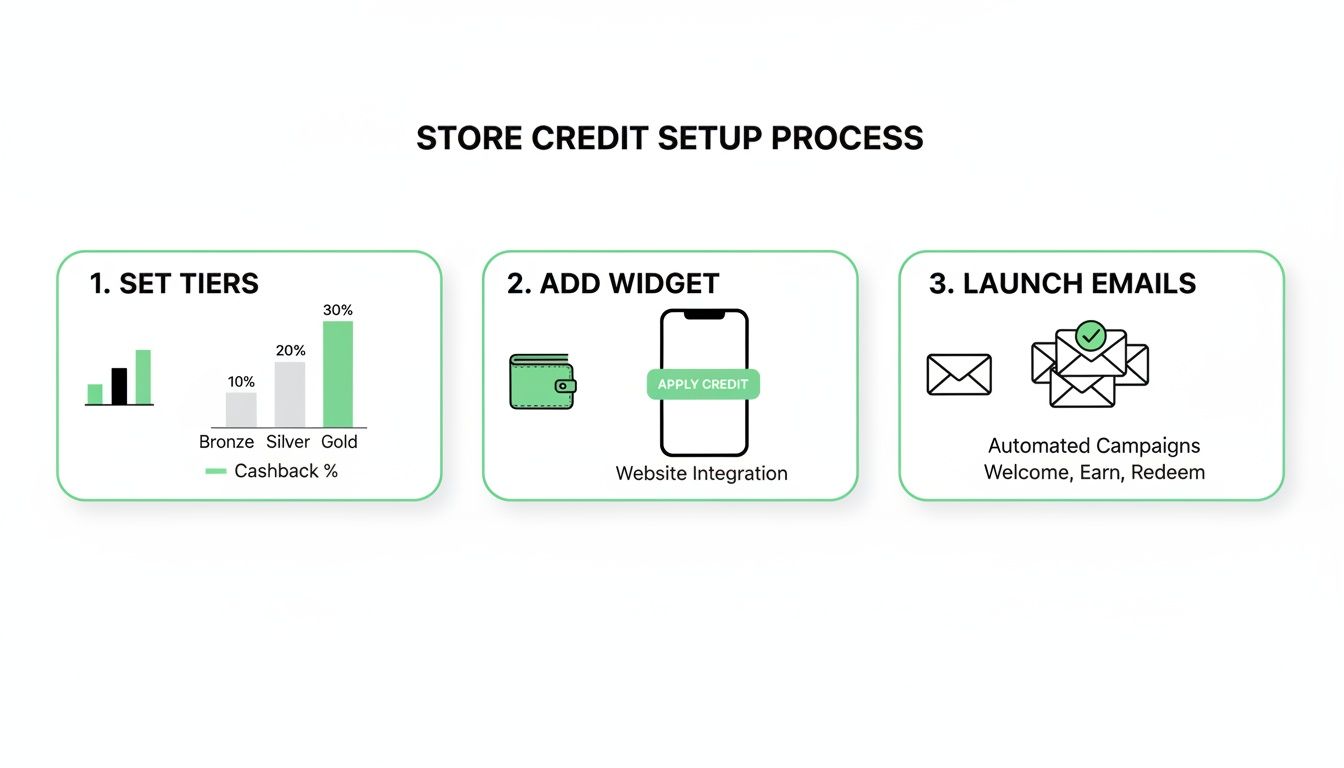

Nailing the setup for a store credit program that works comes down to three things: creating your reward tiers, getting the wallet widget live on your site, and firing up your automated emails.

As you can see, a killer program is built on a foundation of smart rewards, constant visibility, and reliable communication that keeps your customers in the loop and eager to come back.

The Metrics That Belong on Your Retention Dashboard

Your mission is to see a clear cause-and-effect relationship: issuing store credit leads to better business metrics. Don't get bogged down in a sea of analytics. Instead, focus on the vital few that tell the most compelling story about your retention success.

Think of these four metrics as the pillars of a healthy, thriving retention program:

Customer Lifetime Value (LTV): This is your north star. LTV tells you the total revenue you can realistically expect from a single customer over their entire relationship with you. A well-executed store credit program will send LTV soaring by encouraging those second, third, and fourth purchases that might have otherwise never happened.

Repeat Purchase Rate: This one’s simple but powerful: what percentage of your customers have come back to buy again? It's a direct reflection of loyalty. Store credit is purpose-built to crank this number up by giving customers a tangible, valuable reason to return to your store instead of a competitor's.

Average Order Value (AOV): AOV tracks the average amount a customer spends per transaction. Smartly tiered store credit rewards (like "Spend $100, get $10 back") are a fantastic way to nudge shoppers to add just one more item to their cart, giving you an immediate lift in AOV.

Churn Rate: This is the big one—the enemy you're here to defeat. Churn measures the percentage of customers who slip away and don't come back. By creating a "wallet effect" with store credit, you give customers a compelling reason to stick around, which directly pushes your churn rate down.

The data around churn in ecommerce is impossible to ignore. A mere 5% boost in customer retention can increase profits by an incredible 25-95%. This happens because repeat customers spend, on average, 67% more than new ones. For Shopify brands, this is all the proof you need to shift away from margin-destroying discounts and confusing points systems. A simple, cash-like store credit system where the cost is only realized on redemption just makes more sense. You can dive deeper into these kinds of insights with recent industry reports.

Key Retention Metrics to Track

When you launch a store credit initiative, you need a clear way to measure what’s working. The table below outlines the core metrics you should have on your dashboard, what they mean, and how store credit directly influences them for the better.

KPI | What It Measures | How to Improve It with Store Credit |

|---|---|---|

Customer Lifetime Value (LTV) | The total revenue a single customer generates over time. | Store credit encourages repeat purchases, extending the customer lifecycle and increasing their total spend. |

Repeat Purchase Rate (RPR) | The percentage of customers who have made more than one purchase. | Issuing store credit after the first purchase provides a direct, tangible incentive for customers to return. |

Average Order Value (AOV) | The average amount spent per order on your store. | Tiered rewards (e.g., "Spend $100, Get $10") motivate customers to add more items to their cart to unlock credit. |

Churn Rate | The percentage of customers who stop buying from you over a given period. | A store credit balance creates a "switching cost," making customers less likely to abandon your brand for a competitor. |

Purchase Frequency (PF) | How often the average customer makes a purchase in a specific timeframe. | Automated reminders about expiring store credit can trigger purchases that wouldn't have happened otherwise. |

Tracking these KPIs will give you a clear, data-backed picture of your program's ROI and show you exactly where to optimize for even better results.

A Simple Playbook for A/B Testing Your Offers

Once you're tracking your KPIs, the real fun begins. You can start optimizing your program based on actual customer behavior. Instead of guessing which reward structure is best, you can test it and let the data tell you what works.

A straightforward A/B test helps you find that perfect sweet spot—an offer that's irresistible to customers but also highly profitable for your business.

For example, you could run two different offers, each for a month:

Test A: "Spend $75, Get $5 in Store Credit"

Test B: "Get 5% Back in Store Credit on All Orders"

When the test is over, pull the numbers. Compare the core KPIs for the customers in each group. Did one offer generate a much higher AOV? Did the other lead to a better repeat purchase rate? This data-first approach takes the guesswork out of the equation and lets you build a program that is mathematically proven to reduce customer churn and maximize your profitability.

Still Have Questions? Let's Talk It Out

Making a big shift in your loyalty strategy is a serious move, and you've probably got some questions running through your mind. I get it. Let’s tackle the most common concerns I hear from Shopify merchants when they're thinking about ditching discounts and points for a native Shopify store credit system built to slash churn and boost LTV.

"Will Store Credit Wreck My Margins Like Discounts Do?"

This is the big one, and the answer is a resounding no. In fact, it's the opposite.

When you hand out a 20% discount, that's 20% of your revenue gone forever, right off the top. Your profit margin on that sale takes an immediate, irreversible hit.

Native Shopify store credit is a completely different game. The "cost" is only realized when a customer actually comes back to spend it on a future purchase—a sale you might not have gotten otherwise. You're not just giving away money; you're investing it directly into a repeat purchase that increases their lifetime value.

Even better, we see it all the time: customers come back to use their $10 credit and end up spending $50. That extra $40 is pure, full-margin profit. This whole model protects your cash flow and brilliantly ties your loyalty spend to actual repeat business. For more on this, you can explore additional insights on customer retention.

"Is This Going to Be Too Complicated for My Customers?"

Not a chance. Honestly, store credit is way more intuitive than any points program I've ever seen. Shoppers instantly understand what "$10 in store credit" means. They don't have to decipher what "1,000 points" is worth.

The second a customer has to do math, your loyalty program has failed. Store credit feels like cash. It’s a simple, powerful motivator that everyone understands.

A native Shopify app like Redeemly makes the whole experience dead simple. Customers see their balance in a clean on-site wallet, get email reminders about their "cash to spend," and can apply it at checkout with a single click. There are no confusing conversion rates or tiers to track. All that friction that makes people give up on other loyalty programs? Gone.

"How Long Does It Take to Set This Up? I Don't Have Weeks."

You don't need weeks. You don't even need an hour.

This is the beauty of a native Shopify solution. Since Redeemly is built right on Shopify's foundation, there are no clunky integrations or custom code to wrestle with. You can literally:

Install the app from the Shopify App Store.

Set up your first reward rule (e.g., "Spend $100, get $10 credit").

Go live.

Seriously. The whole thing can be done in under 15 minutes. The on-site widgets work with most themes right out of the box, so you can start rewarding customers and bumping up your AOV almost instantly.

"Can I Switch Over From My Old Points App?"

Absolutely. We help merchants do this all the time. The key is to manage the transition smoothly to keep your loyal customers happy.

A solid approach is to announce a final "use-by" date for the old points and get everyone excited about the new "cash-back" credit program taking its place. You can even export your customer data and give everyone a small starting credit balance as a welcome gift. It’s the perfect way to upgrade to a more profitable model while showing your best customers some love.

Ready to stop giving away margin and start building real loyalty? With Redeemly, you can launch a store credit program that turns one-time buyers into lifelong fans. Start growing more profitably today.

Join 7000+ brands using our apps