Reduce customer attrition: Grow Profit with Store Credit

Jan 29, 2026

|

Published

Customer attrition isn't just another metric on your dashboard; it's a multi-trillion dollar problem that's quietly siphoning profits from ecommerce brands all over the world.

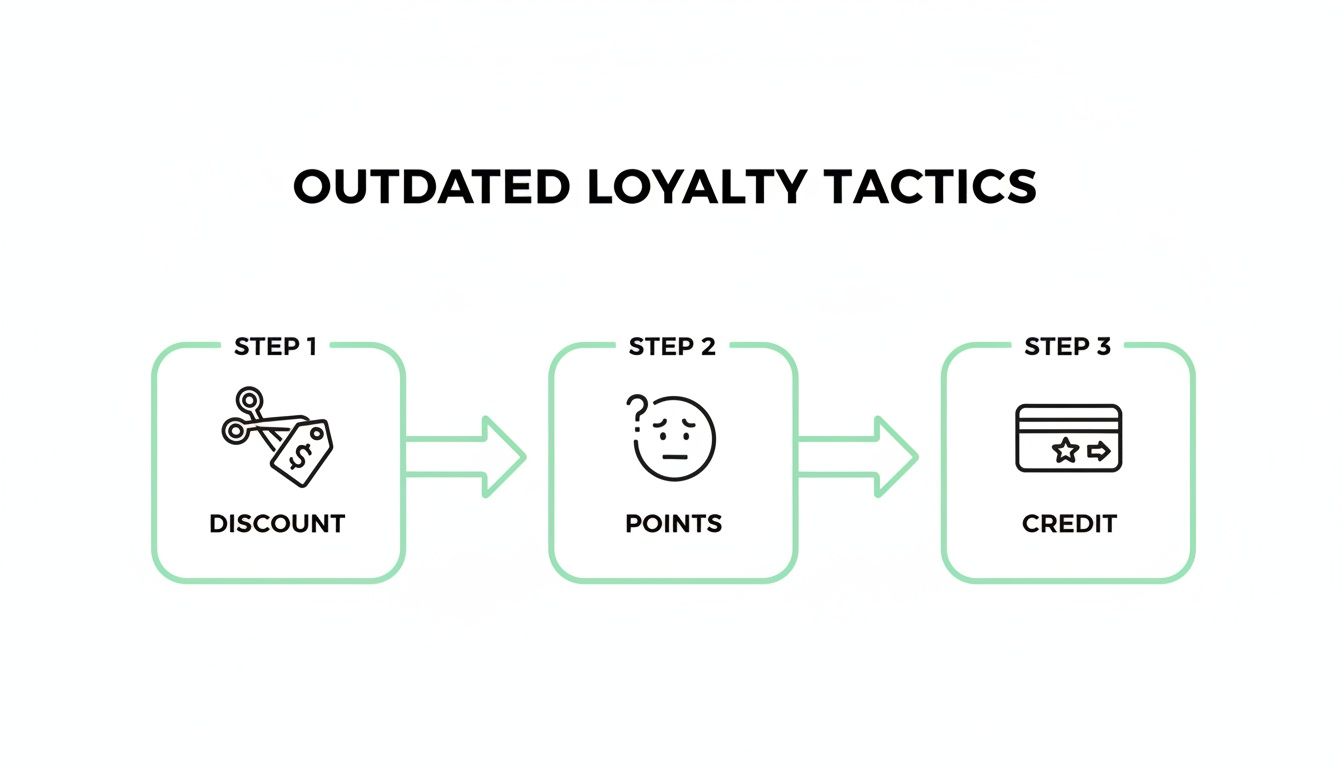

If you really want to reduce customer attrition, you have to stop the endless cycle of margin-killing discount coupons and confusing point systems. The smarter play is to build a loyalty loop with real, tangible rewards—like Shopify native store credit—that actually bumps up both customer lifetime value (LTV) and average order value (AOV).

The High Price of a Leaky Bucket

For Shopify brands, customer churn is the silent killer of growth. It’s easy to get caught up in the chase for new customers, but if you're losing the ones you've already won, you're just trying to fill a leaky bucket. And this isn't some minor drip; it's a financial hemorrhage that completely undermines your marketing spend and torpedoes any chance at sustainable, profitable growth.

The sheer scale of this problem is hard to wrap your head around. In the cutthroat world of e-commerce, customer retention rates hover around a dismal 38%, leading to absolutely massive revenue losses.

Just how massive? US brands are losing an estimated $168 billion every single year to attrition. Globally, that number balloons to an unbelievable $1.6 trillion. This isn't just a challenge; it's a massive opportunity for any brand willing to pivot to a smarter loyalty strategy. You can dig into more of these customer retention statistics to understand the full impact.

Moving Beyond Reactive Discounts

For far too long, the default answer to a disengaged customer has been a reactive discount. Someone hasn't bought in 90 days? Blast them with a 20% off coupon. The problem is, this creates a vicious cycle. You’re effectively training your best customers to devalue your products and hold out for a sale, which eats away at your profit margins with every single order.

The real cost of discounting isn't just the margin you lose on one sale. It's the long-term erosion of your brand's perceived value and the customer's willingness to ever pay full price again.

This old-school tactic is a short-term band-aid that causes long-term damage to your unit economics. It does absolutely nothing to build genuine, lasting loyalty and directly hurts your average order value.

The Problem with Points

Points-based systems aren't much of an improvement. When a customer earns "500 points," what does that even mean? The reward feels abstract, disconnected from any real-world value. This friction leads to confusion and, ultimately, disengagement. Shoppers shouldn't need a calculator to figure out what their loyalty is worth.

The goal should be a simple, transparent system that feels valuable right away. By shifting your focus from discounts and points to a margin-safe Shopify native store credit system, you create a powerful, intuitive reason for customers to come back and spend more. That's how you boost lifetime value and fuel predictable, profitable growth.

Let's get real for a minute. For years, the go-to playbook for Shopify merchants trying to keep customers around has been pretty thin: throw discount coupons around or set up a confusing point system. On the surface, they seem like a good idea, but dig a little deeper and you’ll find they often do more harm than good. They can mess with your brand perception, bleed your profit margins dry, and, ironically, fail to create any real loyalty.

The most common trap is the constant stream of discount codes. It seems harmless enough, but what you're actually doing is training your best customers to never pay full price. Why would they? They know another 15% off coupon is just an email away. This behavior tanks your Average Order Value (AOV) and eats into your margins on every single sale. You're not building a relationship based on the quality of your products; you're just teaching people to wait for the next price drop.

The Problem with Points

Points programs were supposed to be the answer, a way to gamify loyalty. But most of the time, they just create a headache for your customers. Seeing "You have 500 points!" doesn't create an immediate emotional connection. It's abstract.

Your shopper is left trying to do mental gymnastics to figure out what those points are actually worth. That friction is the absolute enemy of a smooth customer experience. The goal should be a reward that feels as tangible and valuable as the cash in their wallet.

Building Real Loyalty Means Building Trust

Here's where things get interesting. Globally, 74% of consumers say they're loyal to at least one brand, and a whopping 86% will recommend a brand they genuinely love. But at the same time, 72% of people trust companies less than they did a year ago. They're demanding more transparency and personalization, not more hoops to jump through. This data comes from some eye-opening customer retention statistics that really highlight the growing trust gap.

A loyalty program shouldn't feel like a puzzle. The second a customer has to do math to figure out the value of their reward, you’ve lost their emotional investment. The best rewards are instant, intuitive, and valuable.

This is exactly why shifting to Shopify native store credit is such a powerful move. It works just like a cash-back reward, which we break down in our guide on what are cash-back rewards. When a customer earns $10 in store credit, they get it instantly. Ten dollars is ten dollars. There’s no confusing conversion rate or complicated tier system.

That simple, cash-like value builds trust and gives them a powerful, concrete reason to come back. It directly encourages that next purchase, boosting their Lifetime Value (LTV) without devaluing your brand.

To make this crystal clear, let's compare these common retention tactics side-by-side. You'll quickly see how they stack up when it comes to what really matters: your bottom line and the customer relationship.

Retention Tactics Compared: Discounts vs. Points vs. Store Credit

Attribute | Discount Coupons | Points Systems | Shopify Store Credit (Redeemly) |

|---|---|---|---|

Margin Impact | High. Directly reduces revenue on every sale. | Moderate. Can be complex to model and often leads to breakage (unclaimed points). | Low. Issued post-purchase, encouraging a second full-price sale. Margin-safe. |

Customer Experience | Transactional. Trains customers to wait for sales, devaluing the product. | Confusing. Requires "mental math" to understand value, creating friction. | Simple & Transparent. |

Loyalty Type | Price-based. Customers are loyal to the deal, not the brand. | Gamified & Abstract. Loyalty is conditional on navigating a complex system. | Brand-based. Fosters a genuine relationship built on value and reciprocity. |

AOV Impact | Negative. Often lowers the average order value as customers buy only during sales. | Neutral. Little direct impact on the initial purchase AOV. | Positive. Encourages larger carts on subsequent purchases to use the credit. |

As you can see, while discount coupons offer a quick sugar rush and points create a sense of progression, Shopify native store credit is the only one that truly aligns with building a sustainable, profitable, and genuine customer relationship. It protects your margins while delivering a reward that customers instantly understand and appreciate, directly boosting lifetime value.

Build a Store Credit Program That Actually Works (and Protects Your Margins)

Alright, let's get practical. Theory is one thing, but actually implementing a system that stops customers from churning is where the magic happens. A Shopify native store credit program shouldn't feel like you're bolting on some clunky, complicated new system. It's about using a simple, margin-friendly tool that feels like a natural part of your store for both you and your customers.

This is how you build a real loyalty loop—one that boosts lifetime value and keeps people coming back without you having to slash prices.

The best programs are dead simple. Forget about confusing point systems that customers have to decipher. We're talking about a clear, compelling reward that immediately connects their spending to a tangible benefit.

Design Your Earning Tiers

Your main goal here is to create an incentive that feels both valuable and within reach. A fantastic place to start is a straightforward "Spend X, Get Y Back" model.

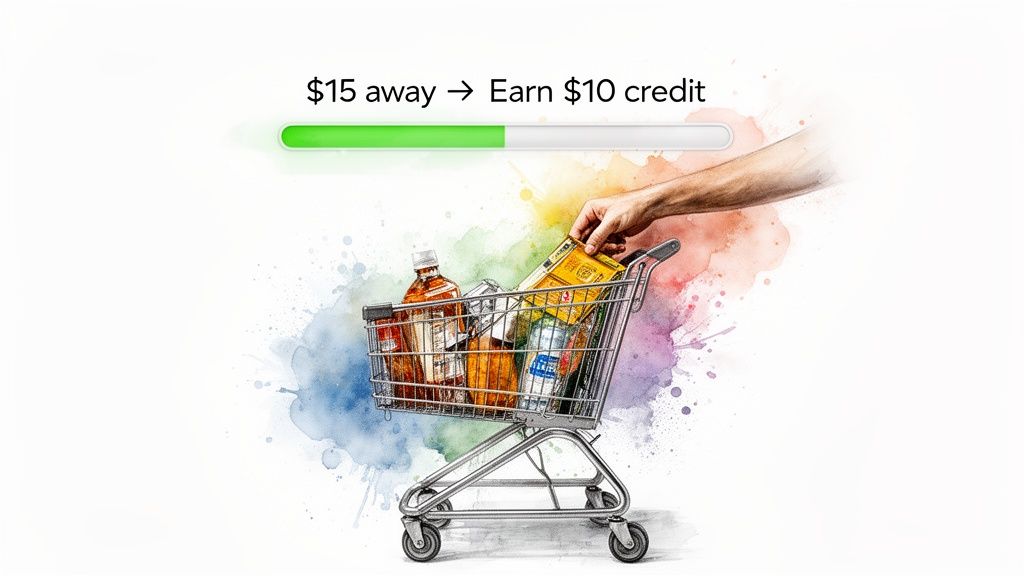

For example, offering $10 in credit for every $100 spent is basically a 10% cash-back offer they can only use with you. It’s incredibly powerful because it nudges customers to increase their average order value just to hit that next reward threshold.

Think about it: a customer with $85 in their cart is way more likely to add one more item to get over the $100 mark and lock in that $10 credit. This isn't a discount coupon; it's an investment in their next purchase. The cost to you only happens when they return to spend it, and that second purchase is often at full price—a sale you might never have gotten otherwise. We break down the nuts and bolts in our guide on how to issue store credit on Shopify.

The beauty of store credit is that it's a 'deferred' cost. A discount coupon immediately cuts into the revenue of the current sale. Store credit, however, protects your upfront profit and acts as a powerful magnet to bring that customer back for a future purchase, boosting their lifetime value.

It represents a clear evolution away from outdated, confusing loyalty tactics.

You can see the journey away from margin-killing discounts and puzzling point systems toward the simple, cash-like value that customers genuinely understand and appreciate.

Make That Credit Impossible to Forget

Once a customer earns credit, "out of sight, out of mind" is your worst enemy. Visibility is everything.

The smartest programs use on-site widgets or a "floating wallet" to constantly remind shoppers of what they have to spend. Seeing “$10.00 Available Credit” on every single page is a powerful psychological nudge that keeps your brand top of mind.

This constant reminder encourages them to start browsing, turning a banked reward into their next purchase.

But don't stop there. Automated emails are your secret weapon. A simple, well-timed email reminding a customer that their credit is waiting is often all it takes to reactivate them. Make sure you have these automations running:

Credit Earned Notification: An instant email celebrating the credit they just earned.

Balance Reminder: A friendly nudge after 30 days if the credit is still sitting there.

New Product Pairing: A smart email suggesting new arrivals they could grab with their credit.

By sticking with a native Shopify solution like Redeemly, you also avoid the site-slowing bloat that comes with external scripts. The entire experience—from earning to redeeming at checkout—is seamlessly integrated, making this one of the most effective retention strategies you can implement.

How Store Credit Supercharges AOV and LTV

This is where the rubber meets the road. A loyalty program is only as good as its impact on the metrics that actually drive your business: Average Order Value (AOV) and Customer Lifetime Value (LTV). Moving away from standard discount coupons and embracing Shopify native store credit creates a powerful feedback loop that naturally pushes both of these numbers up. It's the engine that helps you stop losing customers and start building a more profitable, sustainable brand.

The psychology behind it is straightforward but incredibly powerful. Picture this: a customer has $85 worth of items in their cart. Then, they see a small notification—they're just $15 away from earning a $10 credit. That little nudge is often all it takes to convince them to add one more thing. It’s an almost irresistible urge.

This isn't some cheap trick. It's about gamifying the shopping experience in a way that feels rewarding. You're not just slashing prices and eroding your margins with discount coupons. You’re encouraging a bigger initial purchase, lifting your average order value on the spot.

From a Single Sale to a Lasting Relationship

Boosting AOV is great, but it’s just one piece of the puzzle. The real magic of store credit is how it builds a continuous cycle of earning and spending—the very foundation of a high lifetime value. That credit they just earned becomes a powerful magnet, giving them a very real reason to come back.

Think about it. A one-off discount code feels transactional and temporary. Store credit, on the other hand, builds an actual connection. It feels like money they already have in their account, an investment they've made in your brand that they're not about to let go to waste.

This simple shift changes the customer's mindset from "What deal can I get today?" to "What can I spend my credit on next?" That change is the bedrock of genuine, long-term loyalty and a higher lifetime value.

You're creating a self-sustaining loop: they spend to earn, and they return to spend what they've earned. Every time they go through this cycle, their bond with your brand gets stronger, turning one-time buyers into the kind of loyal, high-value customers that fuel predictable growth.

Mastering the LTV Equation

For any brand playing the long game, focusing on LTV isn't optional. Knowing how to effectively increase customer lifetime value is absolutely critical for sustainable growth, and store credit is a tool that directly feeds into this strategy by encouraging loyalty and repeat business.

Here’s exactly how store credit pulls the key levers of LTV:

Boosts Repeat Purchase Rate: That earned credit is a direct, tangible incentive to make that second, third, and fourth purchase.

Increases Average Order Value: When customers spend a little more to hit that reward threshold, their overall value to your business grows with each order.

Shortens the Time Between Purchases: Seeing a credit balance waiting for them in their account shortens the time they take to decide on their next shopping trip.

By getting off the treadmill of margin-killing discounts and confusing point systems, you’re putting a strategy in place that protects your profitability while building a much stickier customer base. This isn't just about patching a leaky bucket; it's about building a deeper, more valuable relationship with every single customer you bring in.

Measuring and Optimizing Your Retention Strategy

A powerful retention strategy isn't built on guesswork; it's fueled by data. Launching your Shopify native store credit program is a fantastic first step, but the real magic happens when you start measuring its impact and making smart adjustments along the way. The good news? You can track its success using the key performance indicators (KPIs) you already have in your Shopify dashboard and loyalty app.

This isn’t about getting buried in spreadsheets. It's about zeroing in on the numbers that truly reflect customer loyalty and profitability, giving you a clear roadmap for what's working and what needs a little love.

Key Metrics to Monitor

To really get a feel for how your program is performing, you’ll want to keep a close eye on a few core metrics. Think of these as the vital signs of your retention efforts—they’ll tell you if your store credit system is actually increasing lifetime value and bringing people back.

Here are the essentials to have on your radar:

Repeat Purchase Rate: This is your north star metric. If this number is climbing, it's the clearest signal that your store credit is doing its job and encouraging customers to return.

Time Between Purchases: Are you closing the gap between orders? When a customer has credit burning a hole in their digital pocket, they have a real incentive to come back sooner. This is a huge lever for boosting lifetime value.

Average Order Value (AOV): Keep an eye on the AOV for both the initial purchase where credit is earned and subsequent orders where it's spent. You'll often find customers spend well beyond their credit balance, leading to bigger, more profitable carts.

Credit Redemption Rate: This one’s straightforward—are people actually using the credit you give them? A high redemption rate shows your program is visible, appealing, and easy to use.

Turning Data into Action

Of course, tracking these numbers is only half the job. The real win comes from using these insights to fine-tune your strategy. Your data tells a story about your customers' behavior, and your job is to listen carefully and react.

For instance, a low credit redemption rate doesn't automatically mean the program is a flop. It could just be a sign that your on-site reminders are too subtle or your email notifications are getting lost in a crowded inbox. This is a cue to start experimenting. Maybe try a more prominent on-site wallet display or A/B test some punchier email subject lines. You can dig deeper into what to track by exploring these key user retention metrics.

The goal is continuous improvement. Each data point is a chance to optimize, turning small insights into actionable tweaks that maximize your impact and consistently reduce customer attrition.

At the end of the day, a healthy business comes from striking the right balance between customer acquisition and retention. By regularly checking in on your KPIs, you ensure your store credit program isn't just another static feature—it's a dynamic engine driving profitable, long-term growth and higher lifetime value.

FAQs: What You Really Need to Know About Store Credit

Adopting a new loyalty strategy always brings up good questions. When you're trying to reduce customer attrition, you need to know how a shift to Shopify native store credit will actually affect your finances, your customer experience, and your day-to-day operations.

Let's get straight to it. Here are the real answers to the most common questions we hear from merchants.

"Is Setting This Up on Shopify a Total Headache?"

Not at all. A native Shopify app like Redeemly hooks directly into Shopify’s own built-in store credit system. What does that mean for you? No clunky external scripts slowing your site down and no complicated integrations to wrestle with.

You can literally set up your earning rules—like "Spend $100, Get $10"—and get the on-site widgets live in a few minutes, right from your Shopify admin. The whole point is to make it seamless.

"How Is This Any Better for My Margins Than Just Offering Discounts?"

This is the big one. Store credit is so much better for your bottom line because it’s a "deferred" cost, and it's laser-focused on increasing lifetime value.

Think about it: a 20% discount coupon immediately slices into the revenue from that current sale. Poof, gone. Store credit, on the other hand, only gets "spent" when that customer comes back to make a future purchase.

That simple difference protects your upfront profit on the initial transaction and directly drives a second sale. You're not just giving away margin; you're investing in the next full-price order. It's a powerful way to fix your unit economics and build a loyalty loop that actually makes you money.

This is how you grow profitably, not just give stuff away.

"Won't This Just Confuse My Customers?"

Actually, it does the exact opposite. It's way more intuitive than some abstract points system that makes people do mental math.

When a customer sees they have "$15.00 in Store Credit", they get it instantly. It feels like real money they have waiting for them at your store—no conversion charts needed.

Discount coupons often come with a laundry list of confusing restrictions, and points make customers try to figure out what they're really worth. Store credit is simple and tangible. That transparency builds trust and makes the reward feel more valuable, making them far more likely to come back and spend. It just simplifies everything and gets them thinking about their next order with you.

Ready to stop eroding your margins and start building real, profitable loyalty? Redeemly helps Shopify merchants replace confusing point systems and costly discount coupons with a simple, native store credit system that boosts LTV and AOV.

Learn how Redeemly can help you reduce customer attrition today.

Join 7000+ brands using our apps