Marketing market segmentation: Boost LTV & AOV for Shopify Stores

Dec 29, 2025

|

Published

Let’s be honest: are you tired of the endless cycle of site-wide sales? You launch a new product, slap a 20% off banner on your homepage, see a quick spike in orders, and then watch your profit margins evaporate. This is the discount trap, and it’s a tough one to escape.

When you constantly offer discounts, you're training your customers to wait for the next sale. It cheapens your brand and makes building a truly sustainable business feel impossible. But there's a much smarter way to grow your lifetime value (LTV) and average order value (AOV).

The secret is marketing market segmentation. It’s the simple but powerful idea of splitting your broad audience into smaller, more focused groups based on who they are and how they shop. For Shopify merchants, this means you stop shouting the same generic offer at everyone and start having meaningful conversations with specific groups of customers. The goal? To create marketing that feels so personal and relevant, it drives real, profitable growth.

Escape the Discount Trap with Smart Segmentation

Instead of blasting the same weak offer to your entire list, segmentation lets you pinpoint specific customer groups and give them incentives that actually resonate. You can encourage them to spend more without just giving away your profits, directly impacting your AOV and LTV.

Shifting from Discounts to Store Credit

One of the most effective ways to do this is by swapping out those generic coupons for targeted, native Shopify store credit rewards. Think of it less like a confusing points system and more like a personalized gift card. You’re giving your customers what feels like cash in their pocket, ready to be spent only in your store.

This simple shift has a massive impact on customer behavior and your key metrics:

It protects your brand value. Store credit feels like a well-deserved reward or a thoughtful gift, not a desperate plea for a sale.

It boosts Average Order Value (AOV). Customers almost always spend more than the credit amount to "use it all up," providing an organic lift to every transaction.

It builds Lifetime Value (LTV). A store credit balance is a powerful reason for a customer to come back, directly increasing the total value they bring to your business over time.

By segmenting your audience and rewarding them with native Shopify store credit, you're not just making a sale. You're making a strategic investment in your most valuable customers and nurturing a relationship that pays dividends in higher LTV and AOV.

A New Framework for Growth

Let's make this real. Imagine you identify a segment of customers who made their first purchase but haven't returned in 60 days. Instead of sending another generic "We miss you!" email with a 15% off coupon, you surprise them with $10 in store credit.

This gesture feels personal and valuable. It immediately gives them a tangible reason to come back and browse your store. You can learn more about how to master this powerful tool by exploring our complete guide on what is store credit.

This is what modern marketing market segmentation is all about. It’s about truly understanding who your customers are, figuring out what makes them tick, and then using that insight to build a profitable, sustainable business model focused on LTV and AOV. The next sections will show you exactly how to put this strategy into action.

The Five Customer Segments Every DTC Brand Should Know

Trying to market to your entire customer base at once is like shouting into a hurricane. Your message gets torn apart and lost before it reaches anyone. This is where marketing market segmentation comes in—it’s the art of turning that chaotic crowd into smaller, more manageable groups so you can have a real conversation.

Instead of a one-size-fits-all blast, you’re creating tailored experiences that make people feel like you get them. This isn't just a feel-good tactic; it's a massive revenue driver. In fact, brands that get segmentation right can see a mind-boggling 760% increase in email revenue, according to research compiled by Britopian. That's the difference between being ignored and being irresistible.

Let's break down the five most crucial ways to segment your customers and show you how to activate each one with a smart, native Shopify store credit strategy that boosts lifetime value.

Demographic Segmentation

This is the most straightforward place to start. Demographic segmentation groups customers by observable, factual data: age, income, gender, family status, and so on. It’s all about the who. You can find this data right inside Shopify or by running a simple customer survey.

Imagine you sell high-end organic baby clothes. You could easily create a segment of new parents in affluent zip codes. Instead of sending them a generic "10% off" coupon, imagine sending a personalized welcome with a $25 store credit. It’s a thoughtful gesture that positions your brand as a premium, supportive partner from day one.

Geographic Segmentation

As the name suggests, this is all about where your customers are. Grouping by country, state, city, or even neighborhood lets you tailor offers based on local weather, shipping logistics, or regional tastes.

Let's say you're making a big push to grow your brand in Texas. You could build a segment of every shopper from that state and offer them a $10 store credit—coincidentally, the exact cost of standard shipping. This move instantly removes a common purchase barrier, boosts average order value, and builds a ton of goodwill in a market you're trying to win over.

The secret to great segmentation isn't just collecting data; it's turning that data into a compelling reason for someone to buy from you. It’s about giving them a location-specific offer that feels like it was made just for them.

Psychographic Segmentation

Now we're going deeper. Psychographic segmentation is about understanding the why behind the buy. It groups people based on their lifestyles, values, interests, and personalities. Are they eco-warriors? Thrill-seekers? Or homebodies who live for a cozy night in?

Say you sell sustainable home goods. You could create a segment of customers who have only ever purchased from your eco-friendly collection. On Earth Day, you could surprise this group with a $15 store credit as a thank you for sharing your brand's values. This does more than just drive a sale; it strengthens their emotional connection to your mission and boosts their long-term lifetime value.

Behavioral Segmentation

This is where things get really powerful. Behavioral segmentation looks at what customers do—their purchase history, browsing patterns, how often they open your emails, or if they abandoned a cart. You're responding directly to their actions.

One of the most valuable behavioral segments is your "at-risk" customers. You can build a list of everyone who hasn't purchased in 90 days and send them a targeted win-back campaign. An offer like "$15 on us" in store credit feels like a genuine gift, a personal invitation to come back and see what's new. It’s far more compelling than a desperate-looking discount and is a direct play to recover potential lost LTV.

Value-Based Segmentation

Finally, value-based segmentation helps you identify who your best customers are based on their economic value. The most common approach is to create a VIP segment of your top 10% of spenders. These are the people who keep the lights on and have the highest lifetime value.

Your top customers deserve more than just another email. They're the lifeblood of your business. By putting them in an exclusive segment, you can reward them with things like surprise store credit drops or early access to new products. This isn't just about making them feel appreciated; it’s about making sure your most valuable customers stay your most loyal customers, maximizing their LTV.

To make this even clearer, here's a quick reference table showing how these segmentation models pair perfectly with a store credit strategy.

Segmentation Types and Store Credit Applications

Segmentation Type | Core Focus | Store Credit Tactic Example | Primary Goal |

|---|---|---|---|

Demographic | Who they are (age, income) | $25 store credit to new parents in high-income areas | Attract high-value new customers |

Geographic | Where they are (city, state) | $10 credit (value of shipping) to customers in a new target state | Reduce friction and boost AOV |

Psychographic | Why they buy (values, lifestyle) | $15 Earth Day credit for shoppers of your eco-friendly line | Build brand loyalty and increase LTV |

Behavioral | What they do (purchase history) | $15 "we miss you" credit to customers inactive for 90 days | Win back at-risk customers to preserve LTV |

Value-Based | How much they spend (LTV) | Surprise credit drops for your top 10% of spenders | Maximize retention of high-LTV VIPs |

Ultimately, each segmentation type gives you a different lens to view your customers through, and native Shopify store credit provides a flexible and powerful tool to act on what you see.

Your Action Plan for Customer Segmentation

Alright, we’ve covered the "what" and "why" of marketing market segmentation. Now it’s time to get our hands dirty and put this knowledge to work. This is where theory meets reality—a straightforward, step-by-step framework I've seen work wonders for Shopify merchants looking to turn customer data into real, sustainable growth.

And don't worry, you don’t need a team of data scientists to pull this off. You can start building powerful segments with the information you already have. The goal? To boost lifetime value and average order value, all while finally stepping away from those margin-killing discounts.

Let's walk through a simple loop: gather data, define a few key segments, activate them with native store credit, and measure what actually matters.

Step 1: Gather Your Data

All the insights you need are probably sitting right under your nose, hiding in plain sight within the tools you use every day. The trick isn't to find every single data point imaginable. Instead, we're on the hunt for actionable information that tells you who your customers are and how they shop.

Here are your go-to data sources:

Shopify Analytics: Think of this as your command center. Dive into your reports on returning customers, average order value, and sales by location. You can quickly spot your top-spending customers and identify any geographic hotspots.

Email Marketing Platform: Tools like Klaviyo or Mailchimp are goldmines. They track open rates, click-through rates, and purchase history tied to your campaigns. This shows you who’s actually paying attention and what messages get them to act.

Simple Customer Surveys: A one-question post-purchase survey can be surprisingly powerful. Ask something direct like, "What was the main reason you chose us today?" to get a glimpse into your customers' motivations—pure psychographic gold.

By piecing these sources together, you can start painting a much clearer picture of your customer base. It’s about moving beyond simple transaction records to understand the people behind the orders.

Step 2: Define Your Segments

Okay, with your data in hand, it's time to build a few high-value customer groups. A word of advice: don't try to create a dozen segments at once. You'll just get overwhelmed. Start with two or three that directly support your business goals, like boosting repeat purchases or winning back customers who've gone quiet.

Here are three powerful segments you can build today:

High AOV Shoppers: Create a segment of customers whose average order value is 25% or more above your store average. These are your most profitable buyers, and they deserve the VIP treatment.

Potential Churn Risks: Find customers who bought something between 60 and 90 days ago but haven’t been back since. This is a critical window to re-engage them and protect their future lifetime value.

Brand Loyalists: This one’s easy. Build a list of everyone who has made three or more purchases. These are the lifeblood of your business, and their LTV is a key indicator of your store's health.

Each of these groups represents a clear opportunity. They all have different needs and will respond to different incentives, which leads us to the most important part of the process.

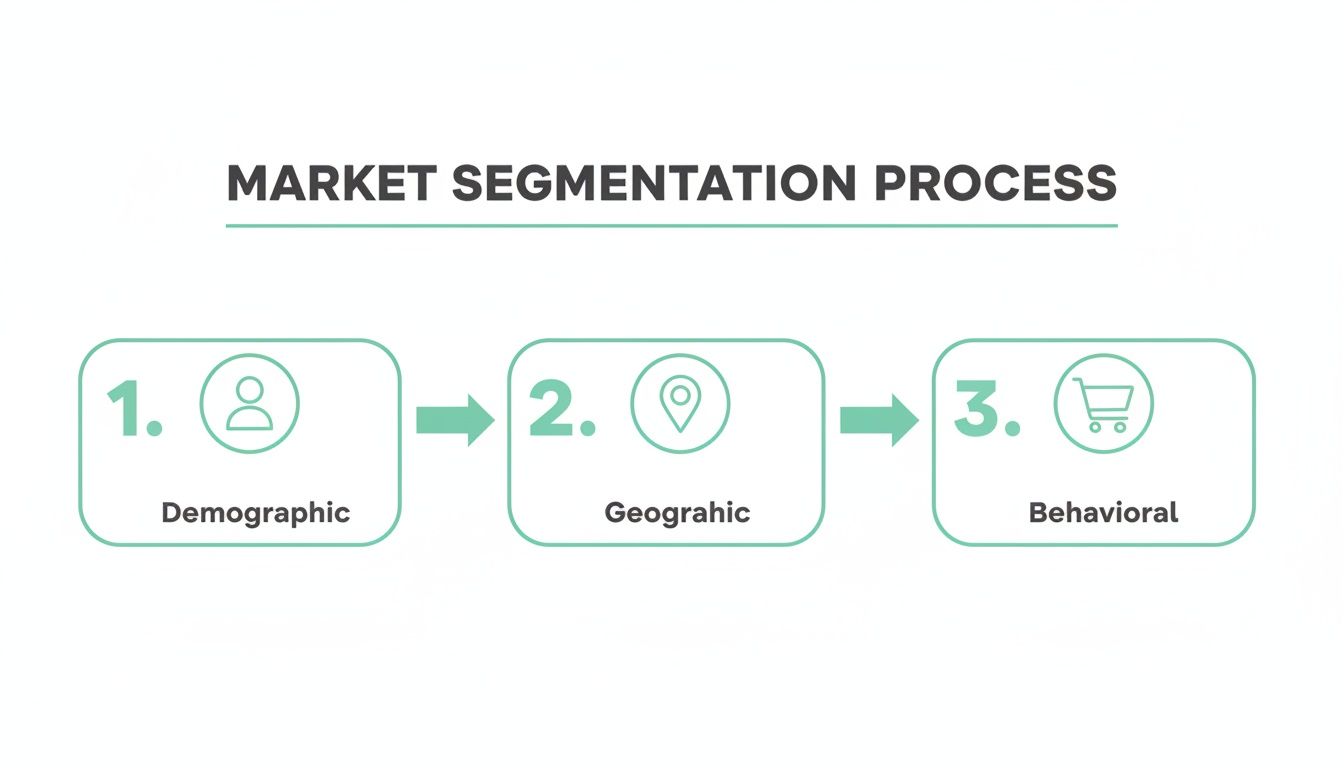

As this diagram shows, the magic happens when you combine who your customers are (demographics), where they live (geographics), and what they do (behaviors). That’s how you create truly effective marketing segments.

Step 3: Activate with Store Credit

This is where your strategy comes to life. Instead of defaulting to another generic discount code or confusing points, you’re going to motivate each segment with targeted, native Shopify store credit. Why? Because store credit feels like cash, practically guarantees a return visit, and often leads to customers spending more than the credit amount, boosting AOV.

Here are a few specific campaign ideas for the segments we just defined:

For High AOV Shoppers: Don't send them a coupon—they've earned better. Surprise them with a $20 store credit as a genuine "thank you" for being a VIP. It reinforces their value and encourages another big purchase.

For Potential Churn Risks: A "We Miss You" email with $10 in store credit is way more compelling than a 15% off code. It’s a no-strings-attached gift that gives them a real reason to come back and see what's new.

For First-Time Buyers: Securing that second sale is crucial for LTV. Create a segment of customers who made their first purchase 30 days ago. Send them a $10 store credit to welcome them to the brand and nudge them toward their next order.

Activating segments is just one piece of the puzzle; you also need a rock-solid plan for keeping them around. For a deeper dive, check out our guide on retention marketing strategies. Once you nail down your segments, you can take it a step further by exploring this ultimate guide to e-commerce personalization to create truly one-of-a-kind experiences.

Step 4: Measure What Matters

The final—and arguably most important—step is to track your results. While metrics like email open rates are nice to know, they don't pay the bills. To understand the true impact of your marketing market segmentation efforts, you need to focus on KPIs that directly affect your bottom line: Lifetime Value and Average Order Value.

The success of your segmentation strategy isn't measured in clicks; it's measured in profit and long-term customer relationships. Focusing on LTV and AOV proves the value of moving away from discounts toward a smarter, more sustainable growth model.

For each segmented campaign, keep a close eye on these three metrics:

Repeat Purchase Rate: Did the store credit offer actually bring people back? Compare the rate for your segmented group against your store-wide average to see the lift.

Customer Lifetime Value (LTV): Over time, are these segmented customers spending more with your brand? An increase in LTV is the clearest sign that you're building real loyalty, not just one-off sales.

Average Order Value (AOV): Did the credit incentive encourage customers to spend more per transaction? Track this against your baseline to see the immediate uplift.

By following this four-step action plan, you can stop guessing and start systematically building a segmentation strategy that drives real, measurable results for your Shopify store.

Segmented Store Credit Campaigns That Actually Work

Okay, the theory is great, but let's get down to brass tacks. Seeing marketing market segmentation actually drive real-world results is where the magic happens. We're going to move past the abstract frameworks and dive into a few story-driven scenarios that show exactly how you can use segmented, native Shopify store credit to solve real growth challenges.

Think of these as blueprints for turning your customer data into dollars. Each example will break down a specific customer segment, the exact store credit strategy used, and how it moved the needle on crucial metrics like lifetime value and average order value.

Scenario 1: The Proactive Upsell for a Skincare Brand

Let's start with "Glow Up," a DTC skincare brand. Their hero product is a fantastic acne-fighting serum that flies off the virtual shelves. But they know the real money isn't in that first sale; it's in turning a one-time buyer into someone who relies on them for their entire skincare routine. That's how you build lifetime value.

The Segment: Glow Up gets clever. They create a behavioral segment of every customer who has purchased the acne serum for the first time. Then, they set a timer to trigger an email exactly 25 days after the purchase—right around the time the bottle starts feeling light.

The Store Credit Strategy: Instead of a boring "Time to reorder!" email, they send a personalized message: "Your skin has had a great month! Ready for the next step?" Along with that message comes a $15 store credit, specifically nudging them to try the brand's best-selling hydrating moisturizer. It’s the perfect next step in their routine.

The Business Outcome: This simple, proactive move accomplishes two massive goals. First, it all but guarantees that second purchase, which is a critical milestone for customer LTV. Second, it brilliantly cross-sells a complementary product, boosting the customer’s average order value. The store credit feels less like a coupon and more like a thoughtful recommendation from an expert who gets their skin.

By anticipating a customer's needs and offering a timely, relevant reward, the brand transforms a simple transaction into the beginning of a long-term relationship. It’s a perfect example of using segmentation to grow LTV and AOV.

Scenario 2: The Exclusive Launch for a Fashion Brand

Next up is "City Stitches," a boutique fashion brand with a cult following in a few major cities. They have a limited-edition collection dropping and want to give their best customers the VIP treatment while making sure the launch is a sell-out success.

The Segment: This is where combining segmentation types gets powerful. City Stitches builds a hyper-targeted list by merging geographic data with value-based data. They isolate their highest-LTV customers who live in New York City, their single best market. This is their "tastemaker" crew.

The Store Credit Strategy: Two full days before the collection is available to everyone else, this high-LTV segment gets an email announcing early access. To make the offer irresistible, they include a $25 store credit as a "thank you for being one of our best customers." This isn't just a sale; it's a private invitation.

The Business Outcome: The results are electric. The early-access campaign sells out 40% of the entire collection before it even hits the main site, creating a wave of hype. The store credit encourages these top-tier shoppers to spend even more, juicing the AOV for the launch. But most importantly, it makes their most valuable customers feel truly special, cementing their loyalty and maximizing their future lifetime value.

Scenario 3: The Win-Back Campaign for a Coffee Subscription

Finally, let's look at "Morning Ritual," a coffee subscription service. Like any subscription business, churn is public enemy number one. They’ve spotted a dangerous pattern: if a customer pauses their subscription for more than one cycle, the odds of them ever coming back plummet.

The Segment: Morning Ritual creates a behavioral segment they call "At-Risk Pausers." This is anyone who skipped their last delivery and is about to miss the cutoff for their next one. They are teetering on the edge of leaving for good.

The Store Credit Strategy: A week before the next renewal date, this segment gets a simple, friendly email with the subject line, "A little something to get you brewing again." Inside is a surprise $10 store credit that automatically applies to their next order if they reactivate their subscription. No codes, no hoops to jump through—just one click and a great reason to come back. Keeping it simple is crucial; you can learn more in our guide on how to give store credit on Shopify.

The Business Outcome: The campaign is a lifesaver. That surprise credit completely removes the friction of restarting a subscription, winning back a huge chunk of customers who would have otherwise churned. This directly lowers their overall churn rate, protecting their LTV and stabilizing that all-important monthly recurring revenue.

And this strategy isn't just for small brands. Think about Sephora, which segments customers across its 2,600 stores in over 30 countries. They use purchase data to create personalized beauty rewards that keep people coming back and spending more. You can see more examples of how major brands use segmentation on Welocalize.com. Each of these scenarios shows that when you pair smart segmentation with the right incentive, you create a powerful engine for profitable growth.

Why Store Credit Is a Smarter Play Than Discounts and Points

In the e-commerce game, the incentives you offer tell your brand's story. For too long, Shopify merchants have leaned on the same two crutches: discount codes and convoluted loyalty points systems. But what if both of these common tactics are actually hurting your LTV and AOV? Effective marketing market segmentation isn't just about finding your customer groups; it's about motivating them with the right kind of reward.

This is where native Shopify store credit comes in and completely changes the conversation. It isn't just another gimmick or a confusing points program. It’s a clean, cash-like reward that shores up your brand, drives your most important metrics like lifetime value, and builds loyalty that actually means something.

Protect Your Margins and Your Brand's Worth

Here’s the hard truth about discounts: they're a race to the bottom. When you constantly run sales, you're training customers to wait for a price drop, which cheapens your products and chips away at your brand’s perceived value. That 20% off coupon stops being a delightful surprise and quickly becomes an expectation.

Native Shopify store credit works on a totally different psychological level. It isn't a price reduction; it's an addition of value.

It's a controlled investment. You're not just slashing prices across the board. You're giving a specific amount of value to a hand-picked segment of customers, turning a marketing cost into a direct investment in your best people.

It feels like a gift. A surprise $10 store credit in someone's inbox feels like a genuine reward for being a loyal customer, not a desperate plea to make a sale. That positive feeling is what builds real relationships and lifetime value.

By making the switch from discounts to native store credit, you can finally stop sacrificing your profits for a temporary bump in sales. You're building a healthier financial model where every incentive is designed to lift your brand up, not tear it down.

Give Your Average Order Value an Instant Boost

Have you ever had a gift card just sitting in your wallet? When you finally go to use it, you almost never spend the exact amount. That's the beautiful, simple magic of store credit—it feels like free money, and customers are wired to use all of it, even if it means spending a little more of their own.

A customer with $15 in store credit doesn't hunt for a $15 product. They look for that $20 or $30 item they really want, and the credit just pushes them over the edge to buy it. This one small shift in behavior is a powerful, organic way to drive up your Average Order Value.

This psychological nudge is a massive advantage. While a 15% off coupon makes people look for the cheapest item to maximize their savings, store credit encourages them to spend more to get the full value of their reward. That single dynamic is a huge lever you can pull to make every single transaction more profitable.

Keep the Customer Experience Clean and Simple

Let’s be honest: loyalty point systems are often a complete mess. Customers have to mentally juggle confusing multipliers ("Earn 2 points per dollar!"), figure out complicated redemption tiers ("You need 500 points for a $5 coupon!"), and dig through clunky dashboards. All that friction leads to one thing: people give up.

Native Shopify store credit slices right through the noise. It is beautifully simple:

It's Instantly Understood: $10 in store credit is $10. There's no math, no conversion, no headache.

It's Effortless to Use: As a native solution, the credit is sitting right there at checkout, ready to be applied with a single click.

There Are No Complicated Rules: Customers don’t have to learn a new currency or study a rulebook. They see their balance, and they use it.

That clarity is everything. A simple, valuable reward gets used far more often, which means you're much more likely to see the repeat business and LTV growth you were hoping for. You end up building a relationship based on straightforward, mutual value—not one that requires a calculator.

Still Have Questions About Segmentation? Let's Clear Them Up.

Dipping your toes into a new marketing strategy can feel like a big leap. I get it. Moving from the comfortable, well-worn path of discounts and confusing points programs to a smarter approach like marketing market segmentation with native Shopify store credit is a change. But the payoff in customer lifetime value and real profit is more than worth the effort.

Let's tackle some of the most common questions merchants ask when they're ready to make the switch.

How Do I Find My Best Customer Segments in Shopify?

The best place to start is with the goldmine of data you already have. Your most valuable customers aren't necessarily the ones who place a single huge order; they're the loyal fans who keep coming back for more.

Jump into your Shopify Analytics and create a simple segment of customers who have made three or more purchases. These are your ride-or-dies with high lifetime value. Next, pull a list of customers whose average order value is way above your store average. Right there, you have two powerhouse groups—your VIPs—perfect for your first test of targeted store credit rewards.

Is Store Credit Really Better Than a Points Program for Boosting LTV?

Yes, and the reason is beautifully simple: store credit is crystal clear. Points programs, on the other hand, force customers to do math. They have to stop and figure out what their points are actually worth, creating a moment of friction that often leads to them just giving up.

Think about it: a customer seeing a $10 store credit in their account feels like they just found cash in their pocket. That direct, tangible value is incredibly powerful for nudging them toward another purchase—which is the key to a high lifetime value. A balance of 500 points just doesn't hit the same way. In marketing, clarity always wins.

Can I Put This Whole Store Credit Thing on Autopilot?

You absolutely can, and you should. Automation is what makes this strategy manageable and incredibly effective. The idea is to create simple "if this, then that" workflows that reward the right people at the right moment, all without you lifting a finger.

For instance, you can automatically send:

$10 in store credit to a new customer 30 days after their first purchase, giving them a great reason to make a second.

A $15 "we miss you" credit to a customer who hasn't shopped in 90 days, pulling them back before they churn for good.

A surprise and delight store credit reward the moment a customer crosses a key lifetime spending milestone.

This way, your marketing is constantly working in the background to build loyalty and drive up your average order value and lifetime value.

What's the Safest First Step to Take Away from Discounts?

Don't go cold turkey. The smartest way to start is to pick just one high-impact segment and swap out their usual discount offer for a native Shopify store credit incentive.

A fantastic place to begin is your win-back campaign for customers who have gone quiet. Instead of blasting them with yet another "15% Off!" email, send that group an email with a $10 store credit and a friendly "We'd love to see you again!" message. Track the repeat purchase rate and AOV from that campaign. When you see how much better store credit works at driving real, profitable action, you'll have all the proof you need to roll out the strategy everywhere else.

Ready to escape the discount trap and build a loyalty program that actually grows your bottom line? Redeemly helps you replace confusing points and margin-killing coupons with real, cash-like store credit that boosts LTV and AOV. Get started with Redeemly today.

Join 7000+ brands using our apps