Shopify Loyalty Programs for Customer Retention That Drive Higher LTV

Dec 24, 2025

|

Published

It’s an old saying in business, but it’s truer now than ever: acquiring a new customer can cost five times more than keeping one you already have. This simple fact makes a great loyalty program one of the most powerful tools for profitability.

Instead of getting stuck in a cycle of margin-killing discounts or overly complicated points systems, smart Shopify brands are finding a better way. They're using Shopify native store credit to build a predictable engine for repeat revenue. This isn't just about rewarding loyalty; it's about simplifying the customer's life while directly boosting the metrics that matter most: customer lifetime value (LTV) and average order value (AOV).

The Real Cost of Losing a Customer

In the cutthroat world of ecommerce, the price of grabbing a new customer’s attention is always going up. We pour money into ads, social media, and endless marketing campaigns, all chasing that next new buyer. But what if the smartest move wasn't about finding someone new, but about holding onto the customers who have already chosen you?

When you lose a customer, you're losing more than a single sale. You’re losing a whole future of potential repeat purchases, word-of-mouth referrals, and the kind of brand love that no ad budget can buy.

This is why the game is shifting from one-off transactions to building genuine, long-term relationships. You want to build a community that comes back to your brand by default. A well-thought-out loyalty program, built on a simple store credit model, is your best bet for making that happen, turning a revolving door of first-timers into a thriving hub for repeat shoppers.

Moving Beyond Discounts to Drive Real Value

For a long time, discount coupons were the default tool for coaxing customers back. And sure, they can give you a quick sales bump. But that bump comes at a high price—you end up teaching your customers to wait for a sale, which slowly chips away at your profit margins.

Likewise, convoluted point systems often do more harm than good. When a rewards program feels like a math quiz, customers just tune out, and the whole thing fails to create any real excitement or loyalty.

A more intelligent, sustainable strategy zeroes in on two metrics that truly define a healthy Shopify store:

Customer Lifetime Value (LTV): This is the big one. It’s the total amount of money you can realistically expect a single customer to spend with you over time. A high LTV is a sign of a stable, loyal customer base.

Average Order Value (AOV): This measures how much customers spend each time they check out. Pushing this number up means every single sale becomes more profitable.

Once you grasp the real cost of customer churn, you see why being proactive is so important. A huge part of keeping customers happy is to consistently find ways to improve ecommerce customer experience and make them feel appreciated for sticking around.

The best loyalty programs don't just give stuff away. They create a powerful, compelling reason for customers to come back and spend more, turning a simple purchase into a real relationship.

Instead of chasing sales with a constant stream of coupons, this guide will show you how a native Shopify store credit program can directly boost both LTV and AOV. By giving customers real, cash-like credit, you create an incentive that protects your margins and keeps that revenue locked right inside your store’s ecosystem.

To get a deeper understanding of this crucial metric, you can learn more about how to calculate Customer LTV in our detailed guide: https://www.redeemly.ai/blogposts/how-to-calculate-customer-ltv. This simple yet powerful shift is the key to building a more profitable and resilient brand.

Choosing Your Loyalty Program Model

When you're thinking about loyalty programs, it's tempting to believe they all work the same. But the model you choose has a huge impact on your profit margins, the customer experience, and the long-term health of your store. Many Shopify merchants go with traditional points or discount systems without realizing there’s a much more powerful—and margin-friendly—way to do things: Shopify native store credit.

Let's break down the three most common models so you can see which one actually helps your bottom line and improves key metrics like lifetime value and average order value.

The Problem with Traditional Points Systems

Points-based programs are the old-school classic. Customers earn points for buying stuff, then eventually trade them in for rewards. While it sounds good on paper, this approach often creates more headaches than it solves.

First off, points force your customers to do mental math. "How many points do I have? What's that worth in real money? What can I even get with this?" That confusion is a major roadblock, causing shoppers to give up before they ever feel rewarded. If a program isn't dead simple, it loses all its motivational power and fails to drive the repeat business that boosts LTV.

On top of that, unredeemed points become a financial liability on your books. You owe your customers value they haven’t claimed, which can complicate your accounting. And if customers aren't redeeming points, it's a clear sign the program isn't driving the repeat business it was built for.

The Downside of Discount-Heavy Programs

Slashing prices with coupons is another popular tactic, but it comes at a steep cost. Constantly offering "20% Off" or "$10 Off" just trains your customers to wait for a sale. Over time, this erodes your brand's value, making people think your products aren't worth paying full price for.

It's a race to the bottom that eats directly into your profit margins. Instead of rewarding true loyalty, you're just giving away revenue. You might get a short-term sales bump, but you're not building a lasting relationship or increasing a customer's lifetime value. They become loyal to the deal, not your brand.

Store Credit: The Smarter Shopify Solution

This brings us to the most effective model for modern Shopify stores: native store credit. Instead of abstract points or margin-killing coupons, you reward customers with real, cash-like credit they can spend on their next purchase. This simple shift changes everything.

Store credit is powerful because it's so easy to understand. A customer who earns $15 in store credit instantly gets its value—it feels like finding money in their pocket. There are no confusing conversion rates or complicated tiers, which means engagement and redemption rates skyrocket.

The financial upside for your store is even bigger.

By issuing store credit, you are effectively locking that future revenue within your store's ecosystem. The reward you give a customer can only be spent with you, creating a powerful, built-in incentive for them to return.

This approach directly fuels your most important growth metrics. When a customer comes back to use their credit, they almost always spend more than their balance, which pushes up your average order value (AOV). That guaranteed repeat visit also naturally boosts their customer lifetime value (LTV), turning one-time buyers into loyal, long-term fans.

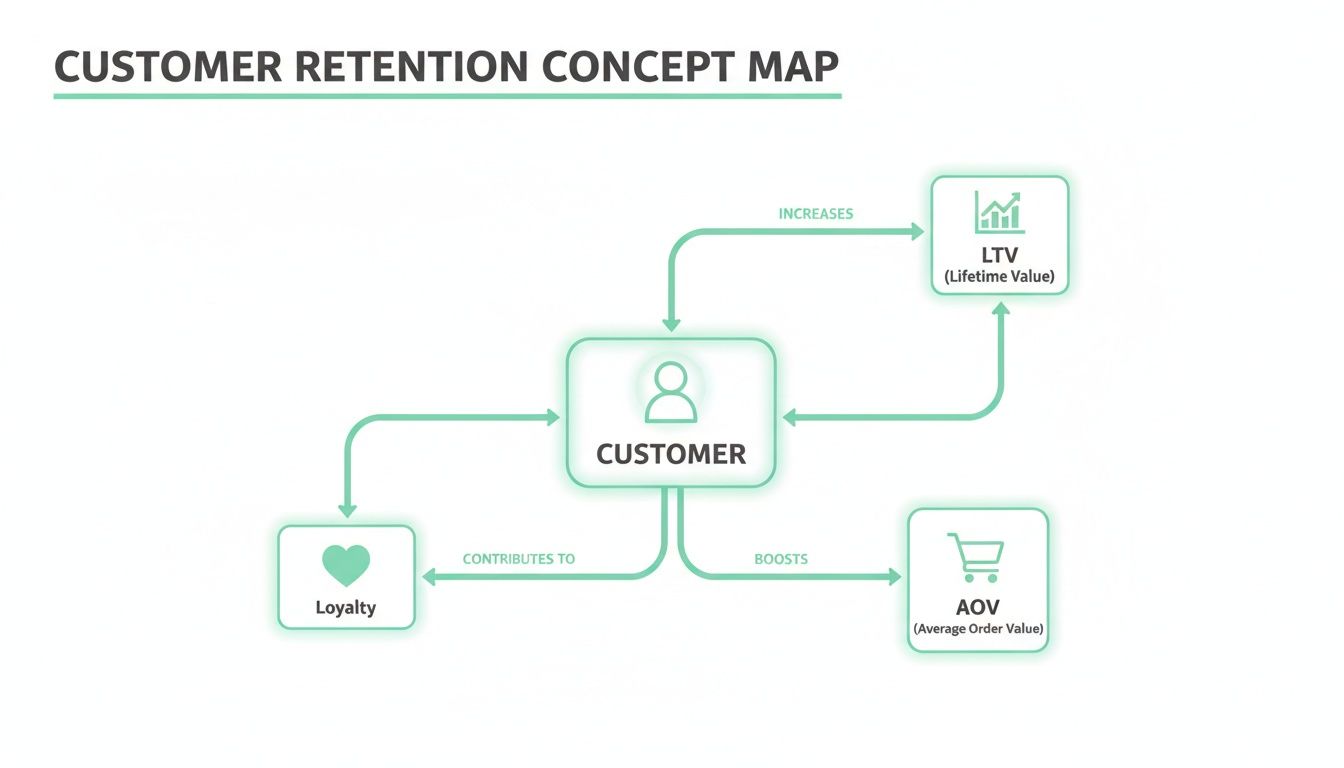

This map helps visualize how a customer-first approach directly lifts key retention metrics.

As you can see, a great customer experience is at the heart of improving the numbers that matter for a healthy ecommerce business.

The data speaks for itself. Loyalty programs are a retention powerhouse, with 84% of consumers saying they're more likely to stick with brands that offer one. Even better, 90% of program owners report a positive ROI, averaging a stunning 4.8x their investment. That's a testament to how repeat business climbs when the rewards are right.

By choosing a store credit model, you create a self-funding retention engine that protects your margins and drives real, sustainable growth. To see how other top brands are doing it, check out these examples of loyalty programs that use store credit to win.

Comparing Loyalty Program Models for Shopify Stores

Choosing the right loyalty structure is critical, as each model impacts your business differently. This table breaks down the three main approaches to help you decide which one aligns best with your goals of increasing LTV and AOV.

Feature | Points System | Discount Coupons | Shopify Store Credit |

|---|---|---|---|

Profit Margins | Moderate. Rewards have a cost, and points create a financial liability. | Low. Directly cuts into revenue and trains customers to expect sales. | High. Locks revenue in your store and encourages higher AOV. |

Customer Experience | Can be confusing. Customers have to calculate point values. | Simple but devalues the brand. Encourages "deal-hunting." | Excellent. Easy to understand and feels like cash in their pocket. |

Business Complexity | High. Requires managing point balances, reward tiers, and accounting for liability. | Low. Easy to create and distribute coupon codes. | Low. Integrates natively with Shopify; simple to manage. |

As the comparison shows, while points and discounts are common, they come with significant trade-offs in either customer experience or profitability. Shopify native store credit, on the other hand, offers a balanced and powerful way to build loyalty without sacrificing your margins.

Why Store Credit Drives Higher LTV and AOV

Let's be honest. Most loyalty programs, with their confusing points systems and margin-killing discounts, don't actually move the needle. There’s a much simpler, more powerful way to think about loyalty: native Shopify store credit. This isn't just another rewards gimmick; it's a model that fundamentally changes how customers behave and directly boosts the two metrics that matter most: Customer Lifetime Value (LTV) and Average Order Value (AOV).

Think of store credit as a pre-paid future purchase. When a customer earns $10 in store credit, it’s not some abstract number of points they have to decode. It's real money waiting for them in their account. This creates a powerful psychological pull—an open loop that practically begs them to come back to your store and spend the money you’ve already given them. It's the most compelling reason to choose you over a competitor next time they're ready to buy.

This simple shift is the foundation for a growth engine that keeps revenue locked inside your brand's ecosystem.

Boosting Customer Lifetime Value Through Guaranteed Repeat Visits

Customer Lifetime Value is the ultimate report card for your customer relationships. A high LTV tells you customers aren't just one-and-done buyers; they're coming back for more. Store credit is hands-down one of the best tools for juicing this number because it builds repeat business right into its DNA.

A discount coupon incentivizes a single sale. Store credit, on the other hand, all but guarantees a future one. The data doesn't lie: loyal customers spend far more than new ones—a staggering 67% more on average. By giving them a clear, cash-like reason to return, you naturally increase how often they buy and how long they stick around.

Every time a customer comes back to redeem their credit, their LTV ticks upward. Your loyalty program stops being a cost center and becomes a strategic asset for creating predictable, long-term revenue.

Increasing Average Order Value with Every Redemption

One of the best—and most immediate—perks of a store credit system is its effect on Average Order Value (AOV). When a customer returns to use their credit, they almost never spend just that amount. They treat it like a bonus, a little nudge to spend more.

It's basic human psychology. If a customer has $15 of store credit, that $50 item they've been eyeing suddenly feels like it only costs $35. The credit lowers the mental barrier to a bigger purchase, encouraging them to add more to their cart to "make the most of it."

This simple dynamic creates a consistent lift in AOV on every redemption. You’re turning a reward into a natural upsell, making each returning customer more profitable than the last. It’s a key reason why store credit is one of the best loyalty programs for customer retention and boosting both LTV and AOV.

By rewarding customers with store credit, you're not just giving them a reason to return; you're giving them a reason to spend more when they do. This dual benefit is what makes the model so powerful for sustainable growth.

Protecting Your Profit Margins from Harmful Discounting

Maybe the most critical benefit of store credit is how it shields your profit margins. Traditional discount programs train your customers to wait for a sale, devaluing your products and slowly bleeding you dry. It's a race to the bottom that most brands can't win.

Store credit gets you out of that dangerous cycle. It’s an earned reward, not a blanket price slash. Here’s how it protects your bottom line:

Preserves Perceived Value: Your product prices stay firm. The credit is a thank-you for loyalty, not a hint that your regular prices are too high.

Encourages Full-Price Purchases: Customers use their credit on future orders, which are almost always full-priced items—a world away from sitewide sales that discount everything.

Reduces "Deal Hunting": You start attracting customers who are loyal to your brand, not just loyal to the next 20% off coupon.

This whole approach creates a much healthier financial model. Instead of giving away margin on the front end, you're reinvesting a tiny piece of a sale to lock in the next one. For a complete breakdown of how this works on Shopify, check out our in-depth guide on the strategic use of Shopify store credit. It’s a sustainable way to grow that actually builds your brand equity instead of eroding it.

How to Design Your Store Credit Program

So, you're sold on the idea of store credit. Great. But how do you turn that concept into a real-world program that actually drives profit?

The good news is, an effective store credit program doesn’t need a complicated web of rules. In fact, simplicity is its superpower. By focusing on dead-simple rewards and crystal-clear communication, you can launch a system that starts boosting customer lifetime value and average order value from day one.

The goal here is to create something that feels less like a marketing ploy and more like a genuine "thank you." Your customers should instantly get how it works and, more importantly, be excited to use their credit. This is your practical guide to building a store credit program on Shopify that customers love and your margins can sustain.

Structuring Your Rewards for Maximum Impact

First things first: what actions are worth rewarding? While purchases are the obvious foundation, a truly smart program encourages other behaviors that help build a community around your brand. The key is to keep the value proposition straightforward: do this, get that.

Here are the most effective ways to set up your rewards:

Reward Purchases: This is non-negotiable. Offer a clear percentage back on every dollar spent, like 5% back in store credit on all orders. This gives customers a direct incentive to fill up their carts to earn a bigger reward, boosting AOV.

Encourage Product Reviews: Honest reviews are gold. Offer a flat reward, like $5 in credit, for every verified product review. You get powerful social proof, and they get a compelling reason to come back and spend.

Drive Social Engagement: Want more followers? Reward them for it. A small credit, maybe $2, for following your brand on social media or sharing your posts can give your organic reach a serious boost.

By mixing rewards for both buying and engaging, you’re building a relationship that goes deeper than just the transaction. This balanced approach is a hallmark of the best loyalty programs for customer retention.

Setting Simple and Motivating Redemption Rules

Complexity is the kryptonite of loyalty programs. If your customers need a spreadsheet to figure out how to redeem their rewards, they’ll just give up. Your rules need to be so simple you can explain them in a single breath.

The best rule is no rule at all. Make store credit as good as cash—no confusing restrictions, no minimums, no blackout dates.

When a customer sees they have $10 in store credit, it should feel exactly like finding a $10 bill in their pocket. This clarity removes all the friction and makes them want to shop again. Complicated rules create hesitation, but simplicity builds trust and drives the repeat purchases that grow LTV.

It's no wonder that as of 2025, over 90% of companies have a loyalty program. The data shows a massive 90% positive return on investment, with an average return of 4.8 times what was spent. It’s one of the smartest marketing investments a brand can make. You can dig into more of these loyalty program statistics on SellersCommerce.com.

Communicating the Value to Your Customers

Even the most generous program will fail if no one knows it exists. You have to weave reminders about your store credit program into the entire customer journey, consistently and clearly.

Start by making the program impossible to miss on your Shopify store. Use banners, pop-ups, and a dedicated landing page to shout about the benefits. On your product pages, show shoppers exactly what they stand to gain—a little message like, "Buy now and get $7.50 back in store credit!" works wonders.

Most importantly, use email to keep the program top-of-mind. Set up automated emails that fire off the second a customer earns credit, and send gentle reminders about their available balance. An email with the subject line, "You have $15 waiting for you!" is infinitely more powerful than another generic sales blast. Make your customers feel seen and constantly remind them they have money to spend with you.

Common Loyalty Program Mistakes to Avoid

Getting a loyalty program off the ground is one thing; making it profitable is another beast entirely. It’s easy to fall into common traps that tank even the best-laid plans. Too many brands roll out programs that tick all the boxes on paper but completely fail to move the needle on the metrics that matter: customer lifetime value (LTV) and average order value (AOV).

The single biggest mistake? Making it too complicated. Traditional points programs, with their confusing conversion rates and Byzantine tier systems, often feel like a pop quiz customers never signed up for. The second a shopper has to ask, “So, what are my points actually worth?” you’ve lost them. The goal is to reward, not to create a puzzle.

This complexity is a direct path to low engagement. If customers can't see the value in a split second, they just won't bother, and your program becomes dead weight. This is where a simple Shopify store credit program shines—it’s a beautifully simple loop everyone gets: spend money, get money back.

Setting Rewards That Fail to Motivate

Another classic blunder is setting rewards so low they feel more like an insult than an incentive. Offering the equivalent of $1 back for a $100 purchase isn't going to get anyone excited enough to come back. The reward needs to feel substantial, creating a genuine psychological pull to return to your store.

Of course, generosity has to be balanced with your margins. You can’t just give away the farm. But the value needs to be high enough to actually change customer behavior. A clear, tangible store credit system makes this balancing act much easier to manage than trying to figure out the perceived value of abstract points.

The most successful loyalty programs are built on two things: clarity and real value. They ditch the complex rules for straightforward rewards, like store credit, that customers immediately understand and actually want to use.

This keeps the focus right where it should be—on boosting your core metrics. The simplicity of store credit naturally encourages customers to return and often spend more than their balance, lifting both LTV and AOV in the process.

Focusing on the Wrong Metrics

Perhaps the most critical pitfall of all is getting distracted by vanity metrics. It’s tempting to celebrate the number of sign-ups or points issued, but those figures don't tell you if your program is actually making you money. A million members are worthless if they aren’t coming back to spend.

To build a program that delivers real, measurable results, you need a laser focus on the KPIs that reflect true customer retention and profitability:

Repeat Purchase Rate: This is your north star. Are members buying from you more often than non-members? If yes, it’s working.

Customer Lifetime Value (LTV): Is the total spending of your loyal customers going up over time? This proves your program is building long-term value.

Average Order Value (AOV): When customers redeem their credit, are they spending more than their credit balance? This shows the program is an effective upselling tool.

By tracking these KPIs, you can see the real ROI of your efforts. A store credit system makes this dead simple. You can directly tie redeemed credit to specific orders and see the immediate uplift in spending, allowing you to fine-tune your program for profit, not just for show.

Your Shopify Loyalty Program Questions Answered

Diving into the world of loyalty programs can feel like a big step, especially when you're laser-focused on protecting your margins and sparking real growth. If you’re a Shopify merchant, you probably have a few questions about making the switch to a store credit system. Let's tackle the most common ones head-on.

This section is all about pulling back the curtain on Shopify native store credit. We'll show you exactly how it works to boost LTV and AOV without the headaches of traditional points or discount-heavy programs.

Is a Store Credit Loyalty Program Better Than a Points System?

For most Shopify stores? Absolutely, yes. A store credit program is a hands-down winner because it eliminates the mental math that kills the momentum of a points system.

Think about it. A system where "10 points = $1, and you need 1,000 points for a $5 reward" forces your customers to stop and do calculations. That friction completely drains the excitement.

Store credit, on the other hand, is simple, direct, and powerful. When you tell a customer, "Spend $100 and get $10 back," they get it instantly. That clarity is why participation and redemption rates for store credit programs are so much higher.

The best loyalty programs feel like a gift, not a puzzle. Store credit communicates its value right away, creating a powerful psychological nudge for customers to return and spend what feels like 'found money.'

Plus, that $10 in credit can only be spent in one place: your store. This simple fact locks that revenue inside your brand's ecosystem, directly fueling more purchases and bumping up your customer lifetime value (LTV). Points often feel abstract and go unredeemed, never actually changing customer behavior.

How Can I Measure the ROI of My Store Credit Program?

Figuring out the return on your store credit program is more straightforward than you might think. It’s all about tracking a few key metrics that show a real-world impact on your business. Forget vanity metrics like sign-ups; we're focused on the numbers that actually drive profit and grow LTV and AOV.

Here’s what you should be watching:

Change in Customer Lifetime Value (LTV): The big one. Compare the LTV of your program members against non-members. A winning program will show that members spend significantly more with you over their entire relationship with your brand.

Repeat Purchase Rate: This is your north star metric. Has the percentage of customers returning for a second, third, or fourth purchase gone up since you launched the program?

Average Order Value (AOV): Keep an eye on the AOV for orders where store credit was used. You'll often find customers spend well beyond their credit balance to get the most out of their reward.

Redemption Rate and Associated Sales: Track how much credit is actually being redeemed and the total sales generated from those specific transactions.

By comparing the lift in these metrics against the cost of the credit you’ve issued, you can calculate a clear, positive ROI. This data-driven approach proves that store credit isn't a cost center—it's a powerful engine for profitable growth.

Will Offering Store Credit Devalue My Brand Like Discounts Do?

No, and this is probably the most critical advantage of using store credit. Aggressive discounting and constant coupon codes train your customers to wait for a sale. A big "20% Off" banner basically tells them your regular prices are inflated, chipping away at your brand's perceived value.

Store credit works in a completely different way. It’s an earned reward for loyalty, not just a price cut.

It doesn’t cheapen the items a customer is buying right now. Instead, it gives them a real benefit to use on a future purchase. This simple shift in framing turns the incentive from a fleeting "deal" into a well-deserved "perk." You get all the benefits of driving repeat business and increasing LTV without sacrificing your pricing integrity or premium positioning.

What's the Easiest Way to Set Up a Store Credit Program on Shopify?

Honestly, the simplest and most effective way is to use a dedicated Shopify app built for this very purpose. While Shopify has a native gift card feature, it just doesn't have the automation or customer-facing tools you need to run a proper loyalty program focused on increasing LTV and AOV. If you're looking for solutions, Exploring Abra Promotions for Shopify is one example of the tools available to tackle this.

Apps designed specifically for store credit loyalty do all the heavy lifting for you. They automate issuing credit after a purchase, keep track of every customer's balance, and let people redeem their credit seamlessly right in the checkout. Using a proven app means you can skip the tedious manual work and the high cost of custom development, getting a professional and effective program live in just a few hours.

Ready to stop giving away margin and start building real, profitable loyalty? Redeemly helps you replace confusing points and discounts with simple, cash-like store credit that boosts LTV and AOV. See how a native Shopify store credit program can transform your customer retention strategy at https://redeemly.ai.

Join 7000+ brands using our apps