How to Calculate Customer Lifetime Value and Grow Your Shopify Store

Dec 23, 2025

|

Published

If you're constantly chasing one-off sales, you're in a race to the bottom. I've seen it time and time again. The real secret to building a sustainable Shopify brand isn't about that next transaction—it's about understanding the total value each customer brings to your business over their entire journey with you.

That metric is Customer Lifetime Value (CLV), and frankly, it's the engine that separates the stores that merely survive from the ones that truly thrive. It forces a critical shift in focus from short-term sales to long-term profitability, driven by a higher average order value and repeat purchases.

Why CLV Is Your Most Important Growth Metric

It’s time to stop thinking about your business in terms of individual orders and start thinking in terms of customer relationships. CLV represents the total revenue you can realistically expect from a single customer over time. This isn't some fluffy, vanity metric; it's a strategic compass that should guide your most important decisions. As many have discovered, the key to business growth was hiding in your customer data, and CLV is how you unlock it.

Once you know your CLV, you suddenly have clarity. You know exactly how much you can afford to spend to acquire a new customer and still be profitable. It also puts a spotlight on your best customers, showing you exactly who to invest in retaining and how to find more people just like them.

Moving Beyond Discounts and Points

For years, the default playbook for Shopify merchants has been a mix of discount codes and confusing point systems. Sure, they can give you a temporary sales bump, but they often erode your margins and, worse, devalue your brand in the long run. You end up training customers to wait for the next sale, which kills profitability and prevents you from building any real loyalty.

There’s a much smarter, more modern way to do this.

A strategy built around native Shopify store credit can completely change the game. Instead of just slashing prices, you're rewarding customers with real, tangible value they can spend on their next purchase. This simple shift has a powerful ripple effect on your lifetime value and average order value:

It protects your margins. Store credit is only "spent" when a loyal customer comes back to make another purchase. You’re rewarding actual repeat business, not just bargain hunting.

It boosts Average Order Value (AOV). When a customer has store credit, it feels like found money. They're far more likely to add another item to their cart to use it all up.

It simplifies everything for the customer. No more tracking points or digging through emails for a coupon code. It's a seamless reward that feels like cash in their pocket.

By focusing on strategies that build CLV, you move from a transactional mindset to a relational one. You're not just selling products; you're cultivating a base of loyal customers who will drive predictable, profitable growth for years to come.

This isn't just theory—it's backed by hard data. A 2022 study found that companies that prioritized CLV over short-term acquisition grew their revenue 2.5x faster than their peers. This just goes to show the immense power of focusing on long-term value. By getting a handle on your CLV, you can build smarter retention marketing strategies that actually move the needle.

Your First CLV Calculation for Quick Insights

Diving into your numbers doesn’t have to feel like a final exam. For your first crack at calculating Customer Lifetime Value, let's skip the complicated algorithms and stick to a simple formula that gives you a surprisingly powerful snapshot of your business's health.

This approach is perfect if you're a busy Shopify merchant who needs real insights without needing a data science degree. The whole point is to get a baseline number—a starting point you can use to make smarter decisions about your marketing budget, retention efforts, and even what products to develop next. It’s all about turning your past sales data into a roadmap for future growth.

The Three Core Metrics for a Simple CLV

To get started, we only need three key pieces of information. The good news? You can pull most of this right from your Shopify analytics dashboard.

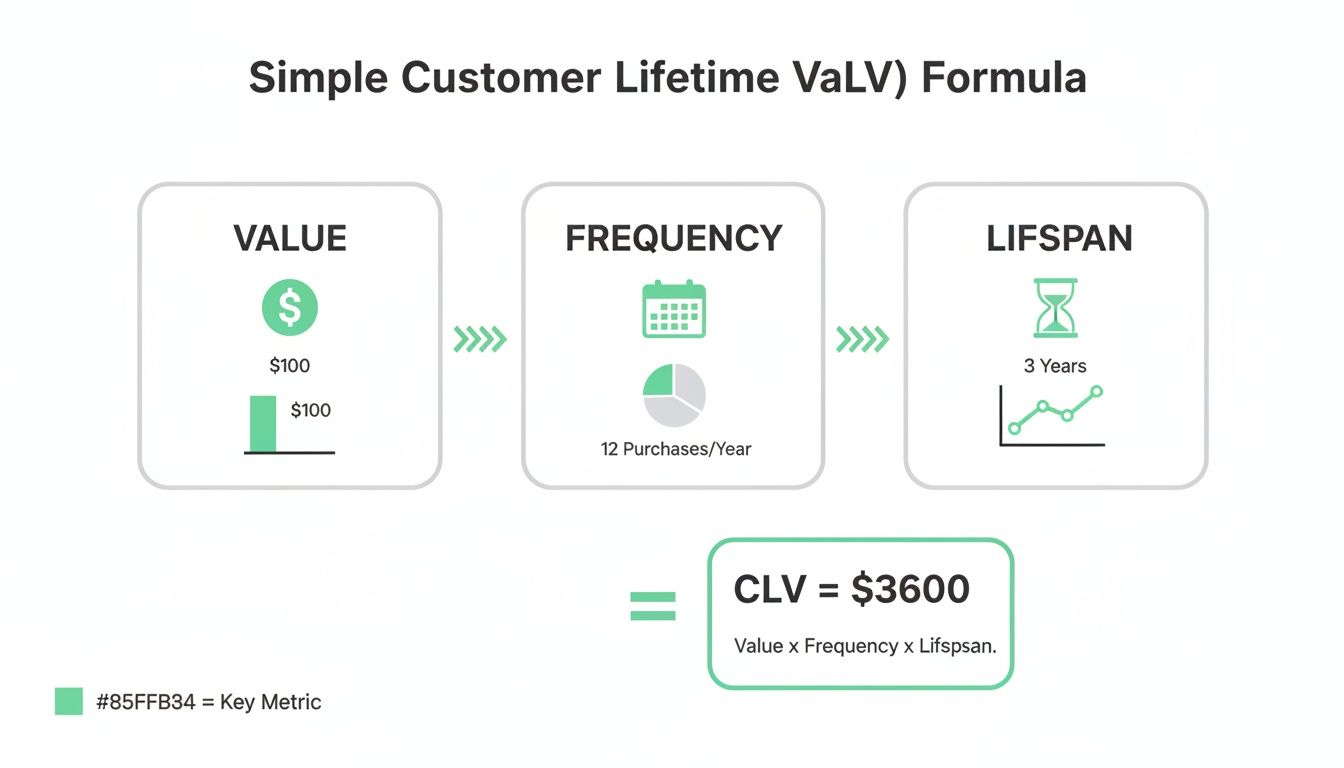

One of the most practical ways to calculate CLV is with a straightforward formula: CLV = (Average Purchase Value × Purchase Frequency) × Customer Lifespan. This method relies on historical data that's easy for any business to get its hands on, which is why it's the go-to for a quick, solid estimate. For a deeper dive into this foundational approach, this customer experience guide from CMSWire is a fantastic resource.

Let's break down what each of those pieces actually means for your store:

Average Purchase Value (APV): This is simply the average amount a customer spends each time they check out. A higher APV is almost always a sign of a healthy business.

Purchase Frequency (PF): This metric tells you how often a customer comes back to buy from you within a specific period, usually a year.

Customer Lifespan (CL): This is the average length of time a customer keeps buying from you before they go quiet.

When you put these three metrics together, you get a clear picture of what a typical customer is worth to your brand over the long haul.

Finding Your Numbers in Shopify

You don't need to be a spreadsheet wizard to find this data. Shopify's built-in analytics makes grabbing these numbers pretty painless.

Here’s a quick reference table to help you find exactly what you need without getting lost in the dashboard.

Shopify Metrics for Your Simple CLV Calculation

Metric Needed | Where to Find It in Shopify | Quick Tip |

|---|---|---|

Average Purchase Value | Go to | For a more accurate figure, set your date range to the last 12 months. This helps smooth out any seasonal spikes or dips. |

Purchase Frequency | Go to | This gives you the average number of orders per customer. Again, a 12-month range is your best bet for a reliable number. |

Customer Lifespan | This one is trickier, as Shopify doesn't have a direct report for it. A common estimate for e-commerce brands is 1-3 years. | If you’re just starting, use a conservative estimate like 2 years. You can always refine this later as you gather more data. |

With these numbers in hand, you're ready to see what your CLV looks like.

Let's Calculate a Real-World Example

Now for the fun part. Let's imagine a Shopify apparel store called "Urban Threads" and see how they'd calculate their customer lifetime value. After pulling their data from the last 12 months, here's what they found:

Average Purchase Value: $85

Purchase Frequency: 2.5 orders per year

Customer Lifespan: 3 years

We just need to plug these numbers into our simple formula:

CLV = Average Purchase Value ($85) x Purchase Frequency (2.5) x Customer Lifespan (3)

CLV = $637.50

So, what does this number actually mean? It means that Urban Threads can expect the average customer to spend a total of $637.50 over their entire relationship with the brand.

Key Takeaway: This isn't just a vanity metric. It's a powerful tool for your business. It tells Urban Threads they can confidently spend, say, $100 or even $150 to acquire a new customer and know that the investment will be wildly profitable over time. It also gives them a clear benchmark to see if their retention strategies—like a new store credit program—are actually working to increase that final number.

Uncovering Trends with Cohort-Based CLV

A single, store-wide CLV gives you a good baseline, but the real magic happens when you start segmenting. Think of it this way: knowing the average temperature of a hospital is useless information. You need to know the temperature of each patient.

Cohort analysis is how you take your customers' temperatures.

A cohort is just a group of customers who share a common trait, usually when they first bought from you. For example, everyone who made their first purchase in January belongs to the "January cohort." This approach lets you compare apples to apples, revealing how different groups of customers behave over time.

Instead of working with one blended average, you can finally answer the questions that really matter:

Are the customers we brought in during our Black Friday sale actually more valuable after six months than the ones from our Valentine's Day campaign?

Did that new product we launched in March lead to higher long-term spending for the customers who bought it?

Are customers from our paid social ads churning faster than those who found us through organic search?

This is where you start to see the patterns that drive your business forward.

The pillars shown here—Purchase Value, Purchase Frequency, and Customer Lifespan—are exactly what you'll track for each cohort to see how they stack up against each other.

Why Cohort Analysis Is a Game-Changer

Calculating CLV with cohorts moves you from a static photo to a dynamic movie of your business. You can see the direct impact of your decisions.

Let's say you launched a new store credit program in Q2. You can compare the Q2 cohort’s repeat purchase rate directly against the Q1 cohort’s. If it’s higher, you have hard evidence that your new strategy is working. It’s that clear.

This level of detail is crucial for optimizing everything from your marketing budget to your retention emails. You might discover that customers from a certain Facebook ad have a high initial AOV but a terrible repeat purchase rate, making their true CLV much lower than you thought.

Armed with that insight, you can tweak your ad or your post-purchase flow to encourage loyalty, not just a one-off sale. This is a core principle of effective market segmentation in marketing, allowing you to tailor your approach to the real-world behaviors of different customer groups.

Building Your Own Cohort Analysis

While Shopify Analytics offers some cohort reporting, you'll get a much clearer picture by exporting your own data. You just need two main reports from your Shopify admin: the Orders report and the Customers report.

Your goal is to build a simple table that tracks each cohort's cumulative spending over time. It looks something like this:

Acquisition Month | Month 1 AOV | Month 2 AOV | Month 3 AOV | Month 4 AOV |

|---|---|---|---|---|

Jan 2024 | $85 | $32 | $28 | $15 |

Feb 2024 | $92 | $41 | $35 | $22 |

Mar 2024 | $78 | $25 | $19 | $11 |

Apr 2024 | $95 | $45 | $39 |

Reading the Tea Leaves: In this table, the February and April cohorts are clearly your all-stars. They started with a higher AOV and are maintaining stronger spending habits. The March cohort, on the other hand, is a red flag. This prompts you to dig in and figure out what happened in March. Maybe a new discount strategy attracted lower-value customers?

By tracking these groups, you stop relying on a single, misleading average. You start seeing the real patterns that are fueling—or hurting—your store’s growth. This deeper understanding is what allows you to make precise, data-backed decisions that genuinely boost the bottom line.

You're no longer guessing. You're seeing exactly which levers to pull to create more high-value customers.

Using Predictive CLV to Forecast Future Growth

While looking at past customer data is useful, what if you could predict the future? That’s where predictive CLV comes in. It’s a powerful way to forecast how much a customer will be worth to your brand over their entire relationship with you, right from their very first purchase.

Imagine knowing, with a good degree of confidence, which of your newest customers will become your next VIPs. This isn't about having a crystal ball; it's about using data to make incredibly smart guesses. Instead of waiting months to see who sticks around, you can spot your most promising buyers almost immediately. For any brand trying to scale, that’s a massive strategic advantage.

Why Predictive Models Are a Growth Engine

Let’s be honest, for a growing Shopify store, you have to be smart about where you put your money. Predictive CLV helps you shift from just reacting to sales data to proactively shaping your store's future. It’s all about investing your marketing dollars where they’ll deliver the biggest bang for your buck.

When you can identify customers who are likely to have a high lifetime value, you can make much smarter decisions. You can double down on the acquisition channels that bring in these high-potential buyers, knowing that your ad spend will pay for itself many times over.

Predictive CLV isn’t just about calculating a number. It’s about spotting opportunities before your competitors do. It helps you answer the million-dollar question: "Which customers should we shower with attention right now to lock in future revenue?"

This model completely changes how you nurture customer relationships. Forget one-size-fits-all marketing. You can now segment new customers based on their predicted worth. The top tier? They get the white-glove treatment—exclusive offers, first dibs on new products, or maybe a surprise store credit to nudge them toward that all-important second purchase.

The Data That Feeds the Prediction

So, what kind of signals do these models look for? It’s not just about how much someone spent on their first order. Predictive models are much smarter than that; they analyze a whole range of early behaviors to get a sense of future loyalty.

You don't need to get bogged down in the complex math, but it's helpful to know what data points really move the needle.

Time Between Purchases: This is a huge one. How fast a customer comes back for a second purchase is one of the strongest indicators of a long-term fan.

Product Categories Viewed: Did they just look at one item, or did they browse around? Customers who explore multiple categories are showing deeper interest in your brand as a whole.

Initial Average Order Value (AOV): While it's not the only thing that matters, a first-time order that’s well above your store's average is almost always a good sign.

Discount Affinity: Was the purchase driven by a steep discount code? Sometimes, customers who only buy on sale can have a lower long-term value than those willing to pay full price.

These early clues are the ingredients for a solid forecast, helping you tell the difference between a future brand loyalist and a one-and-done bargain hunter.

Putting Predictions on Autopilot with Shopify Apps

Let’s be realistic: building these predictive models from scratch is a job for a data scientist, not a busy store owner. The good news is you don’t have to. The Shopify App ecosystem is filled with powerful tools that do all the heavy lifting for you.

Apps like Redeemly are built to help you boost CLV with strategies like store credit, and they often connect with analytics platforms that bring these predictive insights to light. Other dedicated analytics apps can plug right into your store's data and run these complex calculations for you automatically.

These tools are always on, analyzing customer behavior, spotting high-value signals, and segmenting your audience on the fly. This lets you build incredibly targeted marketing campaigns. For example, you could easily set up a rule to automatically send a $10 store credit to any new customer who lands in the top 20% of predicted CLV. It's a small investment that gives them a fantastic reason to come back, cementing that loyalty right from the start.

Boost Your CLV With a Smart Store Credit Strategy

Knowing your CLV is a fantastic starting point. But the real magic happens when you start actively improving it.

For years, Shopify merchants have relied on discount codes and complex points systems. They can certainly nudge sales in the short term, but they often do so by eating into your margins. Worse, they can train your customers to just wait for the next sale, cheapening your brand instead of building real loyalty.

There's a much smarter way to play the game. A native Shopify store credit program is one of the most powerful tools you have for boosting both Customer Lifetime Value and Average Order Value (AOV). You're not just offering a discount; you're giving customers a tangible, cash-like reward that pulls them back to your store.

The Psychology of Store Credit

So, why does store credit work so much better than a coupon? It’s all in the psychology.

A 20% off coupon registers as a way to save money. A $15 store credit, on the other hand, feels like found money. It's a gift card sitting in their account, just waiting to be spent.

This tiny mental shift changes everything. Instead of hunting for a deal, customers start actively looking for something to buy with their credit. This makes a repeat purchase far more likely, and it often drives up their AOV because they'll spend a little extra to "make the most" of their credit.

Store credit transforms the customer relationship from a transactional one based on discounts to a relational one built on reward and reciprocity. It’s a gesture that says, "We value your business," and customers respond by investing more back into your brand.

This strategy hits the core components of your CLV formula dead-on. You increase purchase frequency by giving them a reason to come back, and you lift the average purchase value by motivating bigger carts. It's a win-win that fuels sustainable growth.

Practical Tactics to Increase CLV and AOV

A store credit program isn't just a simple reward system. It's a flexible tool you can weave throughout the entire customer journey to save sales, delight shoppers, and all but guarantee they'll be back.

Here are a few powerful ways to put it into action:

Turn Returns into Repurchases: When a customer requests a return, offer them a little something extra (say, an extra $10) if they take the refund as store credit instead of cash. This simple move keeps that revenue inside your business and gives them a fantastic reason to find something else they love.

Resolve Support Issues with a Guarantee: A bad experience can lose a customer forever—or it can be an opportunity to create a lifelong fan. Instead of a templated apology, empower your support team to issue a generous store credit. It solves the problem and ensures they return for a positive experience next time.

Surprise and Delight Your VIPs: Look at your top customer cohort—the one with the highest CLV—and send them a "just because" store credit. A small, unexpected reward is an incredibly powerful way to deepen loyalty and often triggers an unplanned purchase, pushing their lifetime value even higher. For a deeper dive, our guide on using Shopify store credit effectively covers more advanced strategies.

Store Credit vs. Discount Codes Impact on CLV

When you're deciding on a retention strategy, it's helpful to see a direct comparison. Here's how a store credit program stacks up against the old standby of discount codes.

Strategy Feature | Store Credit Program | Discount Codes |

|---|---|---|

Customer Perception | Feels like a cash gift or reward | A way to save money; can devalue the brand |

Margin Impact | Protects margins; cash stays in the business | Directly cuts into profit margins on each sale |

Purchase Incentive | Encourages spending more to use the credit | Often leads to minimum purchase to get the deal |

Brand Value | Builds a premium feel and customer loyalty | Can train customers to wait for sales |

AOV Impact | Tends to increase AOV | Can lower AOV if used on small orders |

Return Handling | Turns refunds into future sales | Returns are a complete revenue loss |

Ultimately, while discounts have their place, store credit is a fundamentally more profitable and brand-building approach to fostering long-term customer relationships.

Measuring the ROI of Your Store Credit Program

The best part about a store credit strategy is that you can clearly see the impact on your numbers. By tracking the CLV of customers who engage with the program versus those who don't, you can prove its value with cold, hard data.

Remember, a true CLV calculation always nets out your costs. For example, if a customer generates £5,000 over 10 years, but it cost £50 to acquire them and £500 to service them, their actual net CLV is £4,450. This focus on profitability is crucial.

Segment your customers and compare the purchase frequency and AOV of those who have used store credit against a control group. That difference you see? That’s the direct, profitable lift from your new strategy.

Of course, store credit is just one piece of the puzzle. It's powerful when combined with other five proven tactics to increase Customer Lifetime Value. By taking an integrated approach, you're not just making sales—you're building a more resilient and profitable business for the long haul.

Got Questions About CLV? We've Got Answers.

Alright, we've walked through the formulas and the strategies. But if you're like most Shopify merchants I talk to, you probably have a few practical questions still rattling around. Getting a real handle on customer lifetime value is a process, and it's totally normal to wonder about the nitty-gritty details.

Let's clear up some of the most common questions that pop up, from how often you should be crunching these numbers to what a "good" CLV even looks like in the real world.

How Often Should I Actually Calculate CLV?

There isn't a single, perfect answer here, but my go-to recommendation is to calculate your CLV at least quarterly. This hits the sweet spot—it’s frequent enough to spot important trends before they become problems, but not so often that you're just reacting to random noise in your data.

That said, the right cadence really depends on what's happening in your business:

Launching a new strategy? If you just rolled out a new loyalty or store credit program, you need faster feedback. Check your CLV monthly for the first quarter to see if your big idea is actually moving the needle.

Growing like crazy? For stores in a high-growth phase, a monthly check-in is smart. It helps you make sure the new customers you're acquiring are actually valuable in the long run.

Stable and mature? If your business is more established, a quarterly or even semi-annual review can be plenty to keep tabs on long-term customer health.

The most important thing is to be consistent. Pick a schedule and stick with it. That’s how you build a reliable benchmark to measure your progress against.

What Is a Good CLV for an Ecommerce Store?

This is the million-dollar question, isn't it? And the honest-to-goodness answer is: it completely depends on your customer acquisition cost (CAC).

A "good" CLV is relative. A luxury furniture brand's target CLV will be worlds apart from a D2C coffee subscription.

So, instead of fixating on a specific dollar amount, you need to be obsessed with your CLV to CAC ratio. This is where the magic happens. For most ecommerce brands, a healthy ratio to aim for is 3:1. For every dollar you spend to bring a customer in the door, you should be getting at least three dollars back over their lifetime.

Let's say your CLV is $300 and your CAC is $100. You're in a great position. But if your CLV is $150 and your CAC is still $100, your profitability is on life support. That's a huge red flag telling you to focus on retention immediately.

Remember, a high CLV means nothing if it costs you a fortune to get that customer. The real goal is to constantly widen the gap between what you spend and what you earn.

How Can I Calculate CLV with Limited Data?

If you're running a new store, it's easy to feel like you're flying blind without years of data. Don't let that stop you. You can absolutely get a directional sense of your CLV, even in the early days.

You have to start with some educated guesses. For customer lifespan, a conservative starting point for a new store is often one to two years. Then, use the data you do have from your first few months to get an initial read on your Average Purchase Value and Purchase Frequency.

From there, you need to look for predictive signals. Even with just a couple of months of sales, you can spot early patterns:

Time to Second Purchase: This is a goldmine. A customer who comes back for a second purchase within the first 60-90 days is sending a massive signal about their long-term potential.

Initial Order Size: Did a new customer's first order blow your store's AOV out of the water? That's another strong indicator they could become a high-value regular.

Look, your first CLV calculation won't be perfect. But it gives you a baseline—a starting point. As you gather more data month after month, you'll refine your inputs, and your calculations will get sharper and more accurate. The most important step is the first one. Just start.

Ready to stop guessing and start growing? Redeemly helps you build a more profitable Shopify store by replacing margin-killing discounts with a smart, native store credit program. It’s the simplest way to boost repeat purchases, lift AOV, and turn more of your customers into lifelong fans. See how it works and start increasing your CLV today.

Join 7000+ brands using our apps