Market segmentation marketing: Drive LTV with Store Credit & Loyal Customers

Dec 16, 2025

|

Published

Picture this: you walk into a room and try to have the exact same conversation with a brand new acquaintance and your best friend. It would feel awkward and forced, right? The same logic applies to your customers. This is the core problem market segmentation marketing was created to solve.

Instead of shouting one generic message into the void, you get to group customers by shared characteristics. This lets you create personalized experiences that actually build connections and, most importantly, drive profitable growth by focusing on metrics like lifetime value (LTV) and average order value (AOV).

Stop Discounting and Start Connecting with Your Customers

For far too long, ecommerce brands have been stuck on a hamster wheel of discount codes and confusing point systems. Sure, a quick promotion can give you a temporary sales bump, but it’s a dangerous game. This approach slowly bleeds your margins, cheapens your brand, and attracts bargain hunters who disappear the second a better offer comes along. It's a race to the bottom that trades long-term health for a short-term high.

Market segmentation is your way out of that cycle. When you truly understand who your customers are, you can finally move past lazy, generic offers and start building real, meaningful relationships. This goes way beyond just personalizing an email subject line; it's a fundamental shift in how you communicate and deliver value.

From Mass Marketing to Meaningful Connections

The real goal here is to move the needle on metrics that actually matter, like customer lifetime value (LTV) and average order value (AOV). Segmentation is the roadmap that gets you there. Once you know which customers are your most valuable, which ones are about to churn, and which are just getting started, you can tailor your entire strategy.

Let's look at the strategic shift from generic marketing tactics to the kind of targeted engagement that segmentation and value-based rewards, like native store credit, make possible.

Marketing Element | The Old Way (Mass Marketing) | The New Way (Segmentation) |

|---|---|---|

Audience | One big, undefined "everyone" | Specific, defined customer groups |

Messaging | Generic, one-size-fits-all | Personalized and highly relevant |

Offers | Sitewide discounts & confusing points | Targeted native store credit |

Goal | Short-term transactions | Long-term relationships & LTV |

Outcome | Erodes margins, attracts one-timers | Builds loyalty, increases AOV & LTV |

This table really highlights the difference. You're moving from a spray-and-pray approach to a focused, strategic one that respects both your customers and your bottom line.

This shift allows you to:

Identify Your VIPs: Pinpoint that small group of customers who drive a massive chunk of your revenue and treat them like gold with high-value store credit rewards.

Nurture New Buyers: Gently guide first-time purchasers toward that crucial second sale with relevant content and smart incentives that build loyalty from day one.

Re-engage Lapsed Customers: Win back shoppers who have gone cold with targeted store credit offers that remind them why they loved your brand in the first place.

By focusing on the right customers with the right message, you stop wasting money on marketing that falls flat. Instead, every dollar you spend works to strengthen customer bonds and build a more resilient, profitable business with higher LTV and AOV.

This customer-first approach isn't just a "nice to have" anymore; it's a necessity. Research shows a huge gap between how brands and customers see things. While 84% of businesses think they're delivering great personalized engagement, only 54% of customers agree. That 30-point gap is a massive opportunity for brands that get segmentation right.

A smart way to move beyond broad discounts and connect with these different customer groups is by using price segmentation strategies. This means that instead of a one-size-fits-all price tag, you can align the value—and the price—with what specific groups are willing to pay.

Ultimately, the best rewards aren't confusing point systems or margin-killing discounts. They're tangible incentives that feel like real value, like native Shopify store credit. This guide will walk you through how to use segmentation to map these value-based rewards to your most important customer groups, creating a virtuous cycle of retention and profit.

By mastering this, you'll be well on your way to building effective retention marketing strategies that turn casual shoppers into your brand's biggest fans.

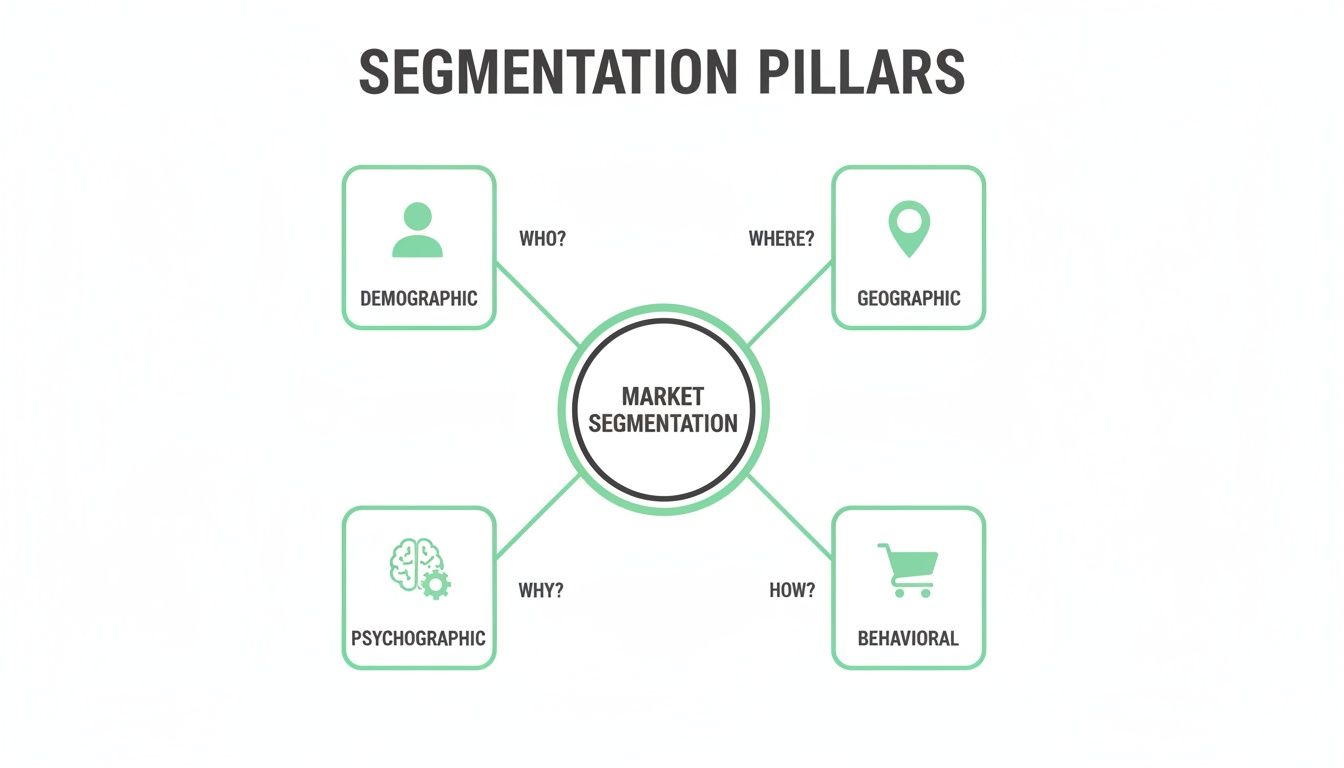

The 4 Pillars of Ecommerce Segmentation: A Practical Guide

Forget the one-size-fits-all marketing of the past. For any serious DTC brand, market segmentation isn't just a strategy; it's the core of your entire approach. It’s about seeing your audience not as a single blob, but as a collection of distinct groups, each with its own story, needs, and motivations.

Think of it like this: you wouldn't build a house using just one material for everything from the foundation to the roof. You need a solid framework. These four pillars give you that structure, helping you figure out not just who your customers are, but more importantly, why they buy from you.

Demographic and Geographic: The Starting Point

Let's start with the basics. Demographic and geographic data are the foundational layers—the "who" and "where" of your customer base. They give you the essential context before you can dig into what really makes people tick.

Demographic Segmentation: This is about grouping customers by straightforward, measurable traits like age, gender, income, or occupation. A skincare brand, for example, isn't going to talk to a Gen Z customer worried about breakouts the same way they talk to a Baby Boomer looking for anti-aging creams. The products, messaging, and even the marketing channels will be completely different.

Geographic Segmentation: This is even simpler. It’s all about organizing customers by their physical location, whether that’s a country, city, or even climate zone. An apparel brand would be wasting money promoting heavy parkas to shoppers in Miami while missing a huge opportunity by not showing them to customers in Chicago during the winter.

Now, these two pillars are crucial, but they only tell part of the story. Relying on them alone is a rookie mistake. Knowing a customer is a 30-year-old woman from California doesn't explain why she buys your sustainable yoga pants instead of a competitor's. To get to that gold, we need to look at the next two pillars.

Psychographic and Behavioral: Where the Real Magic Happens

This is where segmentation goes from a simple organizing tool to a powerful engine for boosting LTV and AOV. Psychographic and behavioral data show you the "why" and "how" behind every click and purchase, letting you craft marketing that truly connects.

By layering psychographic and behavioral insights on top of basic demographics, you transform a flat customer profile into a three-dimensional persona. This is how you stop selling products and start building relationships that drive repeat purchases and increase lifetime value.

Psychographic segmentation is all about a customer's inner world. It groups them by things like:

Lifestyle: Are they an adventurous, outdoorsy type or a homebody who lives for comfort?

Values: Do they obsess over sustainability and eco-friendly products, or are they motivated by luxury and status?

Interests: What are their passions and hobbies when they're not shopping?

A coffee brand, for instance, might identify an "eco-conscious millennial" segment. This person isn't just buying coffee; they're buying into a brand that reflects their values. The right way to market to them is by highlighting ethically sourced beans and compostable packaging, not by shouting about a 10% discount.

Finally, we have behavioral segmentation, which is arguably the most important pillar for any ecommerce store. It groups customers based on their direct actions and interactions with your brand:

Purchase History: Is this a brand-new customer, a loyal VIP, or someone who only ever shops your Black Friday sale?

Engagement Level: Do they open every email you send, or have they gone dark for the last 90 days?

Product Usage: Do they buy the same moisturizer on repeat, or are they always checking out your new arrivals?

A perfect example is creating a segment of "cart abandoners" or people who view a specific product three times but never buy. Instead of a generic blast, you can send them a targeted email that overcomes common objections or even offer a small, risk-free native Shopify store credit to nudge them over the finish line. This is about using real behavior to drive a specific, profitable action.

Of course, identifying these distinct groups requires a deep dive into your customer data. You can learn more about this foundational process by exploring resources on target audience research.

Using Advanced Segmentation Models to Drive LTV

The four pillars of segmentation are a great start, but if you want to really move the needle on customer lifetime value (LTV) and average order value (AOV), you need to get more sophisticated. Advanced segmentation models are where the magic happens. They help you shift from just categorizing customers to actively predicting what they'll do next.

This is the real heart of smart market segmentation marketing. You stop shouting the same message at everyone and start having meaningful conversations. It’s about knowing that the journey from a curious first-time buyer to a die-hard brand fan requires different nudges and rewards—like store credit—along the way.

RFM Analysis for Instant Customer Insights

For any Shopify brand, RFM analysis is a game-changer. It’s powerful, it’s effective, and it gives you a crystal-clear, data-driven snapshot of who your best customers are. It stands for Recency, Frequency, and Monetary Value.

Recency: When was their last purchase? A customer who bought last week is worlds away from someone who hasn't visited your site in a year.

Frequency: How often do they come back? A monthly regular is infinitely more valuable than a one-and-done holiday shopper.

Monetary Value: How much do they spend when they buy? Big spenders obviously have a bigger impact on your bottom line.

Using this simple scoring system, you can instantly group customers into actionable segments. Think "Champions" (high on all three), "Loyalists" (high frequency), and "At-Risk" (low recency). You wouldn't treat them the same, right? A Champion might get a surprise store credit as a thank you, while an At-Risk customer needs a gentle nudge back with a small credit offer to boost LTV.

Value-Based Segmentation to Focus on Profitability

RFM is great for looking at past behavior, but value-based segmentation is all about the future. It helps you zero in on the customers who are most likely to have the highest lifetime spend, so you can stop wasting your marketing budget on the wrong people. This is about investing in profitable relationships, not just chasing cheap transactions.

The idea is to calculate a customer’s potential LTV and group them into tiers—something like "High-Potential," "Medium-Potential," and "Low-Potential." Your best marketing efforts, especially high-impact rewards like native store credit, should be aimed squarely at that high-potential group to lock in their loyalty and maximize their lifetime value. If you want to dive deeper, we've put together a guide on how to calculate customer LTV.

The goal is simple: stop burning cash trying to win over low-value shoppers with endless discounts. Instead, invest that money in turning your best customers into your most passionate advocates. That’s how you build a business that lasts.

The infographic below shows how the four core pillars serve as the foundation for these more advanced models.

This map gives you a great visual for how demographic, geographic, psychographic, and behavioral data points all come together to paint a complete picture of your customer, making these more sophisticated models possible.

Lifecycle Stage Segmentation for a Personalized Journey

Finally, lifecycle segmentation is all about timing. It means tailoring your message to where a customer is in their relationship with your brand. Think about it: the way you talk to someone who just made their first purchase should be completely different from how you talk to a long-time fan.

Common lifecycle stages look something like this:

New Customers: Their only job is to make a second purchase. Welcome them with open arms, show them the ropes with a great onboarding series, and maybe offer a small store credit for their next order to increase their potential LTV from day one.

Active Customers: These are your regulars. Keep them in the loop with new product drops and reward their loyalty with store credit to boost their average order value.

Lapsed Customers: They've gone quiet. It's time for a gentle "we miss you" campaign, perhaps with a compelling store credit offer to win them back.

Brand Advocates: These are your superstars. Give them exclusive access, referral programs, and surprise-and-delight rewards that make them feel like VIPs.

Getting this right is especially crucial with younger demographics. For example, recent research shows that Gen Z spending is growing twice as fast as that of previous generations. They are on track to add $8.9 trillion to the global economy by 2035. Using lifecycle segmentation to build a genuine connection with this group isn't just a good idea—it's essential for your future growth.

By putting these advanced models to work, you can graduate from generic marketing blasts to personalized, one-on-one conversations that build real loyalty and send your LTV soaring.

Rewarding Segments with the Store Credit Advantage

Figuring out who your customer segments are is a huge win. But it’s only half the battle. The real question is: what do you do with that knowledge?

A powerful market segmentation marketing strategy isn't just about sending different emails. It's about delivering different kinds of value. And this is precisely where so many brands trip up, defaulting to the easiest—and most destructive—tool in their arsenal: the discount code or a confusing points system.

Relying on constant sales creates a vicious cycle. You end up attracting one-time bargain hunters, training your best customers to just wait for the next sale, and slowly bleeding your profit margins dry. The alternative isn't some complex loyalty program nobody understands. It's something far simpler and more powerful for driving LTV and AOV: native Shopify store credit.

Why Store Credit Outperforms Discounts

Let's think about the psychology of a reward for a moment. A 10% off coupon feels like a negotiation. It implies your original price was too high and forces the customer to do math at checkout. Confusing point systems often feel like a chore with little tangible benefit.

Now, contrast that with $10 in store credit. That feels like a gift. It's tangible, immediate, and people see it as actual money just waiting to be spent at your store.

This simple shift changes everything. Instead of devaluing what you sell, store credit reinforces its worth. It doesn’t just nudge someone to make a purchase; it practically guarantees they'll come back, which is step one for boosting customer lifetime value (LTV).

Store credit is a pull strategy, not a push strategy. It pulls customers back to your store with value they already possess, fostering a sense of ownership and loyalty that a fleeting discount code or abstract points system can never replicate.

This approach has a direct impact on your most important growth metrics. Because customers treat store credit like "house money," they're far more likely to spend beyond their credit balance. This behavior consistently drives up average order value (AOV), turning a retention play into a profit driver.

Mapping Store Credit Rewards to Key Segments

The real magic happens when you combine segmentation with store credit. You can put your retention budget to work with surgical precision, rewarding the exact behaviors you want to see more of and re-engaging the customers you can't afford to lose. It’s all about giving the right reward to the right person at the right time.

Here are a few practical ways to do this on your Shopify store:

The VIP Segment (Champions): These are your ride-or-dies, the customers with top-tier RFM scores. Instead of a generic loyalty program, surprise them with a generous store credit drop as a genuine thank-you. An unexpected reward like this builds an emotional connection that predictable points just can't match, securing their high lifetime value.

The At-Risk Segment (Lapsed Customers): This group hasn't bought anything in a while. A "we miss you" email with a 15% off coupon is easy to ignore. But an email with the subject line, "You have $5 waiting for you"? That’s almost impossible to resist. A small, targeted store credit is the perfect nudge to get them back in the game.

The New Customer Segment (First-Time Buyers): The single most important goal for a new customer is getting them to make a second purchase. Offer a small store credit right after their first order to encourage a quick return. This closes the gap between transactions, boosts their AOV on the next purchase, and starts building a high-LTV habit from day one.

As you start to design these reward strategies, it’s worth digging into the different ways to implement a Shopify store credit program so it perfectly aligns with your brand’s goals.

The Power of Native Shopify Integration

For any of this to work, the experience has to be seamless. This is where a native Shopify app makes all the difference. The image below shows how a truly integrated loyalty program can feel like a natural part of your store, not some clunky, third-party add-on.

This kind of clean, on-brand integration means customers can easily see and use their credit without ever leaving your site or getting lost in a confusing external portal. By using an app that works natively within Shopify's ecosystem, you avoid slow-loading scripts and messy setups, keeping your site fast and making management a breeze.

At the end of the day, market segmentation is about building a more resilient and profitable business. By moving away from margin-killing discounts and confusing points systems to embrace the strategic power of native store credit, you can reward your best customers, increase AOV, and foster the kind of genuine loyalty that forms the bedrock of sustainable growth.

Putting Your Shopify Segmentation Strategy into Action

Alright, enough with the theory. A great market segmentation marketing plan isn't some dusty document you file away—it’s a living, breathing roadmap for growing your Shopify brand. It’s how you turn raw customer data into campaigns that actually move the needle on customer lifetime value (LTV) and average order value (AOV).

We're going to break this down into five straightforward steps. This isn't about getting lost in spreadsheets; it's about being intentional and using smart tactics, like targeted native store credit rewards, to build real loyalty. Let's get to work.

Step 1: Set Clear and Measurable Goals

Before you even think about creating a segment, you have to know what you're trying to accomplish. And no, "increase sales" doesn't count. That’s a wish, not a goal. You need to get specific and tie your objectives to LTV and AOV.

Think more along these lines:

"Boost the repeat purchase rate of our first-time buyers by 15% this quarter."

"Increase the LTV of our VIP segment by 20% in the next six months."

"Win back 10% of our 'at-risk' customers within the next 60 days."

See the difference? These clear targets become your north star, guiding every decision you make, from the segments you build to the store credit offers you send.

Step 2: Analyze Your Customer Data

With your goals locked in, it’s time to roll up your sleeves and dig into the data. You don't need a data science degree for this. Your own Shopify Analytics is a fantastic starting point, giving you a goldmine of information on purchase habits, locations, and order history.

Layer that with insights from your email platform to see who's actually opening your messages and clicking your links. Look for the natural patterns that emerge. Who has the highest LTV? Who buys frequently but has a low AOV? And who ghosted you 90 days ago? These initial clusters are the raw material for your first segments.

Step 3: Create Your First High-Impact Segments

Don’t boil the ocean by trying to create a dozen segments right out of the gate. That's a recipe for analysis paralysis. Instead, start small with a few high-impact groups that directly serve the goals you just set.

Your first few segments should be your biggest levers for growth. We almost always recommend starting with a "VIP" group (your high-LTV stars), a "New Customer" cohort, and an "At-Risk" segment to get the most bang for your buck early on.

For instance, your "VIPs" could be the top 10% of customers based on their lifetime spend. Your "New Customers" are anyone who placed their first order in the last 30 days. This laser-focused approach makes building, launching, and measuring your campaigns infinitely more manageable.

Step 4: Build and Launch Segmented Campaigns

This is where the magic happens. It’s time to connect your segments to targeted actions. Forget the generic, sitewide discount blasts. We’re going to map specific native store credit strategies to each group to encourage the exact behavior we want to see.

The table below shows a simple but powerful way to map segments to specific store credit rewards.

Sample Segment and Store Credit Strategy

Customer Segment | Primary Goal | Marketing Action | Store Credit Reward |

|---|---|---|---|

VIP Customers | Increase LTV & Advocacy | Send a surprise-and-delight email thanking them for their loyalty. | A generous, unexpected $25 store credit. |

New Customers | Drive a Second Purchase & Increase LTV | Create a welcome email flow that highlights your brand's story and bestsellers. | A $10 store credit to use on their next order. |

At-Risk Customers | Reactivate & Win Back | Launch a "we miss you" campaign that reminds them of your brand's value. | A small, enticing $5 store credit to encourage a return visit. |

Using native store credit this way feels like a genuine reward, not a desperate discount. It protects your brand equity while predictably driving repeat business and boosting AOV.

Step 5: Measure and Refine Your Approach

Launching your first campaign is just the starting line. The final—and most important—step is to measure everything. Keep a close eye on the LTV, AOV, and repeat purchase rates for each segment and compare them to your baseline. Did your "New Customer" segment actually hit that 15% repeat purchase goal? Did the AOV of your VIPs increase?

This data-driven feedback loop is your secret weapon. It tells you what’s working, what’s not, and where to double down. You’ll quickly learn what makes each group tick, allowing you to fine-tune your store credit offers for even better returns.

Personalization isn’t just a buzzword; it’s a proven revenue driver. In fact, a recent report found that 56% of marketing leaders are actively increasing their spending on personalization because they know it works. If you want to dive deeper, you can learn how technology is impacting marketing strategies and stay ahead of the curve.

Answering Your Top Questions About Market Segmentation

Got questions? You're not alone. Here are the most common things we hear from Shopify brands diving into segmentation. Think of this as your quick-start guide to getting it right, with a sharp focus on boosting LTV and AOV using smart rewards like native store credit.

How Many Segments Should I Start With?

It's tempting to slice and dice your customer list into a dozen different groups right away, but trust me, that's a recipe for analysis paralysis. Keep it simple.

Start with 3 to 5 core segments. Focus on the groups that represent your biggest growth opportunities for LTV and AOV.

A great starting point for almost any Shopify store looks like this:

Your VIPs: These are your best customers with high lifetime spend. They love you, so love them back with exclusive store credit rewards.

New Customers: Anyone who bought in the last 30 days. Your goal here is simple: get them to make that crucial second purchase.

"At-Risk" Customers: Shoppers who haven't bought anything in 90+ days. They need a gentle nudge to remind them why they shopped with you in the first place.

Once you’ve got a handle on these foundational groups and have some clear wins, then you can get more granular. The goal is to start small, get results, and build momentum.

Why Is Store Credit So Much Better Than Discounts?

This is a big one. Moving away from the endless cycle of discount codes or confusing points is critical for brand health, and native store credit is the perfect alternative for three key reasons.

First, it practically guarantees a return visit. A discount code is easy to ignore. But store credit? That feels like actual cash sitting in a customer's account, creating a powerful psychological pull to come back and spend it, directly impacting LTV.

Second, it naturally pushes up your average order value. Customers almost always treat store credit as "house money." This little mental trick encourages them to spend more than their credit balance to get the item they really want. Suddenly, your retention tool is also driving immediate profit.

A discount tells a customer your product is worth less. A store credit reward tells them they are worth more. Constant sales train people to wait for a lower price. Store credit, especially when given as a surprise reward, feels like a genuine perk that builds real loyalty.

Finally, it protects your brand's integrity. By breaking free from the "20% off" hamster wheel and avoiding complicated point systems, you stop conditioning customers to only buy on sale. You start attracting people who value what you make, not just a cheap deal.

What Tools Do I Really Need for This on Shopify?

You absolutely do not need a hugely expensive and complex Customer Data Platform (CDP) to pull this off. You can get started with a powerful segmentation strategy using tools you likely already have.

Your essential tech stack for market segmentation is surprisingly lean:

Shopify Analytics: This is ground zero. Your Shopify backend is packed with foundational data on purchase history, location, and order value. It’s all right there.

Your Email Service Provider: Platforms like Klaviyo or Omnisend are built for this. They have incredibly powerful, user-friendly segmentation features that let you group customers based on all sorts of behaviors.

A Native Store Credit App: To make this all seamless, a dedicated app is a must-have. It automates the rewards and makes the experience feel polished and on-brand for your customers without slowing down your site.

That’s it. That combination—native Shopify data, your email platform, and a specialized native store credit app—is the perfect toolkit for running a highly effective segmentation strategy focused on LTV and AOV.

How Do I Know If My Segmentation Efforts Are Actually Working?

To measure the ROI, you have to track your key metrics on a per-segment basis. Don't just look at store-wide numbers.

First, get your baseline. Before you launch anything, benchmark the current LTV, AOV, and repeat purchase rate for your entire customer base. These are your "before" pictures.

Then, as you roll out store credit campaigns to each segment, watch those same three metrics for each specific group. For instance, you can directly compare the LTV of your VIP segment before and after you introduce a surprise store credit reward program. A successful strategy will show a clear, measurable lift in these KPIs, proving your efforts are directly impacting your lifetime value and average order value.

Ready to stop discounting and start building profitable relationships? With Redeemly, you can replace margin-killing coupons with native Shopify store credit rewards that boost LTV and AOV. See how easy it is to launch a loyalty program that actually grows your business.

Join 7000+ brands using our apps