How to Compare Shopify Loyalty Apps and Boost Lifetime Value

Jan 6, 2026

|

Published

When you're weighing your Shopify loyalty options, it really boils down to one critical choice: do you want a complex points program that hands out discounts, or a simpler, more profitable model built around native Shopify store credit?

The smart money is on the approach that boosts lifetime value (LTV) and average order value (AOV) by treating rewards like cash, not coupons. This builds genuine loyalty and encourages full-price purchases instead of training your customers to just wait for the next sale.

The Hidden Costs of Traditional Shopify Loyalty Programs

So many Shopify brands are stuck in a cycle of points and discounts that quietly eats away at their profit margins. The real kicker is that traditional loyalty programs often create transactional, discount-seeking customers, not true brand fans. They inadvertently teach shoppers to devalue your products by always holding out for the next deal, which is a direct hit to your bottom line and your customer's lifetime value.

This guide will walk you through how to compare Shopify loyalty models without getting lost in the weeds. We’re going to challenge the old-school thinking behind confusing point systems and endless coupon codes. Instead, let's look at a simpler, far more powerful alternative: native store credit.

Why Old Models Fall Short

The fundamental flaw with points-based systems is abstraction. A reward like "200 points for $5 off" creates a mental hurdle for your customers. This often leads to low engagement and even lower redemption rates. It’s a classic case of "points fatigue," meaning your loyalty efforts often go to waste because the value isn't immediately clear.

Discount-driven loyalty isn't much better. It attracts one-time bargain hunters, not the repeat buyers who drive sustainable growth and high lifetime value. At the end of the day, these customers are loyal to the deal, not to your brand.

The goal of a modern loyalty program isn't just to reward a transaction; it's to build an asset. By issuing store credit, you're investing in a future full-price purchase, directly boosting customer lifetime value (LTV) and protecting your margins.

A Profitable Alternative: Store Credit

By shifting your focus to a native store credit model, you can fundamentally change how customers behave. Store credit feels like real cash in their account, creating a strong psychological pull to come back and spend it. It’s a simple change with powerful results for key growth metrics:

Increase Average Order Value (AOV): Customers are motivated to add more to their cart to reach credit-earning thresholds, directly increasing the value of each transaction.

Boost Lifetime Value (LTV): Shoppers have a compelling reason to make repeat, full-price purchases, creating a profitable cycle of loyalty.

Protect Profit Margins: You finally break free from the revenue-draining cycle of constant discounting.

This comparison will lay out a clear path to building a loyal customer base that actually contributes to your brand’s financial health.

To make this crystal clear, let's break down how these three models stack up against each other on the metrics that matter most: LTV and AOV.

Shopify Loyalty Model Comparison

Metric | Native Shopify Store Credit | Points-Based Programs | Discount-Driven Loyalty |

|---|---|---|---|

Profit Margin Impact | Protects margins; cost is realized on future full-price purchases. | Moderate erosion; points are redeemed for discounts. | High erosion; directly cuts revenue from each sale. |

AOV Motivation | High; customers add items to hit "spend-to-earn" thresholds. | Moderate; requires complex tiers to motivate higher spending. | Low; encourages buying only when a discount is available. |

Customer LTV | Increases LTV by driving repeat, profitable sales. | Can increase LTV, but often with lower-margin customers. | Attracts transactional buyers with low long-term value. |

User Experience | Simple and intuitive; feels like cash in their account. | Often confusing; customers struggle to track or value points. | Simple, but trains customers to devalue the brand. |

As you can see, when you put them side-by-side, the native store credit model consistently delivers better outcomes for your bottom line and for building a sustainable, long-term relationship with your customers.

Why Points and Discounts Are Quietly Killing Your LTV

When you're weighing loyalty strategies on Shopify, it's easy to fall back on what you know. Points and discounts have been the go-to for decades, but they come with some serious hidden costs that eat away at your long-term growth. They breed a transactional mindset, teaching customers to undervalue your products and ultimately torpedoing your customer lifetime value (LTV).

The fundamental flaw with points is the mental math they demand. Abstract conversions like “earn 200 points for $5 off” create a gap between a customer's action and the reward. This friction is a killer, leading to what we call ‘points fatigue’—customers either can't be bothered to figure out the value or just lose interest. You end up with dismal engagement and even worse redemption rates, meaning all that investment goes right down the drain.

Discount-driven loyalty is even more blunt in its damage. When you constantly push coupons, you're training your best customers to wait for a sale. You condition them to see the discounted price as the real price, which absolutely crushes your margins and lifetime value. You end up with a customer base full of bargain hunters who are loyal to the deal, not to you, and who will jump ship the second a competitor offers a bigger discount.

The Margin Erosion and Cannibalization Trap

Let's be clear: discounts are a direct assault on your revenue. Instead of giving a customer a real reason to make a future purchase, a discount just carves out profit from a sale you were probably going to make anyway. That's classic revenue cannibalization.

Think about this all-too-common scenario:

A loyal customer is ready to buy a $100 product at full price.

Your loyalty program sends them a 20% discount code.

They apply it, pay $80, and you just lost $20 in margin instantly.

This model does nothing to encourage a second purchase or increase lifetime value; it just makes the current one less profitable. It's a short-term play that actively undermines the long-term customer relationships you're trying to build.

How Confusing Points Drive Down Engagement

Points systems throw up a psychological wall. Customers have to stop and translate points into dollars, a task that feels more like a chore than a reward. This complexity is precisely why so many people tune out.

A loyalty program that requires a calculator is a program that’s destined to fail. The value should be immediate and obvious, creating a clear incentive for the customer to return and spend again, not to solve a math problem.

Instead of feeling appreciated, customers often feel confused or just plain indifferent. They rack up points they never use, and your loyalty program becomes dead weight instead of a powerful retention tool. When you compare loyalty Shopify apps, this user experience friction is a massive red flag. A system nobody uses is a complete waste of money. To really get a handle on how these models hit your bottom line, you need a solid guide on customer lifetime value calculation.

Store Credit: A Smarter Path to Higher LTV

Now, let's flip the script and look at a native Shopify store credit model. A customer spends $100 and gets $10 back in store credit. That credit feels like real cash just sitting in their account, creating a powerful psychological pull to come back and spend it.

When they return, they're far more likely to make another full-price purchase to use that credit. They might grab another $100 item, apply their $10 credit, and pay $90. Boom. You’ve just secured a second, highly profitable sale and strengthened their loyalty without ever cheapening your brand. This simple change directly boosts LTV by driving the right kind of repeat purchases, turning one-time buyers into genuine, long-term assets.

Driving Profitable Growth with Native Shopify Store Credit

We've seen how points and discounts can quietly eat away at your margins and lifetime value. So, what’s the alternative? It’s time to look at a smarter, margin-safe approach: native Shopify store credit. This isn't just another reward tactic; it's a completely different way of thinking about profitable customer relationships. You're moving away from confusing points and race-to-the-bottom coupons and toward a strategy that actually grows both lifetime value and your average order value.

The real magic of store credit is in its simplicity and psychological punch. When a customer gets $10 in store credit, it doesn’t feel like some abstract reward. It feels like real cash waiting for them in their account. That creates a tangible, powerful reason to come back and shop again, turning a simple reward into a direct driver of repeat business and higher LTV.

The Power of Native Shopify Integration

One of the biggest wins here is how seamlessly this approach fits into the Shopify ecosystem. Unlike third-party apps that can feel clunky or rely on heavy scripts, a native store credit solution is built right into Shopify's own framework.

This is a huge deal for your brand for two reasons:

Faster Store Performance: You avoid all the bloated code that can drag down your site speed, which helps protect your conversion rates and keeps the user experience snappy.

A Flawless Checkout Experience: Customers see and apply their store credit right inside the native Shopify Checkout. No weird redirects, no confusing pop-ups—just a smooth, trustworthy process.

This native functionality makes the whole loyalty experience feel like an organic part of your brand, not some bolted-on afterthought.

The best loyalty programs feel invisible to the customer—they are simple, intuitive, and seamlessly integrated into the shopping journey. Native store credit achieves this by leveraging Shopify’s own infrastructure to deliver a reward that feels valuable and effortless to use.

Better yet, this model is a lifesaver for your cash flow. A discount is an immediate hit to your revenue on the current sale. Store credit, on the other hand, only becomes a cost when a customer comes back to redeem it on a future purchase. This protects your revenue today while locking in a subsequent, often full-price, sale tomorrow.

Boosting AOV and LTV with Smart Incentives

Store credit is brilliant at nudging customers to spend more without you having to slash prices. You can set up simple "spend-to-earn" tiers—think "Spend $100, Get $10 Back." This gives shoppers a crystal-clear incentive to add just one more item to their cart to hit that threshold, directly pushing up their average order value.

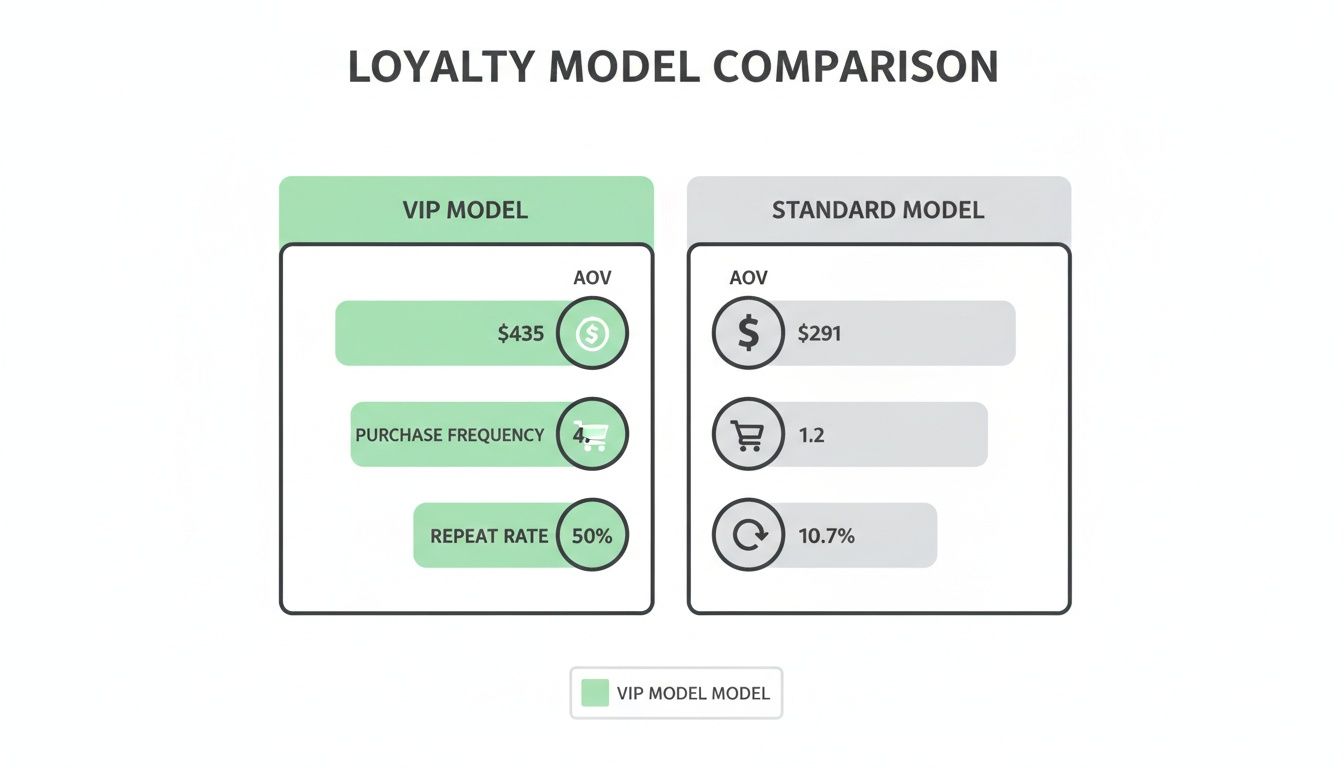

This model becomes a powerful engine for profitable, sustainable loyalty. And the data backs it up, big time. We’re seeing Shopify merchants who switch from points to store credit find their VIP customers with tier status generating a 73% higher AOV—a staggering $435 per order versus $291 for everyone else. Those same customers also make 4.3 purchases on average compared to just 1.2 for non-tiered shoppers. That's a massive 3.6X increase in how often they buy.

If you dig deeper into the loyalty data, you’ll find that customers who redeem store credit have a 50% repeat purchase rate, a huge leap from the 10.7% for non-redeemers. Learn more from this 2025 loyalty report.

By focusing on store credit, you're not just rewarding one-off transactions; you're building a cycle of profitable growth. Customers spend more to earn credit, then come back to use it, deepening their connection to your brand each time. When you compare loyalty Shopify solutions, the unique ability of store credit to protect your margins while driving both AOV and LTV makes it the clear winner for any brand serious about long-term success.

A Head-to-Head Comparison of Loyalty Models

When you're looking at loyalty solutions for your Shopify store, it really boils down to three main players: native store credit, abstract points programs, and good old-fashioned discount codes. Each one hits your business differently, affecting everything from your profit margins to your customers' lifetime value.

Let's cut through the noise and compare these models on the metrics that actually drive profitable growth: average order value and lifetime value. You'll see pretty quickly how native store credit builds lasting value where the other models often just chip away at your bottom line.

Impact on Profit Margins

This is where the differences are most stark—and often the deciding factor for smart merchants.

Discounts are the most obvious margin-killer. A 20% off coupon means you're literally giving away 20% of your revenue on that sale. It’s a direct hit. Worse, it trains customers to wait for the next sale, cheapening your brand in the long run.

Points programs feel a bit more sophisticated, but they’re essentially just delayed discounts. Customers collect points, then cash them in for coupons that—you guessed it—cut into the revenue of a future sale. The damage isn't as immediate, but the end result is the same: margin erosion.

Native Shopify store credit flips this entire script. A reward like "$10 back on your next purchase" isn't a discount. It's an incentive to lock in a future, full-price sale. You only incur the cost when that customer comes back to spend again, protecting the margin on the first sale while guaranteeing a second.

Effect on Average Order Value

Getting customers to spend more per order is the name of the game, and this is another area where store credit shines. It creates clear, achievable spending goals. Think about it: an offer like "Spend $100, Get $10 in Store Credit" is a powerful motivator to add just one more item to the cart. The reward is tangible; it feels like earning real cash back.

Discount codes often do the exact opposite. Why spend more when the discount applies anyway? Points systems try to create spending tiers, but the abstract nature of "earn 200 points" just doesn't have the same psychological punch as "get $10 back." That mental math creates friction and kills the impulse to up the cart value.

The data doesn't lie. For many Shopify stores, repeat customers already drive 40% of revenue, spend 12-18% more per order, and convert at 9 times the rate of new shoppers. A tiny 5% lift in retention can explode profits by 25-95%. This isn't just theory—across over 100 brands, customers who redeem rewards have a staggering 65% repeat purchase rate, compared to just 12.3% for those who don't.

This visual breakdown shows exactly how VIPs in a solid loyalty program outperform everyone else.

It’s clear: focusing on real loyalty with valuable rewards directly drives higher average order value and more frequent purchases.

Customer LTV and Retention

Here’s where you prove the long-term ROI of your strategy. The ultimate goal is to boost Customer Lifetime Value (LTV) by getting people to buy again and again. Store credit is a retention machine because it gives customers a concrete reason to come back. That $10 sitting in their account feels like an unspent gift card—a powerful psychological nudge that discounts could never replicate.

Points programs often fall victim to "points fatigue." Customers forget they have them, or the system is too complicated, leading to abysmal redemption rates. Discounts just attract deal-hunters who are loyal to the sale, not your brand, which means their LTV is predictably low. Store credit, on the other hand, builds a natural, profitable cycle of repeat business. You can see a deeper breakdown of how a modern Shopify store credit app makes this happen.

Implementation and User Experience

Finally, let’s talk about the customer's side of things. The best loyalty programs are the ones you don't have to think about. They just work.

Because they're built directly into Shopify’s architecture, native store credit solutions are seamless. There are no clunky third-party widgets slowing down your site or confusing off-site portals to log into. Customers earn and spend their credit right inside the native Shopify checkout they already know and trust.

A native experience is clean, fast, and feels like a true part of your brand. In contrast, many points-based apps force customers into a disjointed journey, making them log into a separate site just to see their balance. That friction kills engagement. When you're comparing your options, a seamless, truly native experience should be non-negotiable if you want to maximize participation and, ultimately, LTV.

How to Choose the Right Loyalty Strategy for Your Brand

Alright, we've broken down the options. Now comes the most important part: deciding which loyalty strategy actually fits your brand. When you compare loyalty solutions on Shopify, it's not about finding some mythical "best" app. It's about matching the right model to your specific business needs, whether you're just starting out or you're a household name.

The choice you make here will have a direct impact on your profitability, how often customers come back, and your brand's long-term health.

This decision really boils down to what you're trying to achieve. Are you laser-focused on protecting your profit margins? Is your number one goal to bump up that average order value (AOV)? Or are you playing the long game, trying to build customer lifetime value (LTV) by encouraging more full-price purchases? Getting clear on these priorities will light the path forward.

A Decision Checklist for Your Business

To make this dead simple, let's use a quick checklist. Run each model through these filters based on your top priorities and see which one really shines.

Your Goal: Maximize AOV. If getting customers to add just one more item to their cart is your mission, a tiered, native Shopify store credit system is tough to beat. Simple "spend-to-earn" thresholds give a tangible reason for shoppers to hit that next spending level.

Your Goal: Protect Profit Margins. If giving away margin makes you queasy, store credit is the only model that doesn't directly eat into your revenue. Unlike a discount, the credit becomes a real cost only on a future purchase—which is often at full price.

Your Goal: Simplify the User Experience. Are you trying to escape a slow, confusing app? A lightweight, native Shopify solution is the answer. It gets rid of the complicated points math and clunky portals that frustrate customers and kill engagement.

Your Goal: Increase Customer LTV. To build a tribe of true repeat buyers, store credit gives them a compelling, cash-like reason to return. It directly encourages the exact behavior that drives up lifetime value.

Tailored Recommendations for Different Business Profiles

The right strategy often depends on where you are in your growth journey. Let’s look at a couple of common scenarios.

For a startup trying to lock in its first 100 loyal fans, the simplicity and margin protection of native store credit is a perfect match. You can build a solid foundation of repeat customers without burning through precious cash on blanket discounts.

For an established brand optimizing for maximum LTV, a more sophisticated store credit program becomes a powerhouse. You can segment customers, create exclusive VIP tiers, and use earned credit to drive consistent, profitable re-engagement from your most valuable shoppers. It’s also worth noting that some brands go beyond points and create a winning brand ambassador strategy to build even deeper community ties.

The data is clear: loyalty programs are no longer a "nice-to-have." A staggering 44% of Shopify stores without one are already in the process of adding one, 48% plan to start soon, and only a tiny 6% are ignoring them completely.

The proof is in the numbers from over 100 Shopify merchants. Members of a loyalty program make 67% more purchases, and when a program contributes 15-25% of total revenue, you know it’s working. This is especially true when a member’s AOV is 12-18% higher than a non-member's. It’s an undeniable sign that a well-chosen loyalty program is a primary engine for growth.

Ultimately, picking your loyalty strategy is a critical business decision. By using this checklist and being honest about your goals, you can confidently choose the model that will not only make your customers happy but also build a more profitable and sustainable brand for years to come.

Shopify Loyalty Program FAQs

Trying to sift through all the Shopify loyalty apps and strategies can feel overwhelming. It’s easy to get lost in the options, but finding the right answers is crucial for picking a path that actually grows your business instead of just eating into your margins.

Let's tackle some of the most common questions we hear from merchants, focusing on what really matters: boosting lifetime value (LTV) and average order value (AOV).

The big decision really boils down to your main objective. Are you trying to reward one-off transactions with a quick discount, or are you building a real asset that encourages customers to come back and make full-price purchases? A native store credit system is built for that second goal, directly lifting both LTV and AOV.

Which Shopify Loyalty Model Has the Best ROI?

While every store is different, native store credit programs almost always deliver the most impressive and sustainable ROI. The reason is simple: they directly impact the metrics that matter most to your bottom line, specifically LTV and AOV.

A discount is an immediate, sunk cost on a sale. Store credit, on the other hand, protects your profit margin on that first purchase. It then acts as a powerful incentive for customers to place larger orders later, spending their credit on full-priced items. This naturally increases both average order value and customer lifetime value, creating a profitable repeat purchase loop that forms the bedrock of a solid ROI.

Can Store Credit Really Replace Points and Discounts Completely?

Absolutely. For most direct-to-consumer brands, a well-executed store credit system is a far more effective and profitable replacement. It’s designed to fix the inherent flaws of those older, more confusing models by focusing on increasing lifetime value.

When you get rid of abstract points, you sidestep the "points confusion" that tanks engagement and redemption rates. Instead of conditioning your customers to hold out for the next big sale, you're giving them a tangible, cash-like reason to shop again soon. This builds a much stronger financial—and psychological—tie to your brand, which is key to boosting LTV.

The most powerful loyalty programs feel less like a game and more like a genuine benefit. Store credit achieves this by being simple, tangible, and directly valuable, making it a superior alternative to complex point conversions and margin-eroding discounts for driving repeat purchases.

Will a Native Shopify Loyalty App Slow Down My Store?

No, and this is a huge advantage of sticking with a native Shopify app. These tools are built from the ground up to work seamlessly within Shopify’s ecosystem, which means they’re incredibly lightweight and optimized for performance. If you want to get into the nuts and bolts, you can learn more about how to issue store credit on Shopify and its native benefits.

Many third-party points apps rely on clunky, external scripts that can drag down your site speed, hurting the user experience and your conversion rates. A native app avoids all that bloat, keeping your store fast while delivering a smooth, perfectly integrated loyalty experience right inside the checkout.

Ready to build a more profitable loyalty program? Redeemly replaces confusing points and margin-killing discounts with simple, cash-like store credit that boosts LTV and AOV. Get started today.

Join 7000+ brands using our apps