The Shopify Store Credit App Playbook for AOV and Lifetime Value

Dec 16, 2025

|

Published

Are you tired of the endless discount cycle that eats away at your profits? A Shopify store credit app offers a smarter, more sustainable path to growth. Instead of one-off deals that attract bargain hunters, you build real loyalty by giving shoppers a tangible dollar balance to spend in your store. This is the key to turning first-time buyers into high-value, repeat customers and significantly boosting customer lifetime value (LTV).

Why Smart Merchants Ditch Discounts for Store Credit

For a long time, discount codes were the standard playbook for driving sales. While they can deliver a quick bump in revenue, they often attract customers loyal only to the deal, not your brand. This creates a vicious cycle that chips away at your profit margins and devalues your products over time.

Worse, constant discounting trains your customers to wait for the next promotion. That's why savvy merchants are looking past temporary fixes and embracing a more powerful strategy built for long-term profitability: native store credit.

The Problem with Traditional Loyalty Methods

The fundamental flaw with old-school tactics like coupons and complicated point systems is that they create transactional relationships, not emotional connections. Customers become loyal to the discount, not to you.

Discount Coupons: These are a direct hit to your bottom line. They immediately lower your average order value (AOV) and teach shoppers that paying full price is a mistake.

Confusing Point Systems: Let's be honest, points are abstract. They create a mental hurdle where customers have to do the math to figure out what their points are actually worth. This complexity kills excitement and reduces engagement.

This is exactly where a native Shopify store credit app changes the game. It cuts through the noise by offering customers something that feels just like cash in their pocket—a clear, simple dollar amount they can spend.

By replacing fleeting discounts with a persistent store credit balance, you create a powerful incentive for customers to return. This simple shift is fundamental to boosting customer lifetime value and protecting your margins.

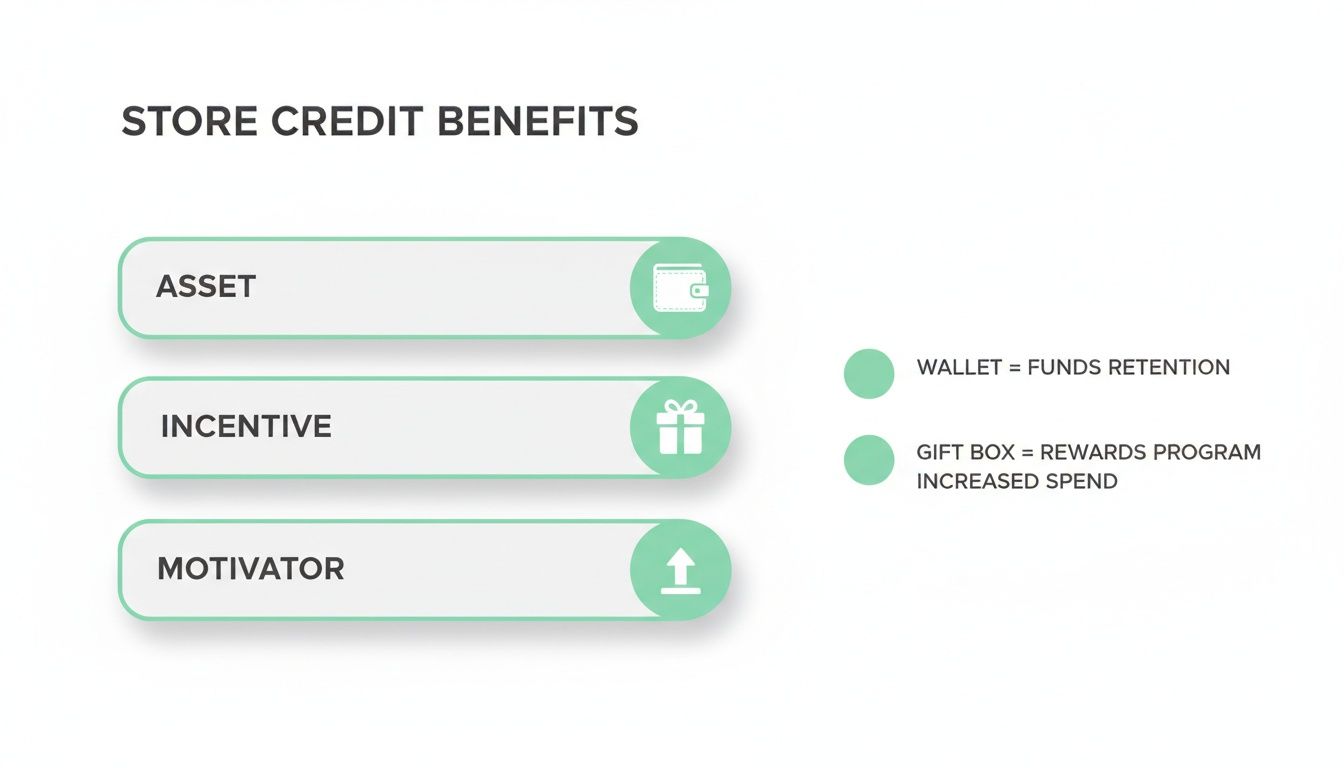

Think of store credit as a proactive marketing tool. You can use it for rewarding your best customers, running cashback campaigns, and resolving support issues gracefully. This approach keeps cash flowing within your business, encourages shoppers to explore new products, and ultimately increases both AOV and LTV.

Thinking Beyond Refunds: How Store Credit Really Works

Let’s be honest, most of us think of store credit as a last resort for returns. It’s the tool you pull out to avoid a cash refund, hoping to keep the sale. But that’s an outdated, defensive way of looking at it. A modern Shopify store credit app flips that script entirely, turning a simple refund tool into one of your most powerful marketing assets.

Think of it less like a refund and more like a dedicated digital wallet for your brand, permanently attached to a customer's account. It’s a constant, gentle reminder that they have money to spend with you. Unlike a discount code that gets buried in an email or a points balance that feels abstract, store credit is real, visible value just waiting to be used.

From Refund Tool to Marketing Asset

This is where the magic happens for your key growth metrics. When store credit is native to your Shopify store, it becomes a seamless part of the checkout. A customer with a balance sees it right there as a payment option—just as easy to use as their credit card or Shop Pay. No codes to copy, no hoops to jump through.

That frictionless experience is everything. It eliminates the mental math that comes with confusing points systems ("Wait, how many points do I need for $10 off?"). A $15 store credit feels like finding cash in your pocket. It’s simple, exciting, and motivates an immediate desire to spend it.

Store credit doesn't just salvage revenue from a single return; it actively creates future revenue. It’s a commitment from the customer to come back, effectively locking in their next purchase and pulling them deeper into your brand's world.

This "locked-in" value is a massive driver for repeat business and a higher lifetime value. A shopper with a balance is far more likely to return than one without. They’ve already got a head start on their next purchase, which makes it that much easier to click "buy," keeps you top-of-mind, and increases their overall spend with your brand over time.

Driving Loyalty and Higher Spending

Once you stop seeing store credit as just a returns tool, you can start using it proactively to build real, lasting loyalty that directly impacts AOV and LTV. It becomes a flexible way to reward customers and nurture those relationships.

Here are a few ways to put it to work:

VIP Perks: Surprise your top customers with a "just because" credit. It’s a simple thank you that makes them feel genuinely valued and encourages their next high-value purchase.

Loyalty Rewards: Ditch the complicated points. Offer cashback-style credit on purchases. This directly motivates people to add more to their cart (increasing AOV) to earn more back for future orders (increasing LTV).

Customer Service Fixes: Turn a frustrating experience around in an instant. Offering immediate store credit shows you care and practically guarantees they’ll give you another chance, preserving their potential lifetime value.

In every one of these scenarios, you’re not just giving away money—you're reinforcing positive behavior and strengthening the bond with your customer. This strategy feeds a powerful cycle of repeat purchases, which is the absolute foundation of a high customer lifetime value.

The Financial Case for a Store Credit Strategy

Let's move past the theory and talk about what really matters: the numbers. Choosing to bring a Shopify store credit app into your business isn't just a nice-to-have; it's a decision rooted in solid financial gains. While discounts erode your bottom line and points systems often create more confusion than loyalty, a smart store credit strategy directly fuels your most important growth metrics: Average Order Value and Customer Lifetime Value.

It all comes down to a simple psychological shift. A discount code feels temporary, a fleeting win. But a store credit balance? That feels like their money—a wallet they can only spend in your store. That feeling is what unlocks real, sustainable growth.

Skyrocket Your Average Order Value

One of the first things you'll notice is a jump in your Average Order Value (AOV). It’s human nature. When a customer has a $10 credit, they almost never spend just $10. Instead, that credit acts as a springboard for a bigger purchase.

Suddenly, that premium product or that extra "just in case" item feels much more justifiable. They see the credit as "found money," which makes them far more likely to add more to their cart and spend beyond the credit amount. You get a natural, consistent lift in order size without having to run a margin-crushing sale.

Think about it: Customers with a store credit balance spend, on average, 20-50% more than the value of the credit itself. That's not just a sale; it's an upsell that paid for itself, directly boosting your AOV.

This simple idea—turning credit into a spending incentive—is a powerful motivator for customers to spend more per transaction.

As you can see, a balance in a customer's account is a constant, gentle nudge, encouraging them to come back and complete a higher-value purchase.

Supercharge Customer Lifetime Value

Store credit is about playing the long game. Beyond a single transaction, it's a powerful engine for boosting Customer Lifetime Value (LTV)—the true north star for any healthy eCommerce business. And a native store credit program is one of the best tools you have to grow it.

Every time you issue credit, you’re not just handling a return or rewarding a purchase; you're giving that customer a concrete reason to come back. When they see that balance in their account on Shopify, it creates a powerful pull to return and shop again. This is where the magic happens for your cash flow and LTV, as data consistently shows customers with credit are far more likely to become repeat buyers.

This cycle of earning and spending builds powerful habits, turning casual shoppers into your most loyal fans. If you want to get serious about tracking this, check out our guide on how to calculate customer LTV.

Protect Your Precious Profit Margins

Finally, let's talk about profitability. Discount codes are a blunt instrument—a direct and immediate blow to your revenue. A 20% off coupon means you instantly kiss 20% of that sale's revenue goodbye. Store credit, on the other hand, is a much more elegant and effective way to protect your margins while driving growth.

Here’s why it works so well:

It’s a deferred cost: You only feel the cost of the credit when a customer actually uses it on a future purchase, often one with a higher AOV.

It keeps cash in your business: Instead of cash refunds that drain your bank account, offering credit for returns keeps that revenue locked inside your ecosystem.

It avoids the race to the bottom: You maintain the perceived value of your products because you aren't constantly slashing prices just to make a sale.

To put it all in perspective, here’s a quick comparison of how these strategies stack up financially.

Financial Impact Store Credit vs Discounts vs Points Systems

Metric | Native Store Credit | Discount Codes | Points Systems |

|---|---|---|---|

Profit Margins | Protected. Cost is deferred and tied to a future full-price purchase. | Immediately reduced. A direct cut from top-line revenue on every sale. | Eroded over time. Liability grows as points accumulate, often without a clear ROI. |

Customer LTV | High. Encourages repeat purchases and builds long-term loyalty. | Low to Moderate. Attracts one-time, deal-seeking customers. | Moderate. Can build loyalty, but complexity often hurts engagement. |

Cash Flow | Positive. Keeps refund money in the business, improving working capital. | Negative. Direct revenue loss; no built-in retention mechanism. | Neutral to Negative. Unpredictable redemption cycles create financial liability. |

By moving away from constant discounts and toward a store credit model, you’re fundamentally changing your approach. You stop sacrificing profit for a quick win and start investing in long-term, profitable relationships that maximize customer lifetime value.

How to Launch Your Store Credit Program

Alright, let's move from theory to action. Getting a store credit system up and running is probably easier than you think. Modern, native apps plug right into your Shopify dashboard, making the whole setup process surprisingly straightforward—no coding required.

The whole point is to get your program launched quickly so you can focus on the good stuff: boosting customer lifetime value and your average order value. Let's walk through the exact steps you need to take to get this powerful new strategy off the ground with confidence.

Choosing the Right Shopify Store Credit App

First things first: you need an app that works with Shopify, not against it. This is where a native Shopify store credit app is non-negotiable. "Native" simply means it uses Shopify's own built-in store credit technology, which guarantees a seamless, fast, and reliable experience for everyone involved.

Steer clear of solutions that rely on clunky external widgets or overly complex integrations that slow your site down. A truly native app like Redeemly feels like it’s just another part of your store. This keeps the customer experience buttery smooth from the moment they earn credit to the second they spend it at checkout.

Configure Your Core Settings

Once you’ve installed the app, it’s time to lay the groundwork. This is where you define the "rules of engagement" for how customers earn and spend their credit.

Here are the key settings you'll want to dial in:

Issuance Rules: Decide when you’ll award credit. Is it for product returns? A reward for hitting a certain spending threshold? Maybe as part of a cashback campaign designed to lift AOV? A great starting point is to automate credit for returns to protect your cash flow.

Automation: This is the magic. Set up triggers that issue credit automatically without you lifting a finger. For instance, you could create a rule that gives a customer $5 in credit right after their second purchase. That’s a powerful nudge to increase their lifetime value.

Customer Notifications: Customize the emails that tell customers they've received credit. Make them clean, on-brand, and exciting. You want people to see the notification, understand the value, and immediately start thinking about what they'll buy next.

The best store credit programs feel effortless because they are. The system should hum along in the background, rewarding your customers and driving repeat business without needing you to constantly step in.

Launch Your First Campaign

With your settings locked in, you're ready to go live. A fantastic way to kick things off is with a small, targeted campaign aimed at your best customers.

Pull a list of your VIPs or loyal repeat buyers and surprise them with a "just because" thank-you credit. It's a simple gesture, but it can create an incredible amount of goodwill and often sparks immediate sales, increasing their LTV even further.

This first campaign is also a perfect test run. Keep an eye on the redemption rates and the AOV of orders placed with credit. As you gather real-world data, you can start fine-tuning your approach and exploring more advanced strategies. For more ideas on nurturing these relationships, our guide on building a powerful client engagement strategy has some great tips.

Proven Store Credit Plays to Drive Growth

Alright, you've got the framework down. Now let's put it to work. Think of your Shopify store credit app as a playbook for boosting AOV and LTV. Instead of always leaning on margin-killing discounts, you can roll out creative strategies that get people excited and drive real revenue.

These "plays" are all about making your customers feel valued. They shift the entire conversation from a single transaction to building a lasting, high-value relationship.

Surprise and Delight Your VIPs

Let's be honest, your best customers deserve special treatment. Find your top spenders or most frequent shoppers and drop a "surprise and delight" credit into their account out of the blue. It feels incredibly personal—way more than just another generic coupon code.

Objective: Maximize the lifetime value of your best customers by showing appreciation and giving them a compelling reason to make another purchase.

How-to: It's simple. Segment the top 10% of your customers and send them a $15 credit with a quick, personalized "thank you" note. A small gesture like this can create a massive amount of goodwill and lock in their loyalty.

Turn Customer Service into a Win

A bad experience doesn't have to end with a lost customer. When something goes wrong—a shipping delay, a damaged item—offering instant store credit can completely turn the situation around. It’s a fast, graceful way to show you care and want to make it right.

Issuing store credit for a support issue isn't just a refund; it's an investment in a second chance. It gracefully resolves the problem while securing their next purchase, often turning a potential detractor into an advocate and preserving their LTV.

This move protects your cash flow and gives you another shot at delivering an amazing experience. This is a core part of any smart customer retention plan. For a deeper dive, check out our guide on retention marketing strategies that actually work.

Run Rewarding Cashback Campaigns

Points systems are confusing. Instead, try running a "cashback" campaign where customers earn a percentage of their purchase back as store credit. Think: 10% back in store credit on all orders over a holiday weekend. This feels way more immediate and valuable than an abstract points reward.

This strategy is a powerhouse for bumping up your average order value. Shoppers will happily add more to their cart to get more credit back, seeing it as an investment in their next purchase. This simultaneously boosts AOV on the current order and LTV by encouraging a future one.

It’s easy to see why this approach is catching on. By 2025, it's predicted that 87% of Shopify merchants will be using third-party apps to handle key functions like this, with many zeroing in on loyalty and credit to keep customers coming back.

When you pair a great rewards program with a smooth, optimized website, you've got a winning formula. To help with that, check out these actionable conversion rate optimization tips.

Making the Switch from Discounts to Store Credit

Let’s be honest: breaking up with discount codes can feel daunting. If your customers are hooked on that 20% off coupon, the thought of taking it away is enough to cause a cold sweat.

But what if you're not taking something away? What if you're giving them something better? That’s the entire mindset shift behind moving to store credit. You’re not just ending discounts; you're graduating your customers to a more valuable, seamless reward system that protects your margins and builds real, long-term customer value.

It's All in How You Frame It

This transition lives and dies by your communication. You can't just pull the plug on discount codes and hope for the best. You need to announce the launch of a new, upgraded loyalty experience built around native store credit.

Highlight the Simplicity: Think about it from their perspective. "No more hunting for coupon codes! Your rewards are now waiting for you in your account, ready to spend." It’s a message of pure convenience.

Showcase the Value: Explain that this credit is just like cash in your store. It's more flexible than a coupon that only works on specific items or has a high minimum spend.

Frame it as a Genuine Upgrade: Position the move as a direct response to making their shopping experience better. This isn't a cost-cutting measure; it's a value-add for your best customers.

When you get the messaging right, you turn a potentially rocky change into a welcome new benefit.

A successful transition hinges on framing store credit not as a replacement for discounts, but as an evolution of your rewards program. Focus on the ease, transparency, and tangible value it provides to the customer.

Migrating from an Old Points Program

If you’re already running a confusing points-based system, you have a golden opportunity. Don't just shut it down and leave loyal customers with a pile of worthless points. That's a surefire way to lose trust.

Instead, create a "points conversion event." Announce that you're moving to a simpler, cash-value system. As a thank you, you'll be converting every last one of their hard-earned points into a generous store credit balance.

This one move does two critical things: it honors their past loyalty and immediately gives them a balance to spend. It’s the perfect way to kick off your new program, drive a fresh wave of sales, and prove the power of using a Shopify store credit app right from the start.

Got Questions About Shopify Store Credit? We've Got Answers.

Making a change to how you handle customer loyalty is a big decision, and it’s smart to have questions. When you're sifting through various e-commerce apps for your Shopify store, getting straight answers is the only way to pick the right tool for the job. Let’s tackle the most common questions merchants have when moving to a native store credit strategy.

What Does Native Store Credit Actually Look Like for My Customers?

It feels like a built-in part of your store, not some clunky add-on. A native Shopify store credit app weaves the credit balance directly into your customer’s account page.

When they log in, they’ll see their store credit sitting right there next to their order history—clear as day. At checkout, that balance automatically shows up as a payment option, ready to be applied with a single click. No codes, no confusion. It’s a completely smooth experience that builds trust and encourages spending.

Is Store Credit Really Better Than a Points System for LTV?

For the vast majority of stores, it’s a night-and-day difference. Why? Because store credit feels like real money.

A $10 credit has a clear, immediate value that customers understand instantly. On the other hand, 1,000 points feel like an abstract currency they have to decode. That simple clarity leads to much higher redemption rates and gives customers a powerful reason to come back and spend their balance. The result is a faster, more direct impact on their lifetime value.

A dollar balance feels like real money waiting to be spent, which is a far more powerful motivator for a return visit than a complicated points total. This simplicity is its greatest strength.

Can I Put an Expiration Date on Store Credit?

Absolutely, and you should. Any good store credit app will let you set custom expiration dates. This is one of your best tools for creating a little urgency and getting customers back into your store sooner rather than later, which shortens the time between purchases and boosts LTV.

You can get strategic with it, too. For instance, you could set a 90-day expiration for a special promotional credit you're running, but offer a much longer window for credit issued from a product return. It's all about controlling the experience.

Ready to replace confusing points and margin-killing discounts with a loyalty system that drives real profit? With Redeemly, you can launch a native store credit program that boosts AOV and LTV from day one. Get started with Redeemly today.

Join 7000+ brands using our apps