Why Is Loyalty Important to Your Shopify Store's Growth?

Jan 30, 2026

|

Published

Customer loyalty is the single most powerful—and most overlooked—growth engine for your Shopify store. It's the critical difference between constantly pouring money into finding new buyers and building a solid base of repeat customers who generate predictable, high-margin revenue.

Forget chasing one-off sales. Real growth comes from maximizing the lifetime value (LTV) and average order value (AOV) of every single person who clicks "buy."

The Real Cost of Chasing New Customers

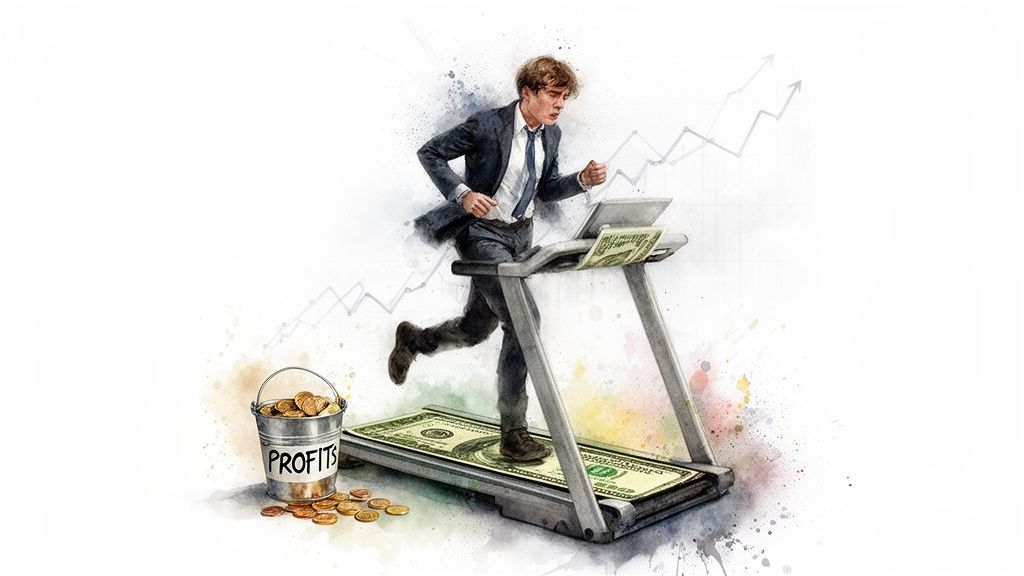

The endless pursuit of new customers feels a lot like running on a treadmill. You’re spending a ton of energy and cash on ads, influencer campaigns, and promotions, but your business isn’t actually moving forward. This "acquisition-at-all-costs" mindset creates a dangerous cycle where your profits are immediately eaten up just trying to replace the customers who never come back.

For too many ecommerce brands, this strategy is a leaky bucket. You keep pouring money into acquiring customers at the top, only to watch them drain out the bottom after one purchase. The result is almost always the same: stagnant growth and thinning profit margins.

The Downward Spiral of Discounts

Relying on discount codes is one of the fastest ways to kill your brand and your bottom line. Sure, a 20% off coupon might snag a new sale today, but it sets a terrible precedent for tomorrow. You're accidentally training customers to wait for the next sale, teaching them that your products are only worth buying at a discount.

This approach is a direct assault on your profitability. Every discount you offer is a straight-up reduction in your average order value (AOV) and lifetime value (LTV). You're building a relationship based on price, not on the quality of your product or the experience you provide.

This constant cycle of acquiring and losing customers isn't just expensive; it's completely unsustainable. The cost to acquire a new customer is a staggering 5 to 10 times higher than keeping an existing one. That makes a loyalty-focused strategy a financial necessity, not a nice-to-have.

Reframing the Goal from Acquisition to Lifetime Value

The only way to break free is to understand why loyalty matters from a purely financial standpoint. Customer acquisition shouldn't be the end goal; it should be the starting line for a long-term, profitable relationship.

Here’s how a simple shift in focus can completely change your business model:

From One-Time Sales to Lifetime Value: Instead of optimizing for a single transaction, you start optimizing for the total amount of money a customer will spend with you over their entire lifetime.

From High Ad Spend to Organic Growth: Loyal customers become your best marketing channel. They tell their friends and family about you, driving word-of-mouth sales that cost you nothing.

From Eroded Margins to Healthy Profits: Smart retention strategies, like Shopify-native store credit, protect your margins. They encourage repeat purchases at full price, which drives up both AOV and LTV.

To really cut down on churn and build a tribe of repeat buyers, you have to continually improve your ecommerce customer experience. This is the foundation you build lasting loyalty on—the thing that finally turns that leaky bucket into a fortified reservoir of revenue you can count on.

Getting Real About Loyalty's Impact on Your Bottom Line

Let's get one thing straight: customer loyalty isn't some fluffy marketing idea. It’s a rock-solid financial strategy that separates the brands that thrive from those that barely survive.

Think of it this way. Building a business on one-time, discount-hungry shoppers is like building on quicksand. Every sale is a struggle, and you’re always spending more to find the next customer. But building on a foundation of loyal customers? That’s like building on bedrock—it creates predictable, high-margin revenue that you can count on.

Imagine a loyal customer is a compounding investment. Your initial customer acquisition cost (CAC) is the money you put in. A single purchase is a small, one-time return. But when that customer comes back again and again, their value starts to snowball, growing with every order—and you didn't have to spend another dime to acquire them.

The Big Three Metrics That Loyalty Supercharges

This compounding effect isn't just a theory; you can see it plain as day in three critical ecommerce metrics. These aren't just numbers on a dashboard; they're the vital signs of your store’s financial health. When you focus on loyalty, every single one of them gets a powerful boost.

Repeat Purchase Rate: This is simply the percentage of your customers who come back to buy again. A high rate means you're turning that initial acquisition cost into a reliable revenue stream.

Average Order Value (AOV): This is how much a customer spends in a single transaction, on average. Loyal customers trust you. They know your quality. And because of that, they consistently spend more than brand-new buyers.

Customer Lifetime Value (LTV): This is the big one—the total profit you can expect from a single customer over their entire relationship with your brand. LTV is the ultimate scoreboard for a healthy, sustainable business.

When you ditch confusing point systems and profit-killing discounts for a simple, Shopify-native store credit model, you give customers a crystal-clear reason to return and spend more. This directly juices both your lifetime value and average order value.

The financial upside here is staggering. Research has shown that a tiny 5% increase in customer retention can boost profits by a whopping 25% to 95%. For a Shopify merchant, that’s pure gold—it means growing your revenue without having to pour more money into the ever-escalating cost of ads.

From a Vague Idea to Real Dollars

Let's walk through a real-world example.

Say a new customer spends $80 on their first purchase. If you’re just chasing sales with discounts, they might take their 15% off and you'll never see them again. Your total revenue from that customer is $80, minus your acquisition cost and the discount you gave away.

Now, let's try a Shopify-native store credit approach. That same customer spends $80 and gets $4 back in store credit. That credit doesn't feel like a coupon; it feels like free money sitting in their account. It’s a powerful psychological nudge to come back.

When they do return, they often add more to their cart to "make the most" of their credit, pushing their second order to $100.

Just like that, one customer has generated $180 in revenue. Their average order value just went up, they became a repeat purchaser, and their lifetime value is officially on a healthy upward climb. That’s the simple, powerful math of a retention-first strategy. To truly appreciate the long-term financial benefits, this guide on What Is Customer Lifetime Value and How It Accelerates Growth is a must-read.

This isn’t just theory—it’s a proven playbook for building an ecommerce brand that lasts. By focusing on the customer journey after that first click of the "buy" button, you turn your existing customers into your most valuable asset.

Want to get a better handle on this key metric? Check out our guide on how to calculate customer LTV and see what it says about the health of your business.

Why Your Points and Discount Strategies Are Actually Hurting You

For years, ecommerce brands have been stuck in a loyalty loop, defaulting to one of two playbooks: slash prices with discounts or build a complicated points program. And while both can give you a quick sales hit, they’re fundamentally broken. They're short-term tactics that actively eat away at your long-term profitability and do very little to build real customer relationships.

Let's start with discounts. Leaning on discount codes is the fastest way to kill your margins. Every time you flash a 15% or 20% off banner, you're doing more than just giving up revenue on that one sale. You're training your customers to believe your products are never worth paying full price for. This creates a culture of bargain-hunters who just wait for the next sale, torpedoing your average order value (AOV) and lifetime value (LTV) in the process.

This isn't just a theory; the numbers back it up.

As you can see, even a tiny lift in genuine loyalty sends profits soaring. Why? Because loyal customers simply spend more, more often. Discounts attract deal-seekers, not fans.

The Problem with Points Programs

Points programs seem like the sophisticated older sibling of discounts, but they often create more headaches than they solve. The biggest issue is simple: confusion.

When a customer sees they’ve earned 100 points, what does that even mean? Is it $1? Is it $10? This ambiguity creates a mental roadblock. Instead of feeling like a genuine reward, it feels like a math problem they have to solve just to use a coupon. That friction is often enough to make them not bother at all, which completely defeats the purpose.

Beyond the customer confusion, points are a growing liability on your balance sheet. Every unredeemed point is debt you owe, creating accounting nightmares and unpredictable future costs. It's a system that adds complexity for everyone involved without delivering clear, tangible value.

A loyalty program should make it easier for a customer to come back, not harder. When they have to decode point values or hunt for discount codes, you’re putting up walls instead of building bridges.

The best loyalty strategies make customers feel smart and appreciated for choosing you. This is why newer approaches like cash back rewards are so effective—they feel just like real money, which is the same psychological driver behind a powerful, Shopify-native store credit system.

Comparing Loyalty Models Impact on Your Business

Let's put these models head-to-head to see why this matters so much. When you look at the real-world impact on your most important metrics, the right choice becomes incredibly clear.

Metric | Discount Coupons | Points Systems | Native Store Credit (Redeemly) |

|---|---|---|---|

Profit Margins | Directly slashes margins on every sale. It's a race to the bottom. | Creates a deferred liability that complicates financials and can be expensive. | Protects full-price sales. It only becomes a cost when redeemed on a future purchase. |

Customer Experience | Trains customers to devalue your brand and wait for the next promotion. | Often confusing. Customers don't know the real cash value of their points. | Simple and tangible. It feels like real money in their account, ready to spend. |

Average Order Value | Often lowers AOV as people buy just enough to qualify for the deal. | Can slightly increase AOV, but the complexity often gets in the way. | Directly boosts AOV as customers add more to their cart to earn more credit. |

Lifetime Value | Actively destroys LTV by attracting one-and-done bargain hunters. | Can improve LTV, but apathy and confusion limit its true potential. | Massively increases LTV by giving customers a powerful, concrete reason to return. |

The verdict is in. Discounts and points are relics of a bygone era. They’re transactional tools that just don’t build the durable, profitable relationships needed to grow a modern ecommerce business.

Switching to a Shopify native store credit model isn't just a small change—it’s a fundamental strategic shift. It aligns your loyalty program directly with your financial health, protecting margins while giving customers an irresistible reason to increase their AOV and LTV. This is why loyalty matters: it's about building a sustainable growth engine, not just chasing another one-off sale.

Store Credit: The Secret to Loyalty That Doesn't Tank Your Margins

So, we've seen how easily traditional discounts and points programs can eat away at your profits. It's time for a better way. The answer isn't another complicated system; it's a shift toward a durable, asset-based reward: Shopify native store credit. This is the key to building real, margin-safe loyalty that actually fuels your growth instead of draining it.

A flimsy coupon code gets used once and then completely forgotten. But store credit? That acts like a dedicated brand wallet for your customer. It’s their money, just waiting to be spent exclusively in your store. That simple shift in perception has a massive psychological impact.

Why Store Credit Just Feels Different

At its core, store credit works because it feels tangible and valuable. A 15% off coupon is just an abstract concept, but $10 in store credit is a concrete asset sitting right there in a customer’s account. That creates a powerful, immediate reason to come back.

Here’s an analogy I like to use: a coupon binder is a chaotic mess of potential savings that you have to work to redeem. A digital wallet, on the other hand, is organized, sleek, and ready to spend. Customers don't have to hunt for codes or do math in their head. They see their balance and feel a natural urge to use what’s already theirs.

This "money in the bank" feeling is what really drives repeat purchases, which gets to the heart of why loyalty is so important for sustainable revenue. You’re turning a one-and-done transaction into a continuous cycle of earning and spending.

By rewarding customers with store credit, you're not just giving them a one-time deal; you're essentially pre-loading their next purchase. This gives them a compelling reason to return that doesn't depend on profit-killing discounts.

And this shift doesn't just feel good—it has a direct, positive effect on your most important metrics, especially Average Order Value (AOV) and Lifetime Value (LTV).

How Store Credit Automatically Boosts AOV and LTV

One of the most powerful things about a native store credit program is its built-in ability to get customers to spend more, almost without thinking about it. When shoppers know they can earn credit back, they’re naturally motivated to add a little more to their cart to hit the next reward level.

Think about a real-world scenario. A customer is about to check out with an $85 cart. But then they see a little notification: spend $100 and get $10 in store credit. What happens? More often than not, they’ll find another item to toss in. It's a simple, automated upsell that boosts AOV right on the spot, and you didn't have to slash a single price.

This behavior compounds over time, and that’s where you see a dramatic increase in lifetime value.

First Purchase: The customer spends a bit more to earn their initial credit.

Second Purchase: They come back specifically to use that credit, and they almost always spend more than the credit amount itself.

Third Purchase: After another great experience, their trust in your brand deepens, and their spending habits become more established.

Each step in this cycle strengthens the customer relationship and grows their LTV, all while protecting your margins. The credit only becomes a "cost" when a customer returns to make another full-price purchase, which is a much healthier financial model than just giving away revenue upfront. By keeping it simple and providing real, cash-like value, native store credit can turn loyalty into your most reliable engine for growth.

Implementing a Store Credit Program That Actually Works

Let's be honest, switching from the familiar world of discounts to a store credit system can feel like a big move. But it's simpler than you think, and it's the key to building a loyalty engine that drives profitable growth on autopilot. We're talking about boosting lifetime value and average order value without creating a management nightmare for yourself.

The best part? A modern, native store credit program integrates directly into your Shopify store. No more clunky, third-party widgets that slow down your site and create a confusing checkout for your customers. A native solution just works, making the whole experience seamless for everyone.

Setting Up Your Earning Rules

First thing's first: how do customers actually earn their credit? The most powerful and easy-to-understand approach is a simple spend-based model. This gives customers a clear reason to add that one extra item to their cart, directly nudging your average order value (AOV) higher.

A great place to start is offering a straightforward percentage back on every single purchase. For example:

Rule: Get 5% back in store credit on every order.

Example: When a customer spends $100, they instantly get $5 added to their store account. Simple as that.

This isn't some confusing points system. It's a clear, cash-like incentive that feels tangible. A customer understands what $5 is—it feels like real money waiting for them, which is a powerful motivator to come back and make that next purchase. You can dive deeper into the setup in our guide on how to give store credit on Shopify.

Making Your Program Visible and Engaging

Once your rules are set, you have to shout about it. Your store credit program isn't just a backend function; it’s one of your best marketing tools. Use on-site widgets and notifications to constantly remind shoppers of the value they're building with every click.

Your store credit balance should act as a constant, gentle reminder of the value waiting in a customer's account. By making it visible on every page, you turn a simple reward into an ever-present reason to return and shop.

Think about adding a floating wallet icon to your site that always shows a customer’s live credit balance. It’s a small visual cue, but it keeps their rewards top-of-mind, turning that balance into a little shopping fund that follows them as they browse. On top of that, sprinkle in messaging on your product and cart pages showing customers exactly how much credit they’ll earn on this specific order.

Automating Reminders to Drive Repeat Purchases

The final piece of the puzzle is putting the system to work for you. A truly effective store credit program doesn't just sit there waiting; it actively brings customers back to your store. This is where automated emails come in.

Set up simple, automated reminders that go out whenever a customer has credit just sitting in their account. These aren't just another marketing blast—they're some of the highest-converting emails you will ever send. A personal note saying, "Hey, you have $10 in credit waiting for you!" is infinitely more powerful than yet another "20% Off" sale banner.

This kind of smart, automated retention is exactly why the loyalty space is booming. The global loyalty management market is on track to explode from $15.19 billion in 2025 to a staggering $41.21 billion by 2032. Why? Because brands everywhere are waking up to the fact that profitable growth comes from keeping the customers you already have. You can discover more insights about these loyalty market trends here. By putting a simple, automated store credit system in place, any Shopify merchant can get in on this and build a much more resilient business.

Proving the ROI of Your New Loyalty Strategy

It's one thing to launch a new strategy; it's another thing entirely to prove it's actually working. The beauty of a Shopify-native store credit program is that its success isn't some fuzzy, feel-good concept. It's something you can see and measure in the numbers that matter most to your business.

This is where we move beyond guesswork. Forget about vanity metrics like points earned or random coupons clipped. We need to zero in on the KPIs that directly fuel profitable growth. Your loyalty dashboard should revolve around the big three: Lifetime Value (LTV), Average Order Value (AOV), and Repeat Purchase Rate. These are the vital signs of a healthy, sustainable ecommerce brand.

From Good Idea to Tangible Growth

The first metric you'll want to watch is your Average Order Value. With a native store credit system in place, you should see a real, measurable lift here. When a customer knows they're close to unlocking their next reward, they'll often add just one more item to their cart to get there. Just like that, your AOV climbs without you ever having to slash your prices.

Next, keep a close eye on your Repeat Purchase Rate. Store credit is like a powerful magnet, constantly pulling customers back for their second, third, and fourth purchase. That credit sitting in their account is a subtle, persistent reminder of the value waiting for them at your store. It’s what turns one-time shoppers into a reliable stream of revenue.

The ultimate scoreboard for your loyalty program is its direct impact on Customer Lifetime Value. LTV isn't just one metric; it's the powerful combination of a higher AOV and more frequent purchases, all rolled into a single number that tells you the total profit a customer brings to your business. It's the true north of any retention strategy.

Connecting the Dots to Your Bottom Line

When you get a rising AOV and a higher repeat purchase rate working together, the effect on your LTV isn't just additive—it's exponential. You’re not just making a little more money on each order; you're getting more orders over time from the customers who matter most. This is the financial engine that a well-designed store credit program is built to power.

By tracking these three KPIs, you can build an undeniable business case for focusing on retention.

Track Your AOV Lift: Compare the average cart size of customers using the store credit program against those who aren't. Is there a clear difference?

Monitor the Repeat Rate: What percentage of first-time buyers who earned credit came back to make a second purchase?

Calculate LTV Growth: Look at the lifetime value of customer groups you acquired after launching the program. How do they stack up against the cohorts from before?

This kind of data-driven thinking turns "loyalty" from a marketing buzzword into a measurable growth channel. It gives you clear, irrefutable proof that by swapping out confusing points and margin-killing discounts, you’re actually building a more profitable and resilient brand for the future.

Got Questions? We've Got Answers

So, we've established why loyalty is a big deal. But how does that translate into a strategy that actually works for your business? Let's tackle the common questions Shopify merchants ask when they're thinking about moving to a store credit loyalty program—one that’s designed to protect your margins and grow lifetime value.

Will Store Credit Eat Into My Profits Like Discounts Do?

Nope. In fact, this is the single biggest reason store credit is the smarter play. Think about it: a discount is an immediate, painful cut to your revenue and margin on the sale you just made.

Store credit, on the other hand, is issued only after a customer pays full price. It becomes a "cost" only when they come back to make another purchase. This completely changes the dynamic.

You get a profitable sale today, and the reward is what guarantees you get another visit tomorrow. It's a much healthier, more sustainable way to encourage repeat business.

Simply put, store credit is an investment in a future sale, not a hit to your profits today. It drives the behavior you want—more full-price orders—making it a fantastic tool for growing your average order value (AOV) and lifetime value (LTV) without giving away your margin.

Isn't This Just Complicated for Customers?

Not at all—and that’s a huge win over those confusing points systems. Points make your customers do mental gymnastics. "What are 500 points actually worth? Is it a dollar? Ten dollars? Who knows?"

Store credit is refreshingly simple because it speaks a language everyone understands: money.

When a customer sees they have $10 in their account, they get it instantly. A good native Shopify solution like Redeemly can even apply it automatically at checkout. This friction-free experience makes your customers feel smart and valued, not confused and frustrated.

How Exactly Does Store Credit Make People Spend More?

It all comes down to a simple, powerful psychological nudge. When your customers see they’re just a little bit away from earning a reward, they’re motivated to add more to their cart to get over the line.

Imagine a shopper with an $85 cart who gets a little pop-up: "Spend $100 and get $10 back!" You'd be surprised how often they’ll happily find another item to hit that number.

This small, automated upsell, repeated across thousands of customers, creates a significant and lasting lift in your store’s AOV.

Ready to see how a real loyalty strategy can impact your bottom line? It's time to ditch the discounts and discover how Redeemly can help you build a profitable retention engine with Shopify-native store credit. Get started with Redeemly today.

Join 7000+ brands using our apps