Master the lifetime value of customer calculation for profitable Shopify growth

Dec 31, 2025

|

Published

Calculating the lifetime value of a customer isn't just another metric to track; it's a fundamental shift in how you view your business. It tells you the total revenue you can realistically expect from any given customer, moving your focus from one-off sales and margin-killing discounts to building long-term, profitable relationships.

Why LTV Is Your Most Important Shopify Metric

It's easy to get tunnel vision on daily sales, conversion rates, and ad spend. While important, those numbers only capture a single moment in time—a transaction. Real, sustainable growth isn't built on isolated purchases. It's built on relationships that bring customers back again and again, increasing both their lifetime value and your store's average order value (AOV).

This is where LTV becomes your north star.

Understanding a customer's lifetime value completely reframes how you operate. You stop asking, "How do I make a sale today?" and start asking, "How do I cultivate a customer who will be valuable for years?" This one shift in perspective will help you make smarter, more profitable decisions across every part of your business.

The Power of a Forward-Looking Metric

Knowing your LTV brings incredible clarity to your marketing budget. If you know the average customer will spend $500 with you over their lifetime, you can confidently spend more than the profit from their first purchase to acquire them. This insight is what allows you to scale ad campaigns profitably instead of just gambling on short-term returns.

But it goes beyond ads. A high focus on LTV forces you to get serious about your retention strategy. It shines a bright light on the immense value locked inside your existing customer base, pushing you to invest in experiences that build genuine loyalty. That means moving away from margin-killing discounts and confusing points systems toward smarter incentives—like native store credit—that boost average order value and encourage repeat purchases without cheapening your brand.

Understanding the Levers of LTV

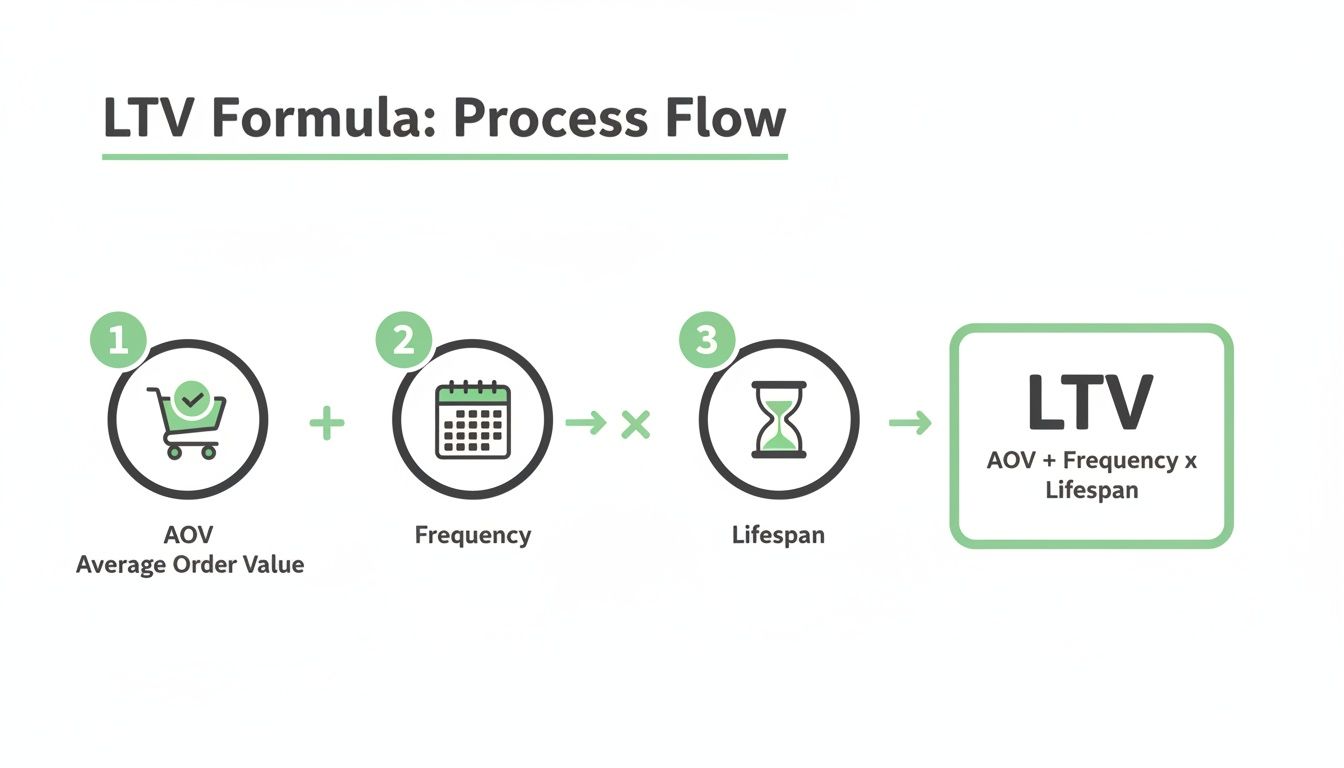

The LTV calculation itself is built on three core business levers. The classic formula is beautifully simple but incredibly powerful:

Average Order Value (AOV) × Purchase Frequency × Customer Lifespan

This equation gives you a clear picture of what a customer is actually worth over time.

Let's imagine a DTC clothing brand. Their AOV is $85, customers typically buy 3.2 times a year, and the average customer sticks around for 2.5 years. Plug those numbers in, and you get an LTV of $680 per customer ($85 × 3.2 × 2.5). Suddenly, you're not just looking at an $85 sale; you're looking at a $680 relationship. For more examples and insights into the LTV formula, check out the resources at Salesgenie.com.

Each part of that formula is an opportunity to grow, especially AOV.

The Core Components of LTV Calculation

The simple LTV formula revolves around three key variables. Understanding what they measure and how a smart, native store credit program can influence them is the first step toward boosting your store's lifetime value and average order value.

Metric | What It Measures | How Native Store Credit Boosts It |

|---|---|---|

Average Order Value (AOV) | The typical amount a customer spends in a single transaction. | Customers with a store credit balance are motivated to spend more to "unlock" their credit or add items to meet a threshold, directly increasing AOV. |

Purchase Frequency | How often a customer returns to buy from your store within a set period. | Store credit acts as a "cash back" incentive, creating a built-in reason for customers to return and make their next purchase sooner than they would with confusing points. |

Customer Lifespan | The total duration a customer actively makes purchases from your brand. | A consistent store credit reward loop fosters loyalty, extending the customer relationship beyond a few transactional purchases driven by discounts. |

By focusing on nudging each of these metrics up—even by a small amount—you can create a massive, compounding impact on your total LTV.

A simple discount might boost one sale, but a well-designed native Shopify store credit system can simultaneously increase average order value, drive repeat purchases, and extend the customer relationship.

This is the kind of strategic thinking that separates thriving brands from those stuck in a constant cycle of chasing one-time sales.

Three Proven LTV Calculation Methods for Shopify

Figuring out the lifetime value of a customer isn't a one-size-fits-all deal. The best method really depends on where your store is at—how long you've been around, what kind of data you're sitting on, and just how precise you need to be. We'll walk through three essential models, starting with a simple calculation and working our way up to a much sharper, profit-focused approach.

For each method, I'll show you exactly where to find the data you need right inside your Shopify dashboard. This will make the lifetime value of customer calculation feel less like a homework assignment and more like unlocking a new level of insight for your business.

The Simple Historical LTV Model

This is the classic formula and the one most people start with: Average Order Value x Purchase Frequency x Customer Lifespan. It's a fantastic starting point because it uses your past sales data to give you a solid baseline for what a typical customer is worth over their entire relationship with you. It’s perfect for newer stores or for when you just need a quick health check on your customer base.

First up, you need your Average Order Value (AOV). This number is a huge lever for profitability and a key component of lifetime value. Think about it—nudging customers to add just one more item to their cart can dramatically boost your bottom line. We have a whole guide on how to calculate AOV you can find at https://www.redeemly.ai/blogposts/how-to-calculate-aov.

Next is Purchase Frequency—how often do your customers come back for more? This is where a smart retention strategy, like a seamless native store credit program, really pays off. A visible store credit balance is a constant, gentle reminder to shop again, pulling customers back far more effectively than a complicated points system they’ll probably forget about.

The last piece of the puzzle is Customer Lifespan, which is the average time a customer sticks around. This can be a bit tricky to pin down if you’re just starting out, but a good estimate is the average time between a customer's very first and very last purchase.

This diagram shows how these three pieces click together.

Each metric builds on the last, creating a powerful multiplier effect that defines your customer's total worth.

Where to find the data in Shopify: Head over to Shopify Analytics > Reports. You can find your AOV under the "Sales over time" report. For purchase frequency and lifespan, you’ll want to export your customer data into a spreadsheet for some quick analysis.

Leveling Up with Cohort Analysis

While the simple model is a great start, its biggest flaw is that it treats every customer the same. But we know that's not true. A customer you acquired during a Black Friday flash sale is going to behave very differently from someone who found you through a blog post in May.

This is where cohort analysis shines.

A cohort is just a fancy term for a group of customers who all started their journey with you around the same time (like everyone who made their first purchase in January 2024). When you track these groups separately, you start to see fascinating trends emerge.

You might find that your January cohort has a stellar LTV because they were the first to experience your new native store credit launch, while the November cohort who came in on a deep discount never came back.

This method shows you the real-world impact of your marketing and retention efforts. Did that new loyalty program actually make customers stick around longer and increase their average order value? Cohort analysis gives you the definitive answer.

Here’s a simplified example of what you might see:

January Cohort: 100 customers, AOV of $80, average of 4 purchases in the first year.

February Cohort: 120 customers, AOV of $75, average of 3.2 purchases in the first year.

Right away, you know the January group is more valuable. Now you can dig in and figure out why. What did you do differently that month? This kind of granular insight is gold—it tells you exactly what to do more of and what to stop wasting money on.

The Margin-Based LTV Calculation for True Profitability

Let's be honest: revenue is vanity, profit is sanity. The most accurate LTV calculation doesn't just look at sales; it looks at the actual profit each customer generates. After all, a customer spending $500 on high-margin products is infinitely more valuable than one spending the same amount on clearance items.

The formula gets a little more advanced here: LTV = (AOV x Purchase Frequency x Customer Lifespan x Gross Margin) - CAC

Let’s quickly break down the new additions.

Gross Margin is the percentage of revenue left after you've paid for the products themselves (Cost of Goods Sold or COGS). A 70% gross margin means for every $100 in sales, you pocket $70 in gross profit.

Customer Acquisition Cost (CAC) is what you spend on marketing and sales to get one new customer in the door.

Imagine your simple LTV calculation gave you a figure of $680. That looks great on paper. But now, let's factor in a 60% gross margin and a $50 cost to acquire each customer.

The real, profit-based LTV is ($680 x 0.60) - $50 = $358.

That $358 is a much more honest and actionable number. It represents the actual profit you can expect from an average customer, which is the key to setting smart ad budgets and understanding the true financial health of your store. If you'd like to explore this further, you might find some useful tips in this guide on How to Calculate Customer Lifetime Value.

This profit-first view is also where you can see why native store credit is so much more powerful than discounts. A 20% off coupon immediately eats into your margin on that sale. Store credit, on the other hand, is earned from a full-price purchase and encourages another profitable, often higher AOV, sale down the road.

Comparing LTV Calculation Methods

To make things clearer, here’s a quick breakdown of the three methods we've covered. Each has its place, and the "best" one really depends on your store's needs.

Calculation Method | Best For | Pros | Cons |

|---|---|---|---|

Simple Historical | New stores, quick snapshots | Easy to calculate using basic Shopify data. | Can be misleading; averages hide important details. |

Cohort Analysis | Growing stores, testing strategies | Reveals trends in customer behavior over time. | Requires more data segmentation and analysis. |

Margin-Based | Mature stores, scaling ads | Provides the most accurate view of true profitability. | Requires tracking COGS and CAC accurately. |

By choosing the right lifetime value of customer calculation for your stage of business, you can stop making educated guesses and start making truly data-driven decisions that will fuel sustainable, and more importantly, profitable growth.

How to Increase LTV with Native Store Credit (Not Discounts)

You've done the math, you've calculated your customer lifetime value, and now you have a baseline. But the real goal isn't just to know your LTV—it's to actively grow it.

This is where many Shopify merchants go wrong. The knee-jerk reaction to drive sales is to throw discount codes around, but that's a race to the bottom. It trains customers to wait for a sale, slicing into your margins and cheapening your brand.

A smarter, more profitable strategy is to replace confusing point systems and tired discount codes with a native Shopify store credit program. This isn't just a different reward; it's a fundamental shift that boosts every single variable in your lifetime value of customer calculation, especially average order value.

Organically Increase Average Order Value

One of the fastest ways to boost LTV is by increasing your average order value (AOV). Discounts actively work against this—they just lower the total. Native store credit, however, creates a powerful incentive to spend more.

Think about a "spend more, get more" campaign. You could offer $10 in store credit for orders over $100, and $25 for orders over $150. Now, picture a customer with $90 worth of products in their cart. They're suddenly very motivated to find one more item to hit that $100 mark and unlock their credit, directly increasing their order value.

This works because it's not just a price cut; it feels like they're earning real value. That credit is like cash in their pocket for a future purchase, which makes the bigger initial order feel like a savvy investment. It's a completely different mindset than a one-and-done discount.

Drive Purchase Frequency with a Visible Wallet

Next up is purchase frequency. A customer might love your products, but life is distracting. Store credit serves as a constant, gentle reminder to return and shop again.

A native credit tool like Redeemly makes this incredibly easy by displaying a customer's available balance in a wallet widget right on your store. Every single time they visit, they see that "money" just sitting there, waiting to be spent. It’s a fantastic nudge that confusing point systems can't replicate.

This simple feature creates a powerful retention loop:

A customer buys something and earns credit.

You can send automated emails when their credit is about to expire or when new products drop.

The visible balance on your site removes friction and reminds them of the value they have with you.

This is worlds better than complex points systems where people have to do mental gymnastics to figure out what their rewards are actually worth. With native store credit, $15 is $15. Simple. That clarity brings people back faster.

The core difference is psychological. A discount says, "Buy this now for less." Native store credit says, "Here’s a reason to come back and shop with us again." The former is a transaction; the latter is the beginning of a high-LTV relationship.

This focus on the customer experience is what truly moves the needle. Research shows that a positive B2C e-commerce experience is directly linked to a 93% repurchase likelihood. Considering that acquiring a new customer has gotten 222% more expensive lately, you can't afford not to focus on retention. If you want to dive deeper, Relay42.com has some great benchmarks on these trends.

Extend Customer Lifespan Through Genuine Loyalty

The final piece of the LTV puzzle—and the most impactful—is the customer's lifespan. This is where native store credit really leaves discounts in the dust. Constantly running sales creates a customer base of deal-hunters who are loyal to the discount, not your brand.

Store credit, however, builds genuine loyalty. It makes customers feel valued and invested in your brand's ecosystem. Since the credit can only be spent at your store, it creates a "sticky" relationship that keeps them coming back. Why would they shop somewhere else when they have a balance waiting for them with you?

By consistently rewarding customers for paying full price, you build a much more resilient business that isn't dependent on margin-killing promotions. You're cultivating a community of repeat buyers who shop with you because they feel appreciated, dramatically extending how long they stay with you and how much they're worth to your business.

Common LTV Calculation Mistakes to Avoid

Getting your LTV wrong can send your entire marketing strategy spiraling. This isn't just a spreadsheet error; it's the kind of mistake that leads to burning cash on the wrong acquisition channels, ignoring your best customers, and making big decisions based on a false sense of security.

If you want your LTV to be a real tool for profitable growth—not just a vanity metric—you need to steer clear of a few common pitfalls. I've seen countless Shopify merchants stumble over these same hurdles, but thankfully, each one has a straightforward fix.

Mistake 1: Using Store-Wide Averages

This is probably the most common trap. Calculating a single, store-wide LTV lumps your most loyal, high-spending fans in with the one-and-done discount chasers. What you get is a blended average that doesn't actually represent any real customer. It completely masks the powerful insights hiding in your data.

Think about it: a customer who found you through a high-intent Google search for your top product is going to behave very differently than someone who clicked a viral TikTok ad for a cheap, trendy item. Their LTVs will be worlds apart.

The Fix: Segment your customers before you calculate LTV. Shopify’s segmentation tools make this surprisingly easy. You can slice your customer base by all sorts of useful criteria:

Acquisition Channel: Filter by where they came from (e.g., email, social, organic search).

Number of Orders: Separate first-time buyers from your VIP repeat purchasers.

Products Purchased: Analyze the LTV of customers who buy your core products versus those who only grab clearance deals.

When you calculate LTV for each segment, you’ll quickly see which channels are actually delivering valuable customers, showing you exactly where to double down.

Mistake 2: Forgetting About Gross Margin

Let's be clear: revenue is not profit. Running your LTV calculation on total sales is dangerously misleading. A customer who spends $500 on products with a juicy 70% margin is infinitely more valuable than one who spends the same amount on items with a razor-thin 20% margin.

Ignoring your costs paints a rosy picture that can trick you into spending way too much to acquire new customers. This is how brands slowly bleed cash without even realizing it.

The Takeaway: True profitability lives in the bottom line. Factoring in your gross margin transforms LTV from a simple revenue guess into a real measure of how much a customer actually contributes to your business's health.

To get this right, you have to subtract your Cost of Goods Sold (COGS) from revenue. That gives you the gross profit per customer—the number you should be using in your LTV formula. It's one extra step that makes the metric honest and truly actionable.

Mistake 3: Ignoring Customer Acquisition Cost

Even a margin-based LTV tells only half the story. The real goal is to understand a customer's net value. That means you have to look at both sides of the coin: what they bring in (profit) and what it cost you to get them in the door (Customer Acquisition Cost, or CAC).

Imagine two customer segments, both with a profit-based LTV of $300. On the surface, they look equally valuable. But what if it costs $150 to acquire a customer from Segment A and only $30 to get one from Segment B? The picture changes completely. Segment B is five times more profitable.

The Fix: Always, always analyze your LTV in relation to your CAC. The LTV:CAC ratio is one of the most vital signs of a healthy ecommerce business. A 3:1 ratio—meaning you generate $3 in lifetime value for every $1 spent on acquisition—is often seen as the gold standard. Knowing this ratio for your different marketing channels is the secret to scaling your ad spend without setting your money on fire.

Putting Your LTV Insights into Action

A number on a spreadsheet doesn't mean much until you use it to make a real change. The true magic of calculating customer lifetime value isn't just knowing the metric; it's about using that knowledge to build a smarter, more resilient business. This is your playbook for turning those LTV insights into profitable action.

It all starts by pairing LTV with its critical partner: Customer Acquisition Cost (CAC). Think of the LTV-to-CAC ratio as the ultimate health check for your marketing spend. It tells you, clear as day, if you're bringing in customers profitably for the long haul. This gives you the confidence to double down on winning ad campaigns and finally cut the ones that only attract low-value, one-time buyers.

Setting Smarter Marketing Budgets

When you know your LTV, you can stop gambling on short-term ROAS (Return on Ad Spend) and start investing with genuine clarity.

If your average customer LTV is $400, you can confidently spend more than the profit from their initial $75 order to acquire them. Why? Because you know your investment will pay dividends over time.

This insight lets you set precise, intelligent budgets for different channels. To really nail down profitability, you have to look at both sides of the coin. A helpful customer acquisition cost (CAC) calculator guide can give you the tools to get an accurate picture of your spending. With both LTV and CAC in hand, you're not just creating fleeting sales spikes—you're building a marketing engine for sustainable growth.

Targeting Your Most Valuable Customers

Once you run the numbers, your LTV calculation will probably reveal a vital truth: a small, dedicated group of your customers is driving a massive chunk of your revenue. The Pareto principle (20% of customers driving 80% of revenue) is almost always in play here. Your job is to figure out who these people are and create campaigns that speak directly to them.

Forget generic, store-wide discount blasts. It’s time to delight your VIPs with exclusive native store credit offers that feel personal.

Surprise & Delight: Reward your top 10% of customers with an unexpected $25 in store credit, simply to thank them for their loyalty.

Early Access: Give your high-LTV crowd a first look at new product drops, sweetened with a "first look" store credit bonus.

Personalized Rewards: If a segment loves a specific product category, offer them bonus credit on their next purchase within that collection.

These targeted store credit campaigns feel like a genuine reward, not a desperate sales pitch. They reaffirm the customer's choice to shop with you, strengthening that relationship and boosting their lifetime value even further.

Boosting customer retention by just 5% can skyrocket profitability by 25% or more—up to a staggering 95% in some cases—making a sharp CLV calculation essential for DTC brands. This is a primary reason why brands are ditching discounts for the kind of native store credit rewards Redeemly offers.

Guiding Product and Inventory Decisions

Your LTV data isn't just for the marketing team. It's a goldmine for product and inventory planning. By digging into the purchase history of your highest-LTV segments, you can spot which products are the gateways to long-term loyalty.

Does that best-selling skincare kit also have the highest repeat purchase rate? That’s a loud and clear signal to never run out of stock and maybe even explore complementary products. Do your best customers consistently buy from a specific clothing collection? That insight should directly inform your future designs and how deep you go on inventory.

This approach ensures you're stocking what your best customers want, not just what's popular for a single season. It aligns your entire business around serving the people who will drive your growth for years to come. By putting these insights into practice, you can build a more strategic and profitable business fueled by powerful retention marketing strategies.

LTV Questions We Hear All the Time

Even after you've nailed down the formulas, a few practical questions always seem to pop up when you start putting LTV calculations to work. Let's tackle some of the most common ones we get from Shopify merchants.

How Often Should I Actually Run These Numbers?

For most stores, calculating LTV on a quarterly basis is the perfect rhythm. This gives you a solid read on how your marketing efforts are paying off and helps smooth out any seasonal bumps without getting bogged down by weekly noise.

Now, if you're in a big growth spurt or trying something new—like launching a native store credit program—you might want to tighten that up to a monthly check-in. It gives you much faster feedback on whether your new tactics are actually moving the needle on LTV and AOV.

What’s a “Good” LTV to CAC Ratio Anyway?

A healthy target for any growing Shopify store is a 3:1 ratio of LTV to Customer Acquisition Cost (CAC). Plain and simple, this means for every dollar you spend bringing a new customer in the door, you should get at least three dollars back over their lifetime.

If you’re seeing a ratio below 3:1, it could be a red flag that you're either overspending on ads or attracting customers who don't stick around. On the flip side, if your ratio is way higher, it's often a sign that you're leaving money on the table and could be spending more aggressively to grow faster.

A strong LTV:CAC ratio is the clearest sign you have a sustainable business. It proves you're not just chasing one-off sales but building profitable, long-term relationships with your customers.

Can I Calculate LTV for My Different Marketing Channels?

Not only can you, but you absolutely should. This is one of the biggest levers you can pull for smarter growth.

Calculating LTV by the channel a customer came from—whether it was Google Ads, a TikTok campaign, or your email list—shows you which sources bring in the best customers, not just the most customers.

The key is to be disciplined with your UTM parameters. Use them on every campaign, and you can then segment your customer reports in Shopify to see exactly where your most valuable people are coming from. That’s how you know where to double down on your ad spend for real, long-term profit.

Why Does Native Store Credit Beat Points for Boosting LTV?

It boils down to one thing: clarity. Native store credit is just simpler and more powerful. A customer immediately gets that $10 in credit means $10 they can spend in your store. It feels like real money, which is far more motivating than a confusing balance of '1,000 points.'

This simplicity directly leads to more people actually using their rewards, which means more repeat purchases and higher lifetime value. More importantly, when your store credit is built natively into the Shopify checkout, it creates a seamless, trustworthy experience. That's the kind of thing that makes customers stick around, which is exactly what drives their LTV up.

Ready to stop eroding your margins with discounts and start building real, profitable loyalty? Redeemly makes it simple to launch a native store credit rewards program that boosts AOV and LTV from day one. See how it works at Redeemly.ai.

Join 7000+ brands using our apps