Unlocking Profitability How to Increase Life Time Value with Store Credit

Jan 2, 2026

|

Published

For too many Shopify brands, the growth playbook feels like a hamster wheel. You spend a fortune on customer acquisition, pull them in with a juicy 20% off coupon, celebrate the sale… and then they’re gone. This endless cycle of chasing one-time buyers with margin-killing discounts is the ecommerce equivalent of trying to fill a leaky bucket.

You pour profits in the top, only to watch them drain out the bottom as customers churn after a single purchase. It’s a frustrating, unsustainable path that treats customers like transactions instead of the long-term assets they should be.

But what if you could plug the leaks? What if you could turn that bucket into a reservoir of predictable, profitable revenue? This is where understanding life time value becomes your most critical business strategy, driven by a smarter tool than discounts: Shopify native store credit.

The Profitability Puzzle: Why Lifetime Value Matters More Than Ever

In the world of direct-to-consumer (DTC) brands, it’s all too easy to get fixated on daily sales and conversion rates. While those metrics are important, they only tell part of the story. They don't reveal the health of your customer relationships or the long-term viability of your business.

The true measure of a resilient brand lies in its life time value (LTV)—the total net profit you can expect from a single customer over their entire relationship with you. A high LTV, often achieved by boosting average order value (AOV), is the bedrock of sustainable growth.

Focusing on LTV completely shifts your perspective from short-term wins to long-term profitability. It's about breaking the costly addiction to one-off discounts and confusing points systems that often do more harm than good.

The Problem with Old-School Loyalty Tactics

Here's the hard truth: traditional loyalty methods often create the very problems they're meant to solve. One-off discount coupons train your customers to wait for a sale, which slowly erodes your brand's perceived value and guts your profit margins. They hurt your AOV and do little for LTV.

Likewise, complex points systems just add friction. A customer has no idea what "2,000 points" actually means in real-world value, leading to low engagement and even lower redemption rates. It's a game they don't want to play.

These tactics fail to build genuine loyalty. Instead, they create a transactional relationship where the lowest price wins, not the best brand experience.

The core issue is that discounts attract deal-seekers, not brand advocates. True loyalty is built on value and a seamless experience, not a race to the bottom on price. This is why a focus on life time value is so essential for modern Shopify stores.

A Smarter Path to Higher LTV and AOV

The solution lies in a simpler, more powerful approach: native Shopify store credit.

Think about it. A discount is a one-and-done deal that vanishes after use. Store credit, on the other hand, feels like real cash sitting in a customer's account. This creates a powerful psychological pull, encouraging them to return and make another purchase—without you spending another dime on acquisition.

By rewarding customers with store credit based on what they spend, you achieve two critical goals at once:

Increased Average Order Value (AOV): Customers are motivated to add a little more to their cart to reach the next reward threshold.

Boosted Repeat Purchases: That earned credit is a potent incentive for them to come back, directly increasing their life time value.

This model is a true win-win. Customers get tangible value they actually understand and appreciate, and you build a more profitable, predictable revenue stream without constantly sacrificing your margins.

To explore the psychological drivers of retention and growth, check out these insightful psychology tips for improving customer lifetime value. And for a deeper dive into the numbers, our guide on how to calculate customer LTV is the perfect place to start.

Calculating And Understanding Your Lifetime Value

Let's be honest, "Life Time Value" can sound like one of those abstract marketing terms that feels impossible to pin down. But to really grow your Shopify store, you have to turn that concept into a hard number. The good news? You don't need a PhD in data science to do it.

Figuring out your LTV is less about complex math and more about gaining the clarity to make smarter, more profitable decisions. Once you know what a customer is truly worth to your brand over time, you’ll know exactly how much you can afford to spend to get them—and how much you should invest in keeping them happy.

The Three Pillars of LTV Calculation

At its core, LTV is a story told by three key metrics. You can find all the data you need right inside your Shopify analytics, making this totally accessible for any store owner.

Average Order Value (AOV): Simply put, this is the average amount a customer spends each time they check out. A higher AOV is a direct lever for a higher LTV.

Purchase Frequency (PF): This measures how often a customer comes back to buy from you within a specific period (usually a year). This metric is the difference between a one-time buyer and a loyal fan.

Customer Lifespan (CL): This is the average amount of time a customer sticks around and continues to buy from your store. Stretching this out, even by a few months, can have a massive impact on your bottom line.

When you focus on strategies that move the needle on these three pillars—like using Shopify native store credit to encourage bigger carts and more frequent visits—you're directly boosting your overall life time value.

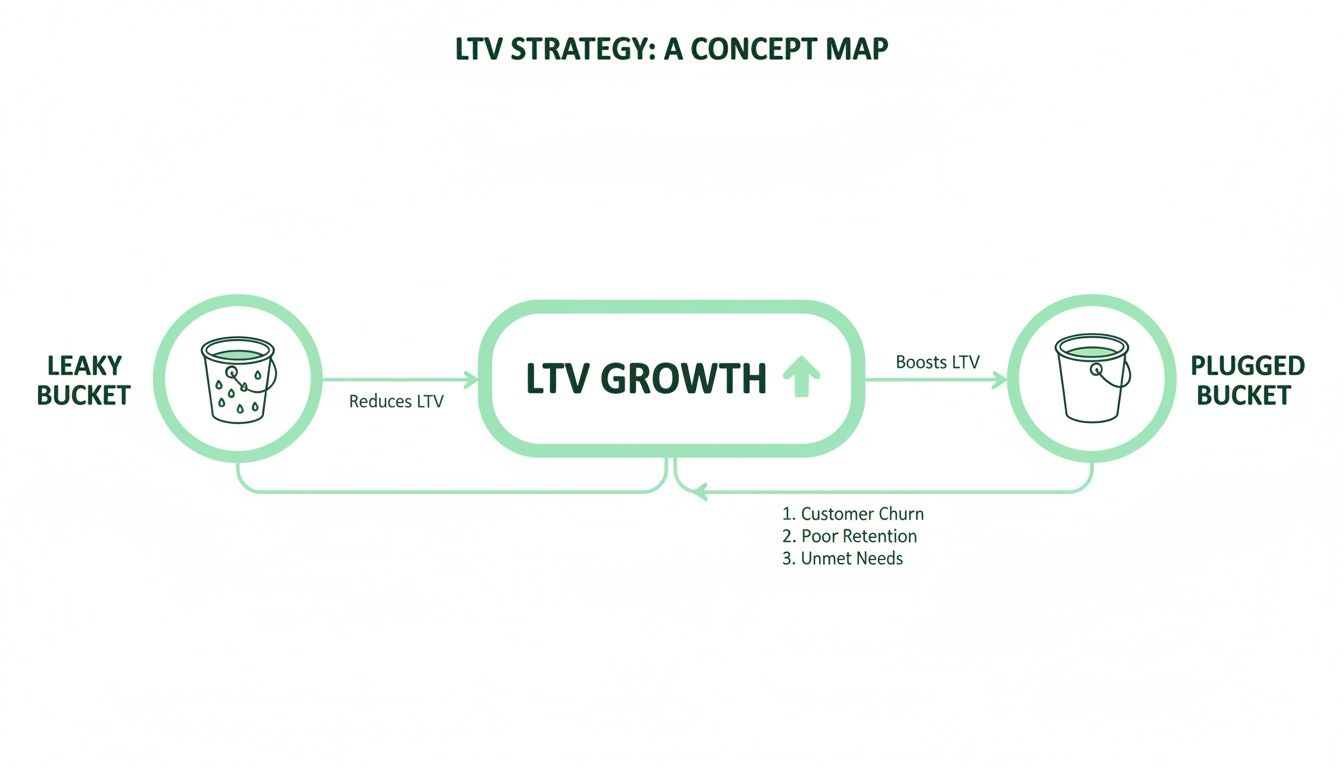

Think of it like fixing a leaky bucket. You can keep pouring new customers (water) in, but if you have holes (poor retention), you'll never fill it up. Plugging those holes is where real growth happens.

This image perfectly illustrates that focusing on retention-driven tactics is the most effective path to increasing customer lifetime value.

Simple LTV Calculation for Shopify Stores

You don't need to overcomplicate things to get started. You can get a powerful, directional estimate of your LTV with a straightforward formula that uses the three pillars we just talked about.

LTV = Average Order Value (AOV) x Purchase Frequency (PF) x Customer Lifespan (CL)

Let's ground this in a quick example.

Example: A Shopify Fashion Boutique Imagine you run a store selling women's apparel. You peek into your analytics and find a few key numbers:

Your AOV is $120.

Your average customer makes 2.5 purchases per year (PF).

Your average customer lifespan (CL) is 3 years.

Your simple LTV calculation would look like this: $120 (AOV) x 2.5 (PF) x 3 (CL) = $900

Just like that, you know that on average, every new customer you bring in is worth $900 in revenue over their relationship with your brand.

This one number is a game-changer. For a more detailed walkthrough of different calculation models, this guide on Mastering Customer Lifetime Value Calculation is a fantastic resource.

More Than a Number: Advanced LTV Models

While the simple formula is a great starting point, different models can give you a more nuanced view as your brand scales. Each serves a slightly different purpose, from historical analysis to future prediction.

Here's a quick look at how these methods stack up.

LTV Calculation Methods At a Glance

Calculation Method | Formula / How it Works | Best For |

|---|---|---|

Simple LTV | (AOV) x (Purchase Frequency) x (Customer Lifespan) | Getting a quick, directional baseline. Great for early-stage brands. |

Gross Margin LTV | (Simple LTV) x (Gross Margin %) | Factoring in profitability to understand the true value of a customer after COGS. |

Predictive LTV | Uses historical data and algorithms to forecast future customer behavior and value. | More mature brands with substantial data who need to make forward-looking decisions. |

Choosing the right model depends on where you are in your journey. Start simple and add complexity as your data and needs evolve.

Why This Number Changes Everything

Knowing your LTV isn't just a fun fact; it fundamentally changes how you approach marketing, ad spend, and your entire business strategy. It’s the key that unlocks your unit economics by telling you the absolute maximum you should ever spend on your Customer Acquisition Cost (CAC).

Think about it. If your average customer is worth $900, spending $50 on Facebook ads to acquire them is a brilliant investment. But if your LTV was only $60, that same ad spend would be a one-way ticket to going out of business.

With a firm grasp on your life time value, you can:

Set Smarter Ad Budgets: You can confidently pour money into paid channels, knowing the long-term return will more than cover the upfront cost.

Prioritize Retention: When you see just how much a repeat customer is worth, investing in margin-safe tools like a Shopify native store credit program becomes a no-brainer compared to profit-shredding discounts.

Find Your "Golden Cohort": You can easily segment your audience to identify your high-LTV champions and then focus your marketing on finding more people just like them.

Ultimately, calculating your LTV is the first real step toward building a more resilient, profitable, and sustainable business—one that’s built on genuine customer loyalty, not just one-off sales.

The Big Mistake Brands Make with Loyalty Discounts and Points

For decades, the go-to strategy for customer loyalty has been a one-two punch of discount codes and points systems. It seems logical on the surface, right? Give people a reason to come back. But dig a little deeper, and you’ll find these old-school tactics are a slow poison for your life time value and average order value.

They’re a holdover from a purely transactional world, and they just don't jive with modern DTC brands that need sustainable growth.

Constant discounting, for instance, is a race to the bottom you can't win. Every "20% OFF" email blast trains your customers to do one thing: wait. Why would anyone ever pay full price when they know another sale is just around the corner? This habit slowly chips away at your brand's perceived value and, more critically, your profit margins.

You end up with a customer base full of bargain hunters who are loyal to the deal, not your brand. The second the sale ends, they’re gone. This vicious cycle actively sabotages your efforts to increase average order value and build a reliable revenue stream from returning customers.

Why Complex Points Systems Just Don't Work

Trying to escape the discount trap, many brands pivot to points-based loyalty programs. It’s a step in the right direction, but the execution often misses the mark entirely, creating a confusing and frustrating experience. These systems are full of psychological friction that kills customer engagement before it even gets started.

Picture this: your loyal customer, Sarah, just completed her fifth order. A little pop-up cheerfully exclaims, "Congrats! You've earned 2,000 points!" For a split second, Sarah feels good. Then, the confusion kicks in.

What does "2,000 points" even mean? Is that worth $5? Or $10? Does she need another 8,000 points just to get a free keychain? The mental gymnastics needed to figure out the value of her "reward" is a huge turn-off. And the data is clear: when a reward isn't immediate and tangible, engagement nosedives. Instead of feeling appreciated, Sarah just feels baffled and is highly unlikely to ever bother redeeming those points.

The fatal flaw with points is abstraction. Your customers don't think in points; they think in dollars and cents. An abstract number just doesn't forge the strong psychological connection you need to inspire another purchase.

The Power of Keeping It Simple

Now, let's run that scenario back with a smarter approach: Shopify native store credit. After her fifth purchase, Sarah gets a simple, clear email: "Thanks for being such a great customer! We've added $10 in store credit to your account."

The difference is night and day. There’s zero confusion. Sarah knows exactly what she has—$10 she can spend on her next order. It feels less like a marketing gimmick and more like cash in her pocket, which creates a powerful, almost magnetic pull to come back and shop.

This clarity is precisely why native store credit is so effective at boosting both life time value and average order value. The tangible reward brings customers back for their next purchase while completely eliminating the friction that dooms complex points systems. Instead of making customers do math to feel valued, you're giving them a straightforward, compelling reason to choose you again.

For brands serious about building a more engaged customer base, it's vital to understand how different rewards drive different behaviors. A great next step is to explore the different types of loyalty program tiers and see how a well-designed structure can make all the difference.

The Store Credit Solution: A Margin-Safe Path to Higher LTV

So, we've picked apart the problems with traditional discounts and points systems. It's pretty clear that inventing a more complicated game for customers to play isn't the answer. The real path forward is actually much simpler: reward them with something that feels real.

This is exactly where native store credit shines. It’s a powerful, psychologically-sound alternative that just makes sense for modern Shopify brands.

Think about it. A discount code is a one-and-done deal—it vanishes the second you use it. But store credit? That feels like actual cash sitting in a customer's account. It has a tangible presence and a value that’s instantly understood. There's no mental gymnastics trying to figure out what “5,000 points” translates to. It’s just $10 waiting to be spent. This simple shift from abstract points to concrete currency creates a powerful, built-in reason for customers to come back.

How Store Credit Drives AOV and Retention at the Same Time

The true genius of a well-designed store credit program, like the one we built at Redeemly, is how it hits two of the most critical growth levers at once: average order value (AOV) and customer retention. It's a one-two punch that makes your unit economics stronger with every single sale.

First, it tackles AOV. You can set up simple reward triggers, like "Spend $100, Get $10 in Credit." This gently nudges customers to add that one extra item to their cart to hit the threshold. That small push can have a huge impact on your AOV, making each transaction more profitable right off the bat.

Second, that earned credit becomes your best retention tool. A customer with $10 of your brand's money burning a hole in their digital pocket is far more likely to return for another purchase. This isn't a discount you have to blast out over email; it's an asset the customer already owns, pulling them back to your store without you spending a dime on new marketing.

A Profit-First Strategy That Protects Your Margins

Here’s the part your finance person will love: store credit is a margin-safe strategy. When you offer a discount, you’re taking an immediate, upfront sledgehammer to your revenue and profit. You give away 20% of the order’s value right then and there. Gone.

Store credit, on the other hand, is treated as a liability on your books—not an instant cost. It only hits your P&L when a customer returns to redeem it on a future purchase. The entire model is designed to fuel your repeat purchase rate, which is the absolute cornerstone of a high life time value.

By tying the "cost" of the reward to a future transaction, you ensure your loyalty program is directly funding the exact behavior you want: repeat business. You're not just giving away margin; you're investing it in guaranteed future revenue.

This approach fundamentally improves your unit economics. The small cost of that redeemed credit is easily covered by the full-margin profit from the rest of the new order it inspired. The numbers don't lie. A simple 10% bump in customer lifetime value can lead to a massive 30% jump in revenue. Since getting a new customer costs up to 5 times more than keeping an old one, switching from margin-killing discounts to smart rewards is a no-brainer. You can explore more on this connection in these insights on lifetime value modeling.

Let’s break down how these common tactics really stack up against each other.

Discounts vs. Points vs. Store Credit

Feature | Discount Codes | Points Systems | Native Shopify Store Credit |

|---|---|---|---|

Psychological Impact | Transactional, feels temporary. | Gamified, but value is abstract and confusing. | Feels like real cash, an asset the customer owns. |

Margin Impact | Immediate, upfront cost. Erodes profit on the spot. | Delayed cost, but can devalue the brand over time. | A liability, not a cost. Only realized on a future purchase. |

Customer Behavior | Encourages one-time bargain hunting. | Encourages point hoarding, not necessarily brand loyalty. | Drives repeat purchases and higher AOV. |

User Experience | Can be frustrating (expired/invalid codes). | Often requires a clunky, separate portal or widget. | Seamless and integrated directly into the Shopify customer account. |

As you can see, when you put them side-by-side, native store credit just offers a cleaner, more effective way to build genuine loyalty that actually contributes to your bottom line.

The Power of Native Shopify Integration

Another huge advantage of modern store credit solutions is their native Shopify integration. Many old-school loyalty apps are clunky, slow-loading widgets that feel tacked on to your site. They can drag down your page speed—a known conversion killer—and create a disjointed experience for your customers.

A native Shopify app is a different beast entirely. It’s built on Shopify's own foundation. This means:

A Seamless Experience: The store credit system just works, blending perfectly with your theme and checkout. No jarring pop-ups or weird-looking interfaces.

No Site Slowdowns: Your site stays lightning-fast and optimized because there are no heavy external scripts to load.

Seriously Simple Setup: You can get a sophisticated, powerful loyalty program running in minutes, no developer needed.

This native approach makes the whole thing feel like a core part of your brand, not some third-party add-on. Customers can easily see and use their credit, reinforcing the value you give them and strengthening their connection to your store. This frictionless experience is key to driving the engagement that ultimately skyrockets your life time value.

Putting It All Together: How to Launch Your Store Credit Program

Theory is one thing, but execution is everything. You get why native Shopify store credit is a better tool for boosting life time value, but how do you actually get started? The good news is that launching a powerful, margin-safe loyalty program on Shopify is way easier than you might think, especially with a native solution like Redeemly.

This isn't about hiring a developer or getting bogged down in a month-long integration project. It’s about making a few smart decisions, flipping a switch, and telling your customers about the new value you’re offering.

Let's walk through the exact steps to get your program live and driving real results.

Step 1: Choose Your Reward Structure

First things first: you have to decide how customers will earn credit. The golden rule here is to keep it simple. A confusing structure just creates friction and kills engagement—the very problems we’re trying to solve. The goal is to make the reward feel both attainable and valuable.

A great place to start is a straightforward "spend and get" model. This directly encourages a higher average order value (AOV) by giving customers a clear target to hit.

Here are a few popular structures to get you thinking:

Fixed Threshold: "Spend $100, Get $10 in Store Credit." This is the most common for a reason—it’s incredibly easy for customers to grasp. It creates a clear goal for them right in the middle of their shopping session.

Percentage Back: "Get 5% Back in Store Credit on Every Purchase." This model rewards every single order, which is fantastic for building a habit of coming back.

Tiered Rewards: "Spend $50, Get $5. Spend $100, Get $12." This can be a powerful way to gamify the experience and nudge customers toward a significantly higher cart value.

Whatever you choose, make sure it's front and center on your site. The value should be impossible to miss. If you need a more detailed walkthrough, our guide on how to give store credit on Shopify dives deep into the technical setup.

Step 2: Communicate Your Program Everywhere

Once your reward structure is locked in, it’s time to shout it from the rooftops. A loyalty program is useless if your customers don't know it exists or how to benefit from it. Your launch communication needs to be multi-channel and crystal clear.

Don't just send one email and call it a day. Weave the message into the entire customer journey to reinforce the value at every single touchpoint.

Essential Communication Channels

Launch Email Campaign: Send a dedicated email to your entire list announcing the new program. Frame it as a "thank you" for their loyalty and explain exactly how it works with a simple, clear example.

On-Site Banners and Pop-ups: Use your homepage banner and non-intrusive pop-ups to tell every site visitor about the program. Language like "Get Rewarded for Shopping" or "$10 Back for Every $100 Spent" is direct and it works.

Post-Purchase Messaging: This is your secret weapon. Use your order confirmation pages and emails to show customers the credit they just earned. That immediate positive reinforcement is the key to driving their next purchase.

A consistent message across all channels is crucial. After all, omnichannel customers already have a 30% higher lifetime value than single-channel shoppers. By using a native Shopify solution like Redeemly to float customer wallets and send reminders, you create a seamless experience that reinforces value and drives retention—a tactic proven to yield 91% higher year-over-year retention. To dig deeper, check out these insights on AI-driven marketing trends for 2025 on Superagi.com.

Step 3: Integrate and Automate

The final piece of the puzzle is to make your store credit program a core part of your existing marketing flows. This is where a native Shopify app really proves its worth, taking the technical headache out of the equation and making automation a breeze.

A successful store credit program shouldn't feel like a separate, tacked-on feature. It should be woven into the fabric of your customer experience, working automatically in the background to boost your life time value.

Start by integrating your program with your email service provider. This lets you set up automated flows that trigger based on store credit activity, doing the work for you.

High-Impact Automation Ideas

Credit Earned Notification: An immediate email the moment a customer earns credit.

Monthly Balance Reminder: A simple, friendly email showing customers their available credit balance.

"Credit About to Expire" Flow: If you decide to add an expiration date, this flow creates urgency and gets people back to your site.

By turning these ideas into a practical, automated system, you create a self-sustaining engine for growth. Each purchase fuels the next one, steadily increasing your repeat purchase rate, AOV, and, most importantly, your overall customer life time value.

FAQ

Will Store Credit Cost My Business More Than Discounts?

That's the million-dollar question, isn't it? The short answer is a hard no. In fact, native Shopify store credit is almost always the more profitable play in the long run.

Think about it this way: a discount is a direct hit to your bottom line, right now. You offer 20% off, and that revenue is gone forever. Poof. It vanishes from that specific sale, and you never get it back.

Store credit is different. It sits on your books as a liability, not an immediate expense. It only turns into a "cost" when the customer comes back to spend it. This is the magic of the model—it’s designed from the ground up to drive repeat purchases, which is the secret ingredient for a sky-high life time value. You’re not just giving away money; you’re investing in guaranteed future sales.

How Is Store Credit Better Than a Points-Based Loyalty Program?

Honestly, it all comes down to simplicity and psychology. Native Shopify store credit cuts through the noise and confusion that kills most points programs.

When a customer sees “$15 of store credit” in their Shopify account, they get it instantly. It feels like real money burning a hole in their pocket. But what does "1500 points" even mean? They have to do mental math, figure out conversion rates, and jump through hoops just to understand the value. That friction is a conversion killer.

The real advantage is clarity. Your customers think in dollars and cents, not in some made-up points currency. Shopify native store credit speaks their language, making it a much more powerful and immediate reason to come back and shop.

You get all the benefits for your retention and life time value without the baggage of complicated tiers, confusing rules, and abstract points. It’s a straightforward reward that feels genuinely valuable to your customers.

Is Setting Up a Native Shopify Store Credit System Difficult?

Not in the slightest. One of the best things about a native Shopify app like Redeemly is how incredibly simple it is. It's built right on top of Shopify’s own store credit system, which means the whole thing is basically plug-and-play.

You won't have to deal with complex integrations, bloated code that slows down your site, or clunky third-party widgets. It just works, feeling like a natural part of your store from day one.

Most store owners can get their entire program up and running in a few minutes flat—no coding or technical headaches required. It’s built to work seamlessly with your existing theme and checkout process, making it one of the easiest ways to launch a loyalty program that actually drives results.

Ready to stop burning cash on discounts and start building real, profitable customer loyalty? With Redeemly, you can launch a native Shopify store credit program in minutes and turn one-time buyers into high-value repeat customers. Protect your margins, boost your AOV, and watch your life time value grow.

Join 7000+ brands using our apps