How to Use Store Credit on Shopify to Boost Lifetime Value

Dec 17, 2025

|

Published

When a Shopify merchant issues store credit, they're essentially giving a customer a balance they can spend at checkout, almost like a gift card. It's a clever way to handle returns or reward loyalty, but the impact goes much deeper than just that. By keeping that money within your store's ecosystem, you're directly encouraging customers to come back and spend again, which is a massive win for both customer lifetime value (LTV) and average order value (AOV).

The Hidden Power of Store Credit Over Discounts

Before we get into the nuts and bolts, let's talk about why this matters. So many DTC brands are stuck on a hamster wheel of discount codes and clunky loyalty point systems. The smart ones? They're moving to something far more effective for keeping customers around: native Shopify store credit. This isn't just about managing returns better; it’s a complete mindset shift in how you build lasting customer relationships.

The psychology here is surprisingly straightforward. A discount code feels temporary, a one-and-done deal that often just teaches shoppers to wait for the next sale. Store credit, on the other hand, feels like real money sitting in their account. It's a tangible, persistent reason for them to come back to your store.

Shifting from Transactional to Relational

A coupon is a fleeting perk. A store credit balance is a commitment—it signals to the customer that you value them, and it gives them a real reason to stick with your brand. That simple change in approach makes all the difference.

Guaranteed Future Revenue: Think about it. When a customer accepts store credit for a return instead of a cash refund, you've just secured a future sale. That revenue never actually leaves your business.

Increased Perceived Value: Customers tend to see store credit as a cash equivalent. This makes it feel like a more satisfying fix for a support issue or a much more exciting reward than a simple percentage-off coupon.

Reduced Margin Erosion: Those sitewide 20% off sales can seriously devalue your products over time. Store credit is different; it's a targeted investment in a customer who has already proven they're willing to buy from you.

Driving Higher Lifetime and Order Value

Ultimately, a solid retention strategy comes down to boosting LTV and AOV. Store credit is one of the best tools in the box for hitting both targets. When a customer has a $25 credit, they almost never spend just $25. Instead, they see it as their chance to finally grab that $50 or $75 item they’ve been eyeing, and they happily pay the difference. That natural "upspend" is an instant AOV booster.

To really grasp the difference, let's compare store credit directly against the old-school discount code.

Store Credit vs. Discount Codes: A Strategic Comparison

While both tools aim to incentivize purchases, they operate on fundamentally different principles and yield very different long-term results.

Attribute | Store Credit | Discount Codes |

|---|---|---|

Customer Mindset | Feels like "my money" to spend | Feels like a temporary deal or coupon |

Revenue Impact | Locks in future revenue, prevents cash refunds | Often attracts one-time bargain hunters |

Brand Perception | Builds a relationship, feels like a premium perk | Can devalue the brand, trains customers to wait for sales |

AOV Impact | Naturally encourages upselling to use the full credit | Can sometimes lower AOV on its own |

Loyalty Building | Creates a strong, tangible reason to return | Fleeting; loyalty is to the discount, not the brand |

Margin Protection | Targeted and controlled; no broad margin erosion | Blanket discounts can significantly eat into profits |

This table makes it clear: store credit is a long-term investment in customer relationships, while discounts are more of a short-term sales tactic. Both have their place, but only one truly builds sustainable growth.

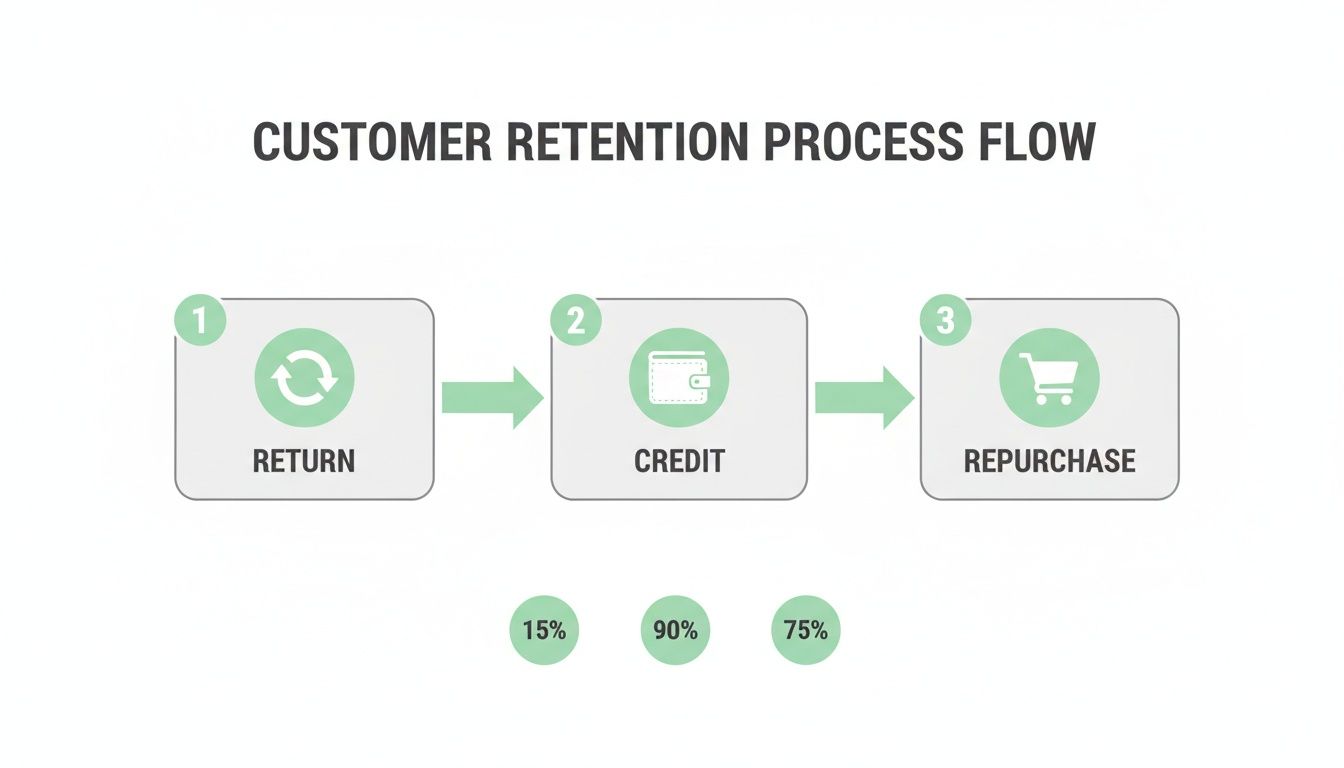

The core idea is to transform a potential loss—like a product return—into a guaranteed future interaction. By keeping value within your store, you're not just preventing a refund; you're building a foundation for the next purchase and strengthening loyalty.

Experienced merchants are using store credit to claw back revenue from returns, boost retention, and get customers to make their next purchase sooner. With Shopify's average AOV hovering around $85 and CLTV estimates often near $132, keeping that money in-house as store credit dramatically increases the odds it fuels another order instead of being spent with a competitor.

If you want to get back to basics, check out our complete guide on what is store credit. You'll see how this simple tool can turn a routine customer service interaction into a powerful engine for growth and profitability.

Your Hands-On Guide to Issuing Store Credit in Shopify

Alright, let's get down to business. Enough with the theory—it's time to put store credit into action on your Shopify store. The best part? You don't need a complicated app or some clunky workaround. We're going to use Shopify's own built-in gift card feature.

I've seen so many merchants overlook this, but it's the most reliable and direct method available. Treating store credit as a gift card (a form of payment) instead of a discount code is a game-changer. It protects your margins and often encourages customers to spend more than their credit amount, giving your average order value a nice little bump.

We'll walk through the two scenarios you'll encounter most: processing a return and proactively issuing credit for customer service or rewards.

Turning Returns into Revenue

This is where store credit truly shines. A customer wants to send something back. Instead of watching that cash walk out the door, you can convert that refund into a guaranteed future sale. It's a simple, elegant way to keep revenue in your ecosystem, and Shopify has made the process incredibly smooth.

This isn't just about damage control; it's a powerful retention loop. You're transforming a potential loss into another chance to delight your customer.

Here's exactly how to do it right from the customer's order page:

Start the Return: First, pull up the customer's order in your Shopify admin. Find and click the "Return" button.

Select the Items: Check the boxes for the products being returned and set the quantity. This is also a good spot to add a return reason for your own records.

Choose Your Refund Method: Pay close attention here. This is the crucial step. You'll see an option to refund to the original payment method, but you want to select "Refund to gift card."

Think of this choice as a strategic move. By selecting "Refund to gift card," you’re actively preserving your cash flow and securing a future purchase. You're not just processing a transaction; you're managing that customer's lifetime value and keeping them locked into your brand.

Once you hit confirm, Shopify handles the rest. It automatically creates a digital gift card with a unique code and zips it straight to the customer's inbox. For them, it's a seamless experience. For you, it’s a massive win for your retention strategy.

Issuing Credit Manually for VIPs, Giveaways, and More

What about those times you want to issue credit for reasons other than a return? Maybe a shipment was delayed and you want to make it right. Or perhaps you're rewarding a loyal VIP customer or running a social media giveaway. The process is just as easy, it just starts in a different spot.

This is all about proactive customer service and creating moments of delight that build real loyalty.

Here’s the quick-and-dirty guide to manually creating store credit:

Head to Gift Cards: In your Shopify admin, navigate to Products > Gift Cards.

Create the Credit: Click the "Issue gift card" button in the top right.

Fill in the Details: From here, you can set the exact value, search for the customer by name or email, and even add a private note for your team (e.g., "Credit for shipping issue on order #12345").

As soon as you issue it, the customer gets a clean, professional email with their gift card code, ready to use on their next purchase. It’s a simple gesture that can have a huge impact.

Shopify has had native gift card functionality since 2015, and its integration has only gotten tighter. With Shopify Payments now used by an estimated 1.85–1.96 million merchants, a huge number of stores can run these plays without any third-party apps. If you're curious about the scale of the ecosystem, you can find more stats on ecommercetrix.com. This native capability makes the entire process secure, seamless, and perfectly built into the workflow you already use every day.

Making Sure Customers Actually Use Their Store Credit

Handing out store credit is the easy part. The real win comes when customers redeem it, and that experience has to be absolutely seamless. If it's clunky or confusing, you've not only lost a sale but you've also soured the goodwill you were trying to build. A customer might start to feel like their "money" is trapped, which is the last thing you want.

We need to walk in their shoes. The entire journey—from the email they receive to that final click at checkout—should feel like a small victory and reinforce their decision to shop with you again. It’s a make-or-break moment.

Don't Settle for the Default Notification Email

The first touchpoint is that notification email from Shopify. Out of the box, it's functional but totally generic. This is a huge missed opportunity to inject your brand's personality and guide your customer.

With a few quick edits to the template, you can transform it from a system alert into a welcoming message:

Make It Yours: Drop in your logo and write the copy in your brand's voice. It should feel like a note from your team, not an automated robot.

Show Them How: The biggest question is always, "Okay, now what?" Add a simple, clear instruction right in the email. Something like, "Just copy this code and pop it into the 'Gift card or discount code' box at checkout!" saves them a lot of guesswork.

Get Them Shopping: Don't just deliver the code; inspire them to use it. Add a small section showcasing "New Arrivals" or linking to your "Best Sellers." You want to get them browsing while they're already engaged.

Think of this email as your first nudge back to the store. The clearer and more compelling it is, the faster they'll come back to spend.

The Checkout Flow: A Quick Walkthrough

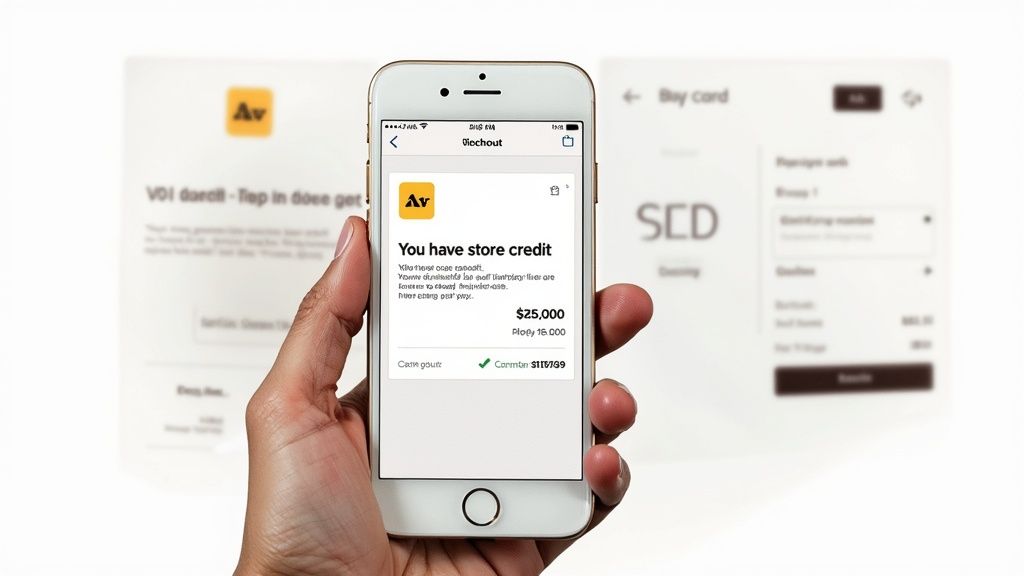

Once your customer has a cart full of goodies, applying the credit should be the easiest part of their checkout. The beauty of using Shopify's native gift card system is that it slots right into the process they're already familiar with.

The store credit code goes into the exact same field as a regular discount code. It’s typically on the right-hand side of the checkout screen, clearly labeled "Gift card or discount code." They just paste it in and hit "Apply."

Key Insight: Shopify treats store credit (which is technically a gift card) as a form of payment, not a discount. This is a massive advantage. It means a customer can stack a 15% off discount code and use their store credit on the very same order. They apply the discount first, which lowers the total, and then use the credit to pay down the remaining balance.

This little detail makes the credit feel more like cash and prevents the classic "Which coupon do I use?" dilemma.

Best Practices for a Flawless Redemption

A few extra touches can turn a good redemption experience into a great one, often encouraging customers to spend even more than their credit balance.

Show Them the Money: Use an app to display a customer's available store credit balance directly on your site, maybe in a small header bar or on their account page. Seeing a reminder like, "You have $25 waiting for you!" is a powerful psychological nudge.

Prep Your Support Team: Your customer service reps should be ready for this. Create a saved reply or canned response that quickly explains how to apply store credit. A little proactive support can prevent a lost sale.

Think Mobile First: Most of your customers are probably shopping on their phones. Go through your own checkout process on a mobile device. Is the gift card field easy to find and tap? Is the layout clean? If it's a pain on a small screen, you're going to lose people.

By fine-tuning these touchpoints, you make using store credit an invisible, positive part of the buying journey. That’s how you turn a simple refund or reward into a repeat purchase and a happier, more loyal customer.

Turning Store Credit into a Growth Engine

This is where store credit gets really exciting. Forget thinking of it as just a way to handle returns. The smartest brands I've worked with use it as a powerful, proactive marketing tool. We're shifting from a defensive "save the sale" mindset to an offensive "create the next sale" strategy.

Instead of just fixing problems, you're building relationships and directly influencing customer behavior. When you start issuing credit strategically, you'll see a real impact on your most important metrics, like customer lifetime value (LTV) and average order value (AOV).

Simple, High-Impact Plays for Growth

You don't need a complicated points system that nobody understands. Simple, targeted store credit campaigns are way more effective. Each one has a clear goal, whether it’s rewarding a specific action or just making a great customer feel seen.

Here are a few powerful ideas you can put into action this week:

The "Surprise and Delight": Think about a customer who has already bought from you five times. Imagine them getting a surprise email with $10 in store credit and a simple note: "Just a little something to say thanks for being one of our best customers." That's a memorable moment a generic discount code could never create.

Better Review Incentives: We all know how critical good reviews are. Instead of a flimsy 10% off coupon, try offering $5 in store credit for every approved product review. It feels more tangible and guarantees they'll spend that reward right back in your store.

Customer Service Recovery: A shipment is late or an item arrives damaged. A refund is expected. But what if, on top of fixing the problem, you immediately issue $15 in store credit? You've just turned a potential one-star review into a positive experience, and you've likely locked in their next purchase.

Store credit is a fantastic tool for building loyalty and is a perfect fit with many other client appreciation ideas.

The Secret to Higher AOV and More Repeat Buys

Here’s the real magic: store credit naturally gets customers to spend more. Someone with a $10 credit rarely looks for a $10 item. That credit becomes the perfect excuse to finally buy the $40 product they’ve been eyeing.

It’s a simple psychological nudge that consistently drives up your AOV. The credit lowers the mental barrier to buying a more expensive item, making the "splurge" feel totally justified. This is a huge advantage over percentage-off discounts, which often just cheapen what the customer was already planning to buy.

This whole approach creates a self-sustaining loyalty loop. A customer buys, you reward them with credit, and that credit pulls them back for their next purchase much sooner. This cycle is how you elevate your repeat purchase rate and build a truly predictable revenue stream.

How It Works Operationally in Shopify

The good news is that running these proactive campaigns is pretty straightforward in Shopify. Merchants typically handle store credit in one of three ways: using native gift cards, issuing credit through the Shopify admin refund flow, or using a third-party app for more detailed balance tracking. With the rise of integrated checkouts like Shop Pay, you can be confident that the credit you issue will be incredibly easy for your customers to redeem.

Using these built-in tools, you can manually issue credit for campaigns like review incentives or VIP rewards in just a few clicks. The process is the same as issuing a credit for a return, but the intent is completely different—it's pure marketing.

These proactive plays are a non-negotiable part of a modern retention program. To get more ideas for building a system that keeps customers loyal, check out our deep dive on retention marketing strategies that the top brands are using right now. It's all about creating value that lasts long after that first purchase.

How to Measure the ROI of Your Store Credit Program

A great strategy needs great data to back it up. Simply launching a store credit program isn't enough; you need to prove it’s actually making you money. Measuring the return on investment (ROI) is what elevates store credit from a simple customer service tool to a core part of your growth engine.

When you track the right numbers, you'll see exactly how your program drives a higher lifetime value (LTV) and average order value (AOV). We're going to skip the vanity metrics and focus on the data that truly matters. This will not only prove the financial worth of your program but also hand you the insights needed to make it even more profitable.

Foundational Metrics to Track in Shopify

Before you can calculate the big-picture ROI, you need a solid baseline. Thankfully, Shopify's built-in reporting has everything you need to check the fundamental health of your store credit system. Make a habit of monitoring these key performance indicators (KPIs) regularly.

These numbers give you a quick, high-level snapshot of how much value is flowing through your program and whether customers are actually using it.

Total Credit Issued: This is your investment. It’s the total dollar amount of store credit you've handed out over a given period, whether that's a month or a quarter.

Total Credit Redeemed: This tracks how much of that issued credit customers have actually spent. A healthy redemption number is the first sign of a program that’s both engaging and easy to use.

Redemption Rate: This is where the rubber meets the road. Calculate it as (Total Credit Redeemed / Total Credit Issued) x 100. A low percentage might mean your notification emails aren't landing or customers simply forget they have a balance.

Average Time to Redemption: How quickly do customers use their credit after receiving it? A shorter timeframe is a fantastic indicator that store credit is bringing people back to buy again, faster than other incentives.

Calculating Your AOV Lift

This is where the real magic happens. The "AOV lift" is the extra cash you pocket when a customer spends more than their credit balance. This is a critical metric because it proves that store credit isn't just a refund substitute—it's an upsell machine.

Think about it: when a customer has $25 in credit, they rarely look for a $25 item. Instead, they see it as a huge discount on that $60 product they’ve been eyeing. That $35 difference is your AOV lift, and it’s pure, incremental revenue you would have otherwise missed.

To calculate it, you need to segment your orders. Compare the AOV of orders placed with store credit against the AOV of orders placed without it. The difference is the direct impact of your program. If your standard AOV is $85 but orders using store credit average $115, you've got an AOV lift of $30. That’s powerful.

Analyzing Long-Term Customer Behavior

The ultimate goal of any loyalty or retention tool is to boost customer lifetime value. This means you have to look beyond a single purchase and analyze the long-term habits of customers who interact with your credit system.

Jump into your Shopify analytics and start asking the right questions:

What’s the repeat purchase rate for customers who have received store credit versus those who haven't?

Do customers who use their credit place their next order faster than the average customer?

How does the LTV of a "store credit customer" stack up against your overall average LTV over 6, 12, or 18 months?

Tracking this data gives you undeniable proof that store credit builds stickier, more valuable customer relationships than one-off discounts ever could. If you want to get really granular on this metric, you can learn more about how to calculate customer LTV in our detailed guide.

Answering these questions with hard data will give your team the confidence to double down on a strategy that fuels profitable, sustainable growth.

Your Top Shopify Store Credit Questions Answered

Even with the best plan, you're bound to hit a few specific scenarios when you start using store credit. You're not alone. I've pulled together the most common questions I hear from fellow Shopify merchants to give you quick, clear answers.

Think of this as your field guide for those "what if" moments. Getting these details right is key to a smooth experience for your customers and your team, which is exactly what builds the kind of trust that keeps people coming back.

Can Customers Use Store Credit and a Discount Code on the Same Order?

Yes, they absolutely can! This is one of the biggest upsides of using Shopify's gift card system for store credit.

Shopify treats store credit as a payment method, just like a credit card, not as a promotional discount. So, a customer can pop in their discount code, see the price drop, and then apply their store credit to pay for the rest.

This is a huge win for the customer experience. It makes the credit feel like real cash in their pocket and avoids that frustrating moment of having to choose between two different offers. Pro tip: Mention this in your store credit notification emails—it's a great little nudge to get them shopping.

Does Store Credit Issued via Gift Cards Expire on Shopify?

Nope. By default, gift cards—and by extension, the store credit you issue through them—never expire on Shopify.

Honestly, this is the way to go. Especially when the credit is for a return, having it expire can feel like a penalty and completely undoes the goodwill you're trying to build.

While it’s always smart to be aware of local laws around gift cards, sticking with a no-expiration policy is a powerful way to build long-term loyalty. It tells your customers you value their business, whenever they're ready to return.

How Do I Handle a Return for an Order Paid with Store Credit?

This is refreshingly simple. When a customer returns something they bought with store credit, you just refund the amount right back onto the original gift card they used.

When you process the return in your Shopify admin, you'll see the option to refund directly to that gift card.

This is so important for keeping everything in a neat, closed loop. Refunding to the original credit source means the money stays within your store's ecosystem, ready for their next purchase. It saves you from the messy work of issuing new codes and gives the customer a super clear, consistent experience.

Keeping it straightforward like this prevents confusion and reinforces the idea that their store credit balance is a valuable asset.

When Should I Consider a Third-Party Store Credit App?

For most brands just getting started, Shopify's built-in gift card feature is more than enough. It's simple, it's reliable, and it works seamlessly. But as your store credit program gets bigger and more ambitious, you might find yourself wanting more firepower.

That's where a dedicated third-party app comes into the picture. It's probably time to look at an app if you want to:

Automate Credit on a Deeper Level: Think automatically issuing $5 in credit on a customer's birthday or after they hit a specific spending milestone.

Give Customers a Digital Wallet: Offer a dedicated account page where shoppers can easily see and track their credit balance at any time.

Get Serious About Analytics: Dive into more advanced reports on redemption rates, how much credit is lifting AOV, and the true ROI of your program.

If you're looking to build a more formal loyalty or rewards program with store credit at its core, an app like Rise.ai or LoyaltyLion will give you the tools and scale you need to really make it sing.

Ready to stop burning money on discounts and start building profitable, long-term customer relationships? Redeemly helps you replace confusing points and margin-killing coupons with real, cash-like store credit that boosts lifetime value and average order value. Learn how to grow your Shopify store more sustainably at https://redeemly.ai.

Join 7000+ brands using our apps