Shopify Store Credit: Your Guide to Higher LTV and AOV

Dec 8, 2025

|

Published

Picture this: a loyalty tool that brings customers back, ready to spend more, without forcing you to splash "50% OFF!" banners everywhere and cheapen your brand. That's the power of Shopify store credit. It’s a deceptively simple alternative to discounts and confusing points systems, designed to build genuine customer relationships and fuel sustainable growth by focusing on two key metrics: Lifetime Value and Average Order Value.

Why Native Store Credit Is Your New Growth Engine

For years, e-commerce brands have been trapped in a race to the bottom, throwing out discounts and overly complex points systems. Sure, those tactics can give you a quick sales bump, but they also eat away at your profit margins and, even worse, teach your customers to wait for the next sale.

Native Shopify store credit flips the script. Think of it as cash that can only be spent at your store.

Instead of dangling a 20% off coupon that subtly lowers the perceived value of your product, you can issue a $20 credit. This isn't just a semantic trick; it's a powerful psychological shift. In the customer's mind, that credit isn't a temporary promotion—it's their money, a tangible asset just waiting to be used. This simple change is a game-changer for two of the most critical metrics in your business: Lifetime Value and Average Order Value.

Driving Lifetime Value and Average Order Value

Let's be honest, the whole point of any customer retention effort is to increase how much a customer spends with you over their lifetime (Lifetime Value, or LTV). Store credit is a natural fit here because it gives them a compelling reason to come back for that second, third, and fourth purchase. A customer with a credit balance is far more likely to return than one without, directly boosting LTV.

At the same time, store credit is brilliant for bumping up your Average Order Value (AOV). When a customer uses their $20 credit on a $75 purchase, they're not just cashing in a reward; they're still spending an extra $55 of their own money. The credit acts as a launchpad for a larger purchase, encouraging them to add more to their cart and increasing the AOV for that specific transaction.

Store credit acts as a powerful retention magnet. It doesn't just incentivize a single purchase; it builds a bridge to the next one, creating a continuous cycle of engagement and spending that is essential for long-term growth and a higher LTV.

This is more than just a transactional tool; a well-designed store credit program becomes a core part of your customer loyalty engine. Weaving it into your broader efforts is key, and understanding effective customer retention strategies will help you get the most out of it. You can also dive deeper with our guide on proven retention marketing strategies to build an even stronger program.

The Problem with Discounts and Points

Let’s be honest, we’ve all been there. You run a 20% off sale, watch the orders flood in, and feel a sense of accomplishment. But what’s really happening under the surface? You’re accidentally teaching your customers that your products aren't worth full price. This creates a dangerous loop where shoppers just wait for the next sale, gutting your profit margins and cheapening your brand in the process. This behavior actively works against building a high lifetime value.

Even worse, that quick sales bump from a discount code is often a mirage. It attracts deal-seekers, not true fans. These shoppers are loyal to the discount, not your brand. As soon as the sale ends, they vanish, leaving you with less profit and no real improvement in customer lifetime value (LTV).

Points systems were supposed to be the answer, but they usually just swap one problem for another. Overly complex rules—think "Earn 1 point for every $1 spent, 100 points = $1 off"—force your customers to pull out a calculator. This mental gymnastics makes the reward feel distant and less valuable, which is why engagement and redemption rates are often so low. Instead of driving loyalty, the confusion creates apathy, failing to boost LTV or AOV in any meaningful way.

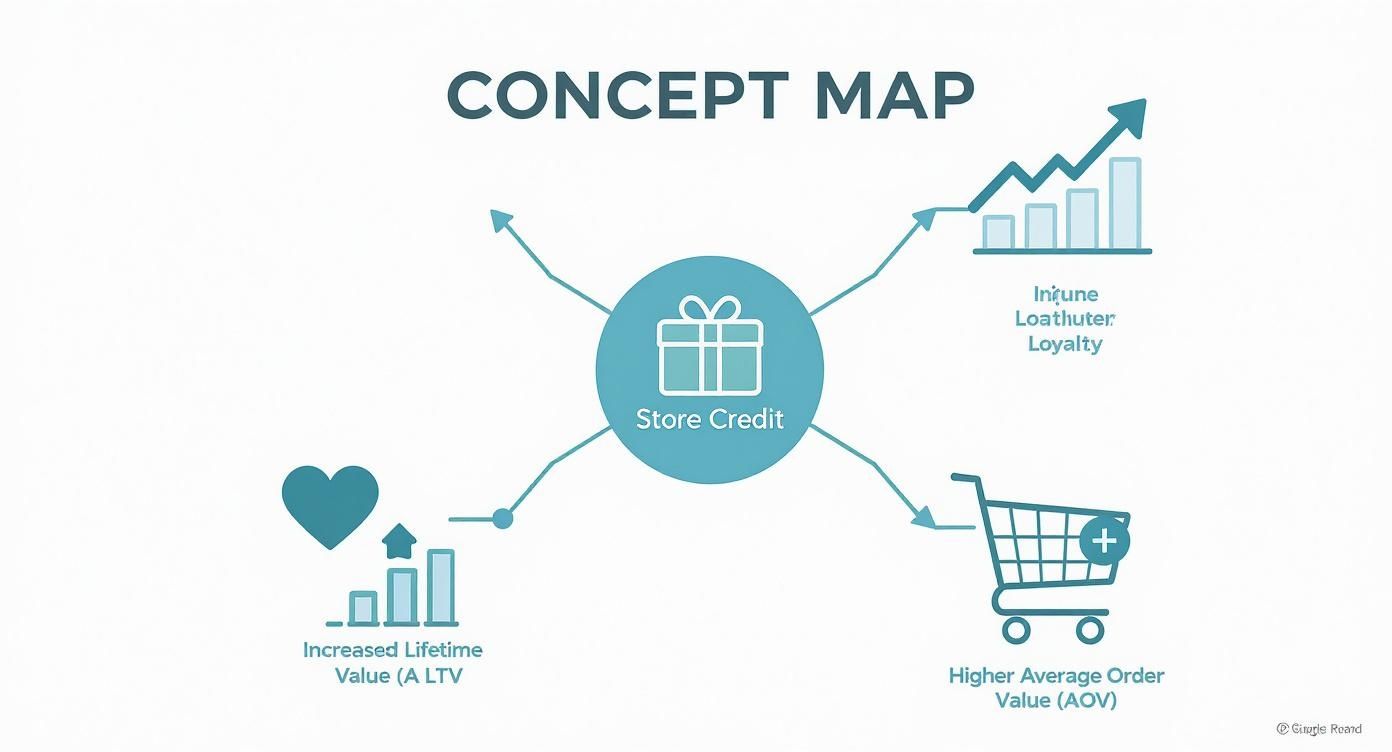

The concept map below shows how store credit breaks this cycle, creating a much clearer and more direct path to hitting your most important business goals.

As you can see, the simplicity of store credit is its superpower. It directly fuels loyalty, which then creates real, measurable growth in both LTV and Average Order Value (AOV).

Store Credit: A Smarter, Simpler Approach

Shopify store credit cuts right through the noise of discounts and the confusion of points. It's clean, transparent, and incredibly effective. Think about it: getting a $15 store credit feels completely different from a 15% off coupon.

Store credit feels like real money in a digital wallet. It creates a psychological sense of ownership and gives customers a powerful, built-in reason to come back and spend, directly influencing lifetime value.

This subtle but profound shift in perception changes everything about how customers behave.

Store Credit vs Discounts vs Points A Strategic Comparison

To really see the difference, it helps to put these three common tactics side-by-side. Each has its place, but native store credit consistently delivers more strategic value for brands focused on long-term growth, LTV, and AOV.

Attribute | Shopify Store Credit | Discount Codes | Points Systems |

|---|---|---|---|

Perceived Value | High. Feels like cash or a gift card. | Low to Medium. Can devalue the product. | Low. Often feels abstract and confusing. |

Customer Behavior | Encourages a full-price second purchase, boosting LTV. | Attracts one-time bargain hunters with low LTV. | Can lead to hoarding or abandonment. |

Impact on AOV | Often increases AOV as customers spend more than the credit. | No direct impact, can lower it if thresholds aren't used. | Minimal, as redemptions are often for small amounts. |

Brand Perception | Protects and reinforces brand value. | Can erode brand value and create a "sale" culture. | Neutral, but can feel transactional and impersonal. |

Implementation | Simple and direct for the customer to understand and use. | Easy to create but can be easily abused or leaked. | Complex to set up and requires ongoing management. |

While discounts offer a quick sales hit and points systems try to gamify loyalty, store credit focuses on what truly matters: building a sustainable, profitable relationship with your customers by increasing their lifetime value.

How Store Credit Directly Boosts AOV and LTV

This is where the rubber meets the road—turning a smart tactic into real, measurable revenue. Offering store credit isn't just a nice customer service gesture; it's a powerful way to move the needle on your most important growth metrics. By swapping out those margin-killing discounts for native store credit, you can start pushing up both your Average Order Value (AOV) and Customer Lifetime Value (LTV).

It’s a simple but incredibly effective psychological loop. A customer with a $15 store credit doesn't just see a number; they feel like they have cash sitting in their account, just waiting to be spent. That feeling creates a powerful pull to come back to your store, turning a one-and-done buyer into a loyal repeat customer and increasing their LTV.

Driving a Higher Average Order Value

One of the first places you’ll see the impact of a good Shopify store credit program is your AOV. A discount code just slashes your total at checkout. Store credit, on the other hand, acts like a starting balance for a new purchase. Customers see it as "house money," which makes them far more likely to spend more of their own money.

Think about this classic scenario. You run a promotion: "Get a $10 credit on all orders over $100." This little move is brilliant for two reasons. First, it nudges shoppers with an $85 or $90 cart to toss one more thing in to cross that $100 line. Boom, instant AOV lift.

Second, when they return to use that $10 credit, they almost never buy something for exactly $10. They're far more likely to apply it to a $50 or $60 order, meaning they spend an extra $40 or $50 out of pocket. That’s a much healthier outcome for your bottom line than simply giving them 10% off, and it contributes positively to their overall lifetime value.

Here are a couple of ways you can put this into action right away:

Tiered Spend Thresholds: Don't just offer one reward. Gamify it. Offer $10 credit on $100 orders, but maybe $25 credit on $200 orders. You'll be surprised how many people will spend more to get more, boosting AOV.

Post-Purchase Rewards: As soon as an order is completed, issue a small, unexpected credit. It’s a fantastic way to say "thank you" and immediately gets them thinking about their next purchase, kickstarting the journey to a higher LTV.

Turning Refunds Into a Retention Engine for LTV

Your Customer Lifetime Value is the ultimate report card for your brand. And honestly, store credit is one of the most powerful tools you have to improve that grade, mainly because it solves one of e-commerce's biggest profit leaks: cash refunds.

Every time you send cash back to a customer's credit card, that revenue is gone forever. But if you make Shopify store credit the easiest, most attractive option for returns, you trap that cash inside your business. You’ve just turned a total loss into a guaranteed future sale, directly protecting and extending customer LTV.

Offer a little sweetener for choosing store credit—say, a 110% credit on their return value. Not only do you keep the revenue, but you turn a frustrating experience into a positive one. The customer feels taken care of, and you’ve already locked in their next order.

This strategy is absolutely fundamental to building loyalty. With nearly 5.8 million active stores, merchants across the Shopify platform are using native tools like store credit to keep shoppers engaged and strengthen their finances. Given that Shopify's average customer lifetime value (CLTV) is around $132, every customer you prevent from churning has a huge impact on your long-term growth. To dig deeper, check out these insightful Shopify merchant statistics from Pagefly.

Using Store Credit as a Customer Service Superpower

Beyond the checkout and return process, store credit is an incredible tool for your support team to build loyalty and boost LTV. It lets them solve problems in a way that makes the customer happy and benefits the business.

Imagine a customer gets a slightly damaged product or their shipment is delayed. Instead of a sterile partial refund, what if your support agent could instantly issue a surprise $20 store credit as an apology?

This one small gesture does three things perfectly:

It solves the problem immediately, no complicated return labels needed.

It creates a "wow" moment, turning a frustrated customer into someone who tells their friends how great you are.

It guarantees they'll be back, giving you another chance to deliver a flawless experience and increase their LTV.

When you empower your team to use Shopify store credit for these "surprise and delight" moments, you’re not just fixing problems—you're building genuine emotional connections. That kind of goodwill is priceless and pays for itself over and over again in higher LTV and fantastic word-of-mouth.

Putting Your Store Credit System into Action

This is where the rubber meets the road. A well-executed store credit program is where you'll see those real-world boosts to your AOV and LTV. But before you jump in, it’s important to know what you’re working with. Different e-commerce platforms like Shopify have their own quirks, and understanding them is key to a smooth rollout.

Shopify does offer a way to get started right out of the box, but honestly, it’s more of a clumsy workaround than a real solution. At its core, Shopify’s built-in method for store credit is just issuing a manual gift card.

Think about what that means for a simple return. You have to figure out the credit amount, go create a brand new gift card with a unique code, and then find a way to email it to the customer. It's slow, leaves plenty of room for human error, and feels pretty clunky for the shopper. Instead of a clean balance in their account, they get a random string of characters they have to remember. This is the exact friction we want to kill; a loyalty program should feel like a perk, not an administrative task for everyone involved.

Why the Manual Gift Card "Hack" Falls Short

Trying to use gift cards as a substitute for a true Shopify store credit system creates a whole host of problems that will absolutely slow your growth. The biggest issue is the sheer lack of automation. Every minute you spend manually creating codes is a minute you aren't spending on marketing or product development.

Beyond the time suck, this approach is just plain basic. You can't easily see how often credit is being used, measure its impact on your AOV, or run a campaign encouraging shoppers to spend their balance. It’s a disconnected, one-and-done transaction that completely misses the point of building a continuous loyalty loop that increases lifetime value.

These manual headaches become a full-blown nightmare during busy seasons. Just look at the Black Friday-Cyber Monday weekend in 2023, where Shopify merchants processed an insane $9.3 billion in sales from over 61 million shoppers. Imagine trying to manage returns and issue credit manually during that chaos. It's a recipe for disaster and a surefire way to deliver a poor customer experience when it matters most.

From Manual Mess to Automated Magic with a Native App

This is exactly why a dedicated, native Shopify store credit app like Redeemly is such a game-changer. It transforms the entire experience from a manual headache into a powerful, automated growth engine. A purpose-built solution plugs directly into your store, automating every step and creating a system that just works.

A native app doesn’t just replace the manual gift card process—it builds an entire automated loyalty engine around it. It turns store credit into an integrated, trackable, and scalable part of your business strategy for boosting AOV and LTV.

Instead of emailing out messy codes, a native app ties store credit directly to a customer's account. This creates a single, unified balance they can see every time they log in—a constant, gentle nudge to come back and shop.

The Perks of a Frictionless Experience

A truly seamless system, powered by the right app, offers benefits a manual workaround can only dream of. It’s a genuine win-win for you and your customers.

For Merchants, it means:

Total Automation: Credit for returns, rewards, or customer service issues is handled automatically based on rules you define.

Painless Setup: Most native apps are built to integrate with Shopify themes right away, so you can skip the custom code and technical drama.

Clear, Actionable Data: You get intuitive dashboards showing you exactly how your program is performing—think redemption rates, impact on AOV, and repeat purchase frequency.

Effortless Scalability: The system can handle one return or one thousand with the same efficiency, so it grows with your business.

For Customers, it feels like:

A Smoother Checkout: Their credit is already there as a payment option. No codes to hunt for or copy-paste.

Total Transparency: They can easily check their balance in their account, making it feel like real money waiting for them.

Instant Gratification: Credit from a return or a reward shows up immediately, creating a positive experience that builds trust.

By moving past Shopify's basic gift card function and embracing a native app, you're not just saving yourself time. You're fundamentally upgrading your ability to build lasting customer relationships that directly fuel higher AOV and LTV.

Measuring the True Impact of Your Program

Launching a Shopify store credit program is a great start, but the real test is seeing how it actually affects your bottom line. It's easy to feel like it's working, but you need to look at the right numbers to be sure. By tracking a few key performance indicators (KPIs), you can prove the ROI of your strategy and turn store credit from just another tactic into a real profit driver for your store.

Unlike a simple discount code, where you just look at the immediate sales lift, the success of store credit is all about long-term customer behavior. You need to watch how it shapes repeat purchases and overall spending habits over time. The goal is to see a clear, positive change in customer value right after they get and use their credit.

Key Metrics to Monitor

To get the full story, you have to look beyond just how much credit you've handed out. The most telling data comes from watching what customers do next.

Here are the three most critical KPIs for any store credit program:

Credit Redemption Rate: This is the most basic, yet essential, metric. It simply tells you what percentage of the store credit you've issued is actually being spent. If this number is low, it could be a sign that customers don't know they have a balance or find the process of using it too complicated.

Average Order Value (AOV) with Credit: This is where you see the direct impact on the cash register. You'll want to compare the AOV of orders where store credit was used against orders where it wasn't. What you'll often find is that customers spend significantly more than their credit balance, giving your AOV a healthy boost.

Repeat Purchase Rate: This one is all about retention. Track the percentage of customers who come back to make a second purchase after receiving store credit. This metric directly proves your program is doing its job of building lifetime value.

A strong store credit program doesn't just fund a purchase; it builds a bridge to the next one. Tracking these KPIs reveals how effectively you are turning one-time buyers into loyal, high-value customers who consistently choose your brand.

Analyzing Your Data for Growth

Once you start pulling this data, you can uncover some really powerful insights. For instance, if you're seeing a huge lift in AOV but the redemption rate is lagging, it might be time to send out a few friendly reminder emails to customers with an outstanding balance.

Or, if your repeat purchase rate is soaring, you know your strategy is building the kind of brand loyalty that leads to sustainable, long-term growth.

Ultimately, the goal is to tie all of these metrics back to Customer Lifetime Value (LTV). A rising repeat purchase rate and a consistently higher AOV are the ingredients for a much healthier LTV. Understanding this connection is critical, and you can get a more detailed breakdown by exploring our complete guide on how to calculate customer LTV for your Shopify store. Using a native app with a clear dashboard makes this analysis a breeze, letting you see the financial impact at a glance without ever having to get lost in a spreadsheet.

Common Mistakes That Can Sabotage Your Store Credit Program

So, you've decided to launch a store credit program on Shopify. That's a great first step. But rolling it out is one thing—making it a real powerhouse for boosting LTV and AOV is a whole different ballgame.

Store credit can absolutely crush traditional discounts when done right. But a few common, seemingly small mistakes can completely tank its effectiveness and leave customers with a bad taste in their mouths. Let's make sure you're setting your program up to be a genuine growth engine, not a source of friction.

One of the biggest blunders I see is making the credit balance a secret. If a customer has no idea they have a balance just sitting in their account, how are they ever going to spend it? Hidden credit is wasted potential. It completely misses the point of creating that little psychological nudge that gets them to come back and shop.

Another classic misstep is slapping on super aggressive expiration dates. Look, I get it—you don't want credit hanging around forever. But a tight 30-day window often feels more like a penalty than a perk. It creates frustration, not loyalty, and can seriously damage the very relationship you're trying to nurture.

It's All in How You Talk About It

The mechanics of your store credit program are only half the battle. How you communicate and frame it for your customers is just as critical. Just issuing credit without any context is a massive missed opportunity to reinforce your brand and make someone's day.

Framing is everything, and nowhere is this truer than in the returns process. Instead of treating a refund as a loss, you can reposition store credit as the faster, easier, and even more rewarding option. Imagine offering a small kicker—say, 110% of the return value in store credit. Suddenly, you've turned a potentially negative experience into a positive one, and you’ve kept that revenue right where it belongs: with your business.

The goal is to make store credit feel like a benefit, not a restriction. When you combine clear communication, easy visibility, and smart framing, it stops being a simple refund tool and becomes a powerful way to grow customer lifetime value.

Sidestepping the Traps: A Quick Checklist

Avoiding these common pitfalls will ensure your program actually builds loyalty instead of creating headaches. Here’s a quick strategic checklist to keep you on the right path:

The Mistake: Burying the credit balance deep within the customer account page.

The Fix: Make that balance pop! Display it prominently in the customer portal, on the cart page, or even with a subtle on-site widget. A visible balance is a constant, friendly reminder to come back and shop.

The Mistake: Creating a novel of terms and conditions for how credit can be used.

The Fix: Keep it dead simple. Let customers use their credit on any product, anytime, no questions asked. The less friction you introduce, the higher your redemption rate will be.

The Mistake: Only using store credit reactively for returns.

The Fix: Turn your support team into heroes. Empower them to issue small amounts of store credit as a "surprise and delight" for a loyal customer or as a quick apology for a minor hiccup. This builds incredible goodwill and practically guarantees they'll be back.

Your Top Shopify Store Credit Questions, Answered

Even with a solid strategy in place, you're bound to have some questions as you start using Shopify store credit. Let's tackle some of the most common things merchants ask when they're ready to move beyond discounts and overly complicated points systems.

Can I Automatically Issue Store Credit for Returns?

Shopify's built-in tools require you to manually create a gift card and send it over, which is a clunky, time-consuming process that’s just begging for human error. A dedicated native store credit app, on the other hand, makes this entire workflow seamless.

Once you approve a return, a good app can instantly issue that refund as store credit, right into the customer's account. It's a massive time-saver for you and a much smoother experience for your customer.

Is Store Credit Really Better Than Points for LTV?

For most stores, it’s not even a contest—store credit wins, hands down. The reason is simple: it’s easy to understand, and that simplicity is what drives up customer lifetime value (LTV). A $10 credit feels like real money that’s spendable only in your store.

Points systems create mental gymnastics. '500 points = $5' just adds a layer of friction that makes customers less likely to bother. The clear, cash-like value of store credit gives people a real, immediate reason to come back and shop again, which is a direct line to boosting your LTV.

Because it's so straightforward, customers are more likely to redeem their credit quickly. This leads to more repeat purchases and a higher overall spend over time, making it a much more effective tool for building genuine, long-term loyalty.

How Do I Actually Prove the ROI of This Program?

To track your return on investment (ROI), you need to zero in on three key metrics. These numbers will tell you the real story of how your program is affecting revenue and customer behavior.

Credit Redemption Rate: This is your baseline. How much of the credit you're issuing is actually being spent?

Average Order Value (AOV) Comparison: Look at the AOV for orders placed with store credit versus those without. You'll often find that customers spend well beyond their credit balance, giving your AOV a healthy lift.

Repeat Purchase Rate: Are customers who receive store credit coming back to buy again more often? This metric is the clearest indicator of its impact on retention and lifetime value.

A quality store credit app will have a dashboard that puts these KPIs front and center. That way, you get a clear, data-driven picture of the real revenue and loyalty your program is generating.

Ready to replace discounts with a loyalty system that protects your margins and boosts LTV? Redeemly helps you build a powerful, automated store credit program that customers love. It’s the simple, profit-safe way to turn more shoppers into lifelong fans. Discover how Redeemly can grow your Shopify store.

Join 7000+ brands using our apps